Top Technology Trends Set to Impact the Apartment Sector

- Artificial intelligence and other advanced technologies are creating platforms for multifamily operators to focus on the resident experience.

- In today's competitive environment, AI can help owners respond quickly to prospective tenants in the hopes of converting them to residents.

- Smart home features have broad applications for the apartment industry, from creating operational efficiencies to offering high-tech amenities.

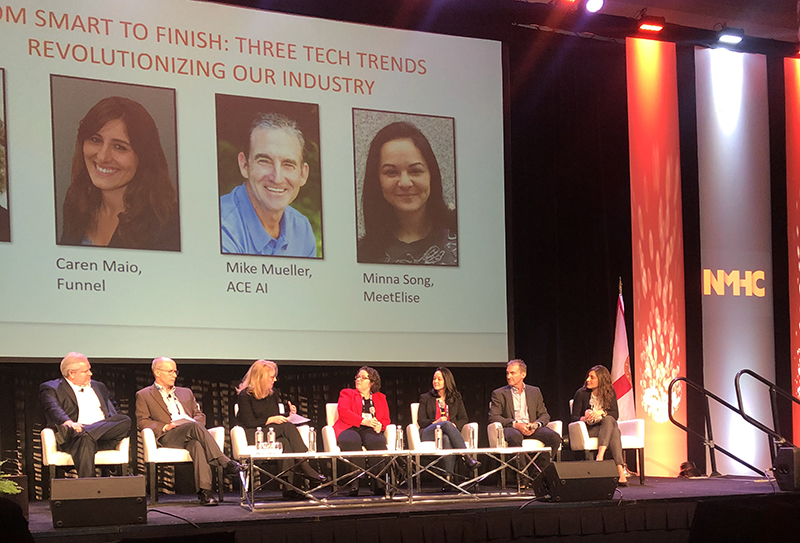

There’s no question that technology has significantly disrupted the real estate industry, and we’re just in the early stages of seeing what the impacts are for owners, operators and managers, panelists concurred at the recent 2020 NMHC Annual Meeting held in Orlando, FL.

Many early technology solutions have been operationally focused. Building management software is now commonly used to lower costs and make properties run more efficiently. Today, advanced technology like artificial intelligence and data analytics tools allow owners to focus their efforts on improving the customer experience.

While the real estate industry is known to be a slow adopter of change, multifamily owners are increasingly seeing the benefit of using some of these new solutions. Technology enables them to improve their current and potential tenants’ quality of life in the hopes of retaining them as residents.

“Technology used to be a necessary evil 10 years ago,” noted panelist Karen Hollinger, SVP of Corporate Initiatives at AvalonBay Communities. “Now, you can’t perform without tech.”

Speakers on the “Tech Trends” panel discussed the emerging types of platforms focused on apartment renter experience and the benefits they can have for both residents and owners.

Digital Assistants Improving the Leasing Process

With the amount of choice and online information available today, attracting potential renters has never been more competitive. Apartment owners and managers are relying more heavily on converting online leads to residents, and new software platforms are assisting with the process.

“Our data shows that if you respond to a lead within the first 90 seconds, which these tools can do today, 47% of those leads will turn into a showing. If that goes to 30 minutes…that reduces by 80%,” said Stacy Holden, Industry Principal of property management software firm AppFolio.

Fellow panelist Minna Song, CEO of AI leasing assistant platform MeetElise, agreed. She added that being able to convert leads faster helps reduce the number of days a property or unit is on the market and increase revenue for multifamily owners.

Quick response times are especially critical to many of today’s younger renters. “You have to be able to communicate with your prospect or resident on the terms that they want,” observed Mike Mueller, CEO of LeaseHawk, a multifamily software company offering an AI bot that residents can call, text and chat.

These solutions also help to “reduce friction and automate as much as possible,” added Caren Maio, CEO of Funnel, an automated data collection platform. She emphasized that automation is helpful to complete mundane, manual tasks and shouldn’t “replace humans, but allow humans to go deeper to build relationships with the community.”

Smart Home Technology Improving Operations and Boosting Revenues

Multifamily owners are also getting more comfortable with installing smart home features like voice-activated lights and app-controlled thermostats in their properties. Scott Wesson, Chief Investment Officer of UDR, Inc., noted that his firm installed 30,000 smart home units and plans to add 10,000 more in the first half of this year.

Aside from adding value for residents, owners see additional revenue from smart technology. Kyle LeFevbre, Director of Business Development at smart home service provider Vivint, noted that his firm compared the rents for 8,000 of its customers’ units to competitors’ rents in the same markets. They found that the smart home units were achieving additional revenue of $35 to $50 a month per unit compared to non-smart home apartments.

He added that the devices you put in and the resident experience could also drive the rent premium for your property.

“The real value is letting residents customize the smart home package,” noted Lucas Haldeman, CEO of apartment automation company SmartRent. “We see lower turnover because they’ve invested in their own unit.”

While many think smart home tech is only for luxury buildings, Haldeman added that there are broad applications. Workforce housing properties can use smart tech for leak detection, as well as temperature and access control.

Panelist Sean Miller, President of PointCentral, summed it up nicely, noting that there are three buckets where smart home tech can help: operational efficiencies, asset protection and resident amenities.

“The balance of those three depends on the city, the asset class and what the operator wants to do with it,” he said.

For more multifamily trends and insights, visit the Chatter blog.