Uncategorized

With homebuying out of reach for many, more tenants are staying in the rental market longer than in previous cycles. This dynamic offers multifamily investors a strategic opportunity to focus on tenant retention, according to Dr. Sam Chandan, one of the commercial real estate industry’s leading scholars, who recently shared his expert insights on the 2026 Housing Outlook webinar with RentRedi.

Articles

Normalization was the thread that tied together multifamily real estate narratives in 2025. Asset valuations stabilized, cap rates held steady, and rent growth was balanced. Entering the new year, normalization is still driving the conversation, as shown by newly released data from the Federal Reserve Bank of Atlanta on real estate conditions and associated trends.

Articles

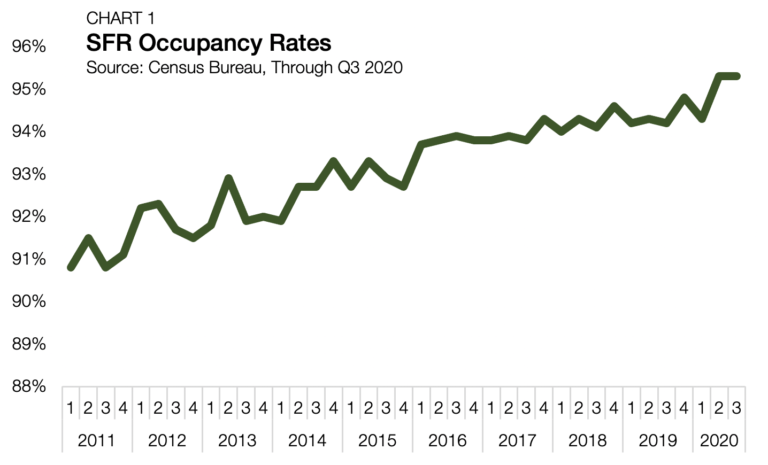

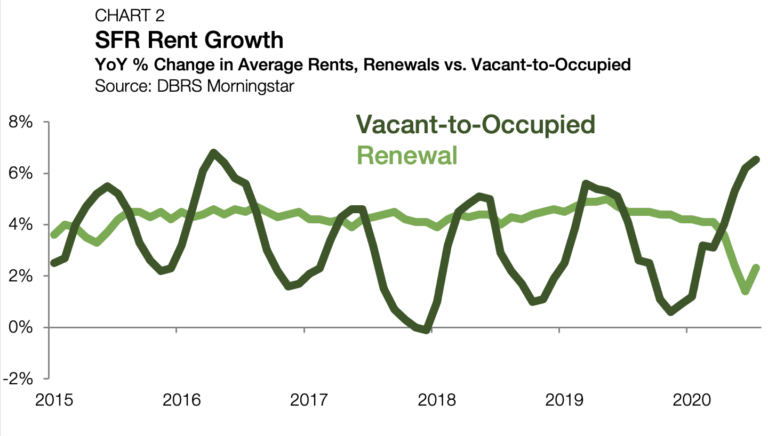

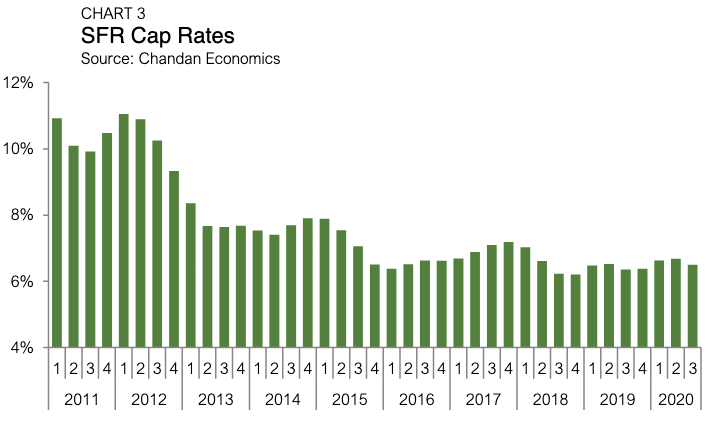

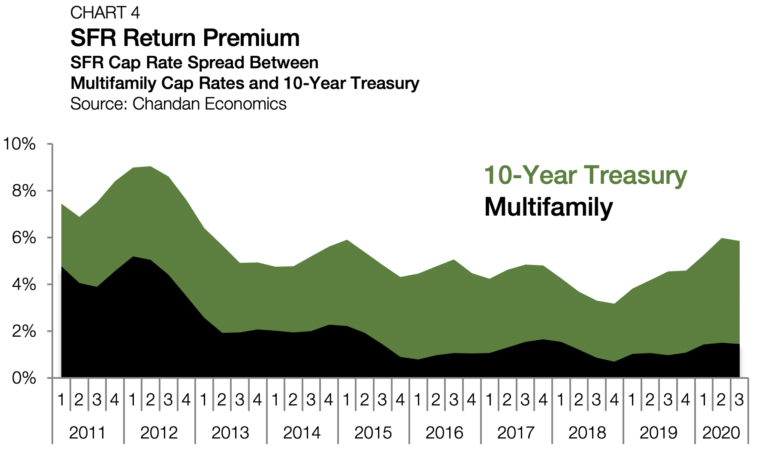

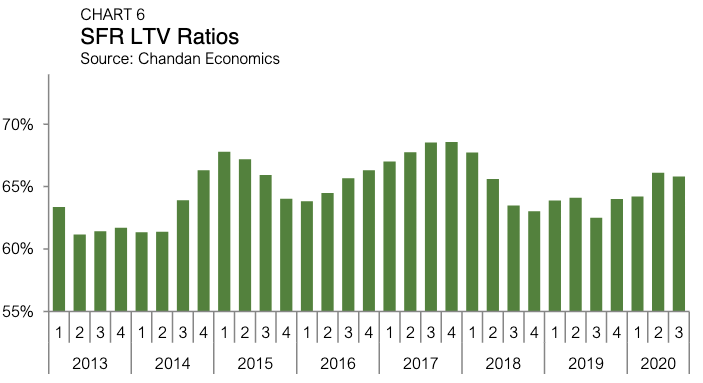

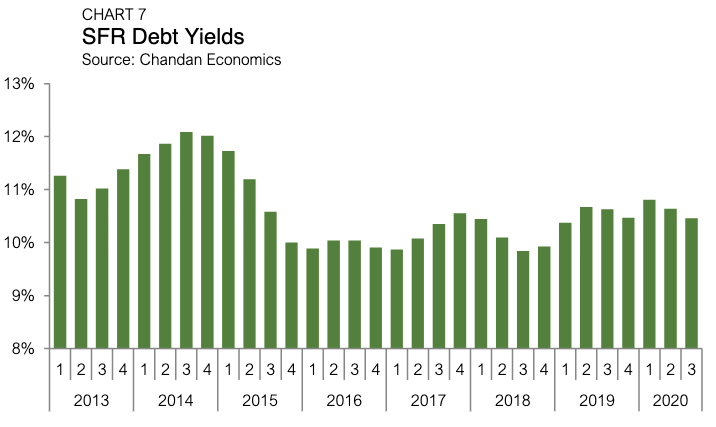

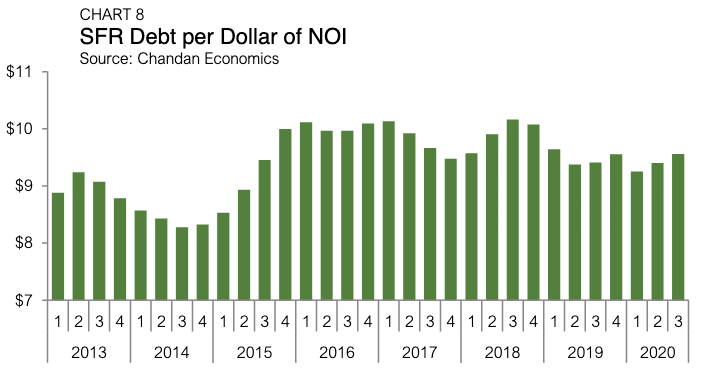

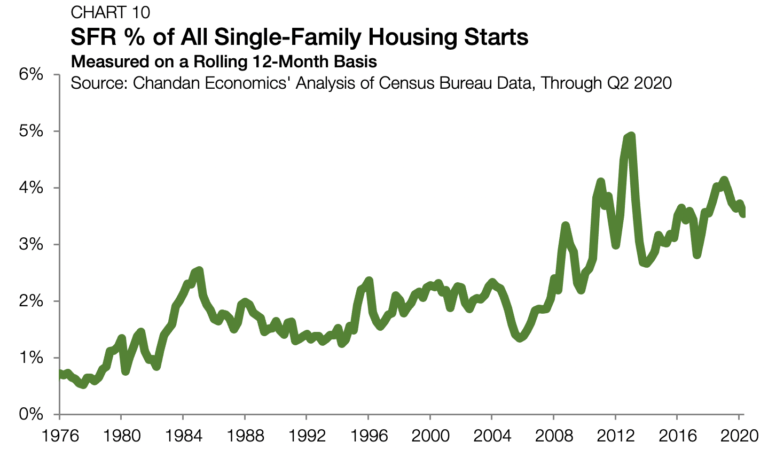

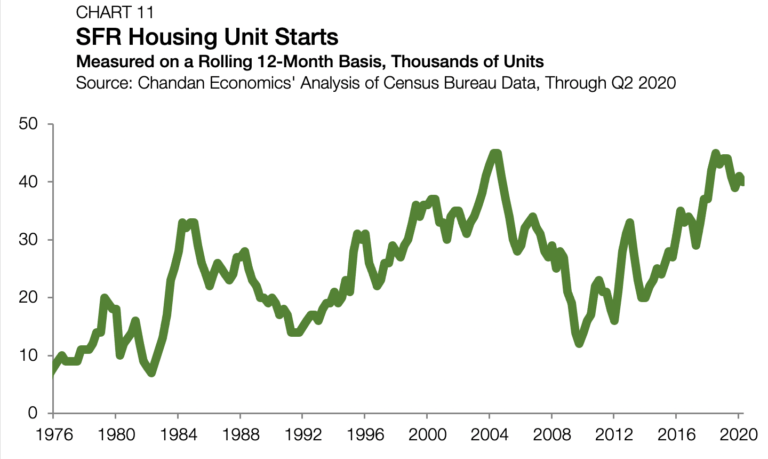

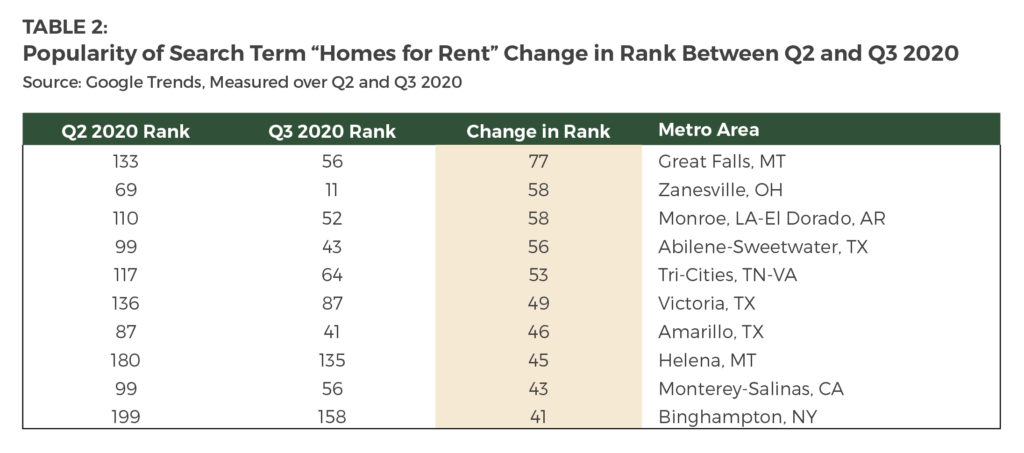

The single-family rental (SFR) sector, supported by healthy fundamentals, demonstrated its strength and durability again last quarter as the for-sale home market softened.

Articles

The multifamily rental households estimate reached an all-time high of 22.4 million in 2025, following meaningful post-pandemic shifts in affordable housing and rental demand. The commercial real estate pillar maintained its growth, as new inventory and persistent homeownership constraints supported a rising number of multifamily household formations.

Articles

In any multifamily project, site selection is a critical step requiring careful consideration. From New York to Los Angeles and all the major metropolitan areas in between, U.S. metros are ripe for new investment, but narrowing down the optimal location is never easy. In a new video, Dr. Sam Chandan, one of the commercial real estate industry’s leading scholars, shares his expert insight into Arbor Realty Trust’s latest Top Markets for Multifamily Investment Report.

Analysis

The U.S. rental housing market remained strong and stable in 2025, spreading through the multifamily and single-family rentals sectors. Here’s a look at this year’s top articles from Arbor Realty Trust, in case you missed them.

Uncategorized

Senior debt, a foundational element of most multifamily property acquisitions and developments, rarely covers the full capital requirement. To bridge the gap between what senior lenders offer and what sponsors need, many borrowers pursue mezzanine financing, which provides greater leverage and more control.