Small Multifamily is Home to a Wide Mix of Workers

- Small apartment buildings form the economic backbone of cities, as they support renters who are employed in a wide range of occupations.

- Across all multifamily, the renter mix is skewed toward workers with high-skill jobs.

- This evolving shift in renter composition is most visible in large apartment properties.

Small Buildings Support Broad Base of Workers

As the U.S. economy expands, there is an ongoing transformation of both where and how Americans are working. Two-thirds of the jobs gained over the last decade have been concentrated in just 25 metro areas, according to a McKinsey Global Institute report. Additionally, technology and automation are altering the nature of work. White-collar, high-skill occupations and work involving personal interaction will continue to grow in these same locations.

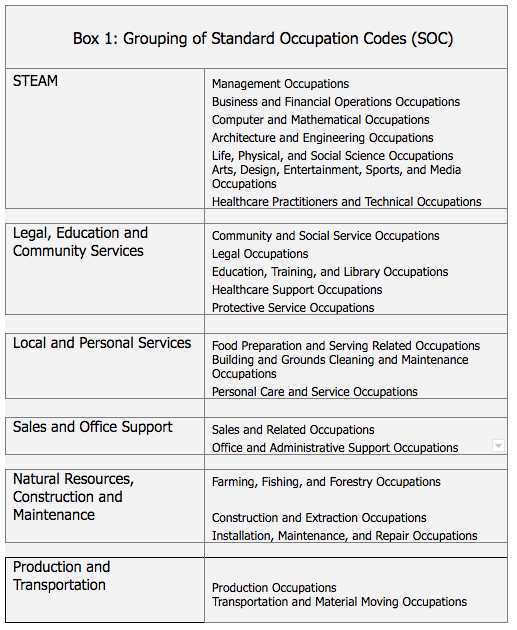

Emerging employment trends have significant implications for multifamily demand. Here, we further explore the evolving mix of apartment renters across industry occupations, using the U.S. Bureau of Labor Statistics definitions, as shown in Box 1.

Through 2017, workers in lower-skill Local and Personal Services jobs formed the largest renter group in both small asset multifamily and in single-family rentals (SFRs). They accounted for a 41% share in each. These workers formed a smaller share in large asset multifamily, dropping to 36%.

Workers in high-skill science, technology, engineering, arts and design, and mathematics (STEAM) occupations made up the biggest share of renters in large apartment buildings, at 37%. The share drops off to 26% in small multifamily, and further to 21% in SFRs.

These findings reflect a segmentation in multifamily demand. Amenity-rich large apartment properties are increasingly geared toward high-skill jobs within the urban core. On the other hand, the more dispersed and affordable small apartment properties cater to a wider mix of workers.

Renters in STEAM Occupations Growing Rapidly

Higher housing costs in the urban core and the uneven impact of technology across occupations continue to reshuffle renter demand.

STEAM renters are moving into small asset multifamily at a higher clip than any other renter group. This segment increased its share by 93 basis points (bps) from 2015 to 2017. On the other hand, there was a 117 bps share decline for Local Services, Sales and Office Support workers, who are most affected by technological change and automation.

These renter composition shifts are even more pronounced in large asset multifamily. The share of STEAM workers went up by 133 bps over this period, while Local Services workers declined by 115 bps.

Churning in the labor market poses questions for the future of housing supply and affordability. At the same time, the emerging segmentation of the rental market may be viewed as a growth opportunity for multifamily developers and owners. New product types and price points could cater to a wider swath of workers, requiring close attention to age demographics, as explored in a future blog.

Note: All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection, and include a margin of error.