Metro-Level SFR Rent Growth Trends in the First Half of 2025

- The New York metropolitan area had the highest share of renters in the country, with San Francisco and Los Angeles following closely behind.

- There is a strong connection between home values and the rental share of households in a metro, underscoring the cost barriers to homeownership.

- Richmond, Tulsa, and Charlotte have seen sizable shifts towards rental housing in the past five years, driven by young professionals’ moving there.

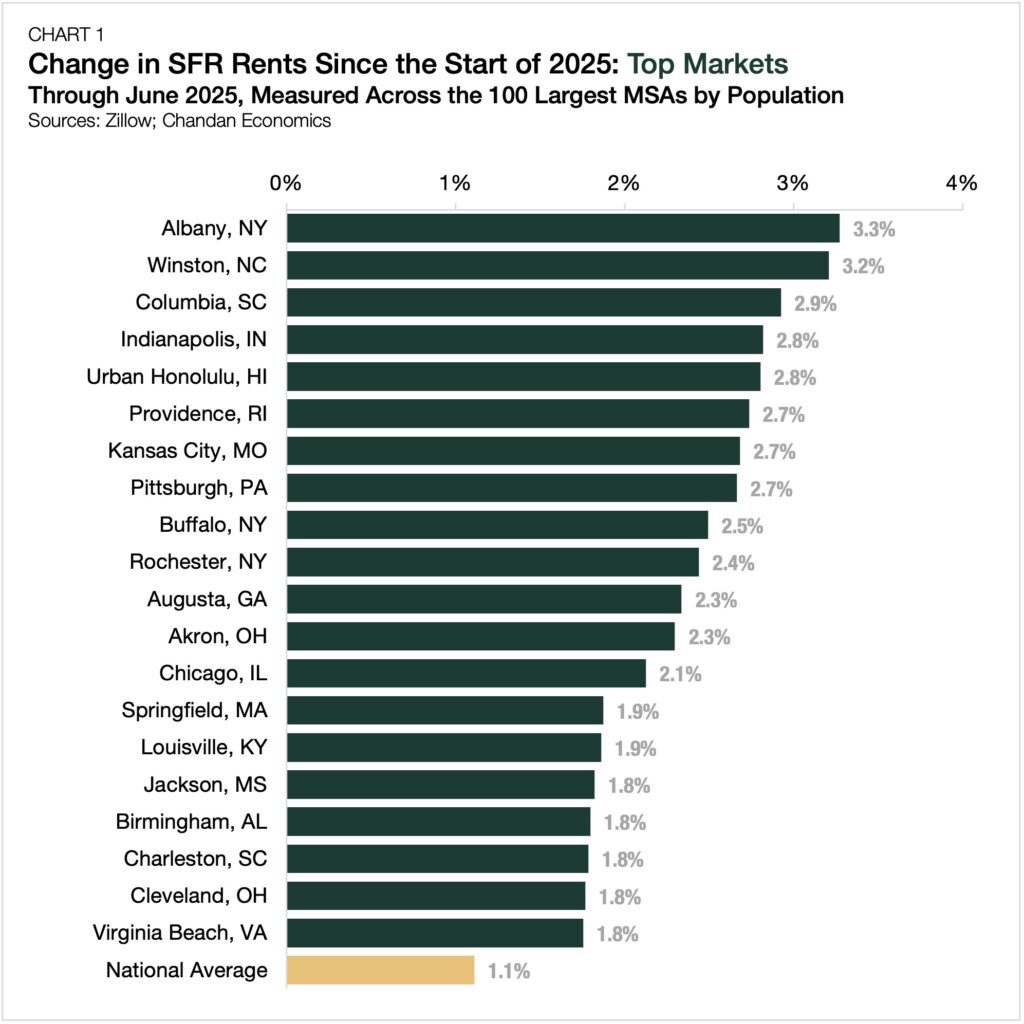

Albany, NY, and many other affordable mid-sized metropolitan statistical areas (MSAs) outpaced the national rent growth average for single-family rental (SFR) properties in the first half of 2025, according to an analysis of Zillow’s Observed Rent Index, which tracks the 100 largest markets in the U.S.

SFR Rent Growth Leaders

New York State’s capital, Albany, posted a 3.3% SFR rent growth gain through June (Chart 1). While New York is known for its high real estate prices, rents typically ease outside the New York City metro area. In Albany, the monthly rental price for single-family homes averaged $2,338, which was only $14 higher than the national average.

Albany’s rental gains have been driven by three key factors: stable public sector employment, ample technology jobs, and a tight supply of housing inventory. As the Empire State’s capital, Albany has an employment base anchored by government and education. Moreover, the region’s tech sector, which encompasses semiconductor and advanced manufacturing initiatives, has benefited from renewed federal investment resulting from the CHIPS Act.

Following closely behind Albany are two standouts from the Carolinas — Winston, NC (+3.2%), and Columbia, SC (+2.9%). Even as many markets in the Sun Belt have experienced a price correction following a post-pandemic rent surge and an influx of new inventory, Winston-Salem ($1,902) and Columbia ($1,854) continue to outperform in part due to their affordability. Out of the 100 largest MSAs, both consistently ranked among the top 30 most affordable.

The top-line characteristics of Winston-Salem and Columbia align with a larger theme, where affordable mid-sized metro areas dominated the list of top SFR rent growth markets for the first half of 2025. Of the top 20 markets, 14 had average monthly rent prices below the national average, and 19 of 20 markets had fewer than 2.5 million residents.

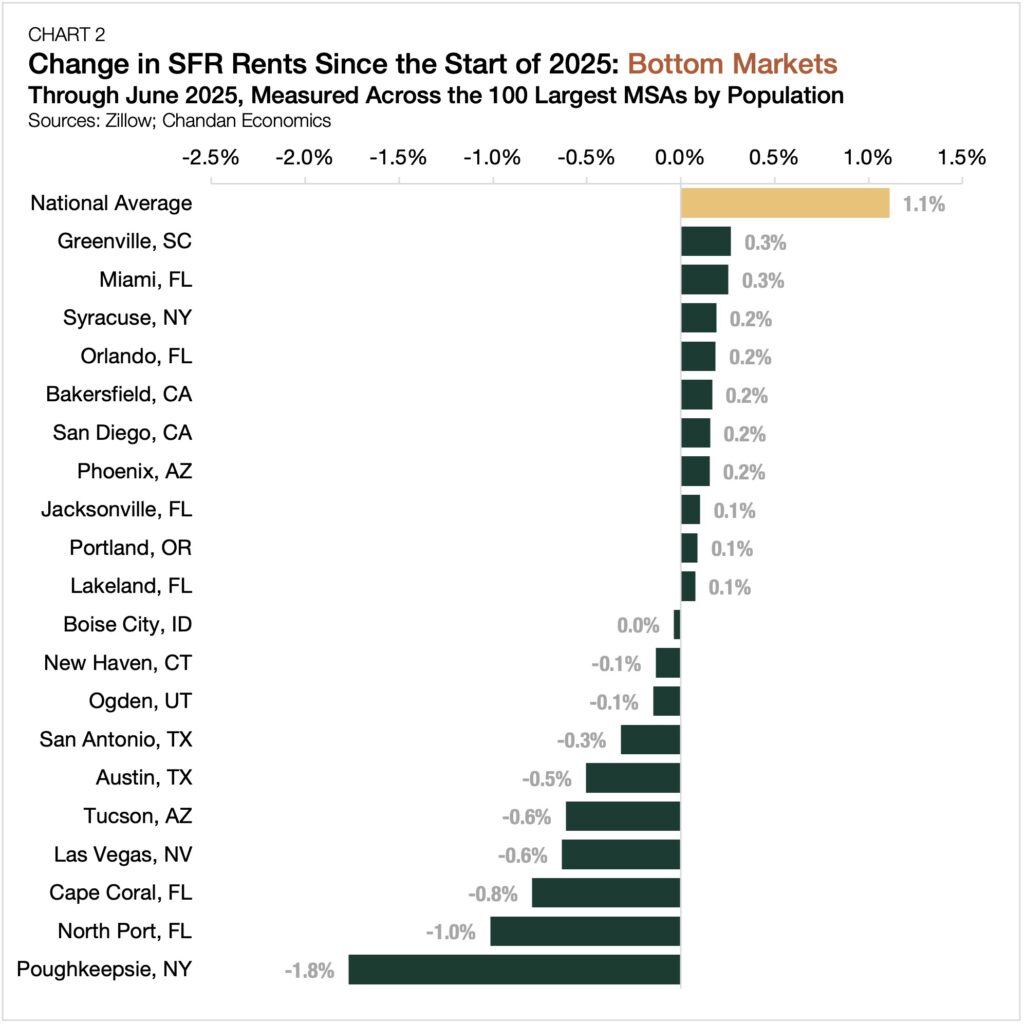

Trailing the Pack

Poughkeepsie, NY, where rents have fallen by 1.8% so far this year, landed at the other end of the spectrum (Chart 2). Poughkeepsie’s rent growth weakness is noteworthy, especially as it is only about 80 miles away from the top market on the list, Albany.

Several Sun Belt markets, including North Port, FL (-1.0%), Cape Coral, FL (-0.8%), and Las Vegas (-0.6%), which were darlings of the previous investment cycle, also posted negative rent growth.

Altogether, out of the 100 most populous metros, 40 had six-month rent growth of less than 1% over the first half of the year. However, only 10 had negative rent growth, with the overwhelming majority continuing to see price gains.

The Bottom Line

In an unsettled economic climate, local factors, such as affordability and employment opportunities, have greater influence. With mortgage interest rates elevated and some sellers opting to withdraw listings rather than reduce asking prices, the residential housing market remains a challenge for many. As a result, would-be homeowners have increased demand for single-family rentals, which has sustained positive rent growth in the majority of U.S. metro areas.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.