Working Seniors on the Rise: A Renter Segment to Watch

Though a clear majority of senior householders in apartments do not work, delayed retirement has become a rising trend. Since the financial crisis, this trend has created a growing demand segment for small apartment building owners.

Most Senior Householders Depend on Retirement Income and Entitlements

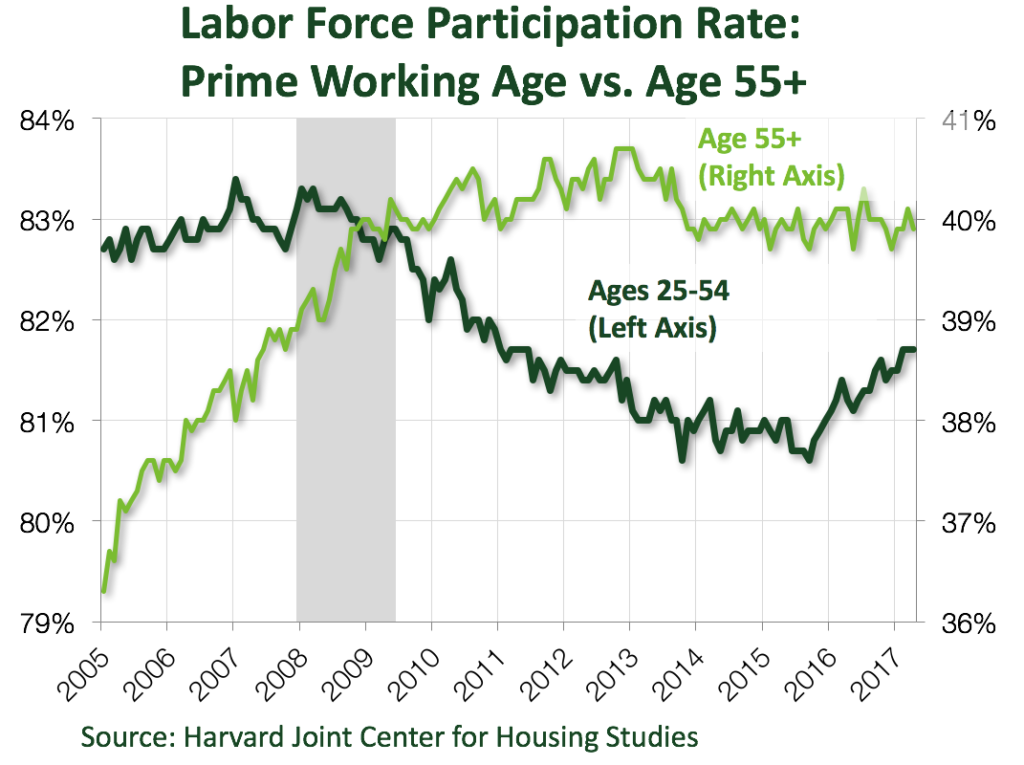

Not too long ago, to work past the age of 65 years would be considered an exception rather than the rule. However, the financial crisis changed everything, including an increase in the number of employed people who choose to work past the retirement age. The chart below shows how a new normal for labor participation rates among those 55 and older formed during the recessionary years.

While this is a rising trend for apartment renters, an overwhelming majority of senior renters (age 65 years or over) do not work. Instead, they pay for their housing expenditures with income derived from retirement funds, investments, entitlements and other government assistance programs.

As shown below, only about 18% of senior householders in small apartment buildings worked in 2015. In large buildings, an even lower share of 10% of seniors worked. The large building segment has historically supported a larger share of affordable housing and rent control components.

The Financial Crisis Delayed Retirement Decisions

While retirement dominates the senior renter segment, the latest data from the Census Bureau indicates some structural shifts underway in the labor market over the post-crisis period. These changes are working to reshape demand fundamentals for this group.

As shown below, the working senior householder segment in apartments grew twice as fast as overall household growth across all apartment types between 2010 and 2015.

Households with a working senior householder grew at an annual rate of about 6% across both small and large apartment buildings. However, retiree household growth was lower compared to the overall growth.

The above bears great significance for apartment demand because retiree households make less than half of the income of their working counterparts.

Following this growing trend will be critical for apartment property owners. This will lead to a greater need for age-sensitive amenities that may facilitate longer-term tenancies and rent-roll stability.

For more information on demographic trends in the senior housing and healthcare market, be sure to check out our recent webinar hosted by Seniors Housing News.

The program starts off with an in-depth conversation on demographic demand drivers led by distinguished professor and economist Sam Chandan. After reviewing how this demand is impacting property fundaments within independent living, assisted living and memory care facilities, Arbor finance experts explain how a unique combination of Bridge and FHA loans can benefit senior housing operators.