Arbor Realty Trust recently wrapped up its 18th Annual Holiday Drive, which raised nearly $22,000 for Long Island-based Family & Children’s Association (FCA). As in past years, Arbor extended the impact of the drive by matching all employee contributions dollar-for-dollar.

Small Multifamily Investment Trends Report Q3 2025

Asset Valuations Returned to Growth as Credit Conditions Continued to Improve

Key Findings

- Small multifamily valuations rose year-over-year for the first time since 2023.

- Cap rates extended a streak of stability.

- LTVs climbed higher as underwriting conditions continued to normalize.

State of the Market

The small multifamily sector’s performance measurably improved during the second quarter of 2025, despite ambiguity permeating the economic climate. Capital markets continued to recalibrate as new U.S. tariff policies began to impact inflation. Although interest rates remain elevated, relief may not be far off. According to futures markets, the Federal Reserve could make its next interest rate cut as soon as September, and the consensus remains that it will reduce the Federal Funds Rate twice before the end of the year.

As markets reacted to headline news, small multifamily continued to navigate without disruptions, supported by strong fundamentals. Normalization spread more broadly through multifamily market as a whole as debt financing conditions continued to tighten, the National Multifamily Housing Council’s July 2025 Survey of Apartment Conditions shows.

Several core small multifamily performance metrics strengthened in the quarter, including a return to positive annual price gains. Credit standards and origination activity also moved in the right direction. Although there were areas of unevenness, the positives outweighed the negatives for small multifamily as overall conditions firmed.

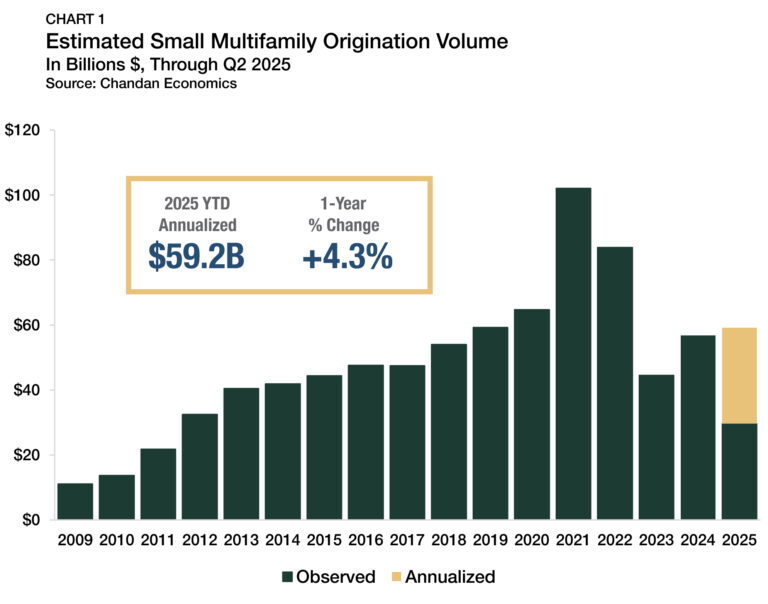

Lending Volume

Small multifamily continued to show modest improvement over last year’s pace. Through the midpoint of the year, the annualized estimate of new multifamily lending volume on loans with original balances between $1 million and $9 million (including loans for apartment building sales and refinancing) increased to $59.2 billion (Chart 1). The annualized estimate as of the end of the second quarter was 4.3% higher than 2024’s year-end total. Although lending volumes remained well below the highs fueled by low interest rates during 2021-22, the pace of lending stayed in line with pre-pandemic norms.

1 All data, unless otherwise stated, are based on Chandan Economics’ analysis of a limited pool of loans with original balances of $1 million to $9.0 million and loan-to-value ratios above 50%.

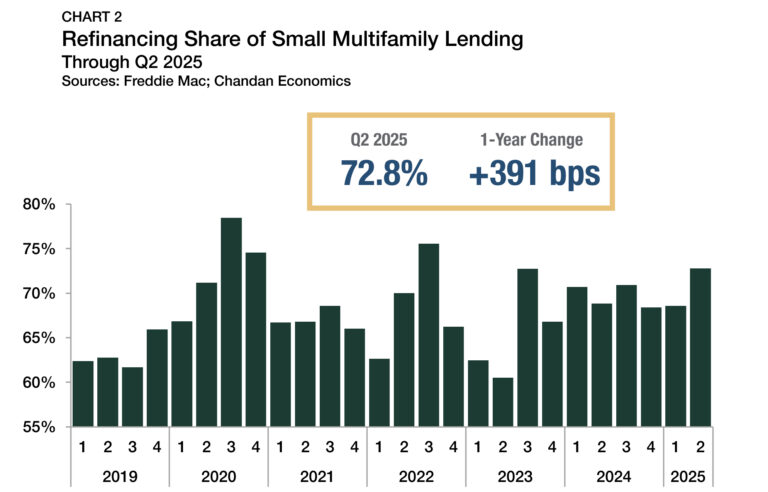

Loans by Purpose

Once the Federal Reserve began tightening monetary policy in 2023, the incentive for investors to pursue loan refinancings lessened.

The refinancing share of small multifamily hit a post-2022 high in the second quarter of 2025, rising to 72.8%. The share peaked at 75.6% in the third quarter of 2022 before falling to a low of 60.5% in the second quarter of 2023 (Chart 2). Even as interest rates have remained elevated, the refinancing share of lending has recovered, driven by investors’ need for capital.

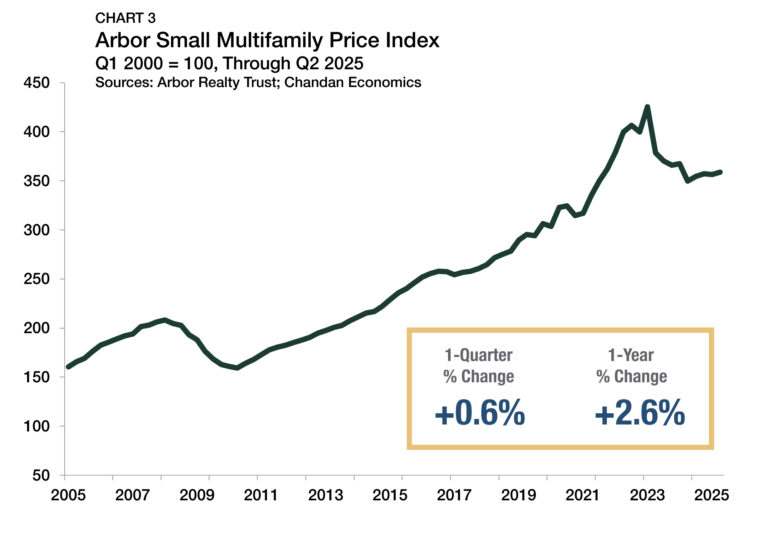

Arbor Small Multifamily Price Index

During the second quarter, asset valuations increased 2.6% from a year earlier, marking a return to positive annual growth for the first time in eight consecutive quarters, according to the Arbor Small Multifamily Price Index (Chart 3). Prices also rose quarter-over-quarter (+0.6%), underscoring the sector’s increasing momentum. Higher average rents, which translate into higher operating revenues, drove the index higher during the quarter. Operating expense ratios ticked down, which also boosted net income. Cap rates remained stable, which neither aided nor weighed on valuations. However, occupancy rates slid, limiting the scope of small multifamily’s momentum.

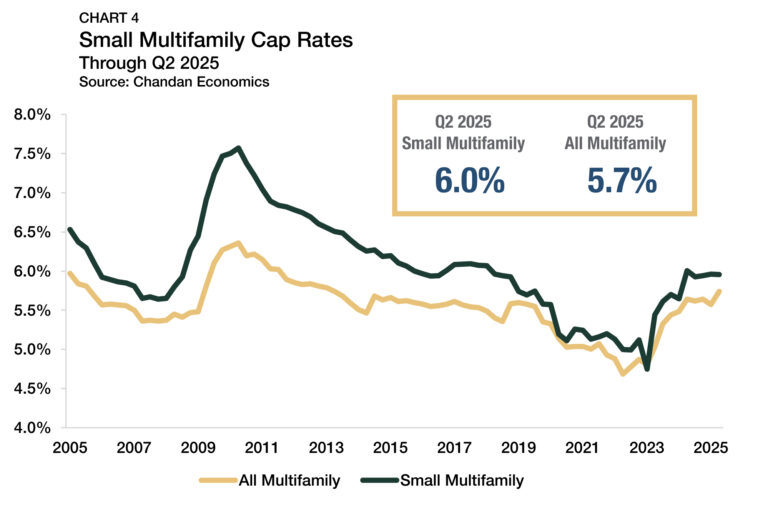

Cap Rates & Spreads

Small multifamily cap rates averaged 6.0% during the second quarter of 2025, holding flat from the first quarter (Chart 4). After cap rates rose rapidly in the second quarter of 2024, they have been stable in spite of significant interest rate volatility. Over the past five quarters, small multifamily cap rates have remained in an exceptionally narrow eight bps range. Compared to the cyclical low point of 4.8% in the first quarter of 2023, cap rates have climbed by 120 bps. Although elevated cap rates have negatively weighed on asset valuations over the past two years, they have also improved the return profile of the sector.

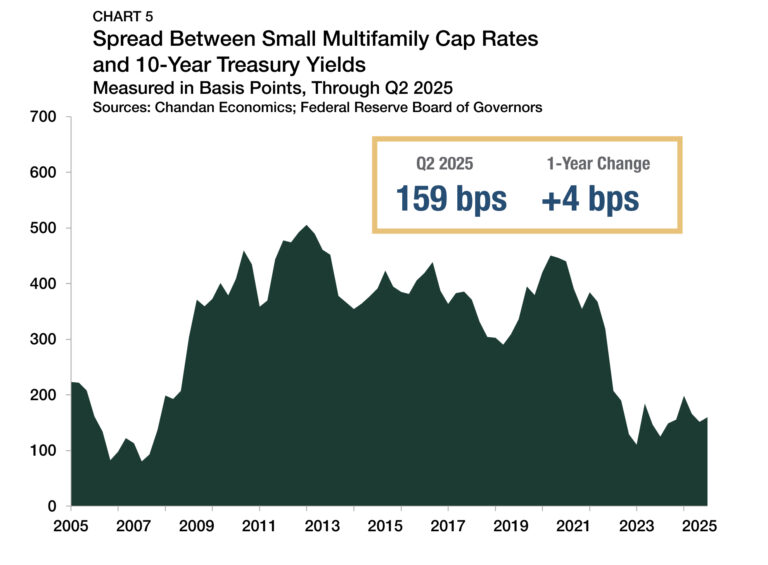

The small multifamily risk premium, measured by comparing cap rates to the yield on the 10-year Treasury, approximates the additional compensation investors require to account for higher levels of risk. This risk premium increased by eight bps in the second quarter of 2025 to reach 159 bps (Chart 5). The increase occurred as 10-year Treasury yields averaged 4.4% between April and June 2025, down from 4.5% during the first quarter.

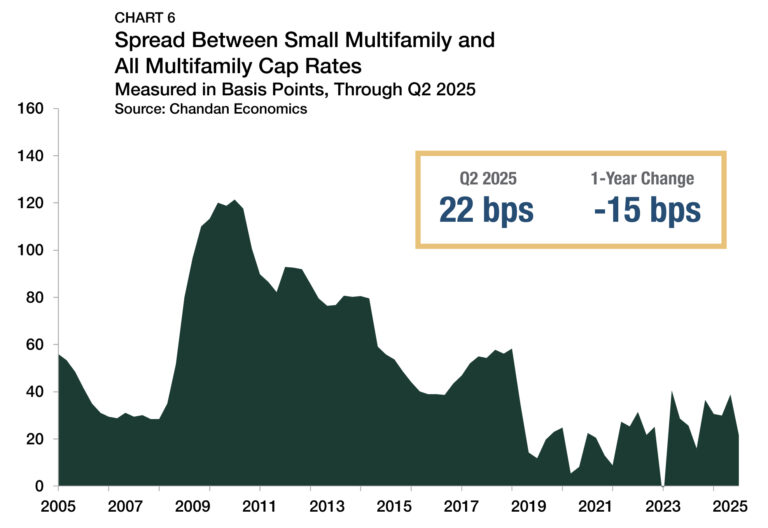

Long-term government bond yields have remained fixed above 4% for the past two years, which has kept the small multifamily risk premium well below pre-pandemic norms. Between 2015 and 2019, the small multifamily risk premium averaged 369 bps — more than double the current spread. The small multifamily/Treasury risk premium remained below 200 bps for the past 12 consecutive quarters. At the same time, the cap rate spread between small multifamily assets and the rest of the multifamily sector, a measure of the risk unique to smaller properties, narrowed by 17 bps during the second quarter to reach 22 bps, its lowest point since early 2024 (Chart 6). As liquidity for small multifamily improved after the 2008 financial crisis and property management software technologies enhanced operational efficiency, small multifamily risk premiums re-settled slightly above all multifamily properties. Over the past 10 years, this risk premium for small multifamily assets over the rest of the sector has averaged 31 bps — less than half the average risk premium typically seen during the preceding decade (70 bps).

Expense Ratios

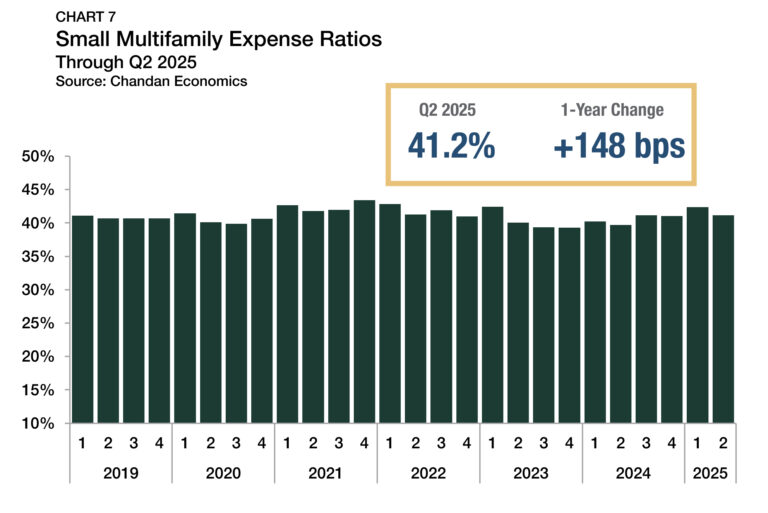

Expense ratios, measured as the relationship between underwritten property-level expenses and gross income, fell by 119 bps in the second quarter of 2025 to 41.2% (Chart 7). Large single-quarter swings in expense ratios are typical, as more than half of all quarterly movements are greater than 75 bps. Despite the single-quarter improvement, expense ratios were 148 bps higher than a year ago.

Occupancy Rates

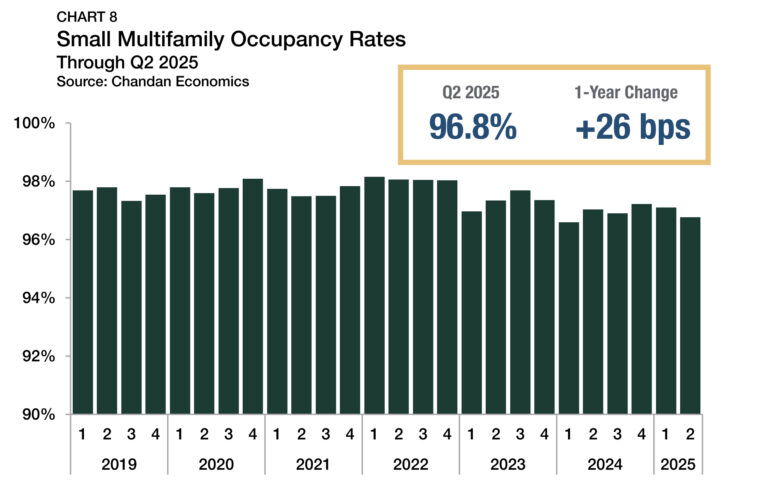

Occupancy rates in small multifamily properties that received financing during the second quarter averaged 96.8% (Chart 8). Compared to the previous quarter, occupancy saw a slight decline of 38 bps. After exceeding 98% in 2022, small multifamily occupancy rates have settled into an equilibrium of approximately 97% for the past 18 months.

Despite recent modest declines, occupancy levels throughout the small multifamily sector remain on solid ground. Small multifamily occupancy rates routinely outperform, tracking about 2% higher than the average set across all multifamily properties, which may result from closer tenant-landlord relationships in small buildings. According to a recent report by the Terner Center for Housing Innovation at UC Berkeley, a majority of small multifamily property owners reported that at least half of their rental units have been leased at below-market-rate rents, a strategy used to retain quality tenants. By and large, small multifamily households are moving less today. A recent Chandan Economics analysis of the U.S. Census Bureau’s American Community Survey found that 58.3% of existing small multifamily households have lived in their current unit for at least two years — 3.4 percentage points higher than in large multifamily (50+ units) properties.

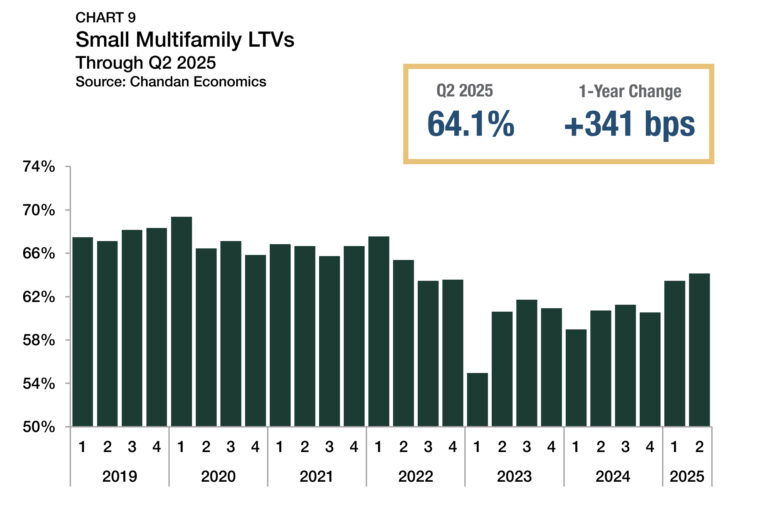

Leverage & Debt Yields

So far this year, shifting underwriting trends have proven to be the most significant area of change within the small multifamily sector. After loan-to-value ratios (LTVs) soared by 291 bps during the first quarter, they increased again in the second quarter — up 67 bps to reach 64.1% (Chart 9).

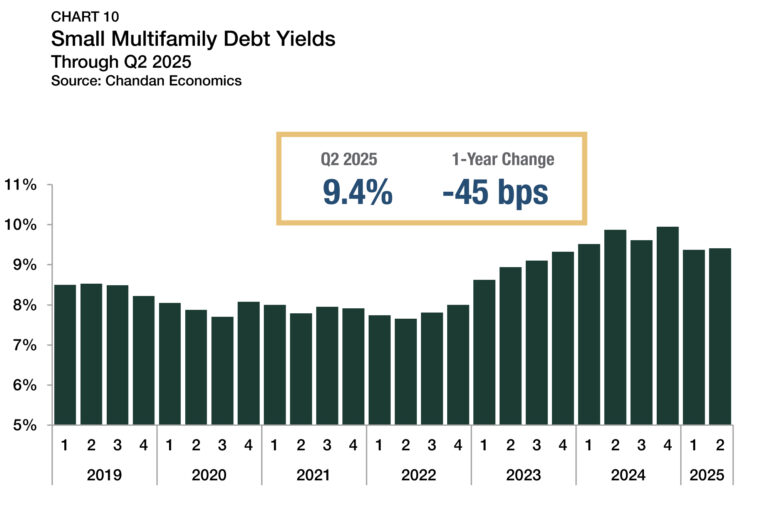

LTVs often have high levels of quarter-to-quarter variability, as they are responsive to both lenders’ underwriting criteria and borrower preferences. Still, the increases seen over the past two quarters have been noteworthy. The last time small multifamily LTVs finished the quarter above their current level was the second quarter of 2022, when the Federal Reserve had just initiated its monetary tightening cycle. While average debt yields fell considerably during the first quarter (-58 bps), they held relatively flat in the second quarter, rising by a marginal four bps to remain at 9.4% (Chart 10). In late 2024, small multifamily debt yields reached their highest point in over a decade; however, the first half of 2025 was marked by improvement and stabilization.

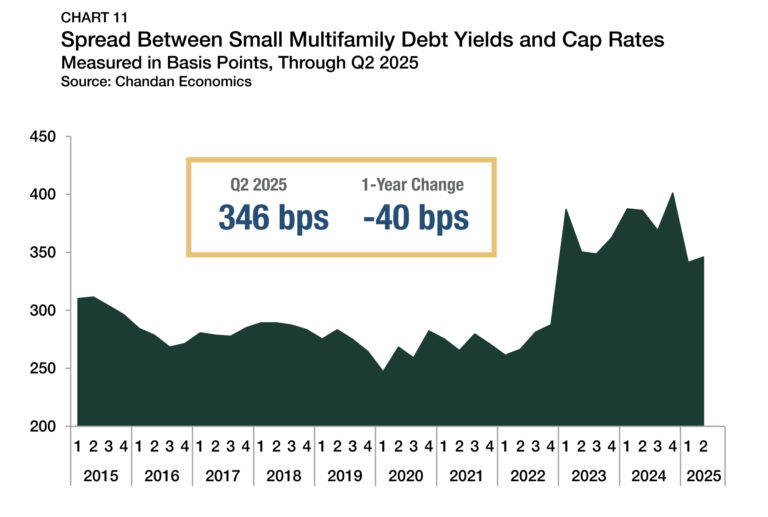

The inverse of debt yield, measured as debt per dollar of net operating income (NOI), decreased minimally. Small multifamily borrowers secured an average of $10.62 in new debt for every $1.00 of property NOI during the quarter — down $0.07 from the first quarter but still up $0.49 year-over-year. With both cap rates and debt yields remaining steady during the second quarter, changes in their spread were negligible, rising 4 bps to 346 bps (Chart 11). Last quarter’s stabilization follows a substantial narrowing in the first quarter of 2025 in which the spread tightened 60 bps.

While the spread remains elevated compared to pre-pandemic norms, its recent downward momentum suggests lenders have become more confident in prevailing valuations and the reliability of NOIs. Data from NMHC’s July 2025 Survey of Apartment Conditions supports these findings, with more than half of respondents reporting that debt financing conditions tightened during the second quarter.

Outlook

Entering the second half of the year, the small multifamily sector is poised to maintain stability and strength with the support of solid rental housing demand and improvements in credit market conditions.

While the macroeconomic backdrop remains in flux, particularly as it relates to tariffs and inflation, small multifamily is well-positioned to navigate uncertainty. According to Oxford Economics, the effective tariff rate on imported construction materials rose to 27.7% as of June 2025 — up from 0.9% last year. But, even if operating and development costs were to increase meaningfully, the sector’s single-year lease structure allows investors to transfer inflationary pressures to tenants more quickly than other commercial real estate property types.

If input costs pick up, more investors may turn their attention toward small multifamily properties as a hedge against inflation. With attractive pricing and valuations only slightly less than 15% below a 2023 peak, small multifamily will continue to present compelling investment opportunities through year-end and beyond.

For more small multifamily research and insights, visit arbor.com/articles

Disclaimer

This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein and is not prepared in accordance with the regulation regarding investment analysis. The material in the report is obtained from various sources per dating of the report. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. That said, all content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations or warranties, express or implied, as to the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third-party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein. There may have been changes in matters which affect the content contained herein and/or the Companies subsequent to the date of this report. Neither the issue nor delivery of this report shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that the affairs of the Companies have not since changed. The Companies do not intend, and do not assume any obligation to update or correct the information included in this report. The contents of this report are not to be construed as legal, business, investment or tax advice. Each recipient should consult with its legal, business, investment and tax advisors as to legal, business, investment and tax advice. The information contained herein may be subject to changes without prior notice. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person.