In all market cycles, commercial real estate firms are better positioned to achieve successful results with leaders who are strong, confident, and authentic, qualities demonstrated by the dozens of speakers at the 2025 Real Estate Pride Roundtable in New York City.

Small Multifamily Investment Trends Report Q1 2023

Cash Flows Remain Resilient

as Valuations and Cap Rates Feel

Interest Rate Pressure

Key Findings

-

Small multifamily prices slid 2.6% from the previous quarter, as new purchases and originations activity slowed.

-

Cap rates posted the largest quarterly jump since 2009, finishing at 5.4%.

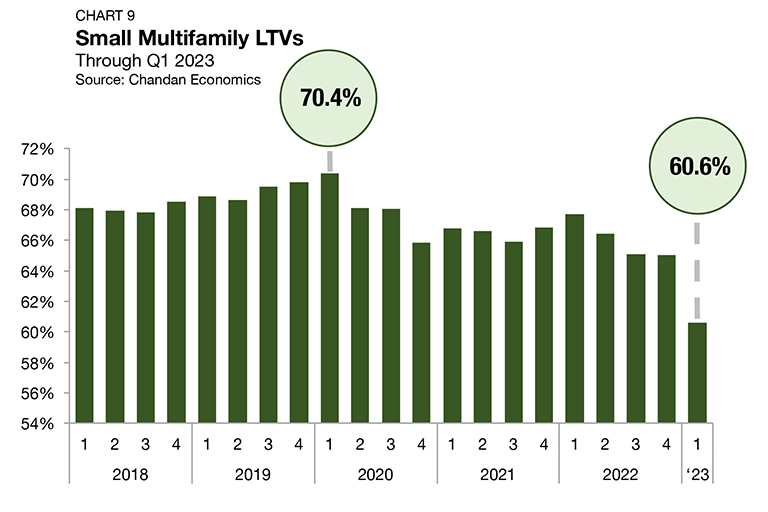

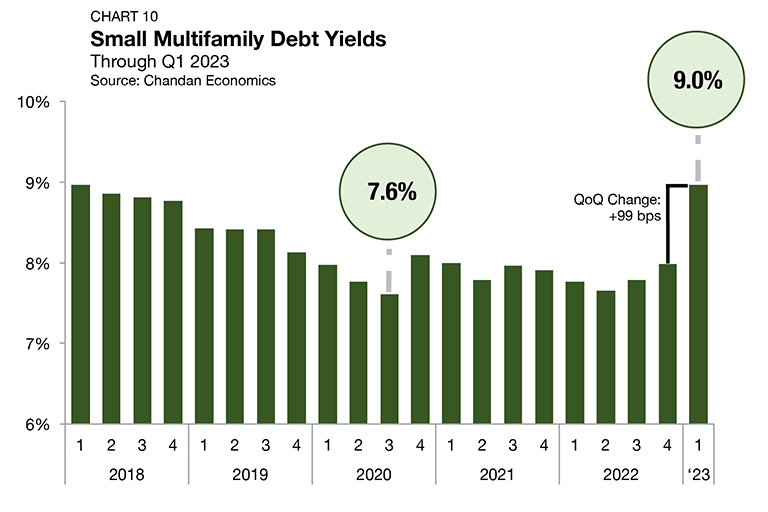

Debt yields rose and LTVs plummeted as lending standards tightened amid financial sector volatility.

State of the Market

Through the first quarter of 2023, the small multifamily subsector lies in a unique position, battling financial sector headwinds on one side while benefiting from structural tailwinds on the other.

After the failures of Silicon Valley Bank and Signature Bank in March, lenders, especially regional banks with less stringent capital requirements and greater interest rate risk exposure, have become more conservative. As a result, new purchases and originations of small multifamily properties saw much lower levels of activity than in previous quarters.

The recent banking sector distress has been primarily driven by the Federal Reserve’s ongoing monetary policy tightening cycle. In the 13 months ending in March 2023, the Federal Reserve hiked interest rates a total of 475 bps in nine different policy meetings. Over the short term, the economy must learn to adapt to higher interest rates.

At its May 2023 meeting, the Fed raised rates by 25 bps as expected. However, some relief may be on the horizon. Markets are betting that the Fed will begin cutting interest rates by the end of the summer. Similarly, the central bank has communicated that it foresees a less stringent interest rate environment in the short term, with the federal funds rate expected to average 4.3% in 2023 and come back down to an average of 2.5% over the longer run.

Despite significant headwinds, the small multifamily subsector is weathering the ongoing storm impacting the commercial real estate industry. A challenging environment for homebuyers combined with a resilient labor market has created an economic climate where there is more demand for rental housing units, and tenants are, by and large, maintaining their ability to pay rent. As noted by Freddie Mac in their 2023 multifamily outlook, so long as the labor market remains healthy, “tailwinds will keep the multifamily market performing in 2023,” albeit at “more modest levels compared with the prior few years.” While financial market conditions could restrain new activity, the structural health profile of small multifamily households remains largely intact — a factor that should allow the sector to limit distress between now and when a period of interest rate normalization arrives.

Lending Volume

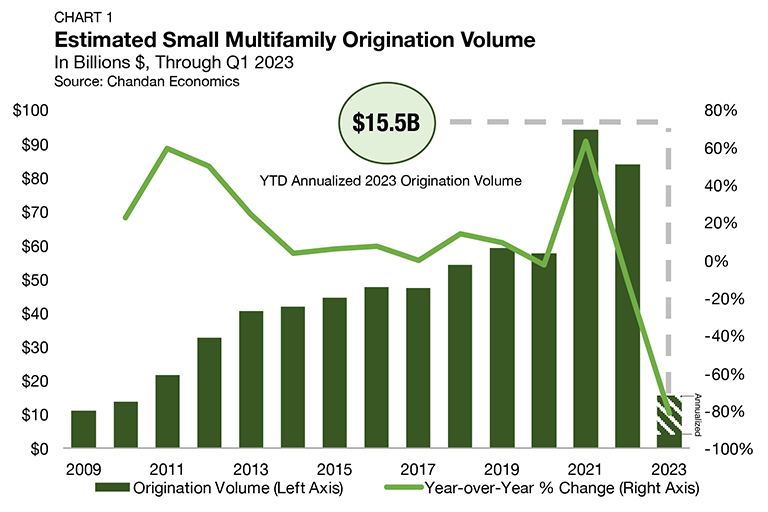

The year-end 2022 estimate of new multifamily lending volume on loans with original balances between $1 million and $7.5 million1 — including loans for apartment building sales and refinancing — fell to $83.9 billion (Chart 1).

The 2022 estimate indicates there was a modest 10.9% deceleration from 2021’s record high of $94.1 billion. Initial estimates of small multifamily lending in 2023 reflect a market environment that is currently in a pause. The annualized level of small multifamily lending activity during the first quarter came in at just $15.5 billion — which would represent the lowest annual total on record since 2010.

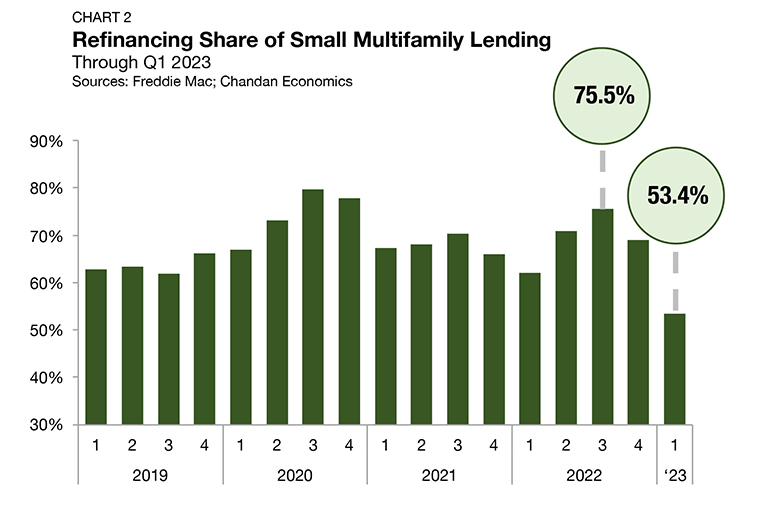

A significant factor contributing to the drop off in new small multifamily originations has been the reduced incentive to engage in cash-out refinancing. Borrowers often use accrued equity in their properties to finance subsequent acquisitions. However, cash-out refinancings in today’s market environment would likely mean a voluntary increase in debt servicing costs. Refinancings accounted for just 53.4% of tracked small multifamily originations during the first quarter of 2023 — a 15.6 percentage point decrease from the previous quarter (Chart 2).

Arbor Small Multifamily Price Index

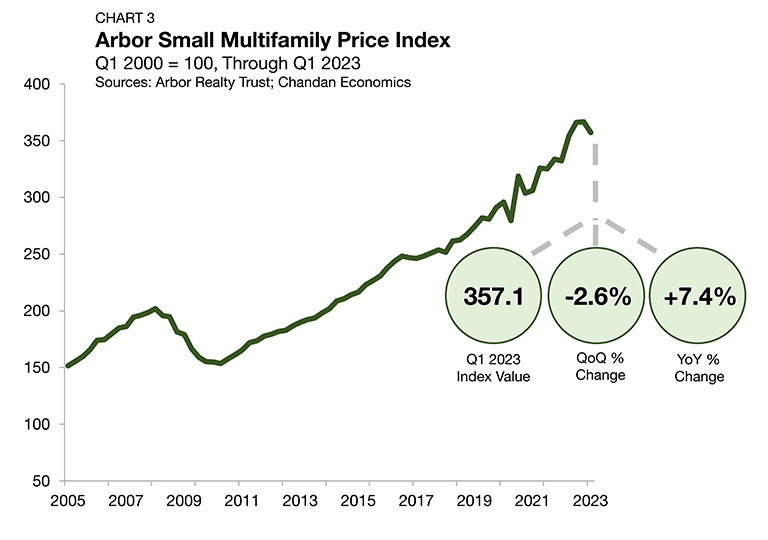

As measured by the Arbor Small Multifamily Price Index2 , small multifamily asset valuations fell 2.6% quarter-over-quarter. Still, thanks to a runup in prices through mid-2022, prices were 7.4% higher than a year earlier (Chart 3).

Negative pricing pressures in the current environment are not unique to either multifamily or the small asset subsector. An effect of the Federal Reserve’s fight against inflation is higher costs of capital. As a result, potential buyers of all property types have higher required yields that need to be met before a deal can begin to make sense. While multifamily owners seemed content to hold firm on pricing last year, late-2022 and early-2023 data indicate that some seller capitulation is taking place, leading to higher cap rates and a softening of prices.

Cap Rates & Spreads

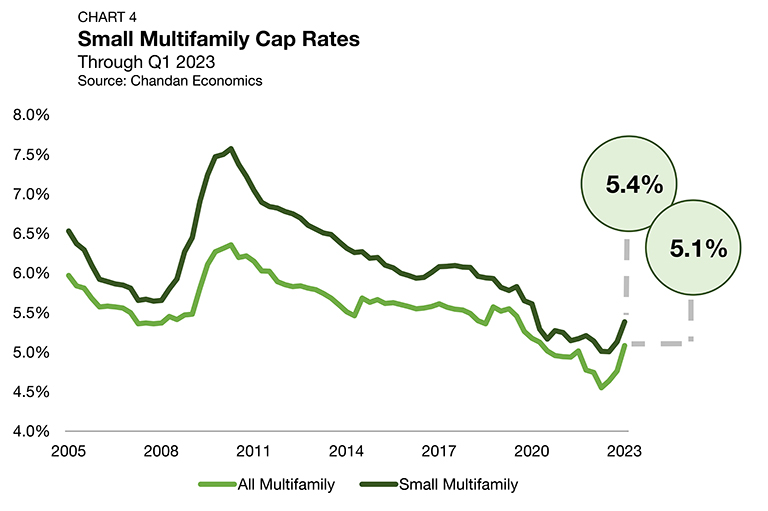

For the first time in over a decade, cap rates across all commercial property types are rising, including multifamily and the small asset subsector. The Federal Reserve is in the midst of one of its most rapid monetary tightening cycles in history and its full effects are still filtering through the economy. Multifamily cap rates are just one of the many risk pricing measures that investors are re-evaluating in real-time. After small multifamily cap rates reached a record low of 5.0% in the third quarter of 2022, they have since risen in two consecutive quarters, rising to 5.4% during the first quarter of 2023 (Chart 4). Measured quarter-over-quarter, small multifamily cap rates rose by 25 basis points — the largest single increase on record since 2009.

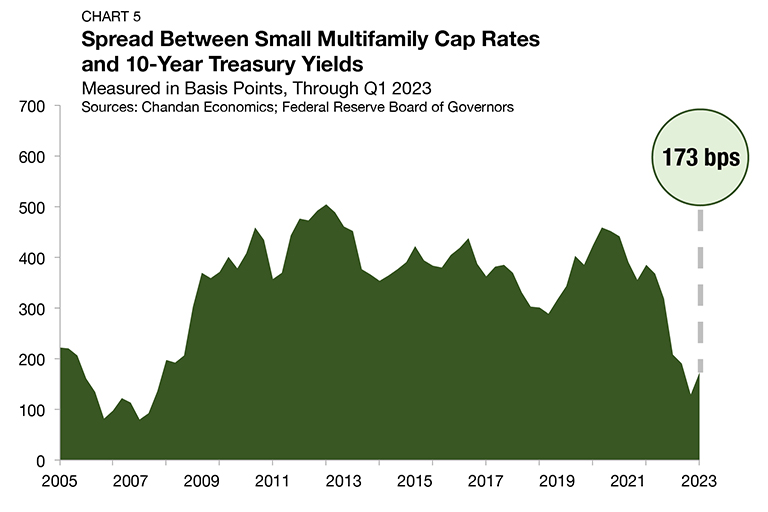

The small multifamily risk premium, which is best measured by comparing cap rates to the yield on the 10-Year Treasury, is a measurement of additional compensation that investors require to account for higher levels of risk. In the first quarter of 2023, this metric rose for the first time in a year and a half, increasing to 173 bps (Chart 5).

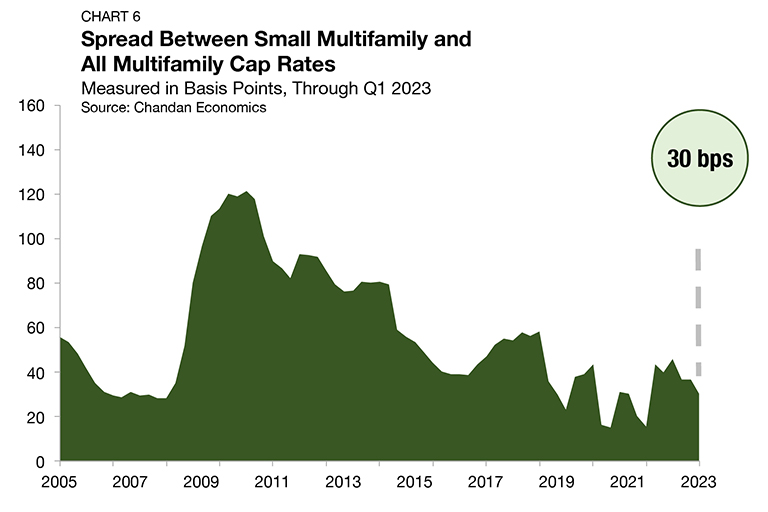

Quarter-over-quarter, the small multifamily risk premium jumped by 43 bps — its largest increase since mid-2019. The cap rate spread between small multifamily assets and the rest of the multifamily sector, a measure of the risk unique to smaller properties, fell 6 bps during the quarter, to finish at 30 bps (Chart 6).

Expense Ratios

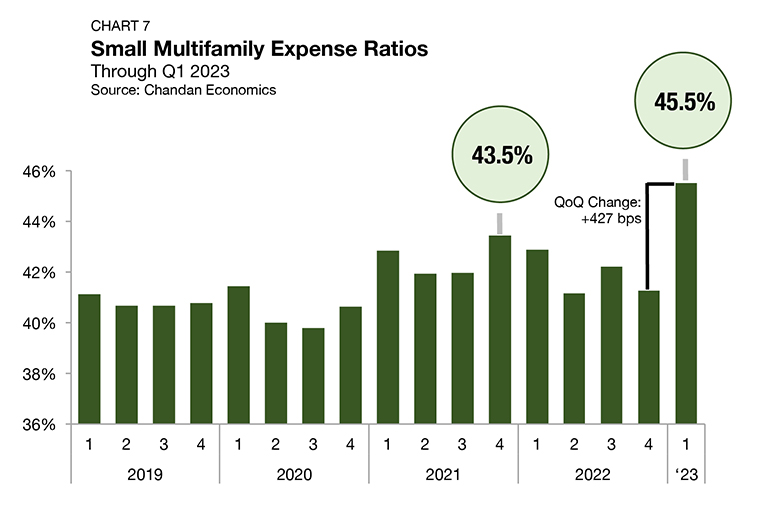

Expense ratios, measured as the relationship between underwritten property-level expenses and effective gross income, jumped significantly, rising 427 bps quarter-over-quarter to 45.5% (Chart 7). This sharp increase likely reflects a recent slowdown in rent growth, which was flat for multifamily properties during the quarter, according to Yardi Matrix. A slowdown in rent growth has historically impacted the amount of income a property generates — putting downward pressure on effective gross income and increasing expense ratios.

Rent Collections

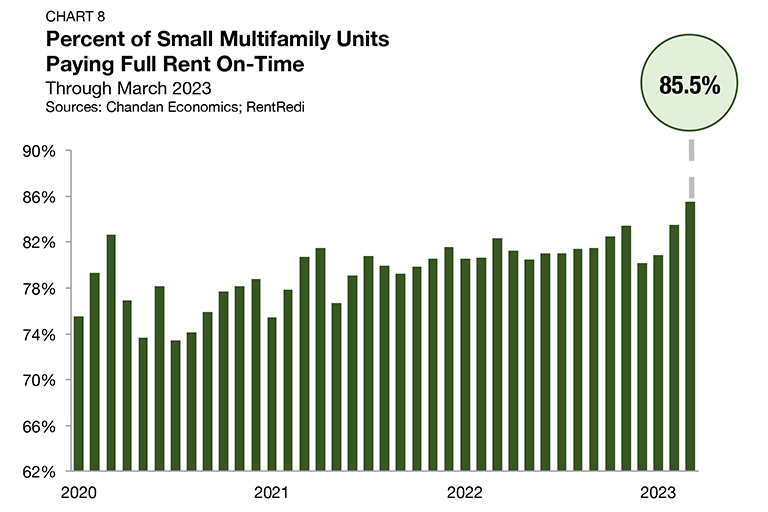

On-time rent payments in small multifamily properties reached their highest levels since the onset of the pandemic, according to Chandan Economics and RentRedi’s Independent Landlord Rental Performance Report. In March 2023, full rent was paid on time in an estimated 85.5% of units — improving 197 bps from the month prior (Chart 8).

More on-time rent payments signal that, despite financial market turbulence, economic distress has not substantially filtered down to rental households. Tenants have maintained their ability to pay rent, and as a result, property-level cash flows appear to be secure.

In this environment of economic uncertainty, the resilient underlying health of rental households is among the most reassuring factors for the small multifamily sector. As long as the cash flow ecosystem between tenants, property owners, and lenders remains intact, the probable range of downside scenarios will remain limited.

Leverage & Debt Yields

While the equity side of the capital stack has shifted to reflect economic and financial market volatility over the past half-year, the debt side has maintained a conservative stance since the onset of the pandemic. Even so, the first quarter of 2023 showed that underwriting standards have room to tighten further. Loan-to-value ratios (LTVs) have slid in each of the past four quarters as lenders are increasing their requirements for how much capital borrowers need to have at risk. Small multifamily LTVs fell to 60.6%, dropping by a substantial 439 bps from the prior quarter (Chart 9).

Debt yields for small multifamily loans averaged 9.0%, rising 99 bps from the previous period — the largest quarterly jump in the history of Chandan Economics’ post-global financial crisis tracking (Chart 10). The inverse of debt yields, the debt per dollar of net operating income (NOI), fell for small multifamily loans. Small multifamily borrowers secured an average of $11.18 in new debt for every $1 of property NOI, down $1.38 from the previous quarter and reaching the lowest level since 2015.

Outlook

The small multifamily subsector will continue to be tested over the next several months. However, the asset type has developed structural fortification to ensure it will bend rather than break. The Mortgage Bankers Association found that delinquencies in the multifamily sector have remained negligible, reporting a mere 20 bps increase during the first three months of 2023. Moreover, according to the Federal Reserve Bank of New York’s recently released 2023 SCE Housing Survey, the share of renters who anticipate buying a home in the next three years has fallen to a nine-year low (42.2%) — a factor that should continue to support demand for rental housing. The intersection of the small multifamily subsector and naturally occurring affordable housing (NOAH) is a potential tailwind to watch. With every state in the U.S. not having enough affordable housing to meet demand, public support for the small multifamily subsector is substantial and growing, including from Fannie Mae and Freddie Mac. All things being equal, balance sheet asset valuations and new deal volume will likely continue to show sensitivity to sustained higher interest rates over the short term, although the intact structural demand profile of the sector will enable it to absorb downside pressures better than many other commercial real estate asset classes.

For more small multifamily research and insights, visit arbor.com/articles

1 All data, unless otherwise stated, are based on Chandan Economics’ analysis of a limited pool of loans with original balances of $1 million to $7.5 million and loan-to-value ratios above 50%.

2 The Arbor Small Multifamily Price Index (ASMPI) uses model estimates of small multifamily rents and compares them against small multifamily cap rates. The index measures the estimated average price appreciation on small multifamily properties with 5 to 50 units and primary mortgages of $1 million to $7.5 million. For the full methodology, visit arbor.com/asmpi-faq.

Disclaimer

All content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations regarding the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein.