Slowdown in Apartment Filtering Impacts Workforce Housing Supply

- The natural process of new apartment supply declining in quality and value, called "filtering," has slowed during this recovery.

- Low-income households depend on this process to have access to more affordable housing options.

- New construction is necessary for the housing market to experience more effective filtering.

For many decades, the multifamily industry has observed the natural phenomenon of “apartment filtering,” a process Dowell Myers, Professor of Policy, Planning and Demography at USC Price, discussed at the 2020 NMHC Annual Meeting in Orlando, FL.

Apartment filtering describes the natural process of new apartment supply gradually declining in quality and price as it ages, therefore commanding lower rents and providing housing options for low-income households (defined as those making at or below 50% of the area median income, usually termed “very low-income” by the U.S. Department of Housing and Urban Planning.)

Great Recession Inhibits Apartment Filtering Process

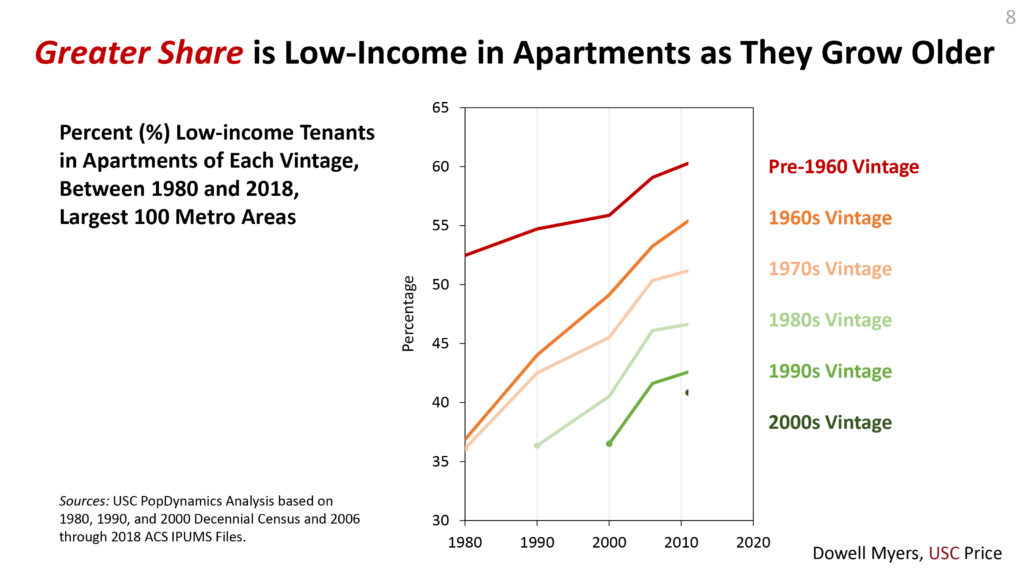

Analyzing the share of low-income households living in rental housing units provides a good indicator of how the filtering process has worked over the last few decades.

Myers used U.S. Census Bureau and American Community Survey data to look at filtering trends over five periods (1980-1990, 1990-2000, 2000-2006, 2007-2011, and 2012-2018). His research showed that the filtering process worked well for several decades, with the share of lower-income residents increasing across all building vintages (apartment properties built before 1960, and in the 1960s, 1970s, 1980s, 1990s and 2000s). When looking at the 1980s vintage, for example, 36% were occupied by low-income households in 1990, 40% in 2000 and 46% in 2006.

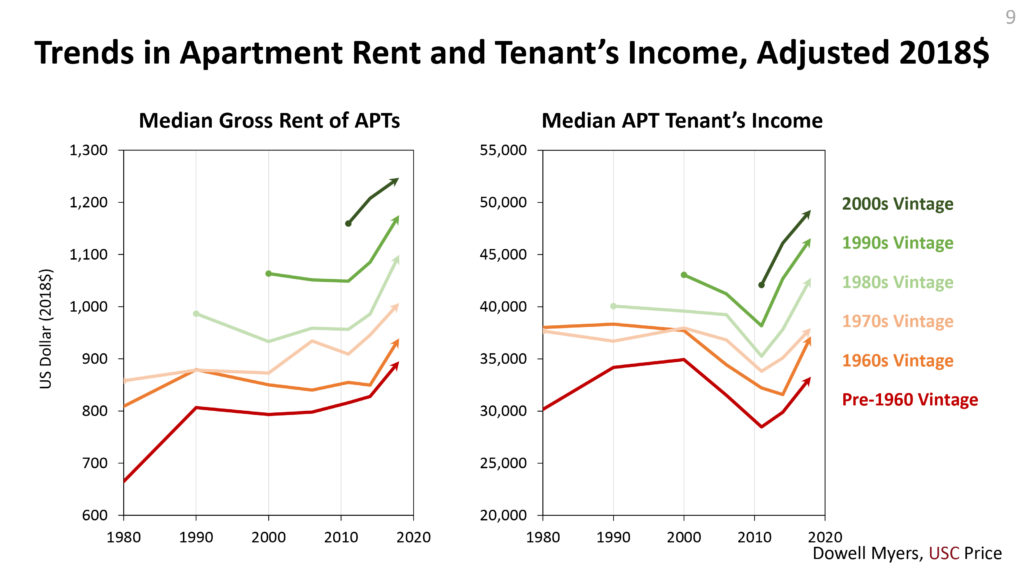

The recession, however, caused a break in the filtering pattern, Myers said, as seen by looking at median rents and renter incomes. From 1990 to 2010, median apartment rent growth remained relatively flat. During the recovery, however,rent growth began to increase significantly.

The median apartment tenant income across building vintages has been more volatile. The housing boom from 2000 to 2007 caused the median renter income to plummet as higher-income renters left the rental market and entered homeownership. Renter incomes pattern changed direction sharply after the recession, when those higher-income renters re-entered the rental market, driving up incomes and rents, and pricing out lower-income households.

These trends have resulted in a shortage of the naturally occurring affordable housing (NOAH) that typically results from the filtering process. Gentrification over the last decade in many large cities has exacerbated the issue.

“It creates a loss of many of the housing opportunities we used to have,” Myers said.

Low-Income Renter Shares by Unit Mix and Market

Myers also analyzed unit mix trends over time, noting that while the number of bedrooms has remained relatively constant since 1980, declining shares of low-income renters are prevalent across all building vintages. Low-income renter shares were the highest in studio (70%) and one-bedroom (65%) units due to their lower rents.

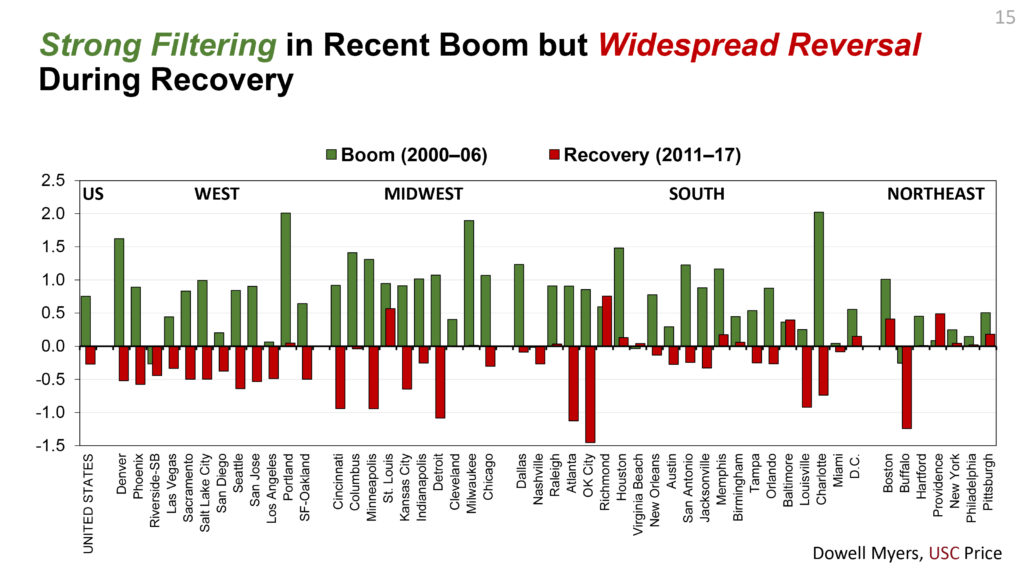

Looking at specific regions of the U.S., Myers noted that the South saw healthy apartment filtering in the 80s due to rapid construction, with annual growth in the share of low-income renters nationwide. The 90s saw a bit less growth before rebounding during the housing boom from 2000 to 2007.

During the recovery, however, “filtering began tanking everywhere aside from a few exceptions,” Myers said.

New Construction Needed to Supply Workforce Housing Options

These filtering trends provide evidence that new supply is necessary to provide housing for the workforce renter segment.

“The nation’s workforce depends on having enough old housing that’s coming out of our previous new housing, or else it’s not going to work,” Myers pointed out.

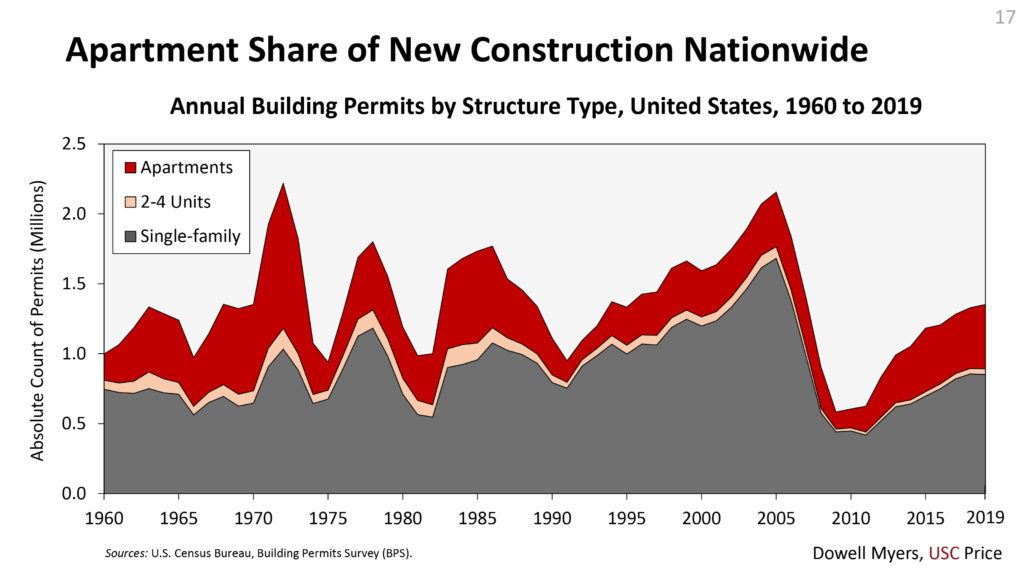

The U.S. housing market has made progress in the last decade to ramp up new construction activity, but supply has still not recovered to pre-recession levels. The apartment share of new building permits hovered around one third from the 1960s to the 1980s, before declining significantly in the 1990s (19.2%) and 2000s (20.7%). In the last decade, the apartment share has rebounded, moving back up to 33.7%.

“The lack of construction in previous decades…made a really strong market for new this decade to catch up for the absence of the previous production,” he said. But it will take time for supply to catch up after two significant periods of low construction activity in the 90s and 2000s.

Myers pointed to some reasons for slower construction during this recovery, including weaker job growth and wage growth, resulting in a lack of supply. The available new inventory is also being “cannibalized” by higher-income renters.

“The high bidders go first, the low bidders go last and if there’s not enough housing, the low bidders are out,” he observed.

In addition to the need for new construction, an increase in the homeownership rate would also help create more effective filtering. Higher-income millennials leaving the rental market for homeownership would ease some competition in the rental market and create more opportunities for low-income renters, Myers found.

“Our housing shortages are so great and our needs are so great, we can’t provide it with build a 50-unit project here or 50-unit project there,” Myers said. “It really requires a mass solution and it’s going to require market-rate solutions.”

For more multifamily trends and insights, visit the Chatter blog and see our additionalcoverage from the 2020 NMHC Annual Meeting.