CREF Special Report: Economic & Commercial Real Estate Market Outlook

Job growth, increased consumer spending and population demographics are three macroeconomic factors contributing to a positive outlook for the multifamily and commercial real estate market according to a new forecast released by the Mortgage Bankers Association (MBA) this week.

Findings were presented by the MBA’s Michael Fratantoni, Chief Economist, SVP of Research & Technology and Jamie Woodwell, VP of Commercial/Multifamily Research at the opening session of CREF 2018 in San Diego.

Fratantoni opened up the session addressing concerns over the recent volatility in the stock market.

Mike Fratantoni, Chief Economist, SVP of Research & Technology, Mortgage Bankers Association.

“What the heck just happened? Nothing really. Nothing fundamental changed in our view. Sure, interest rates have ticked up 30 basis points in the first month of the year, but that was reflecting fundamental economic activity. Now for the gyrations in the stock market you can take your pick for what to blame — it happened on the day of the jobs report showing yet another strong month of job growth.”

Volatility in the stock market is nothing new, Fratantoni added, saying that while we may have entered a period of high volatility, the overarching macro picture remains reliably positive.

U.S. GDP growth is predicted to remain in the 2% – 2.5% range through 2020; the national unemployment rate should drop as low as 3.8% this year; and job growth is expected to experience continued growth, similar to 2017, which averaged 181,000 jobs added each month.”

Add in steady wage growth in the 3.5% range, and it’s no surprise that the MBA predicts the Fed will raise the Federal Fund Rate by 25 basis points after each FOMC meeting in 2018, arriving at 2.25% to 2.5% by year end.

Two areas to keep an eye on are inflation and consumer savings. With wage growth comes higher operating costs, and retailers might raise prices to compensate. High levels of employment and consumer confidence mean the public is spending all but 2.4% of their income. Market volatility could play a role in causing the low consumer savings rate to tick up.

“One question you certainly could ask, in the face of trillions of dollars of stock market losses in the past couple of weeks, are people going to pull back and start saving some more? That would be a natural reaction,” Fratantoni said.

Jamie Woodwell then took the podium to explore what this economic growth means for the various commercial real estate asset classes.

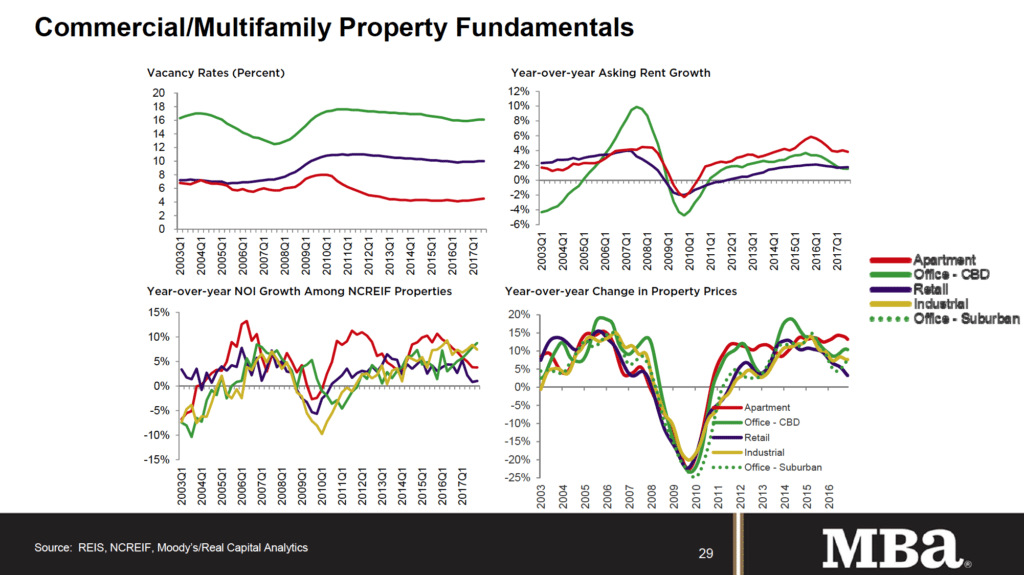

“For a number of years we were at a point where the rising economic tide coming out of the recession was really floating all boats,” Woodwell said. “But now, you’ve got different stories for each property type, and each one is nuanced.”

For multifamily, it’s all about the interaction of supply and demand. Millennials and baby boomers are taking care of the demand side of the equation. On the supply side we’ve been running at 600,000 units under construction for several years — which is the largest amount since the mid ’70s. So there is lots of demand, but lots of supply, and it remains important to get familiar with the local subtleties in any investment market.

Moving on to the office sector, Woodwell reports that solid long-term employment growth has supported this asset class. Yet firms are running increasingly efficient operations and need less space. In 2010, companies allocated roughly 225 square feet per employee. Today — thanks to teleworking, workshare firms and a trend for collaborative spaces over cubicles — that number is 150 square feet.

In terms of retail, Woodwell advises not to get so caught up in the narrative forecasting the end of brick and mortar. Sure, there is a shift in demand towards e-commerce, which is responsible for 9% of total retail sales. But that means 91% of sales volume is still occurring in stores.

That leaves industrial.

“What e-commerce taketh away from retail, e-commerce giveth to industrial — which is just on fire right now,” Woodwell added.

The talk closed with a few items to keep in mind when running your business this year. Historically low unemployment — combined with baby boomers aging out and millennials aging in — has complicated attracting, retaining and developing staff. Technology is playing an increasingly important role in conducting business effectively, efficiently and securely as possible — and early tech adopters can earn a competitive advantage.

Closing out the session, Woodwell summed up that today’s market participants should consider taking advantage of the competitive financing climate. “When you look at where we are in the market right now, it is still just an incredibly positive time for financing. Even with the recent increase, you are still in a very low rate environment.”