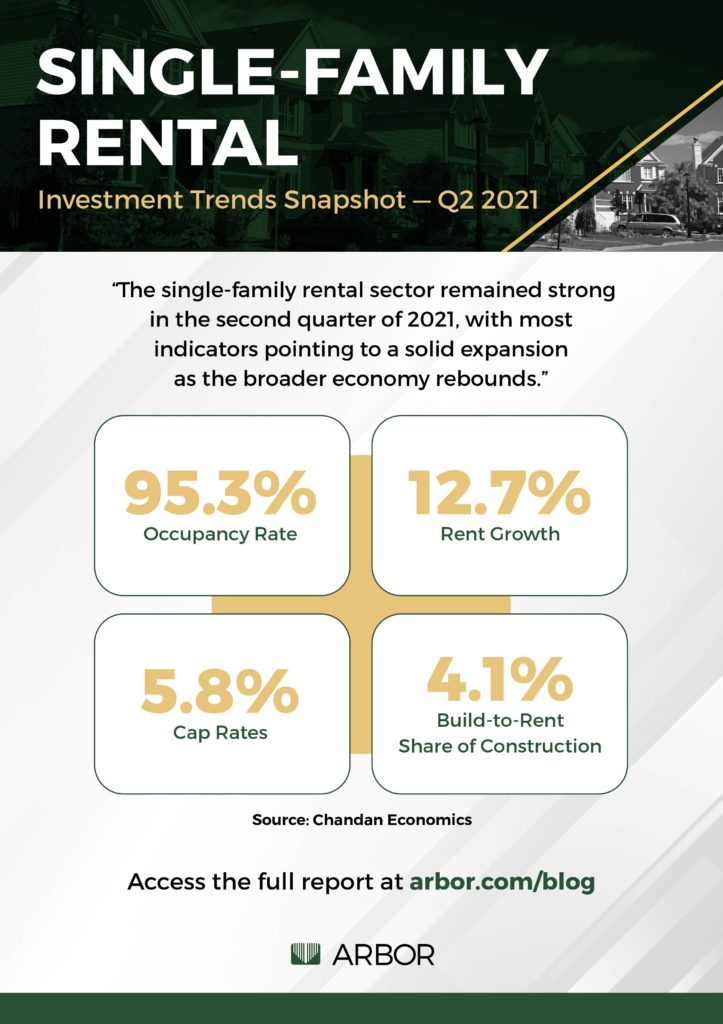

Single-Family Rental Investment Snapshot — Q2 2021

Prior to the COVID-19 pandemic, single-family rentals (SFRs) had already experienced record growth, as more institutional participants entered the space. The sector performed well in the second quarter of 2021, driven by robust demand that led to surging rent growth and improving cap rates. Q2 2021 single-family rental rent growth hit 12.7%, the highest mark since tracking began in 2015. At the metro-level, the Sun Belt has dominated over the past year. The Arizona metros of Phoenix and Tucson saw the largest annual jumps, climbing by 12.2% and 10.6%, respectively. Additionally, SFR occupancy rates rose to 95.3%, returning to their generational highs.

Property-level yields for SFR assets ticked down in the second quarter of 2021, as cap rates averaged 5.8%, reflecting strong investor demand and asset price growth. The second-quarter reading marks the lowest level on record going back to 2011.

For more market insights, read our Q2 2021 Single-Family Rental Investment Trends Report and visit arbor.com/sfr to learn more about our SFR portfolio financing.