The latest report in Arbor Realty Trust’s Affordable Housing Trends series, developed in partnership with Chandan Economics, explores lingering challenges and new opportunities in this critically important multifamily real estate sector. In a new video, Dr. Sam Chandan, one of the commercial real estate industry’s leading scholars, shares his take on the new research report and what its findings could mean for the future of affordable housing finance.

Affordable Housing

Spring 2024

About This Report

The Arbor Realty Trust Affordable Housing Trends Report, developed in partnership with Chandan Economics, offers a wide-ranging view into the complex, yet critically important affordable and workforce housing sectors.

This report series is a comprehensive primer to help industry stakeholders understand the major trends shaping the affordable housing market. It addresses the significant changes observed both in terms of policy decisions and market dynamics and describes opportunities for investment and financing in the space.

Focused primarily on affordable housing supported by government spending, subsidies, or tax incentives, including the Low-Income Housing Tax Credit (LIHTC), Housing Choice Vouchers (HCV), and Project-Based Section 8, these reports also cover the Naturally Occurring Affordable Housing (NOAH) segment and the utilization of rent control.

Key Takeaways

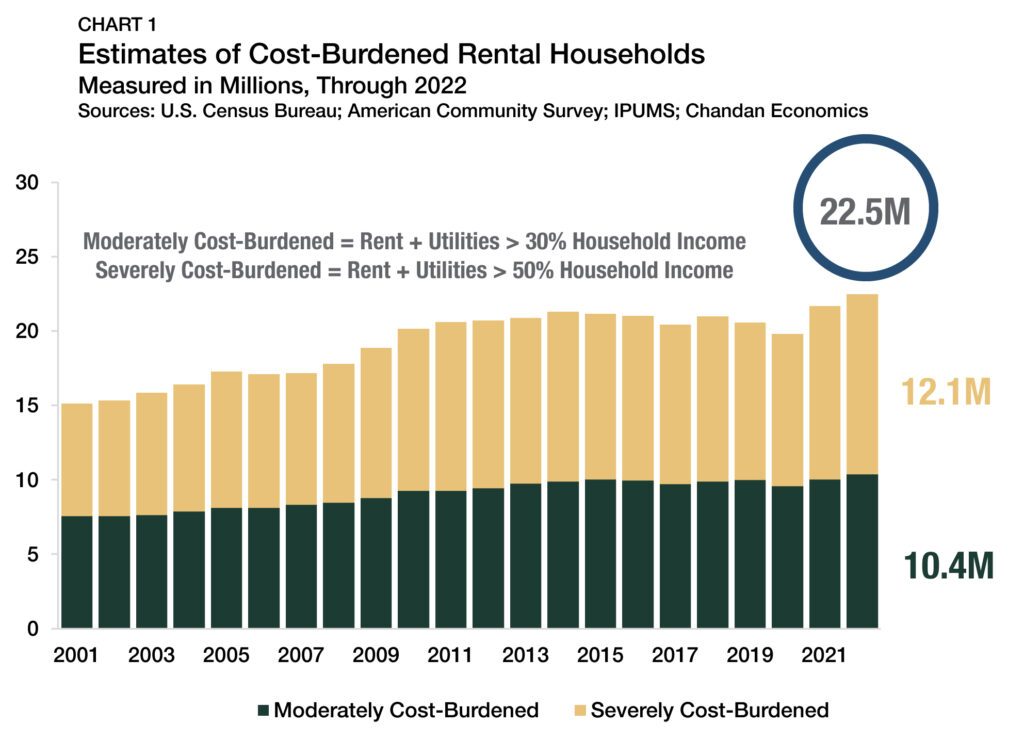

- Approximately half of all rental households in the U.S. are now classified as moderately or severely cost-constrained.

- Critical affordable housing programs received funding expansions in the recently passed FY 2024 federal spending package.

- Up-zoning is being utilized more frequently to encourage affordable housing creation by allowing development in higher-density areas.

State of the Market

As the cost of homeownership climbs ever higher, the affordability crisis has become one of the nation’s most intractable issues. The number of renters that are either moderately or severely housing cost-constrained reached an all-time high of 22.5 million households in 2022, accounting for roughly half (49.8%) of all rentals (Chart 1)1, according to a Chandan Economics analysis of U.S. Census Bureau data. While the number of non-cost-burdened rental households has remained effectively flat (-0.05%) over the past five years, cost-burdened rentals have swelled by 10%.

The National Low Income Housing Coalition’s (NLIHC) March 2024 report The Gap notes that the shortage of affordable rental housing widened between 2019 and 2022, expanding by 480,000 units. The NLIHC estimated that the U.S. currently needs 7.3 million more affordable housing units to meet current demand.

As affordable housing advocates continued to pressure lawmakers, the federal government’s 2024 budget offered some welcomed news. It included an $8.3 billion increase in funding for the U.S. Department of Housing and Urban Development’s affordable housing programs. At the same time, state and local governments are utilizing policy initiatives, including tax credits for new construction and targeted amendments to zoning codes, to encourage development. With more funding on the way, policymakers and private market advocates are pressing ahead with plans to add units to an increasingly tight housing market.

LIHTC

The Low-Income Housing Tax Credit (LIHTC) program is the nation’s single-largest supply-side affordable housing resource. LIHTCs come in two forms: a 9% tax credit to incentivize new development and a 4% tax credit for rehabilitating and preserving existing properties. According to the National Housing Preservation Database, LIHTCs supported approximately 2.6 million rental units in 2023. In recent years, developer funding gaps have limited the use of the 9% LIHTC. Construction costs have soared while the 9% LIHTC tax credit, which developers can sell to finance their projects, has declined in value. Following the 2016 election, LIHTC equity prices dropped in value by about 10% as investors anticipated (and eventually received) a decrease in tax liabilities (Chart 2). Since 2021, 9% LIHTC equity prices have stabilized between $0.87 and $0.89 per credit, according to CohnReznick’s Housing Tax Credit Monitor.

Meanwhile, the rehabilitation tax credit became more appealing after the December 2020 passage of the Consolidated Appropriations Act established a minimum 4% floor on the applicable federal tax credit rate for tax-exempt multifamily housing private activity bonds (PABs). The minimum floor made the 4% tax credit more valuable and increased how much funding developers can raise to finance construction. As a result, the 4% LIHTC tax credit for rehabilitation became more attractive compared to the ground-up development 9% credit, leading to a greater share of rehabilitation activity. In 2023, the 4% credit accounted for 59.5% of newly HUD-insured LIHTC mortgages — a new high.

In 2023, the dollar volume of investor equity closed into housing tax credit funds reached another record high of $26.3 billion — an increase of 6.6% year-over-year, according to CohnReznick (Chart 3). In its Housing Tax Credit Monitor Report, CohnReznick notes that two factors were largely responsible for the volume increase: increased use of the 4% tax credit and the Community Reinvestment Act (CRA). Amended in October 2023, the CRA encourages banks to help meet the credit needs of low- and moderate-income neighborhoods.

Despite the federal LIHTC program’s overwhelming importance, LIHTC’s complexity and incremental funding expansions have made it more difficult for it to keep pace with the growing national need for new housing. However, progress has been moving faster at the state level. According to Novogradac, 29 states now have state-level LIHTC programs, more than double the amount just a decade ago, with 17 state-level programs introduced since 2013. This trend likely has staying power after Texas and Rhode Island both introduced LIHTC programs in the past year.

Project-Based Section 8

The Section 8 Project-Based Rental Assistance (PBRA) program is one of the largest affordable housing initiatives in the U.S., supporting an estimated 1.4 million rental units through 2023. It is open to low-income households earning at most 80% of their local area median income. Landlords participating in the PBRA program receive the fair market rent (FMR) for each occupied unit, as established by the local public housing agency. Tenants are responsible for paying up to 30% of their adjusted income toward rent and utilities or $25 — whichever is greater. The Federal PBRA subsidy will then cover the difference between the FMR and the tenant contribution.

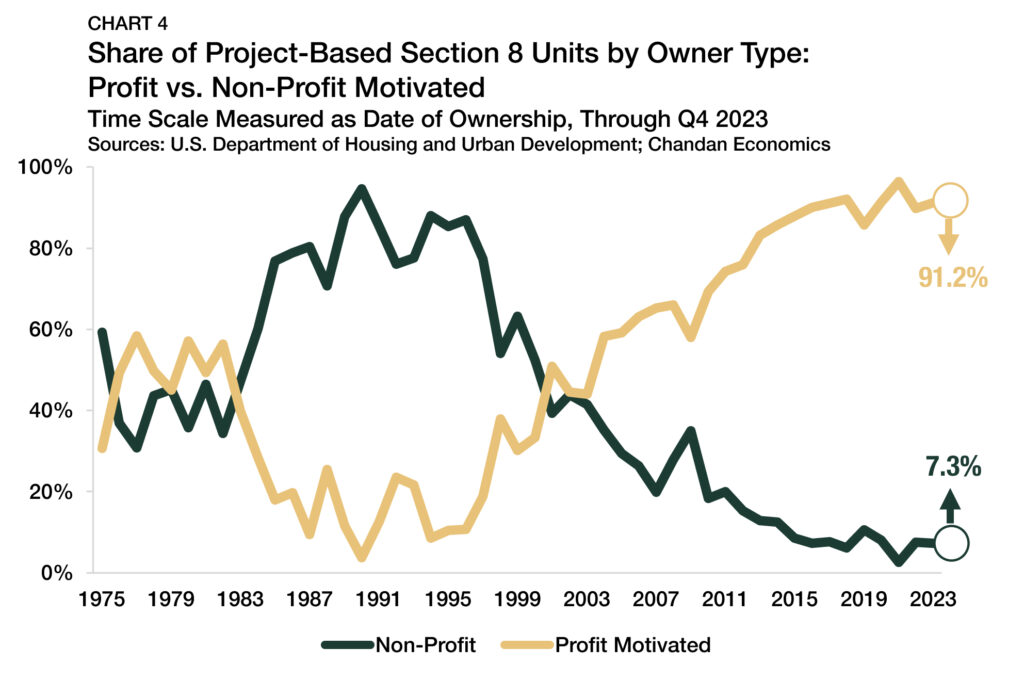

For decades, this program has successfully attracted large numbers of private, for-profit owners. Between 1990 and 2023, the share of owners entering Section 8 PBRA that are profit-motivated has grown from 3.4% to 91.2% (Chart 4). The U.S. Department of Housing and Urban Development has also made a series of updates and rule changes in the past year that make the program more attractive to the private market and make it easier for owners to rehabilitate and re-capitalize their properties. In 2024, the PBRA is slated to receive a much-needed boost in federal support as HUD’s FY 2024 budget included a 7.4% increase above FY 2023 levels.

Housing Choice Vouchers (HCV)

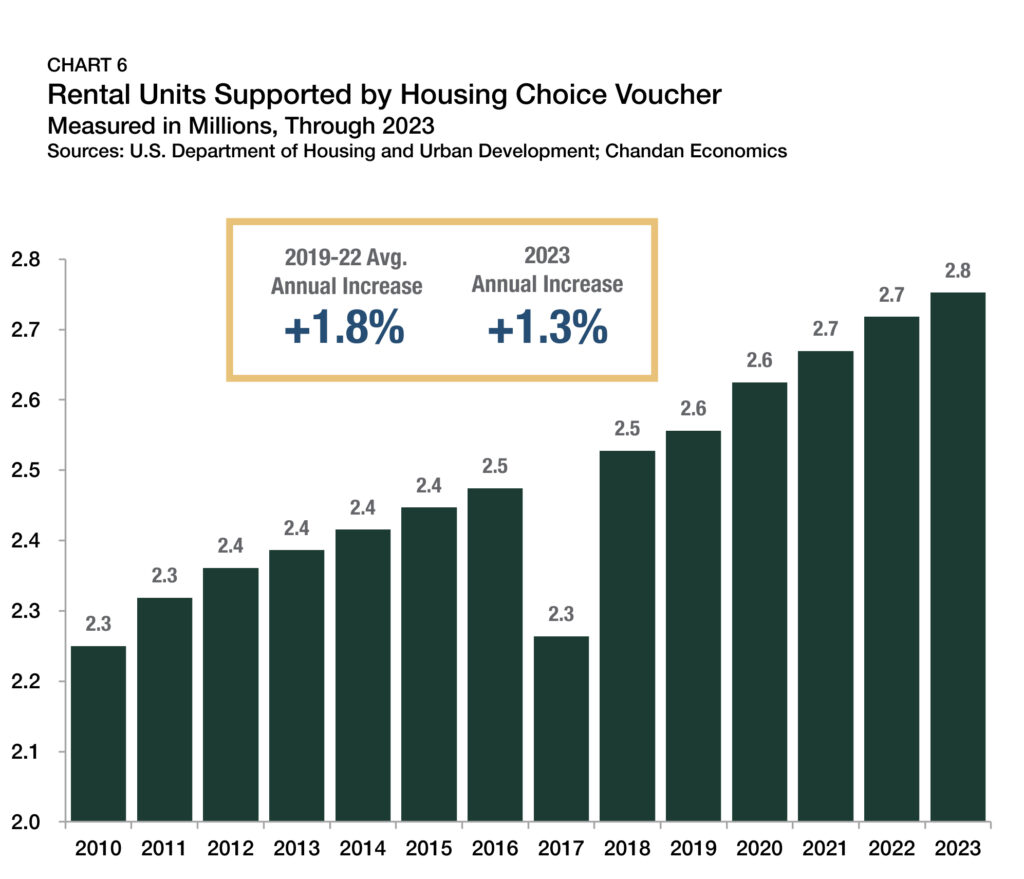

LIHTC is the largest supply-side affordable housing program in the U.S., but the Housing Choice Voucher (HCV) program is the biggest overall and continues to grow. It accounted for nearly 2.8 million units or 53.7% of all federally subsidized rental units2, climbing 59 basis points (bps) from 2022 (Chart 5). The next largest program by unit count, Project-Based Section 8, is a distant second at 25.6%. (Note: LIHTCs are excluded from this analysis.)

The HCV program is primarily a form of tenant-based housing assistance in which renters spend 30% of their adjusted monthly income on rent, and the balance is covered through a subsidy — much like in the PBRA program. However, the HCV program allows tenants to move to a new location and maintain their voucher, which promotes housing mobility and greater access to economic opportunities. In 2023, the average household income for renters in this program was $17,835. Both major political parties and the private market broadly support the HCV program.

Unlike rent control, which places the subsidy burden on the landlord, HCVs interact openly in a market setting. The program gives households the option to retain their subsidy should they move, encouraging positive housing mobility. However, the HCV program has been slow to expand in recent years, failing to keep pace with the growing needs of low-income renters. Between 2019 and 2022, the program grew an average of 1.8% annually (Chart 6). The pace of its increase slowed to 1.3% in 2023, as federal government operations were funded through a series of short-term spending bills. But with more support from the federal government promised, next year’s projections are brighter. Funding for the HCV program is set to expand by nearly 7% (or $2.1 billion) in 2024.

In October 2023, HUD announced that it was expanding its Small Area Fair Market Rents (SAFMR) rule to an additional 41 metropolitan areas. Under the SAFMR rule, the maximum rent covered by the voucher is determined by rent prices within local zip codes — rather than at the metro level. The updated policy allows the voucher program to track local market conditions more closely, improving their usability and utility. By extension, tenants can more easily use vouchers to access higher-rent neighborhoods with better-performing schools and improved economic opportunities.

Zoning

Zoning law reform has emerged as a favored policy tool among both tenant and industry advocates searching for a solution to the ongoing housing supply shortage. Recently, NPR called up-zoning the “hottest trend in U.S. cities,” with roughly 20 municipal-level reforms being considered nationwide as of April 2024.

Up-zoning allows an increase in the density of housing units in a given area. Experts consider it to be a way to lift the artificial cap on the amount of housing that can exist in a local area. The idea behind up-zoning is that allowing more new construction and improving the supply of rental units will decrease competition for housing and slow rent growth.

In recent years, states such as California, Vermont, and Montana, alongside numerous localities, have implemented generational changes to zoning laws. According to the University of California, Berkeley’s zoning reform tracker, Washington has had the most up-zoning reforms since 2007, with 15 adopted or ongoing. California follows closely behind, with 14 adopted or ongoing up-zoning reforms, while North Carolina, Minnesota, and Michigan round out the top five.

Although the Federal government doesn’t hold jurisdiction over zoning, Congress funded a new grant program in its 2023 budget through the Department of Housing and Urban Development (HUD) called the “Yes In My Back Yard” initiative. It aims to incentivize states and localities to reform their zoning laws. The program’s initial $85 million in funding was raised to $100 million in the recently passed FY 2024 budget as part of HUD’s Community Development Block Grant (CDBG) program.

Naturally Occurring and Workforce Housing

While public attention often centers on regulation and policy, naturally occurring affordable housing (NOAH) makes up a much greater share of the total affordable supply. According to an analysis of Freddie Mac lending data and other estimates, NOAH outnumbers regulatory-supported units by a factor of four. In 2023, NOAH properties accounted for nearly 75% of multifamily originations of units affordable at 80% or below the local area median income (AMI) (Chart 7)3.

In 2024, Fannie Mae and Freddie Mac each have a $70 billion multifamily lending cap — down from $75 billion in 2023. However, the FHFA is maintaining its direction that at least 50% of the agencies’ loan volume needs to be mission-driven lending, such as supporting the creation and preservation of affordable housing. Loans classified as supporting workforce housing properties are exempt from the volume caps, which should generate more liquidity within the workforce housing segment.

Nationally, workforce housing, which is often called the ‘missing middle,’ is starting to attract the policy attention it deserves. In December 2023, the Workforce Housing Tax Credit Act was introduced to both chambers of Congress. If passed, the bill would establish a middle-income housing tax credit (MIHTC), which is modeled after the success of the LIHTC program, to help finance the construction of an estimated 344,000 rental units. In addition to the bill receiving support from both Republicans and Democrats, the National Multifamily Housing Council and the National Apartment Association have also endorsed the proposed legislation.

Rent Control

Over the past few years, rent control has reemerged as a political issue. Cities like San Francisco, San Diego, and Washington, D.C., have imposed new restrictions on landlords in recent years, while new state-wide regulations in Washington could potentially follow those already in place in Oregon and California. But, rent control continues to be a contentious topic of discussion.

The long-standing position of housing market economists remains that rent control tends to adversely impact the same renters the policy intends to help.

A recent NMHC Report, Rent Regulation Policy in the United States, explores how, in the long run, rent control policies reduce the number of housing units in a market, exacerbating affordability issues. Rent control regulations can also negatively impact land values, reducing local communities’ tax revenues. A 2024 review of rent regulations by the Federal Reserve of St. Louis found that following rent control implementation, rental stock typically declines as landlords and developers pivot towards owner-occupied properties, undermining potential benefits to tenants.

At the Federal level, the rent control debate remains intense, especially concerning LIHTC. Earlier this year, HUD announced an update to its formula for the maximum allowable rental increase for units in properties receiving LIHTCs. Under the new methodology, the maximum annual rent increase is lowered to 10% — down from 14.7% using the previous methodology. Novogradac estimates that the share of units that the rent cap will impact will rise from 10% to 30%. Industry groups broadly oppose the rule change. Mortgage Bankers Association noted that the updated rent cap policy severely suppresses the LIHTC program and “contradicts many of the Administration’s other efforts to increase affordable rental housing.”

What to Watch

Looking ahead, increasing the affordable housing supply will continue to require an all-hands-on-deck approach. The bi-partisan Tax Relief for American Families and Workers Act of 2024 passed the House with overwhelming support earlier this year, although its fate remains uncertain in the Senate. If passed, the bill would restore higher allocation increases for LIHTC, which could lead to the creation of an additional 200,000 affordable rental units.

The path forward may differ depending on which major political party controls the White House and Congress in 2025. The Biden-Harris Administration’s proposed FY 2025 budget calls for meaningful expansions of key policy programs, including HCV, LIHTC, and PBRA. Meanwhile, the Republican Study Committee recently released its FY 2025 Budget Proposal, which calls for combining and re-purposing current Federal subsidies for programs such as LIHTC and PBRA into increased funding for Housing Choice Vouchers.

Although housing affordability is a national concern, state and local lawmakers continue demonstrating their worth in easing the crisis. As myriad solutions aimed at expanding supply begin building upon one another, fundamental change will be next to follow.

-

Affordable Housing

Affordable housing broadly refers to housing that costs less than 30% of a household’s income. Affordable housing includes units that are naturally occurring without any policy intervention, as well as government-supported units that are made affordable to income-constrained renters through a subsidy or a tax incentive.

-

Affordability

Housing affordability is measured as spending up to 30% of a renter household's income on rent plus utilities.

-

Naturally Occurring Affordable Housing (NOAH)

Units that do not receive subsidies, but are affordable to low- and moderate-income renters. In this analysis, a NOAH unit is defined as one where a renter household earning at most 80% of the area median income would spend less than 30% of its income on rent plus utilities.

-

Housing Choice Voucher (HCV)

The federal government's major program for assisting low-income renters in the private market. A subsidy is paid to the landlord and the occupant pays the difference between the rent charged and the subsidy.

-

Low-Income Housing Tax Credit (LIHTC)

Tax credits provided for the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

-

U.S. Department of Housing and Urban Development (HUD)

A U.S. government agency that supports community development and home ownership. The Agency oversees many affordable housing programs including the HCV and LIHTC.

Sources: U.S. Department of Housing and Urban Development; Tax Policy Center; Chandan Economics

For more affordable housing research and insights, visit arbor.com/articles

1 Housing cost burden measured as gross rents, including contract rents and utilities. For this analysis, households with no recorded gross rent are considered non-cost-burdened and households with positive gross rents and negative or no incomes are considered severely cost-burdened.

2 The total is based on data retrieved from HUD’s Office of Policy Development and Research as of the end of 2023.

3 According to a Chandan Economics analysis of Freddie Mac K-Deals.

Disclaimer

All content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations regarding the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein.