National rent growth in the single-family rental (SFR) sector remained strong and consistent in 2025 as market-level pricing momentum was broad-based and robust, according to an analysis of newly released data from the Zillow Observed Rent Index. Year-end annual rent gains averaged 2.9%, down from 4.1% in 2024, marking the most modest increase since 2015. But even as the intensity of SFR rent growth abated last year, its reach was extensive, with 98 of the 100 largest markets posting year-over-year gains.

Top Markets for Multifamily Investment Report 2024

Table of Contents

Overview

As interest rates have begun falling, optimism has spread through major metropolitan areas. From coast to coast, attractive opportunities abound as the economy normalizes. With investment activity poised to rise, the question remains: Where are the best locations to deploy capital?

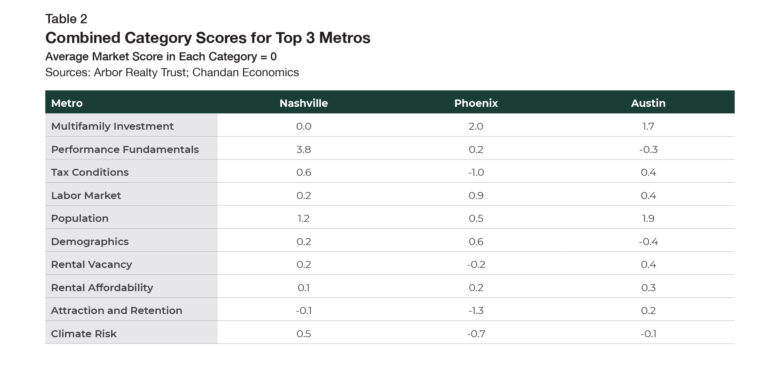

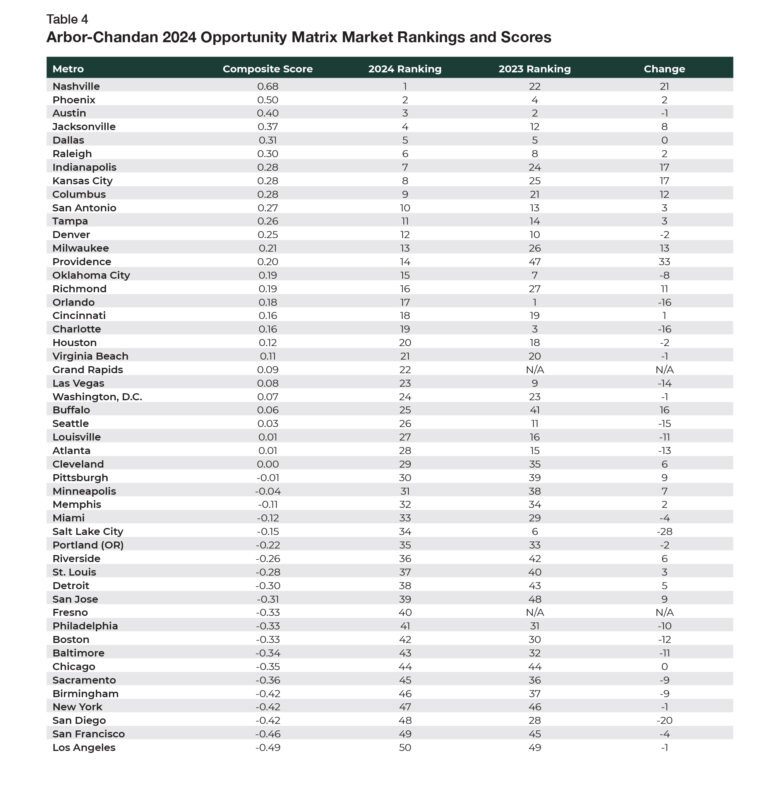

In 2024, Nashville, TN, Phoenix, AZ, and Austin, TX, are proving to be the top markets for multifamily investment, displaying winning combinations of attributes, such as affordability, population growth, and attractive climates.

The Arbor-Chandan 2024 Multifamily Opportunity Matrix analyzed a wide range of factors to determine the economic strength of the largest 50 U.S. metros over the last year and assess their ability to handle market conditions in 2025 and beyond. Top Markets for Multifamily Investment Report 2024, a roadmap to best-performing metros, is a guide to help investors select the right location for their capital.

Key Findings

- Nashville is 2024’s top metropolitan market for multifamily investment due to its solid performance fundamentals, robust population growth, and rapidly growing technology, healthcare, and tourism sectors.

-

Affordable Midwestern markets performed strongly in this year’s rankings, while many of the nation’s largest cities finished lower.

-

Austin and Phoenix finished second and third, respectively — underscoring that structural strengths can outweigh short-term housing supply imbalances.

PDF link below

Top Ranked Markets

Nashville

Nashville ranked number one in the 2024 Multifamily Opportunity Matrix due to its well-rounded set of fundamentals, competitive tax climate, and ability to attract renters from other metropolitan areas (Table 1). Whether it is Nashville’s vibrant culture or its bustling economy, Tennessee’s capital city has gained residents at an impressive clip. In 2023, Nashville’s population swelled 1.5%, three times faster than the national average. Driven by the healthcare, technology, and tourism sectors, Nashville’s labor market had the lowest unemployment rate (2.5%) of all the 50 largest U.S. metros through July 2024.

For a full breakout of the 2024 scores and rankings, see Table 4

in the Appendix at the end

of the report.

Phoenix

While rent growth has slowed amid increased housing supply, Phoenix’s economic engine continued to show signs of its enduring health. Thanks to a dynamic labor market,Phoenix climbed to the second spot.

Over the past year, the unemployment rate in Phoenix has decreased by 0.5 percentage points to reach 3.1% in July 2024, the best mark of the 50 metros measured in the Multifamily Opportunity Matrix.

Phoenix’s impressive job gains sharply contrast with the national unemployment rate, which ticked 0.8 percentage points higher over the same period to reach 4.2% in August 2024, according to the U.S. B ureau of Labor Statistics. Phoenix has emerged as a domestic semiconductor manufacturing hub, creating skilled jobs that have reinforced local housing demand. Despite its temporary supply imbalance, rental vacancy rates across the metro have decreased over the past year by 3.4 percentage points, a Census Bureau analysis shows.

Austin

Austin, the third leading high-opportunity market, is another example of where limited housing has camouflaged the underlying strengths of a thriving city. For the past 13 consecutive years, annual population growth in Austin exceeded 2%, a feat not accomplished nationally since 1960. The lack of individual and corporate state-level income tax in Texas has propelled economic activity in the Austin metro area, attracting a growing number of young people. Known as a center of technology and business, Austin now has an above-average share of renters under 35.

Multifamily Investment

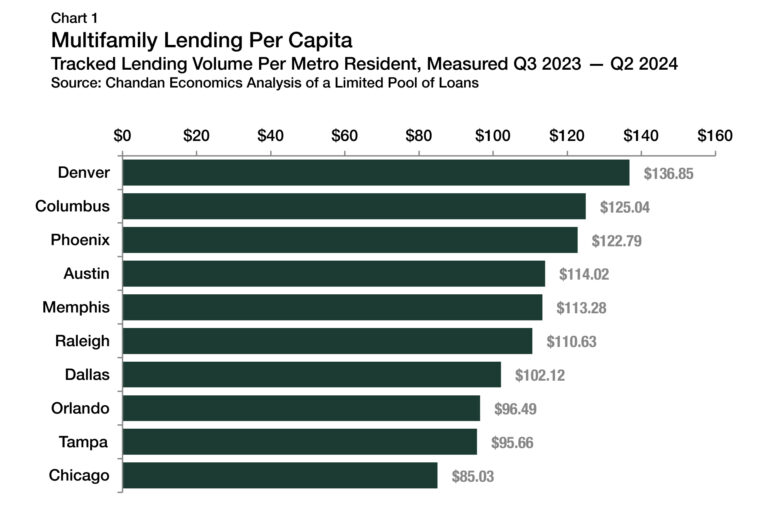

Multifamily investment across U.S. markets is rarely uniform. To locate the best areas of opportunity, we analyzed a pool of multifamily loans tracked by Chandan Economics across the largest 50 metros, originated between July 1, 2023, and June 30, 2024, for both investment sales and refinancings, to determine the markets with the most liquidity to support new multifamily investments. Measured per capita, Denver led the way with the highest total multifamily lending volume within the past year relative to its existing population at $136.85 per person (Chart 1). Part of the surging Midwest region, Columbus claimed the ninth spot in this year’s rankings with $125.04 per resident in multifamily lending volume relative to population.

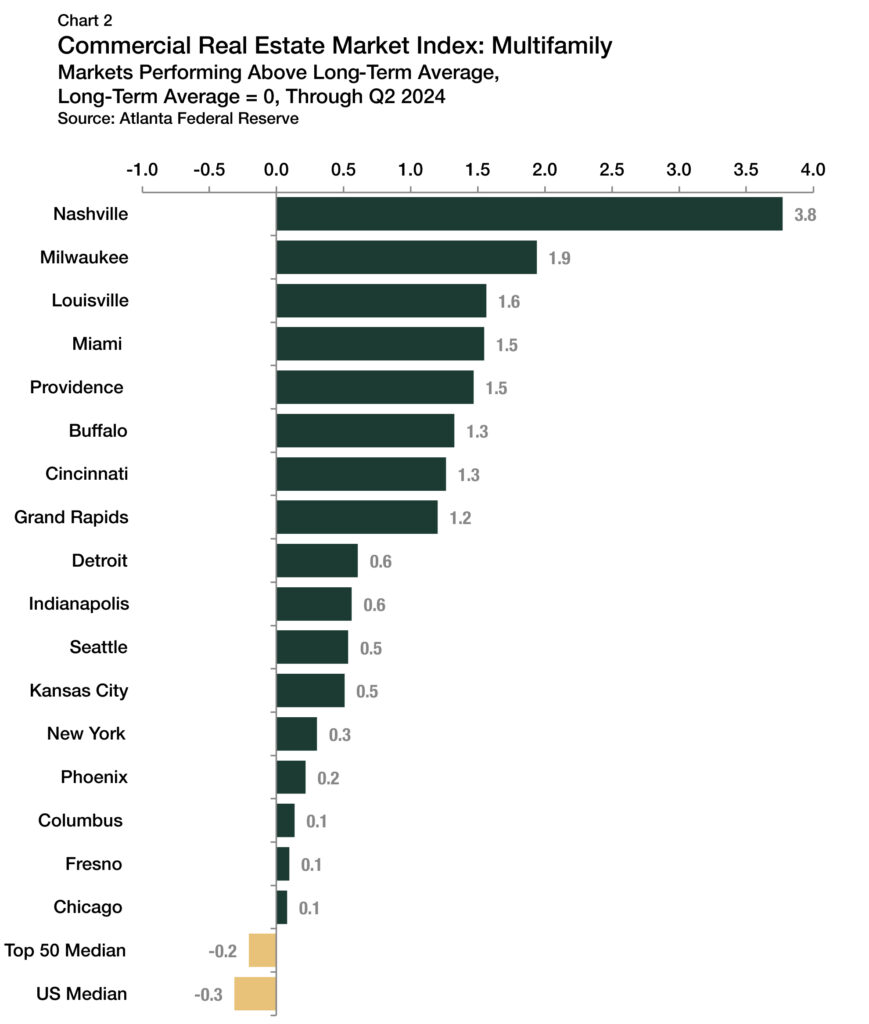

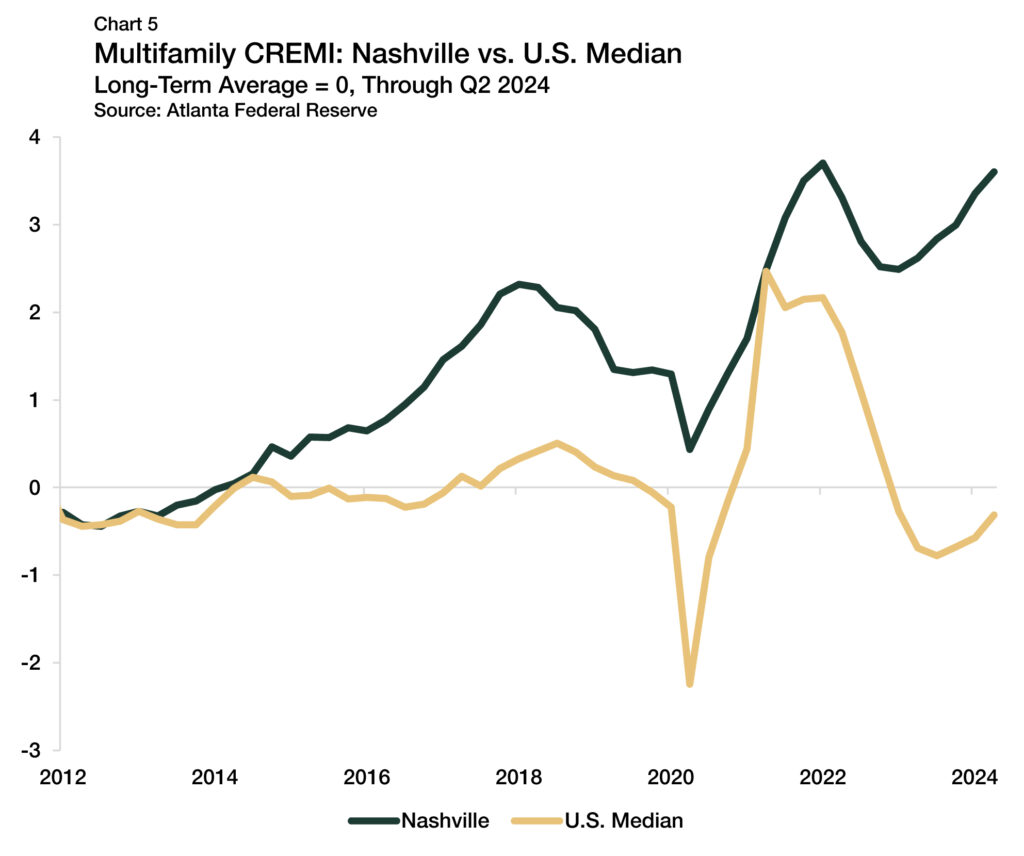

Performance Fundamentals

The Federal Reserve Bank of Atlanta’s Commercial Real Estate Market Index (CREMI) for multifamily properties was a significant factor in the Multifamily Opportunity Matrix’s 2024 rankings. CREMI comprehensively scores how well metro-level multifamily sectors hold up relative to their historical patterns. Net operating income, cap rates, valuations, and absorption are just a few inputs the Atlanta Fed uses to calculate its quarterly indices. With every market having a long-term average score of zero, nationally, most (65%) metros continue to see below-average multifamily sector performance through the second quarter of 2024. Similarly, 60% of the markets in our sample also saw below-average performance relative to their historical standards. However, there were several significant standouts this year, with Nashville, 2024’s top-ranked market, leading the way (Chart 2).

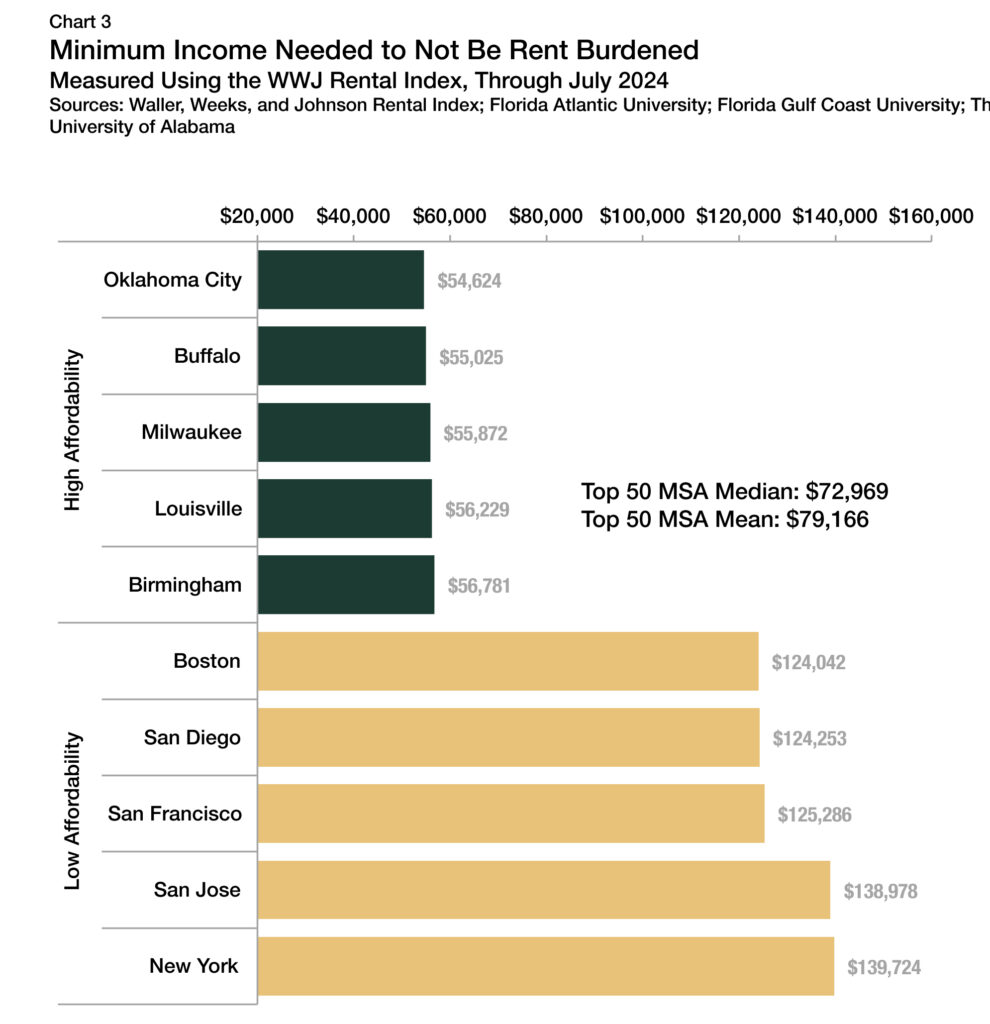

Rental Affordability

Housing affordability remains a primary concern in 2024, and its relevance is reflected in the results of this year’s Multifamily Opportunity Matrix. According to an analysis of the U.S. Census Bureau’s 2023 Current Population Survey, a desire for lower-priced housing, better/new housing, a more desirable neighborhood, or another housing-centric reason motivated the moving decision of more than one-third of renters last year.

Housing affordability in the Multifamily Opportunity Matrix was determined by reviewing Waller, Weeks, and Johnson Rental Index data, which calculates the minimum income required in each metro for households not to be considered rent-constrained. Metros with lower income thresholds for affordability scored higher because they are more attractive to budget-conscious renters.

Oklahoma City led the country in rental affordability in 2024, with an average monthly rental price of $1,366 through July 2024. Households earning $54,624 or more are not considered rent-burdened there (Chart 3). Just behind Oklahoma City was Buffalo, where the rent-burdened threshold was slightly higher at $55,025. Rounding out the top five in rental affordability are Milwaukee ($55,872), Louisville ($56,229), and Birmingham ($56,781). Meanwhile, coastal cities are seeing very different trends in affordability. The threshold is more than twice as high in several of these cities, including New York ($139,724), San Jose ($138,978), and San Francisco ($125,286), which sit at the top of the spectrum.

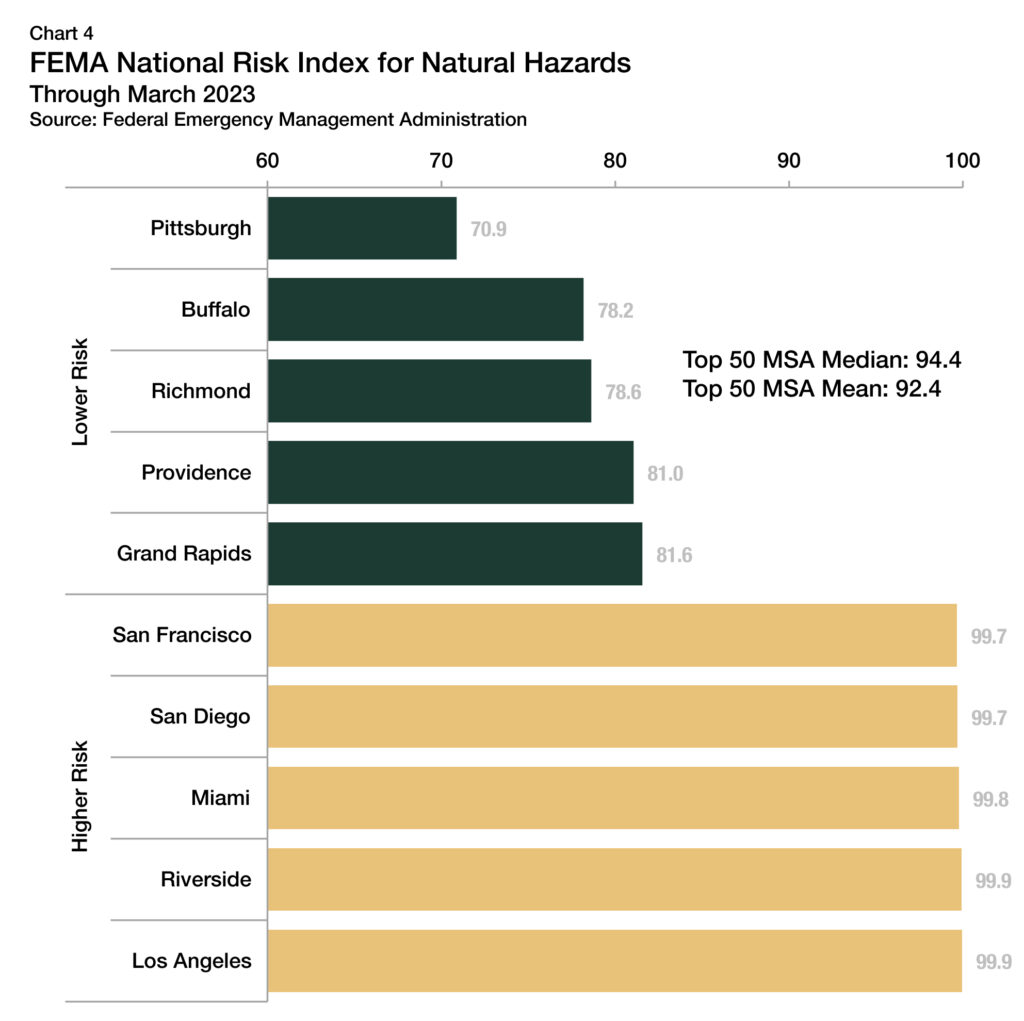

Climate Risk

The 2024 Multifamily Opportunity Matrix includes a comprehensive measure of natural hazard risk. With major storms, extreme heat, and wildfires on the rise, property owners must now incorporate climate risks into their investment decisions. Today, there is a greater likelihood that a multifamily property will encounter hazardous weather that can impact the structural integrity of the asset and the willingness of renters to live there. Beyond direct damage, rental operators need to be wary of increases in insurance premiums as well. While property insurance prices moderated in 2024, annual insurance price growth hit nearly 20% as recently as mid-2023, according to Marsh. Climate factors, which influence a property’s risk-reward calculus, have quickly become a prime consideration in multifamily investment decisions.

The Federal Emergency Management Agency’s (FEMA) National Risk Index for Natural Hazards (NRI) was utilized to assess climate risk in each metro market. FEMA describes the NRI as a “tool that shows which communities are most at risk to natural hazards” and includes data about natural hazards and community resilience.

Los Angeles was the most hazard-prone metro among the top 50, with high exposure to earthquakes, extreme heat, and wildfires (Chart 4). Following closely behind are Riverside, CA, and Miami, FL. While Riverside receives its high-risk rating for many of the same reasons as Los Angeles, Miami’s risk score was more influenced by hurricane and flooding exposure. On the lower end of the risk spectrum were several Midwest and Rust Belt markets. Pittsburgh was the least hazard-prone market by a wide margin, with a score 7.9 percentage points lower than Buffalo, the second least hazard-prone market.

Market Spotlight: Nashville

Nashville, now a top-tier music, culture, and sports destination, has gained residents and popularity in recent years.

The Nashville labor market continues to be a driving force behind the metro’s success. While many business sectors in Nashville are booming, the most significant engines of growth are technology, healthcare, and tourism. Tech giants such as Oracle, Amazon, and Meta have all carved out substantial hub footprints in Music City, resulting in billions of dollars invested into the local economy and a growing long-term base of high-paying jobs.

According to the Nashville Chamber Research Center, the number of payrolls related to professional, scientific, and technical services swelled by 7.4% in 2023, leading all other local sectors. Following closely behind was private education and health services, which saw job totals jump by 5.4% in 2023. The healthcare industry employs an estimated 550,000 people across the Nashville metro area. According to the Nashville Healthcare Council, the Tennessee city is home to more than 900 healthcare-supporting companies.

Lastly, tourism continues to fuel the local economy. According to YouGov, Nashville is the eighth most popular travel destination for domestic tourism, finishing just ahead of Washington, DC. A record-breaking 16.8 million people were estimated to have visited Nashville last year. If the performance of the local rental sector is any indication, more than a few visitors have traded their hotel rooms for apartments.

Simply put, Nashville’s multifamily sector has been bolstered by its healthy local economy. According to the Atlanta Federal Reserve’s CREMI, which considers a basket of performance indicators such as pricing, absorption, and cap rates, Nashville currently has the most robust fundamentals of any market (Chart 5).

Supporting Nashville’s underlying fundamentals is a striking ability to attract rental demand from other parts of the country. Beyond the thriving labor market, incoming renters also relocate to Nashville for its unique music-centric culture, abundant nightlife options, picturesque neighborhoods, and affordability. According to Apartment List’s Renter Migration Report, 45.0% of Nashville apartment searchers have moved there from other metros, the fifth-highest mark among the top 50. Its renters are younger than most, with 44.6% under the age of 35. By and large, Nashville’s multifamily real estate market exhibits strengths that have staying power.

Outlook

Multifamily investors see light at the end of the tunnel. The Federal Reserve started reducing interest rates in September, ushering in a return to a normalized capital cost environment. Weaker interest rate headwinds will begin to support growth in real estate investing across the country, irrespective of geography. Nevertheless, fundamental strengths make some markets better candidates for growth than others in 2025. As the U.S. population growth rate continues to fall and migratory patterns shift, competition for residents escalates, making market knowledge a crucial advantage to multifamily investors.

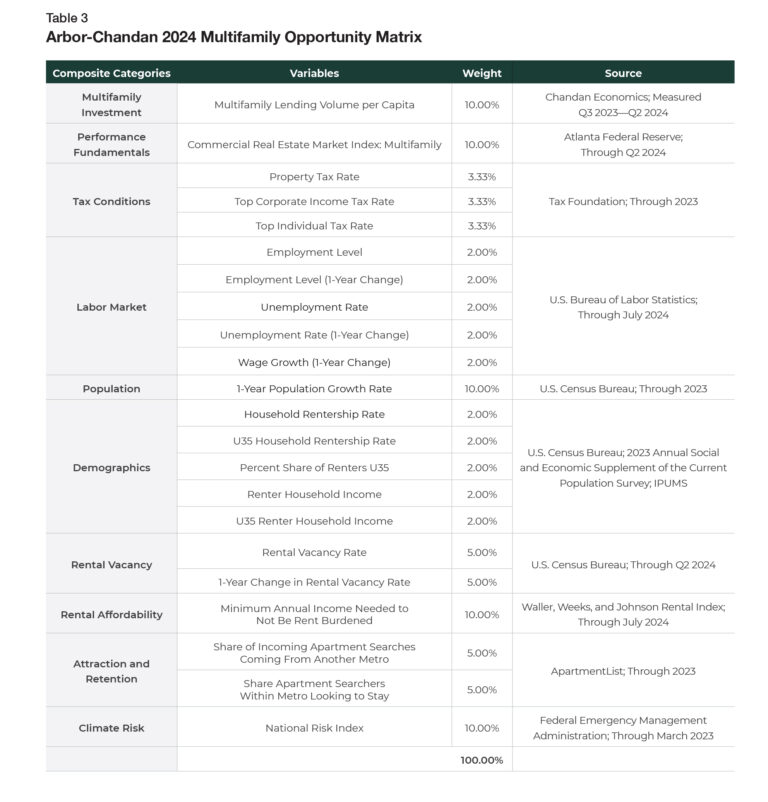

The Opportunity Matrix

- Multifamily Investment: measured as a proxy for the availability of debt financing, overall liquidity, and a market’s ability to support additional multifamily investment. Both acquisitions and refinancing are tracked in this analysis.

- Performance Fundamentals: comprehensive mix of recent multifamily sector performance and momentum.

- Tax Conditions: tax burdens for firms, properties, and individuals — measuring monetary and human capital attractiveness.

- Labor Market: topline profile of key labor market performance indicators, including market size and growth, unemployment rate, change in the unemployment rate over the past year, and wage growth.

- Population Growth: overall growth of a metro over the short and medium term.

- Renter Demographics: spending power and age profile of existing renters (higher household incomes and younger householders assumed as conducive for higher levels of multifamily demand).

- Renter Vacancy: measures the current market tightness for all existing metro-level rental inventory.

- Attraction and Retention: considers how well a market attracts rental demand from other parts of the country and holds on to existing renters that already call the metro home.

- Affordability: minimum income needed to rent an apartment without being rent-burdened, included to capture a market’s attractiveness for incoming rental demand.

- Climate Risk: a composite measure of risk, preparedness, and social vulnerability, which is included to account for the increasing frequency of natural hazards and the evolving property insurance landscape.

The Opportunity Matrix includes factors a multifamily investor might consider in their market selection process. All 10 categories have received equal weighting. In categories with more than one variable, each variable received equal weighting.

Methodology

This report presents an analytical framework to develop a cross-market comparison for opportunistic multifamily investments. For the purposes of this analysis, “large multifamily” is considered to be assets containing 50 or more units with a combined valuation exceeding $20 million.

The top 50 U.S. metros1 are ranked using the Arbor-Chandan Large Multifamily Opportunity Matrix based on a weighted average of performance metrics. The Opportunity Matrix pays specific attention to how well metro-level economies have maintained strength over the past year and how they are positioned to handle shifting market conditions in 2024 and beyond.

Appendix

About Us

Arbor Realty Trust, Inc. (NYSE: ABR) is a nationwide real estate investment trust and direct lender, providing loan origination and servicing for multifamily, single-family rental (SFR) portfolios, and other diverse commercial real estate assets. Headquartered in Uniondale, New York, Arbor manages a multibillion-dollar servicing portfolio, specializing in government-sponsored enterprise products. Arbor is a leading Fannie Mae DUS® lender, Freddie Mac Optigo® Seller/Servicer, and an approved FHA Multifamily Accelerated Processing (MAP) lender. Arbor’s product platform also includes bridge, CMBS, mezzanine, and preferred equity loans. Arbor is rated by Standard and Poor’s and Fitch. In June 2023, Arbor was added to the S&P SmallCap 600® index. Arbor is committed to building on its reputation for service, quality, and customized solutions with an unparalleled dedication to providing our clients excellence over the entire life of a loan.

Disclaimer

This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation, or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein and is not prepared in accordance with the regulation regarding investment analysis. The material in the report is obtained from various sources per dating of the report. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. That said, all content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations or warranties, express or implied, as to the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third-party rights. The Companies shall not be liable for any direct, indirect, or consequential damages to the reader or a third party arising from the use of the information contained herein. There may have been changes in matters which affect the content contained herein and/or the Companies subsequent to the date of this report. Neither the issue nor delivery of this report shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that the affairs of the Companies have not since changed. The Companies do not intend and do not assume any obligation to update or correct the information included in this report. The contents of this report are not to be construed as legal, business, investment, or tax advice. Each recipient should consult with its legal, business, investment, and tax advisors as to legal, business, investment and tax advice. The information contained herein may be subject to changes without prior notice. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person.