Diverse Labor Workforce Calls Small Multifamily Home

- Small multifamily renters represent a diverse worker base across U.S. cities.

- Public services workers (teachers, government and healthcare) form a growing segment of renters across all apartment properties.

- High-skill workers form the fastest growing share in large properties; Trade and production workers are gravitating toward affordable small multifamily options.

Occupational Snapshot Across Rental Properties

A select handful of metro areas are responsible for the majority of U.S. job gains over the past decade, according to a 2019 McKinsey Global Institute report, “Future of Work in America: Places and People, Today and Tomorrow.” Even as cities continue to serve as the country’s economic engine, housing options that favorably match preferences of location and affordability are increasingly limited.

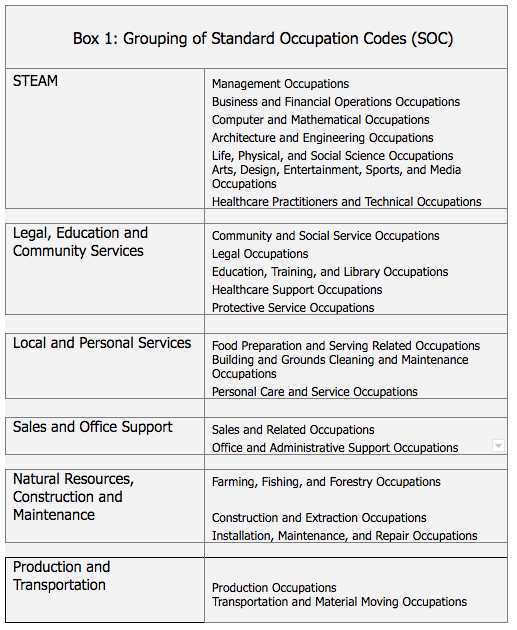

Rentals close to central business districts are typically large multifamily properties that house a high-earning tenant mix. These renters are often in occupations that fall into the STEAM classification, which covers science, technology and creative roles. (See Box 1 for a description of occupational groupings, noting the balance of occupations are within trades and production.)

Meanwhile, small multifamily properties, with their greater affordability and wider geographic dispersion, are home to a wider swath of the workforce.

These patterns mentioned above continue to consolidate. As seen in the latest Census data, 76% of workers living in small multifamily properties are employed in occupations other than STEAM, compared to only 62% in large multifamily.

Local services, sales, and office support workers form the largest group in small multifamily and single-family rentals (SFRs) at around 38% in each. This group sees a smaller share in large multifamily, accounting for 32% of the workforce. The biggest difference across these asset classes remains the share of high-skill STEAM workers. The 37% share in large multifamily dwarfs the 26% and 22% in small multifamily and SFRs, respectively.

Ongoing Labor Market Changes

The updated Census data indicates that STEAM workers are increasingly shifting into large multifamily. This is occurring while production and trade workers are shifting towards small multifamily and SFR. The share of STEAM workers in large properties increased by 229 basis points (bps), the most across the board, with more muted gains in small multifamily (88 bps) and SFR (69 bps).

In contrast, production and trades workers’ share expanded by 205 bps in SFR and 169 bps in small multifamily compared to only 92 bps in large multifamily. Renters in legal and community services, representing a range of public-facing occupations including government, legal, educators and healthcare workers, form a healthy growing share across all rental properties.

However, offsetting these gains, automation and self-service is having a telling impact on retail sales and office support activities, with worker share declines of 404 bps in small properties and 506 bps in large properties.

For property operators, keeping tabs on the changing labor market is essential for demand strategies, including grasping income differences and trends across worker occupation and age. Upcoming blogs will further discuss this data.

To find out more about the multifamily landscape, visit the Chatter blog. Contact Arbor today to learn about investment opportunities and our various loan programs for multifamily housing.

Note: All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection, and include a margin of error. Small multifamily, based on the ACS data, is defined as structures with 5 to 49 units.