Top Multifamily Markets for Low Renter Turnover

- Nationally, nearly one-third of multifamily households have lived in the same apartment for over two years.

- In many high-cost markets, such as New York and Los Angeles, the share of multifamily renters who signed a third lease was above 40%.

- Three-year tenant retention rates positively correlate with low vacancy rates.

Tenant retention is a valuable — though sometimes elusive — contributing factor to the strength of a multifamily property. Nationally, 29% of multifamily households signed a third lease for the same unit, according to an analysis of the U.S. Census Bureau’s American Community Survey. Locally, renter turnover was lowest in major coastal markets, like New York City, and highest in transient renter markets, like Charleston, SC.

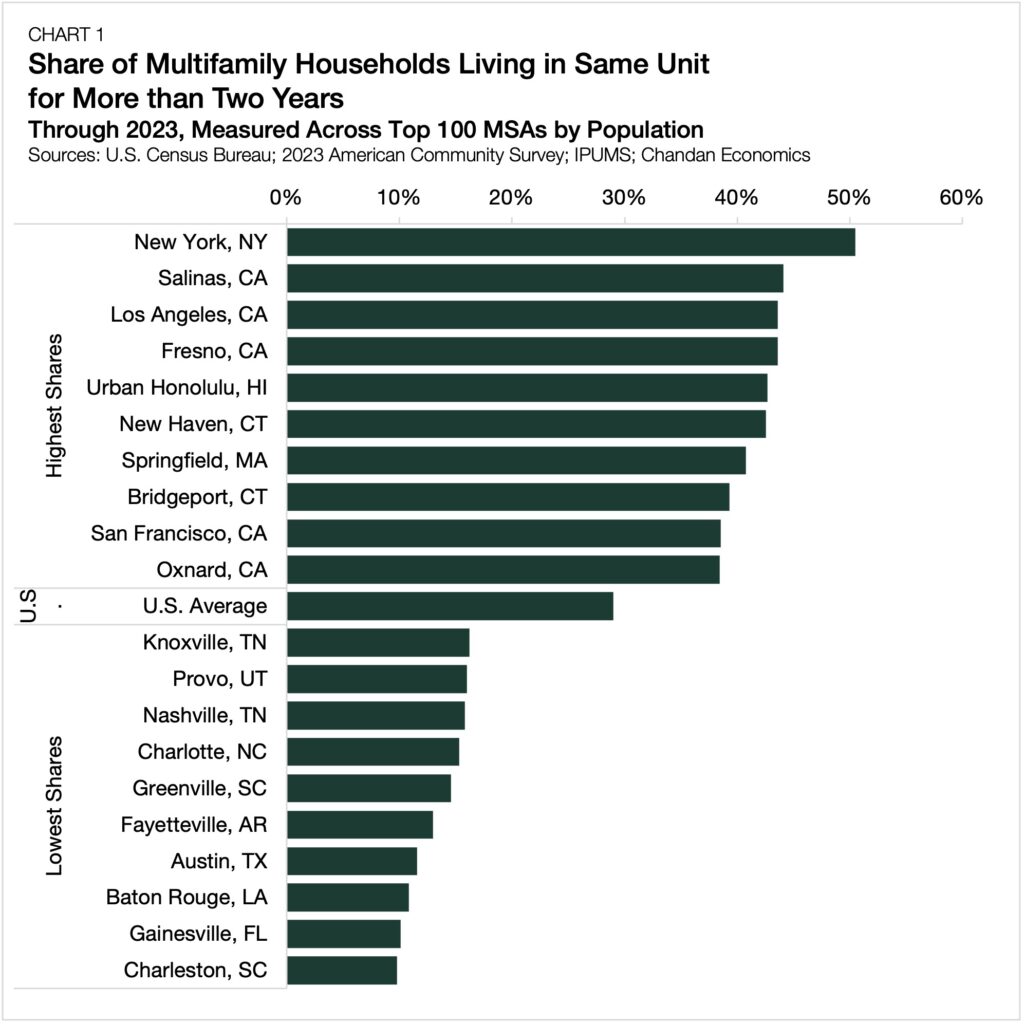

Highest Share of Multifamily Renters on Third Lease

Across the top 100 metro areas by population, third leases are far more common. Leading the way is New York City, the only metro where a majority (50.5%) of renters stayed in the same unit for more than two years (Chart 1). New York’s share of renters on their third lease was more than six percentage points higher than any other market, making the nation’s largest city a unique outlier.

Sitting right behind New York is a trio of high-cost California metros, led by Salinas (44.1%), Los Angeles (43.6%), and Fresno (43.6%), demonstrating that less-affordable rental markets can support higher rates of long-term multifamily renters.

Financial incentives are a key driver of this trend. Renters in these markets often incur high transaction costs, including broker fees and security deposits, which make moving less attractive. Low inventory — a factor that supports rent growth — has also made securing a new place to live in these markets more challenging. For some of the renters, moving to a new apartment is not worth it.

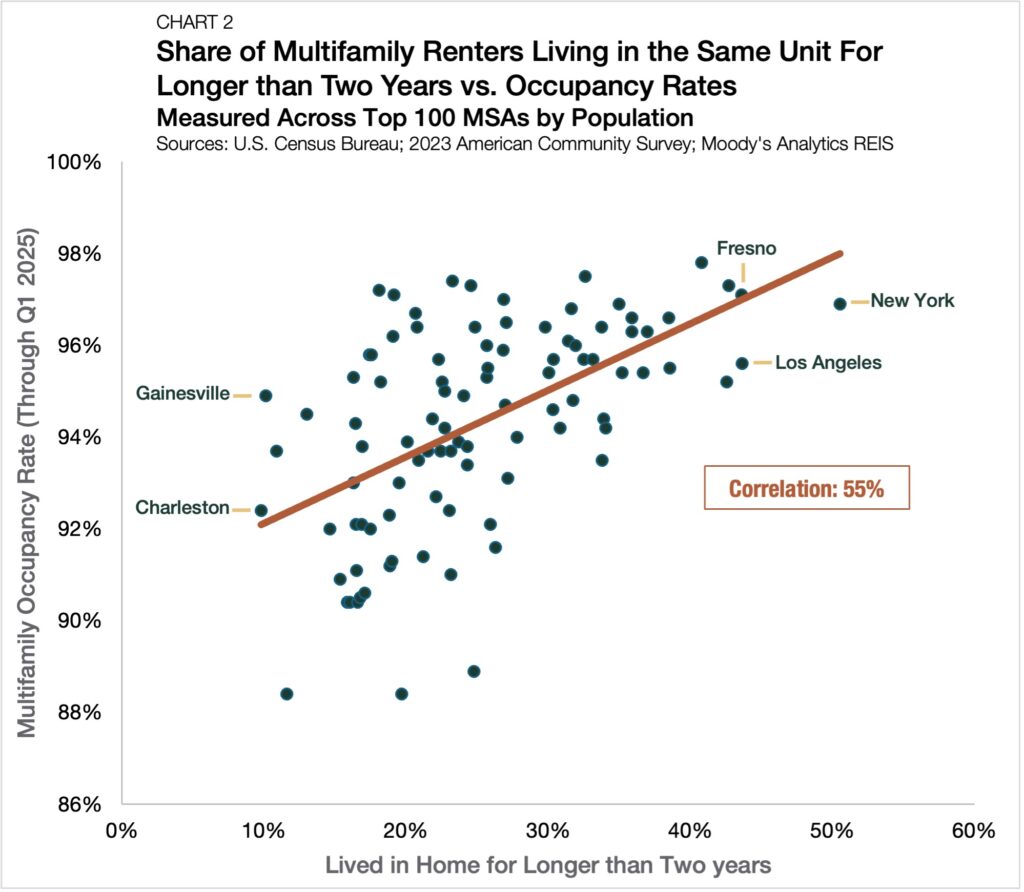

Renters staying put in more expensive markets typically lead to higher occupancy levels. An analysis of Moody’s Analytics REIS data supports this assertion, showing a 55% correlation between occupancy and the share of multifamily renters who signed a third lease.

Lowest Share of Multifamily Renters on Third Lease

Charleston, SC (9.8%), Gainesville, FL (10.1%), and Baton Rouge, LA (10.8%) — all of which cater to highly transient renter populations — fall at the other end of the spectrum.

In Charleston, the interplay between a large military population and its local economy helps to explain the city’s distinct rental market dynamics. Joint Base Charleston supports 11,500 active-duty personnel and an additional 2,500 civilian contractors. Rentals are the most common housing type for active-duty personnel in Charleston. In total, 45.4% live in a rental, 15.3% own their home, and 39.3% reside on a military base.

In Gainesville and Baton Rouge, a highly mobile renter population includes a large concentration of students. Gainesville’s rental economy is centered around the University of Florida, while Baton Rouge is home to Louisiana State University. In these two southern markets, students often live off-campus in multifamily housing.

For rental operators, a market’s low-retention profile may also have advantages. High turnover rates often reflect a consistently active pool of renters. Property managers can capitalize on heightened rental demand while effectively managing vacancy risk by aligning lease expirations with peak periods of renter demand within the school calendar year.

The Bottom Line

Tenant retention varies widely across the multifamily landscape, often reflecting the broader economic and demographic forces at play in each market. As a result, renters are moving less in high-cost markets and more in transient markets. For operators and prospective investors, knowing the patterns of renters’ moving behavior will help them stay a step ahead.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.