Investment

After proving its resilience, the multifamily real estate sector is positioned to thrive in the next growth cycle. While uncertainties persist and risks remain, new federal policies and long-awaited interest rate relief have brought optimistic investors back to the table with a new sense of urgency.

Finance

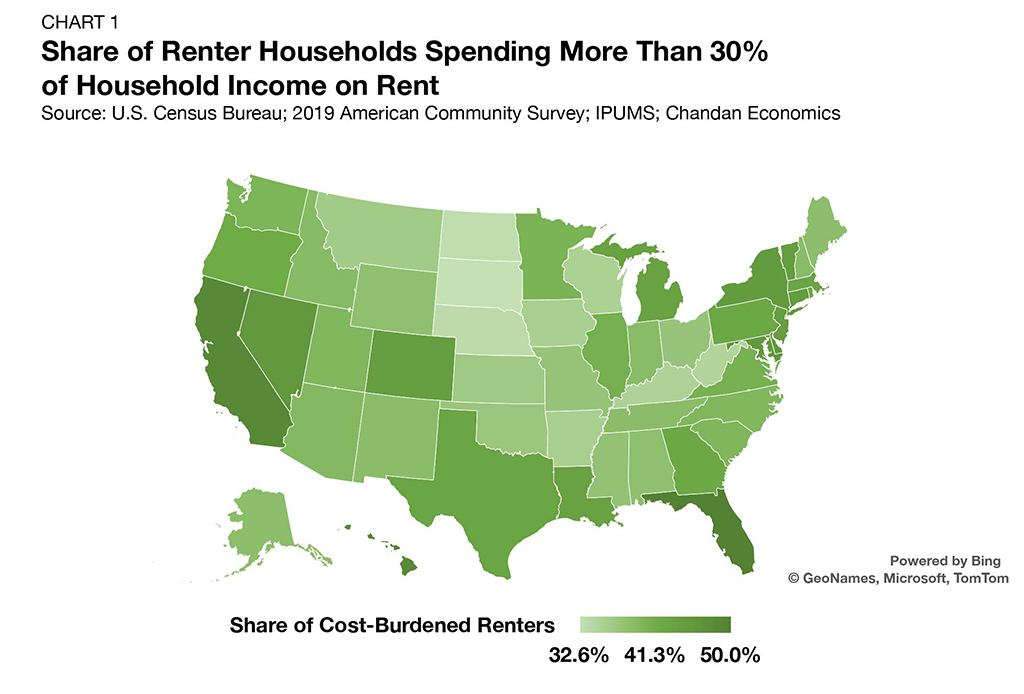

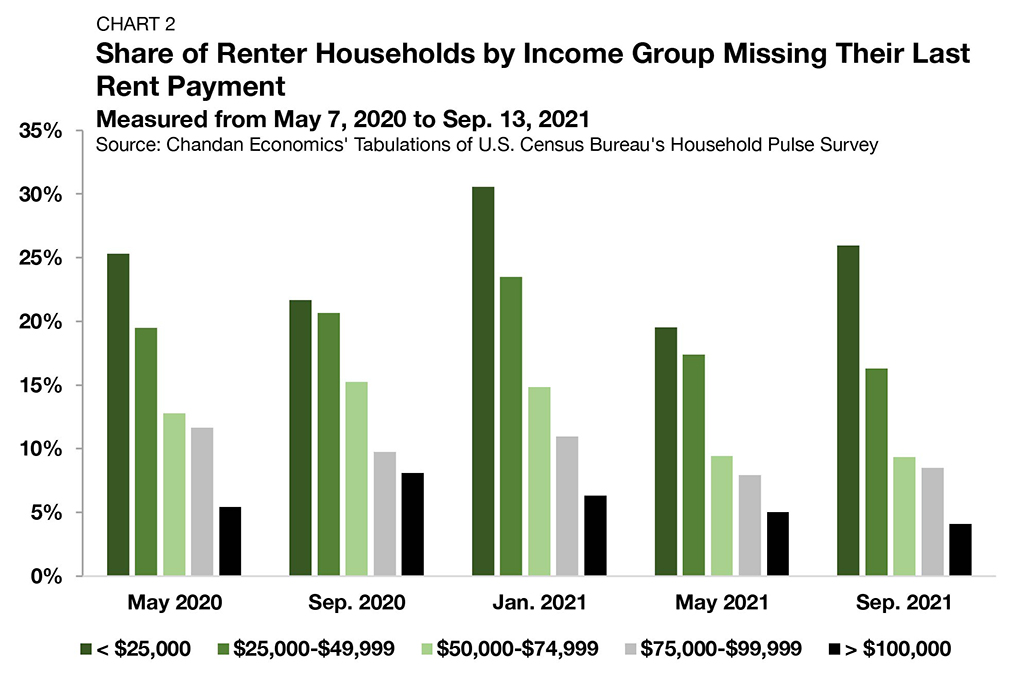

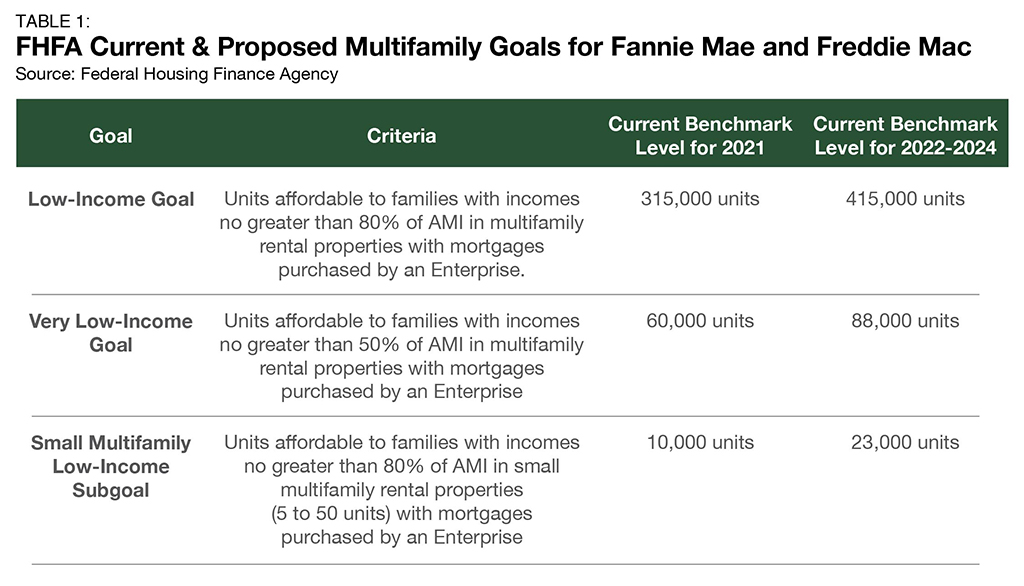

Fannie Mae and Freddie Mac, which operate under the Federal Housing Finance Agency’s Duty to Serve Plan, have made financing workforce housing a central component of creating more equitable and sustainable access to quality rental housing. With a wide range of programs and incentives now available, investors have been increasingly securing stable and valuable opportunities, which can also improve the lives of cost-burdened middle-income professionals.

Articles

Unless an 11th-hour agreement is reached, a political impasse over budget legislation for the next fiscal year will trigger a federal government shutdown. Starting October 1, 2025, many non-essential federal government operations could potentially be limited or suspended, but most multifamily financing activities will not be disrupted.

Articles

Arbor Private Construction (APC), Arbor’s newest non-agency financing product, has seen robust demand during the first half of 2025, with high-profile transactions closed in strong markets like Surfside, FL, and Philadelphia, PA. Designed for shovel-ready projects, APC is a dynamic program expanding premium rental housing options in primary markets.

Structured Financing Preferred Equity

Structured Financing Mezzanine Loan Program Term Sheet

Structured Financing Bridge Loan Program