Build-to-rent (BTR), a compelling solution to the U.S. housing market’s evolving needs, is experiencing record growth. BTR accounted for 8% of all single-family rental (SFR) construction starts in the 12 months that ended in the first quarter of 2024, according to Arbor’s Single-Family Rental Investment Trends Report Q2 2024. As the need for quality rental units remains high, borrowers have much to gain from partnering with an experienced lender who specializes in build-to-rent financing.

Affordable Housing

Winter 2024/2025

About This Report

The Arbor Realty Trust Affordable Housing Trends Report, developed in partnership with Chandan Economics, provides insight and analysis of the affordable and workforce housing sectors. It is designed to help industry stakeholders gain a deeper understanding of market dynamics, policy decisions, and economic opportunities with its comprehensive coverage of the multifamily real estate sector where federally supported initiatives — such as the Low-Income Housing Tax Credit (LIHTC) and Housing Choice Vouchers (HCV), zoning measures, naturally occurring affordable housing (NOAH), and rent control regulations — remain in flux.

Key Takeaways

-

The direction of federal affordable housing policy is yet to be determined as new leadership is set to assume control in Washington, DC., in January 2025.

-

California voters rejected a ballot measure in the November 2024 election that would have implemented statewide rent controls.

-

The Republican Party’s full-year 2025 budget proposal shows that the incoming administration is in favor of expanding the Housing Choice Voucher program.

-

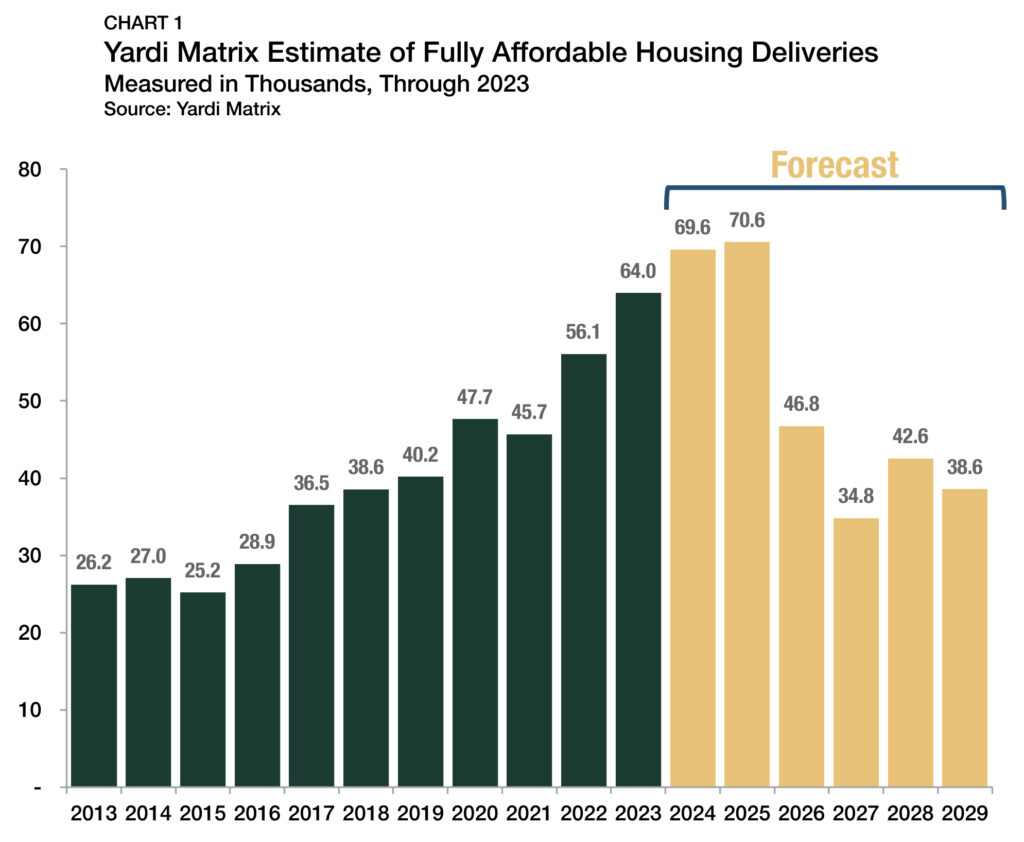

Annual affordable housing completions have been forecasted to peak next year at more than 70,000 units and then drop considerably over the next several years.

State of the Market

Following the results of the 2024 general election, new political leaders will be charged with tackling a persistent affordable housing deficit. Increasingly, the magnitude of the national housing crisis has been capturing public attention. The Pew Research Center reported that 69% of Americans “express a high degree of concern” with the state of affordability in the U.S. Additionally, nearly half of all rental households pay more than 30% of their income towards housing costs, highlighting a mounting need for more affordable housing.

While public and private efforts to close the affordability gap have made significant progress, the creation and preservation of affordable housing units have been forecasted to peak in 2025. Fully affordable housing deliveries have consistently risen since 2014, according to Yardi Matrix (Chart 1). Next year, 70,590 fully affordable units will reach the market, representing a 261% increase in 10 years. However, the delivery of fully affordable units could be cut in half by 2027, to 34,832 units, further weakening housing affordability nationally.

At year-end, the affordable and workforce housing sectors sit at a crossroads. Under the Biden administration, federal funding for several key programs expanded, albeit gradually. However, in a second Trump administration, a market-based approach to housing policy will likely shake up long-standing programs and initiatives that incentivize affordable housing development.

LIHTC

The Low-Income Housing Tax Credit (LIHTC) program, the single-largest supply-side affordable housing resource in the U.S., supported approximately 2.6 million rental units in 2023. It comes in two forms: a 9% tax credit to incentivize new development and a 4% tax credit for rehabilitating and preserving existing properties.

In anticipation of the 2017 Tax Cuts and Jobs Act, LIHTC equity prices dropped in value by about 10% as a result of decreased tax liabilities (Chart 2).

Since 2021, 9% LIHTC equity prices have stabilized between $0.87 and $0.89 per credit, according to CohnReznick’s Housing Tax Credit Monitor. As developers commonly sell these credits to finance their projects, the pricing drop-off has exacerbated funding shortfalls and made it less advantageous to use the 9% LIHTC. However, state and local governments are increasingly finding new ways to fill the gap. For example, in North Carolina, local housing authorities have been tapping into the U.S. Department of Housing and Urban Development (HUD)’s HOME Investment Partnerships Program, which provides grants to states and localities that communities use to fund affordable housing. In May 2024, the Biden administration announced an additional $5.5 billion in funding for more than 2,400 grants to states, counties, and localities — generating increased financial support for innovative policy solutions.

The rehabilitation tax credit has also become more appealing since the December 2020 passage of the Consolidated Appropriations Act established a minimum 4% floor on the applicable federal tax credit rate for tax-exempt multifamily housing Private Activity Bonds. The minimum floor made the 4% tax credit more valuable and increased how much funding developers can raise to finance construction. As a result, the 4% LIHTC tax credit for rehabilitation became more attractive than the ground-up development 9% credit, leading to it receiving a greater share of rehabilitation activity. Over the year ending in the third quarter of 2024, the 4% credit accounted for nearly two-thirds (64.4%) of newly HUD-insured LIHTC mortgages.

While LIHTC’s complexity and incremental funding expansions have challenged the program’s ability to keep pace with the growing national need for new housing, minor improvements have occurred. In early 2024, the Tax Relief for American Families Act passed with an overwhelming bipartisan majority. The legislation secured funding increases of 12.5% through 2025 and aims to support the development of an additional 200,000 affordable units. Additionally, 2024 marks the deadline for property owners and managers to comply with the Housing Opportunities Through Modernization Act (HOTMA) of 2016, which standardized the LIHTC tenant qualification process. As part of a set of rule changes, HOTMA introduced impactful income-averaging provisions that allow for greater flexibility in the leasing process.

Housing Choice Vouchers (HCV)

The Housing Choice Voucher (HCV) program is the largest affordable housing spending program in the U.S., and it continues to grow. It accounted for nearly 2.8 million units or 53.7% of all federally subsidized rental units1, climbing 59 basis points (bps) in 2023 (Chart 3). The next largest program by unit count, Project-Based Section 8, is a distant second at 25.6%. (Note: LIHTCs are excluded from this analysis.).

1 Total is based on data retrieved from HUD’s Office of Policy Development and Research; data are through 2023.

The HCV program is primarily a form of tenant-based housing assistance in which renters spend 30% of their adjusted monthly income on rent, and the balance is covered through a subsidy — much like in the PBRA program. However, the HCV program allows tenants to move to a new location and maintain their voucher, a provision that promotes housing mobility and access to economic opportunities among a group of renters who have an average annual household income of $17,835.

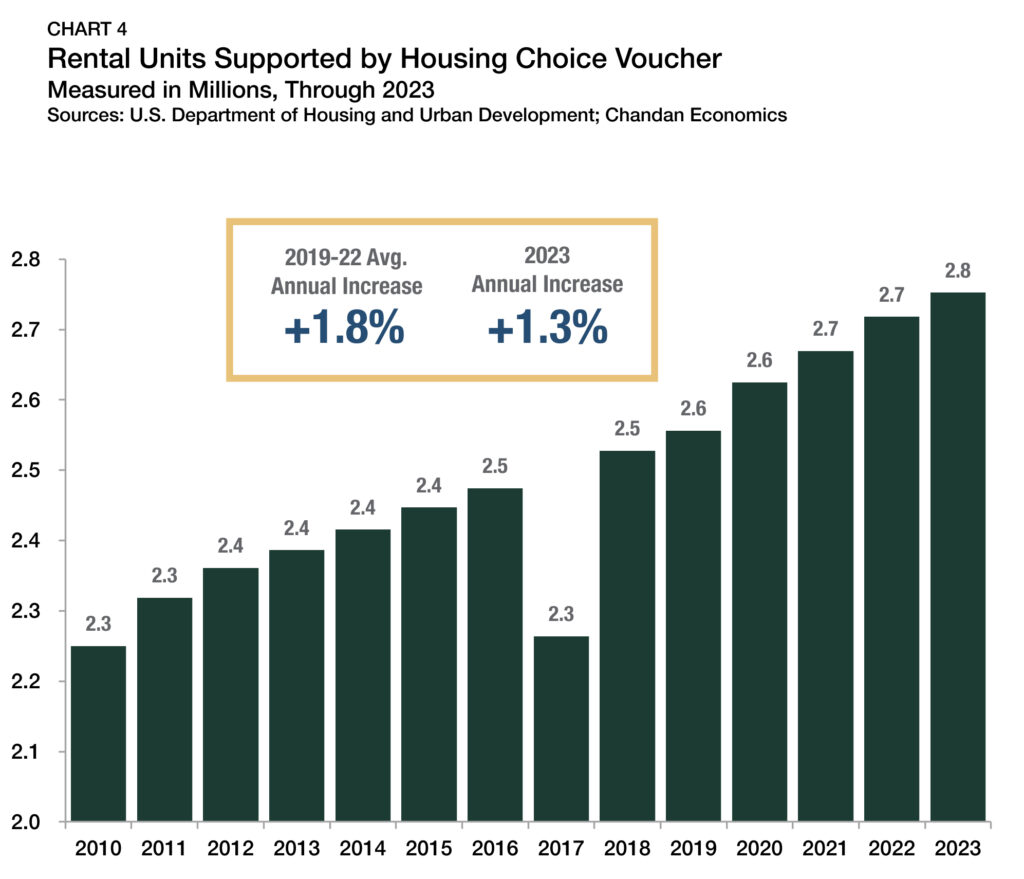

Unlike rent control, which places the subsidy burden on the landlord, HCVs interact openly in a market setting. As a result, HCV has remained popular on Capitol Hill among both major political parties, even though it has not seen significant expansion in recent years. Its allocation grew by less than 2% in four of the past five years, including in 2023 (+1.3%) (Chart 4). While HCV funding received a more sizeable 7.1% boost in 2024, future funding levels remain less clear.

Although the previous Trump administration proposed cutting funding to HUD by more than 13%, the Republican Study Committee’s 2025 FY Budget Proposal has called for re-purposing federal funds earmarked for other affordable housing programs to use in the HCV program. If the incoming Congress adopts a similar approach, it could mean a larger HCV program alongside a smaller federal government footprint.

Zoning

Zoning law reforms remain a favored strategy among housing advocates looking to alleviate today’s supply constraints. One approach to land use reform, often referred to as up-zoning, focuses on increasing housing density through expanding property air rights, eliminating parking requirements, and lifting regulations prohibiting certain accessory units. According to data tracked by the University of California-Berkeley, 105 separate state or municipal-level up-zoning reforms were passed nationwide between the beginning of 2020 and the end of 2023. In the four preceding years, only 35 of these types of laws were passed.

While calls for zoning reform have grown louder, state-level efforts have only gradually been gaining momentum. Since 2007, the state of Washington has led the nation in up-zoning legislation, with 15 adopted or ongoing reforms. California follows closely behind, with 14 adopted or ongoing, while North Carolina, Minnesota, and Michigan round out the top five.

However, zoning reforms have yet to emerge as a legislative priority nationally. Although the federal government doesn’t have jurisdiction over zoning, any political consensus has been elusive as some leaders believe zoning laws will weaken affordability. Several bills have been proposed by members of both parties aimed at addressing zoning laws. While most remain in legislative limbo, President Biden appeared to embrace zoning reforms in March 2024 as a potential solution for housing needs, demonstrating it has support at the federal level.

Since the 2022 omnibus spending bill, Congress has funded grants to incentivize and provide resources for local zoning overhauls through HUD. Dubbed the Yes in My Back Yard (YIMBY) initiative, the program’s initial $85 million appropriation in FY 2023 was increased to $100 million in the 2024 federal budget. Next year’s budget has not been passed as the federal government is currently operating on a continuing resolution set to expire on December 20, 2024. As a result, YIMBY’s funding remains at FY 2024 levels.

A new budget is unlikely until after the January inauguration — when the realities of a new Congress and a new administration will determine what mandate, if any, zoning reformers have. Early indications are that the incoming Trump administration does not favor zoning reform. Still, pressure from middle-of-the-aisle members of Congress could keep the issue in the national spotlight.

Naturally Occurring and Workforce Housing

While public attention often centers on regulation and policy, naturally occurring affordable housing (NOAH) is responsible for a much larger share of the total affordable supply. According to McKinsey, NOAH outnumbers regulatory-supported units four-to-one. Freddie Mac lending data shows a similar proportional split. Through the first three quarters of 2024, NOAH properties accounted for more than 77% of multifamily originations of units affordable at 80% or below the local area median income (AMI) (Chart 5)2.

2 According to a Chandan Economics analysis of Freddie Mac K-Deals.

In 2025, the Federal Housing Finance Agency (FHFA) will allow Fannie Mae and Freddie Mac each to have an annual $73 billion multifamily lending cap, up from $70 billion in 2024. However, FHFA maintained its direction that at least 50% of the Government-Sponsored Enterprises’ (GSE) loan volume needs to be mission-driven lending, such as supporting the creation and preservation of affordable housing. Loans classified as supporting workforce housing properties are exempt from the volume caps, which has generated more liquidity within the workforce housing segment.

The incoming presidential administration has signaled that it intends to use deregulation to encourage construction, which could mean that NOAH’s role in the affordable housing ecosystem may soon expand. But, whether the privatization of the GSEs is a policy priority, as it was during the first Trump administration, is another open question. If it is, the affordable financing deck would certainly shuffle.

Rent Control

Rent regulations, which have recently gained traction in political circles, remain a contentious issue. While rent price restrictions benefit existing tenants of price-restricted housing units, they can ultimately negatively impact housing availability and undermine renters more broadly.

A 2024 review of rent regulations by the Federal Reserve Bank of St. Louis found that following rent control implementation, rental stock typically declines as landlords and developers pivot towards owner-occupied properties. Declines in the availability of affordable rentals in low-income areas can drive up prices due to changes in supply and demand, displacing low-income families and fueling gentrification.

One of the most noteworthy state-level rent regulation bills this year was California’s Proposition 33, which proposed lifting the state’s restrictions on cities’ and counties’ ability to impose rent caps while prohibiting the state from imposing such limits in the future. California voters rejected Proposition 33 on November 5, the third such defeat for rent control reform since 2018. Meanwhile, in New York City, affordable housing advocates received welcome news from the Supreme Court on November 12, 2024, when it declined to hear a case that challenged current rent control regulations that limit price increases and make it more difficult for landlords to evict non-paying tenants.

Trump’s reelection and an incoming Republican majority in Congress will likely limit rent control debate at the federal level for the foreseeable future. In the outgoing Congress, LIHTC has been the primary avenue where debate over rent control has occurred nationally. In early 2024, HUD lowered the maximum allowable rental increase for property units receiving LIHTCs from 14.7% to 10.0%. Industry groups, such as the National Association of Home Builders, have long called for the expansion of LIHTC, which stands to hold a prominent place in any affordable housing discussions within the incoming administration.

What to Watch

2025 could usher in big changes to affordable housing. Unified Republican control of the White House and both chambers of Congress will likely pivot policy toward more market-based approaches. In the same vein, federally-directed affordable housing policy will likely shift away from HUD initiatives, but the big outstanding question is: by how much?

As part of the Heritage Foundation’s Project 2025, a policy blueprint of GOP priorities, President-elect Trump’s previous HUD Secretary, Dr. Ben Carson, proposed sweeping overhauls, including tighter financial controls, strengthened work-readiness requirements, and many other initiatives that would altogether “reset” HUD and offer a “broad reversal of the Biden administration’s” program expansions. While the HUD policy direction of the incoming administration remains to be seen, if its actions follow Carson’s outline, a dramatic shift could occur in the federal government’s role in the affordable housing sector.

Beyond changes afoot at HUD, the Republican Party’s 2024 platform proposed leasing federal lands for new home construction and tax incentives for first-time home-buyers. Vice President Harris endorsed similar proposals during her campaign, suggesting that such initiatives could be palatable to moderate Democrats whose support Republicans may need.

Nevertheless, tight margins in the House and Senate will influence the extent of any cuts and could open the door for bipartisan compromise. Given the traction housing affordability has with voters, the issue may be able to unite members of both parties. While supply shortages in the U.S. remain acute, governmental programs and initiatives have proven effective thus far in creating and preserving affordable housing. All that may be needed now is a fresh perspective on how to close the gap.

-

Affordable Housing

Affordable housing broadly refers to housing that costs less than 30% of a household’s income. Affordable housing includes units that are naturally occurring without any policy intervention, as well as government-supported units that are made affordable to income-constrained renters through a subsidy or a tax incentive.

-

Affordability

Housing affordability is measured as spending up to 30% of a renter household's income on rent plus utilities.

-

Naturally Occurring Affordable Housing (NOAH)

Units that do not receive subsidies, but are affordable to low- and moderate-income renters. In this analysis, a NOAH unit is defined as one where a renter household earning at most 80% of the area median income would spend less than 30% of its income on rent plus utilities.

-

Housing Choice Voucher (HCV)

The federal government's major program for assisting low-income renters in the private market. A subsidy is paid to the landlord and the occupant pays the difference between the rent charged and the subsidy.

-

Low-Income Housing Tax Credit (LIHTC)

Tax credits provided for the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

-

U.S. Department of Housing and Urban Development (HUD)

A U.S. government agency that supports community development and home ownership. The Agency oversees many affordable housing programs including the HCV and LIHTC.

Sources: U.S. Department of Housing and Urban Development; Tax Policy Center; Chandan Economics

For more affordable housing research and insights, visit arbor.com/articles

Disclaimer

This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein and is not prepared in accordance with the regulation regarding investment analysis. The material in the report is obtained from various sources per dating of the report. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. That said, all content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations or warranties, express or implied, as to the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third-party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein. There may have been changes in matters which affect the content contained herein and/or the Companies subsequent to the date of this report. Neither the issue nor delivery of this report shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that the affairs of the Companies have not since changed. The Companies do not intend, and do not assume any obligation to update or correct the information included in this report. The contents of this report are not to be construed as legal, business, investment or tax advice. Each recipient should consult with its legal, business, investment and tax advisors as to legal, business, investment and tax advice. The information contained herein may be subject to changes without prior notice. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person.