The single-family rental (SFR) sector continued showing strength in several key areas in the second quarter of 2025, even as residential housing market growth moderated.

Affordable Housing

Fall 2023

About This Report

The Arbor Realty Trust Affordable Housing Trends Report, developed in partnership with Chandan Economics, offers a wide-ranging lens into the complex, though critically important, affordable and workforce housing sectors. The aim of the report series is to provide a comprehensive primer for industry stakeholders to better understand the major trends shaping the market.

This series focuses on affordable housing supported by government subsidies or tax incentives like the Low-Income Housing Tax Credit (LIHTC), as well as the Naturally Occurring Affordable Housing (NOAH) segment. It addresses the significant changes observed both in terms of policy decisions and market dynamics and describes opportunities for investment and financing in the space

Key Findings

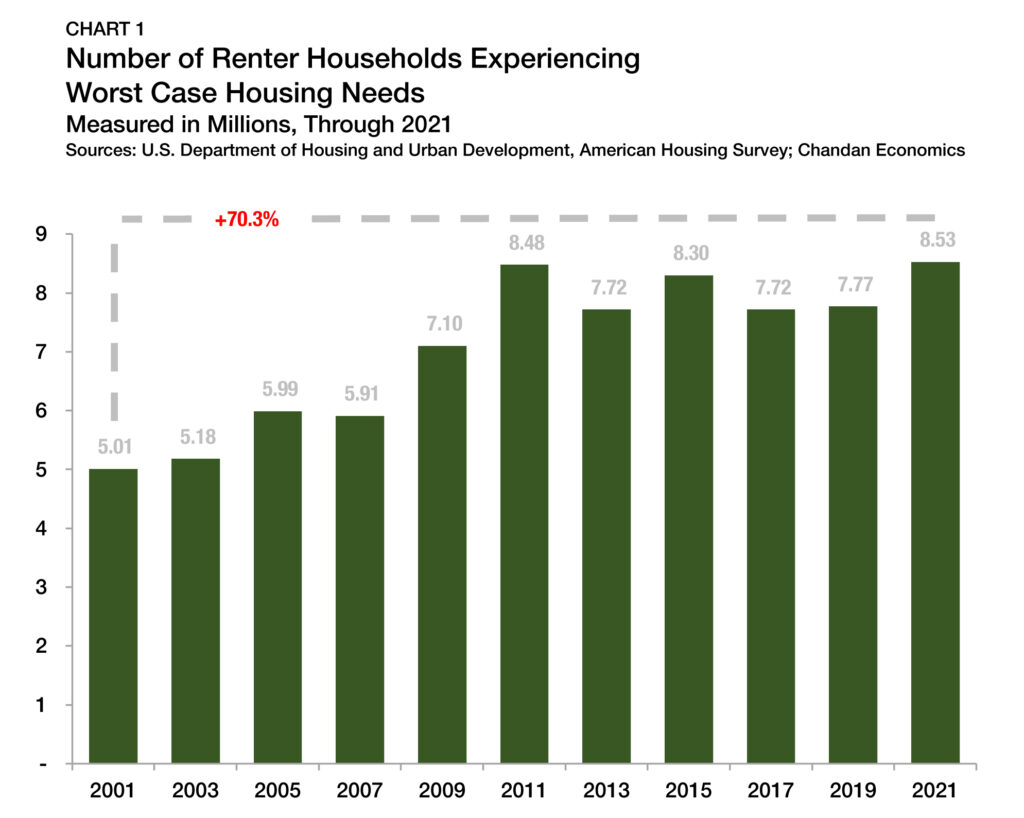

- The number of households of renters living in inadequate conditions who do not receive rental assistance has grown by 70% over the past two decades.

- Utilization of the 4% Low-Income Housing Tax Credit (LIHTC) reached a new high as affordable housing rehabilitations outpaced ground-up development.

- With the 2024 federal budget in limbo, the U.S. Department of Housing and Urban Development’s (HUD) spending programs are frozen at 2023 levels, delaying an expansion of the Housing Choice Voucher (HCV) program.

Glossary

-

Affordable Housing

Affordable housing broadly refers to housing that costs less than 30% of a household’s income. Affordable housing includes units that are naturally occurring without any policy intervention, as well as government-supported units that are made affordable to income-constrained renters through a subsidy or a tax incentive.

-

Affordability

Housing affordability is measured as spending up to 30% of a renter household's income on rent plus utilities.

-

Naturally Occurring Affordable Housing (NOAH)

Units that do not receive subsidies, but are affordable to low- and moderate-income renters. In this analysis, a NOAH unit is defined as one where a renter household earning at most 80% of the area median income would spend less than 30% of its income on rent plus utilities.

-

Housing Choice Voucher (HCV)

The federal government's major program for assisting low-income renters in the private market. A subsidy is paid to the landlord and the occupant pays the difference between the rent charged and the subsidy.

-

Low-Income Housing Tax Credit (LIHTC)

Tax credits provided for the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

-

U.S. Department of Housing and Urban Development (HUD)

A U.S. government agency that supports community development and home ownership. The Agency oversees many affordable housing programs including the HCV and LIHTC.

Sources: U.S. Department of Housing and Urban Development; Tax Policy Center; Chandan Economics

State of the Market

The state of housing affordability in the U.S. has continued to erode as a growing wave of supply-driven policies offers hope of a solution on the horizon. A closer look at the nation’s overall housing needs underscores the increasing urgency of the situation.

According to the U.S. Department of Housing and Urban Development’s (HUD) most recent Worst Case Housing Needs Report, 8.5 million U.S. renter households were very low-income, did not receive government assistance, and lived in inadequately livable housing conditions (Chart 1). The State of the Nation’s Housing 2023 Report by the Joint Center for Housing Studies of Harvard University paints a similarly dire picture, estimating that there has been a 25% increase in the unsheltered homeless population — due in part to a contraction of the affordable housing supply stock.

At the federal level, efforts to reshape the affordable housing landscape have stalled while incremental expansions of existing programs have moved forward. Despite falling short of the White House’s initial funding requests, the Senate approved HUD spending increases in 2024 that will expand the Housing Choice Voucher (HCV) program by 4.9%, an increase of $1.5 billion, and the Project-Based Section 8 program by 5.9%, an increase of $884 million. However, the full 2024 Fiscal Year budget has not been adopted as the federal government is temporarily remaining open through a Continuing Resolution that stipulates 2023 FY levels remain in place.

LIHTC

The Low-Income Housing Tax Credit (LIHTC) program is the nation’s single-largest affordable housing resource that directly addresses supply. It comes in two forms: a 9% tax credit to incentivize new development and a 4% tax credit for the rehabilitation and preservation of existing properties. According to the National Housing Preservation Database, LIHTCs support approximately 2.5 million rental units. Further, a recent Urban Institute analysis of data from the National Council of State Housing Agencies (NCSHA) estimates that this tax credit program financed 156,000 new rental units in 2021 — 95% of which were affordable to moderate- and low-income renters.

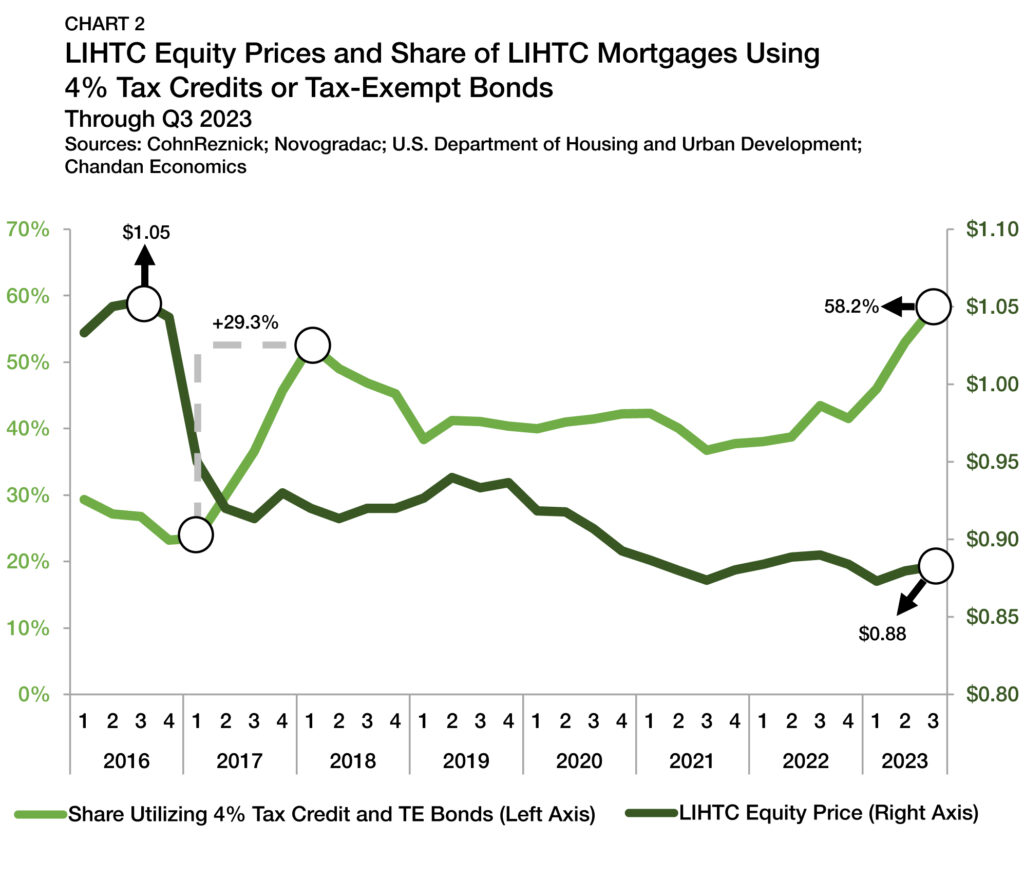

In recent years, developer funding gaps have limited the use of the 9% LIHTC. Construction costs have soared while the 9% LIHTC tax credit, which developers can sell to finance their projects, has declined in value. Following the 2016 election, LIHTC equity prices dropped in value by about 10% as investors anticipated (and eventually received) a decrease in tax liabilities (Chart 2). Since 2021, 9% LIHTC equity prices have stabilized between $0.87 and $0.89 per credit, where they remain today, according to CohnReznick’s Housing Tax Credit Monitor.

Meanwhile, the rehabilitation tax credit became more appealing after the December 2020 passage of the Consolidated Appropriations Act established a minimum 4% floor on the applicable federal tax credit rate for tax-exempt multifamily housing private activity bonds (PABs). The minimum floor made the 4% tax credit more valuable and increased how much funding developers can raise to finance construction. As a result, the 4% LIHTC tax credit for rehabilitation became more attractive compared to the ground-up development 9% credit, leading to more widespread use of the rehabilitation tax credit. Through the third quarter of 2023, the 4% credit has accounted for 58% of newly HUD-insured LIHTC mortgages — a new high-water mark.

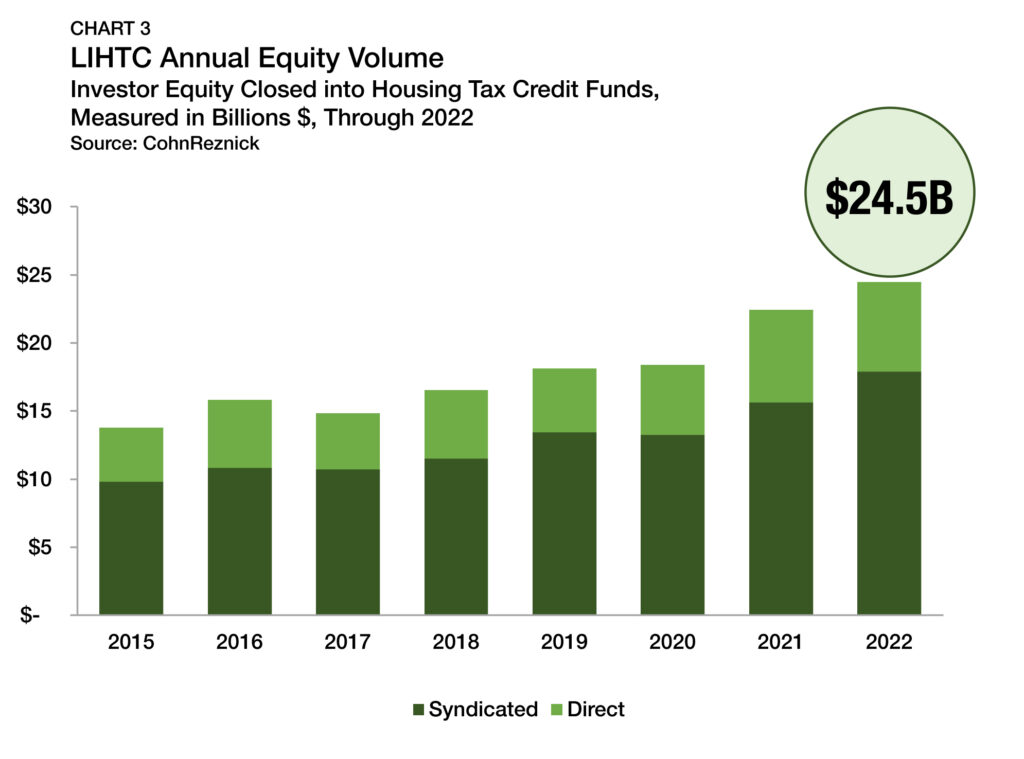

In 2022, the dollar volume of investor equity closed into housing tax credit funds reached a record high of $24.5 billion — rising 9.1% from the year prior, according to CohnReznick (Chart 3). The sharp increase was surprising as it coincided with the expiration of the 9% tax credit’s 12.5% allocation increase and other disaster-related credit allocations. CohnReznick notes investor equity closed in 2022 likely reflects credits that were secured in 2021. However, the report also cites the increased utilization of the 4% LIHTC as a meaningful driver of the surge in volume.

Despite the federal LIHTC program’s overwhelming importance, its complexity and incremental funding expansion have prevented it from keeping pace with the growing urgency of the national need for new housing. However, at the state level, progress has been moving faster. According to the Affordable Housing Tax Credit Coalition, 26 states have LIHTC programs of their own. Jennifer Schwartz, director of tax and housing advocacy at NCSHA, told Affordable Housing Finance that “there has been an increase in activity with states either expanding or creating new state tax credits.” Citing significant construction challenges in recent years, she considers the need to have an additional source of equity beyond federal LIHTC to be “critical.”

Fannie Mae DUS® Multifamily Affordable Housing

Arbor can assist you with access to Fannie Mae’s Multifamily Affordable Housing (MAH) loan products, which are made available through its Delegated Underwriting and Servicing (DUS®) lender network.

MAH loans are designed to assist borrowers who participate in an affordable housing program that either restricts rent prices charged to tenants or imposes income limits on who is eligible to rent. Operators participating in the Low-Income Housing Tax Credit (LIHTC), Project-Based Section 8, and the Housing Choice Voucher (HCV) Program are among the MAH product’s core base of borrowers.

In addition to the favorable underwriting extended to MAH loans, many loans are subject to lower borrowing costs via Federal Housing Administration (FHA)

risk sharing. MAH loans are also eligible to be financed through tax-exempt bonds and may receive other state, local, or federal subsidies, which are conditioned on the affordability of some or all of the units in the property.

Contact your Arbor originator to learn more.

Project-Based Section 8

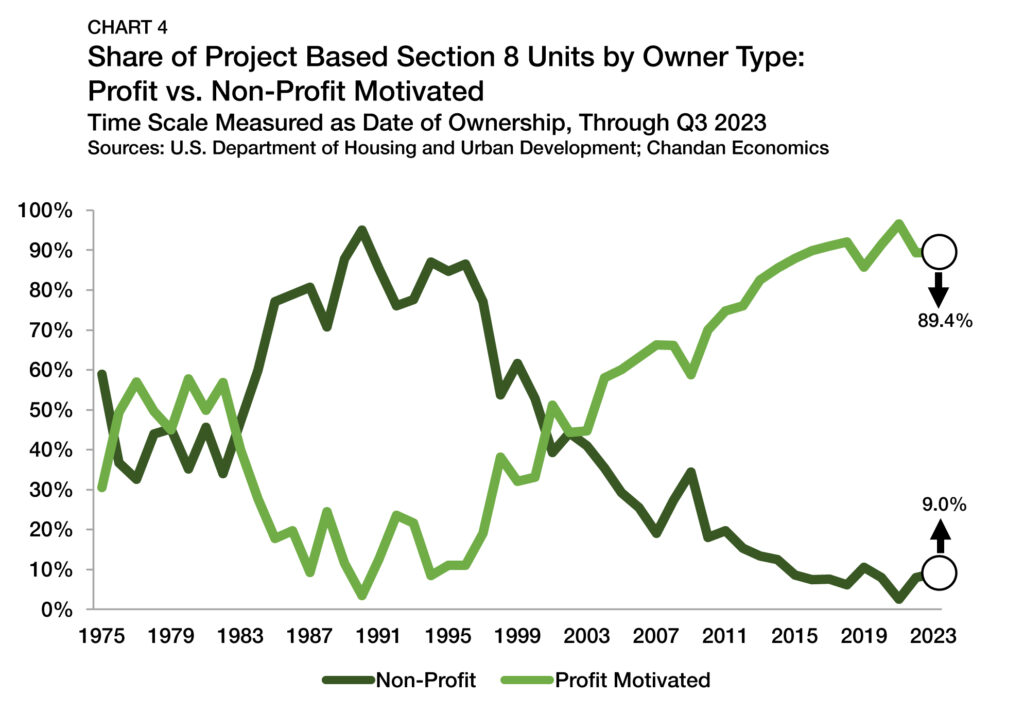

Project-Based Section 8 The second-largest supply-side affordable housing initiative in the U.S. is the Section 8 Project-Based Rental Assistance (PBRA) program. The Section 8 PBRA program caters to low-income households that earn at most 80% of their local area median income. Tenants in participating properties pay 30% of their income toward rent and utilities, and the federal government subsidy then covers the difference between the tenant contribution and the local area’s fair market rent. According to the National Housing Preservation Database, Section 8 PBRA supports approximately 1.4 million rental units. It has been proven to be markedly successful at attracting private, for-profit owners into the program. Between 1990 and 2023, the share of owners entering Section 8 PBRA that are profit-motivated has grown from 3.4% to 89.4% (Chart 4). HUD has also made a series of updates and rule changes in the past year that have added to the program’s private-market attractiveness by making it easier for owners to rehabilitate and re-capitalize their properties.

Housing Choice Vouchers (HCV)

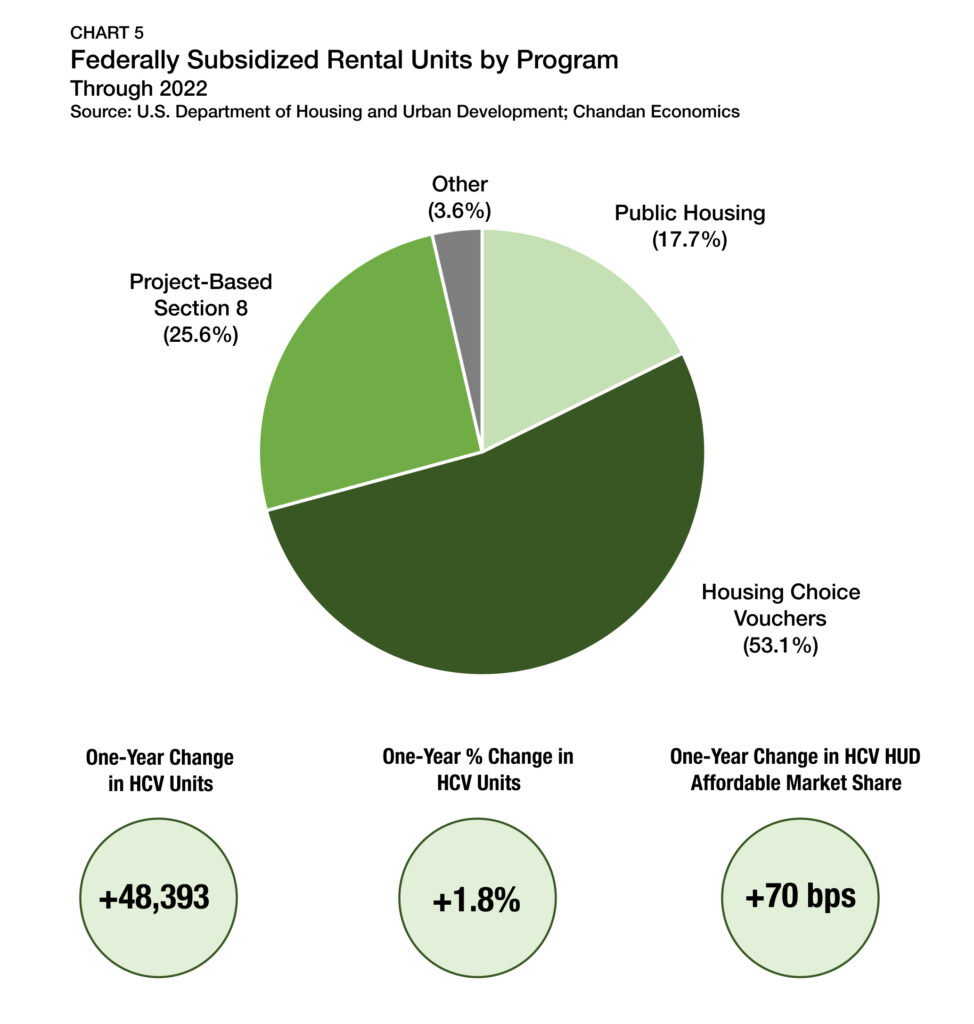

Housing Choice Vouchers (HCV) While LIHTC is the largest supply-side affordable housing program in the U.S., the HCV program is the biggest overall, accounting for 2.7 million units or 53.1% of all federally subsidized rental units1 , climbing 70 basis points (bps) from 2021 (Chart 5). The next largest program by unit count, Project-Based Section 8 is a distant second at 25.6%.

The HCV program is primarily a form of tenant-based housing assistance, where renters spend 30% of their adjusted monthly income on rent, and the balance is covered through a subsidy. It provides targeted assistance to very low-income households. The average household income for renters in this program was $16,019 in 2022. HCVs are widely supported by private-market advocates. Unlike rent control, which places the burden of the subsidy on the landlord, HCVs interact openly in a market setting. Moreover, households in the program can retain their subsidy should they move, encouraging positive housing mobility.

However, the HCV program has expanded slowly in recent years, failing to keep pace with the growing need for it. Aside from 2017 and 2018, the number of units covered under the program has expanded between 1.1% and 2.7% per year since 2012 (Chart 6). While recent White House efforts for a more significant expansion of vouchers have failed to garner enough congressional support, momentum has been building over the past year. Within the signed version of the Inflation Reduction Act of 2022, HUD was provided an additional $4 billion for HCV expansion. Looking ahead to 2024, the U.S. Senate has appropriated an additional $1.5 billion of funding for the HCV program. However, as of mid-October, federal spending levels have been frozen at 2023 FY levels, and the timing of a 2024 FY budget vote remains unclear.

Beyond the budget debate, there is a growing congressional effort to amend the HCV program by making it more attractive to private landlords to accept vouchers. A 2018 Urban Institute study concluded that many landlords have been refusing to accept them, driving the rejection rates for qualifying units above 75% in Fort Worth and Los Angeles. To improve the voucher program’s private-market appeal, Representatives Emanuel Cleaver (D-MO) and Lori Chavez-DeRemer (R-OR) reintroduced the Choice in Affordable Housing Act (H.R. 4606) in the U.S. House of Representatives in July 2023. The bill’s $500 million investment aims to increase housing choices for the 2.3 million households currently enrolled in the program. According to the National Low Income Housing Coalition (NLIHC), “the bipartisan bill would expand access to affordable housing through HUD’s Housing Choice Voucher (HCV) program by removing programmatic barriers and establishing incentives to increase landlord participation.”

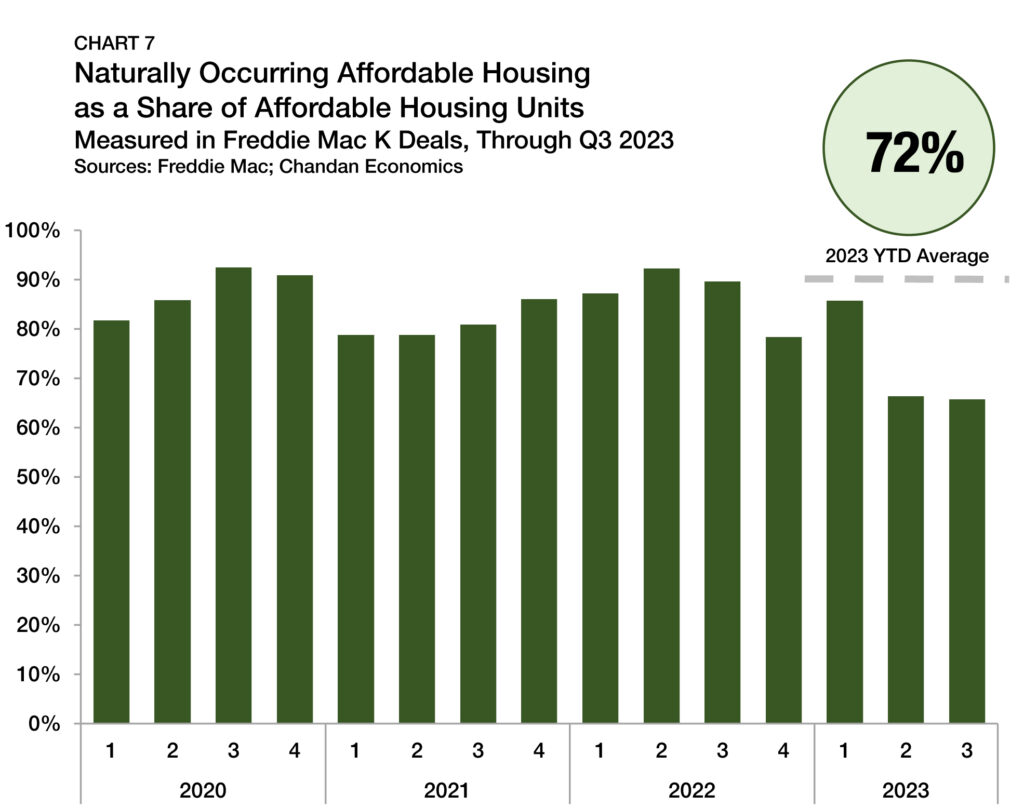

Naturally Occurring and Workforce Housing

Naturally Occurring and Workforce Housing While most of the attention paid to the affordable housing sector focuses on regulation and policy intervention, the supply of naturally occurring affordable housing (NOAH) is far greater. By some estimates, NOAH outnumbers regulatory-supported units by a factor of four — a figure also found in an analysis of Freddie Mac lending data. Through the third quarter of 2023, NOAH properties accounted for 72% of multifamily originations of units affordable at 80% or below of local area median income (AMI) (Chart 7).2

Through the end of 2023, Fannie Mae and Freddie Mac each have a $75 billion multifamily lending cap, with the direction that at least 50% of their loan volume is mission-driven lending, such as supporting the creation and preservation of affordable housing. This significant commitment to improving affordability is likely to enhance housing options nationwide.

Fannie Mae’s Sponsor-Dedicated Workforce Housing Product

Arbor can help you access Fannie Mae’s recently-introduced Sponsor-Dedicated Workforce (SDW) Housing product, designed to help create and preserve workforce housing in the U.S. Through a combination of pricing and underwriting benefits, SDW aims to improve rental affordability and accessibility by establishing an incentive for borrowers to elect rent restrictions over the life of the loan.

The SDW product and its benefits are available to borrowers who agree to keep at least 20% of a multifamily property’s units affordable to renters earning either 80% or 100-120% of the local area median income, depending on the metro area’s cost-burden profile.

The introduction of SDW demonstrates how Fannie Mae and Arbor are working in partnership to encourage more conventional borrowers to become part of the affordable housing solution by being competitive with pricing, maintaining simplicity, and providing a manageable threshold of compliance.

Rent Control

Rent Control Rent control continues to be a contentious issue both locally and nationally. Earlier this year, the Boston City Council approved a petition to exempt the city from the statewide ban on rent control. However, the petition now requires approval from state lawmakers to move ahead, slowing the bill’s momentum to overturn a ban that has been in effect for nearly 30 years. In July, Maryland’s Montgomery County passed a rent control bill that would cap the allowable annual increase for rents at the Consumer Price Index for all urban consumers plus 3% or a maximum of 6%.

The rent control debate has also heated up on the national stage. The Federal Housing Finance Agency (FHFA) is moving ahead with the White House’s Renter Bill of Rights initiative and receiving input from industry voices about how the proposed policies would impact operations. Central to the concern of rental housing providers is a proposal to tie together rent control and Government-Sponsored Enterprise (GSE) mortgage eligibility. According to the National Multifamily Housing Council (NMHC), “implementing rent control would be contrary to the goal and mission of Fannie Mae and Freddie Mac to create more affordable housing opportunities for low- and moderate-income residents.”

Zoning

Utilizing updates to local zoning ordinances has been increasingly gaining favor among tenant and industry advocates alike. Upzoning — an alteration to a zoning code that allows an increase in density of housing units in a given area — is being used more frequently today. It is a way to lift the artificial cap on the amount of housing that can exist in a local area. The idea behind upzoning is that allowing more new construction and improving the supply of rental units will decrease competition for housing and slow rent growth.

The Minneapolis City Council moved to end single-family zoning in 2018, and results of the policy have been broadly positive. A recent analysis by Pew Charitable Trusts concluded that between 2017 and early 2023, rents have stabilized even as the number of total households has grown faster than the national average in that time. California recently followed suit, passing legislation that effectively bans single-family zoning statewide, an action intended to encourage more housing production.

While the federal government does not have jurisdiction over zoning, the White House has called for state and local governments to use upzoning as a policy tool to support the creation of new housing. A key component of the White House’s Housing Supply Action Plan is encouraging supply-side housing policies, including through zoning reforms. Municipalities that institute zoning reforms will be rewarded with higher scores for federal grants, offering a tangible incentive for local policymakers to act.

What to Watch

As Zillow’s Observed Rent Index details, rents in the U.S. are up by roughly 30% since the start of the pandemic. Meanwhile, over the same period, average incomes are only up by about 18%. Housing affordability has quickly eroded over the past couple of years, creating a profound sense of urgency to create more balance in the housing market.

The status of the 2024 FY budget remains a primary concern for all affordable housing stakeholders. Until lawmakers reach an agreement, planned funding increases to the HCV program will stay on hold. Beyond the halls of Congress, the fight to add more affordable housing has become increasingly local, with state-level LIHTCs and zoning reforms gaining prominence in legislative agendas. While the nation’s affordability crisis has become more acute, the attention it is attracting is helping to move the needle forward to a solution.

For more affordable housing research and insights, visit arbor.com/research

1 Total is based on data retrieved from HUD’s Office of Policy Development and Research; data are through 2022.

2 According to a Chandan Economics analysis of Freddie Mac K-Deals.

Disclaimer

All content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations regarding the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein.