How Federal COVID-19 Relief Affects Small Multifamily Renters

- While highly needed, federal COVID-19 relief does not account for regional differences in the cost of living, including housing.

- For renters, the number of lease days covered by the stimulus varies across U.S. metro areas.

- Renters living alone, the majority of small multifamily tenants, had the lowest number of lease days covered by the Economic Impact Payment (EIP) program.

COVID-19 Relief, Easing Back to Work

Working toward economic recovery from the coronavirus disruptions, states are cautiously reopening. Employees are returning to work, while the country continues to face sobering statistics. COVID-19 has claimed more than 110,000 lives and the number of confirmed positive cases has exceeded two million, as of early June. Since the start of the nationwide economic shutdown, over 42 million Americans have filed for first-time unemployment benefits, eclipsing the 2007-09 recession total.

However, there are signs that the economy is beginning to improve. According to the U.S. Department of Labor, while initial unemployment claims remain elevated, they declined on a week-over-week basis at the end of May. The Bureau of Labor Statistics indicated that the economy added a net 2.5 million jobs last month. This reduced the unemployment rate to 13.3%, down from 14.7% in April, which had hit a post-World War II record high.

Much of what happens next will depend on a safe reopening sequence across states and cities that avoids a second wave of infections.

As an initial response to the pandemic, the federal government introduced several policies and programs to help individuals, families and businesses. This report looks specifically at what the individual assistance component of the pandemic response means for different renter segments.

Assistance Benefiting Renters

To combat public health and economic fallouts resulting from COVID-19, the federal government passed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27. Provisions cover wide-ranging support for healthcare, individuals, and businesses through direct stimulus, loans and tax relief measures.

The Act provides assistance applicable to real estate. Business operators can benefit from the Paycheck Protection Program and Economic Injury Disaster Loans. In addition, mortgage forbearance and eviction moratorium measures were implemented for multifamily borrowers with agency-backed loans.

For individuals, the CARES Act provides much-needed relief with the Economic Impact Payment (EIP) program. Stimulus payments, made through the Internal Revenue Service (IRS), are calibrated based on 2018-19 or 2019-20 tax filings, household composition and adjusted gross income (AGI). The EIP tranches are defined as follows:

- $1,200 for single filers with AGI up to $75,000 and household head filers up to $112,500;

- $2,400 for married couples filing jointly with AGI up to $150,000;

- $500 additional payment per qualifying child for each case;

- The above are defined as base amounts, including amounts for qualifying children;

- 5% reduction in EIP per AGI dollar exceeding the $75,000/$112,500/$150,000 thresholds, phased out completely for individuals with no children at $99,000 for single filers, $136,500 for household head filers and $198,000 for joint filers.

- Individuals with AGI above the respective thresholds can still get payments for qualifying children, which is calculated as the base amount less the 5% EIP reduction.

For renter households, especially those employed in high-risk industries, the EIP provides some breathing room and additional liquidity to household budgets. For example, the EIP guidelines translate to varying stimulus amounts when looking at typical apartment living arrangements:

- $3,900 for married-couple households with two children and AGI under $150,000;

- $2,400 for couples with no children and AGI under $150,000;

- $2,200 for single-parent households with two children and AGI under $112,500;

- $1,200 for every single renter, whether living alone or with unrelated individuals.

Living Arrangements and Unit Size

According to the U.S. Census Bureau’s American Community Survey (ACS), the above household types capture the majority of living arrangements found within small multifamily apartment buildings with an 81% share. Renters living alone make up the plurality of all units with a share of 45%, followed by single-parent households (15%), married couples with no children (11%), and married couples with children (10%). Altogether, households with children make up 25% of all units within small apartment properties.

These households show strong preferences for specific unit types, defined by number of bedrooms. For example, 57% of renters living alone in small multifamily buildings reside in one-bedroom units. Households with children (married couples and single parents) have a higher preference for larger apartment sizes, with two-bedroom units dominating the overall distribution. With married-couple households with children, 63% live in two-bedroom units, compared to 61% for single-parent households.

At the extremes, approximately 20% of households with children flock to units with three or more bedrooms, while 36% of married couples without children skew toward one-bedroom units. Similarly, a significantly higher share of individuals living alone rent studio apartments.

What Cushion Does EIP Add to Housing Budgets?

We next examine how the EIP stimulus payments measure against average gross rents by unit size (number of bedrooms). The analysis accounts for the estimated share of housing costs within each household type. Gross rents reflect the total housing costs, including both the monthly contract rent and utility expenses. The monthly share of housing costs varies significantly depending on household income and budgets.

The latest Census ACS data shows gross rents increasing with the number of bedrooms within small apartment properties.

Nationally, gross rents range from $977 per month for studio apartments to $1,194 for two-bedroom units. While larger units (three bedrooms or more) average $1,307 per month, these units make up a small share (10%) the total small multifamily unit inventory.

While various factors, such as unit finishes, building amenities and property age, drive market gross rents, all else equal, prices adjust in tight lockstep with unit size. At the same time, families self-select in choosing different apartment units, optimizing their housing consumption based on space needs and budget constraints.

Households with two wage earners incur lower relative housing costs as a percent of their income compared to households with a single wage earner.

For example, looking at two-bedroom units, married couples with children, with a higher probability of two incomes, allocate as much as 33% of their monthly budget toward housing costs compared to 44% in single-parent households. Renters living alone spend more than 42% of their income on housing costs across unit sizes.

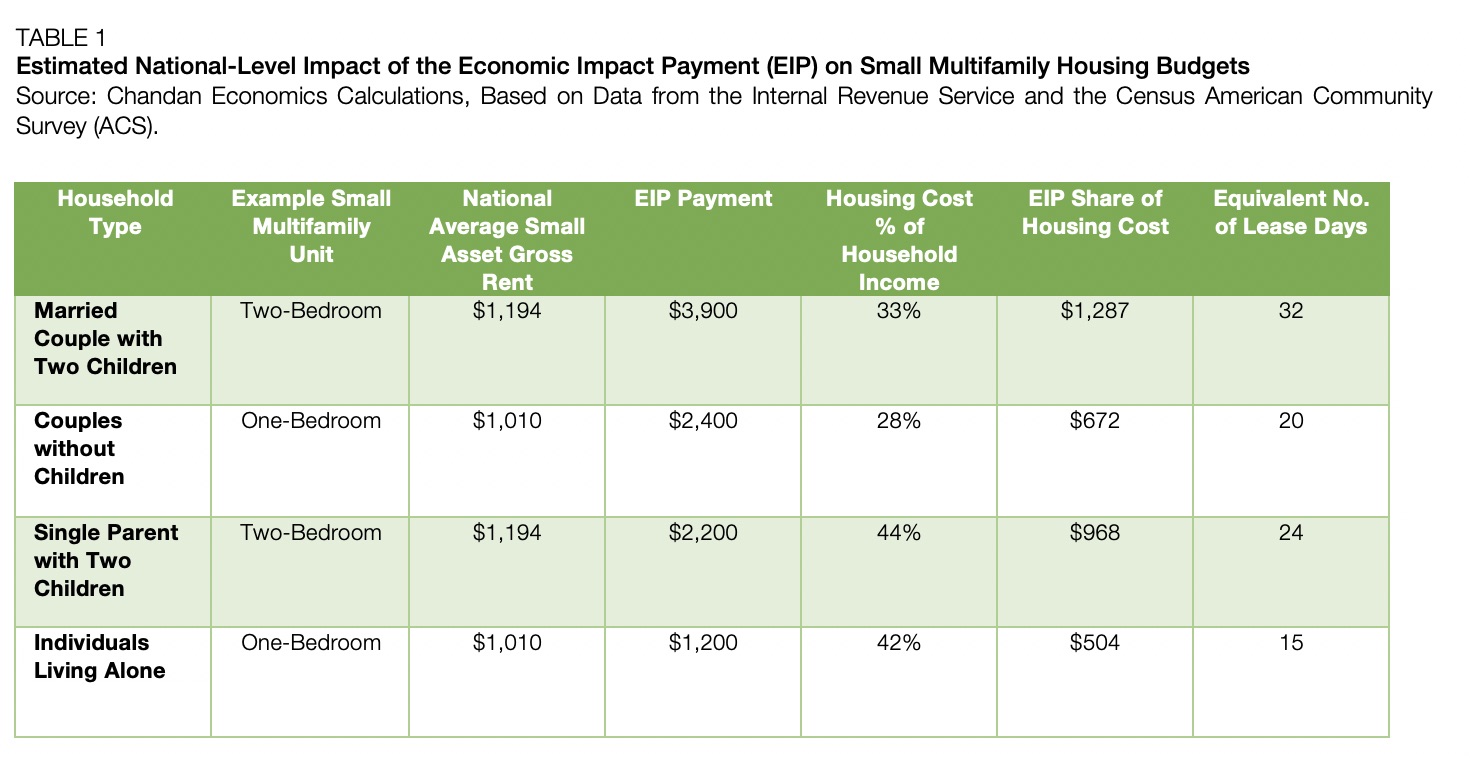

Families with children are more likely to select units with comparatively more usable space for the same number of bedrooms, incurring slightly higher rents. For example, married couples without children living in two-bedroom units allocate a lower share of their household income (28%) to housing costs compared to the 33% share spent by couples with children. Bringing together the above elements of payments and housing costs, we estimated the national-level impact of the EIP on the housing budgets for four typical households [TABLE 1].

While these examples are not exhaustive, they illustrate the varying levels at which the pandemic household stimulus provides a cushion for lease payments. We allocated the EIP to the housing budget using the average housing cost share of income specific to each household type, accounting for all other living expenses.

For example, taking the case of married couples with two children living in two-bedroom units, with an EIP of $3,900, an average of 33% share toward housing costs adds $1,287 to the household budget for monthly rent. When measured against the national small multifamily average rent of $1,194 for two-bedroom units, this results in an equivalent lease cushion of 32 days.

The same analysis results in equivalent lease cushions of 15 days for individuals living alone in one-bedroom units, 20 days for couples without children in one-bedroom units, and 24 days for single-parents with two children in two-bedroom units. Considering other possible permutations, the lease cushion duration generally decreases with increasing unit size.

Stimulus Cushion Varies Across Metro Areas

While the national analysis provides a useful gauge of how supportive stimulus protections are to rental leases, it masks variations across metro areas. This is primarily because the EIP is identical across the country and does not take into account significant differences in living costs, in particular, housing costs across states and cities.

We estimate impacts across the 50 largest U.S. metro areas, using more detailed calculations at the subnational level. Applying historical household rent shares of income to allocate stimulus amounts, the methodology preserves spending patterns unique to metro markets. The research accounts for other living expenses, such as food, transportation and schooling, which are influenced by factors such as public amenities and taxation.

Compared to the national average of 32 days, the equivalent lease cushion afforded by the EIP for married-couple households with two children in two-bedroom units varies from 17 days to 45 days across the largest 50 metro areas. As expected, metros grouped with the fewest days include some of the most expensive housing markets in the country, including the Bay Area, Los Angeles, New York, Boston, Seattle, Washington, D.C. and San Diego. Metro areas with longer lease cushions include Orlando, Madison, Nashville and Las Vegas.

For renters living alone in one-bedroom units, we see a further clear consolidation of the most expensive housing markets at the very bottom of the metro ranking list.

The largest California metros, including Los Angeles, the Bay Area and San Diego, along with New York, Washington, D.C., Boston and Seattle, all fall under the national average of 15 days. The stimulus payments go farther in mid-size metros, such as Cincinnati, Milwaukee, Pittsburg and Memphis.

The federal stimulus package was a step in the right direction in preventing housing hardships. While the country remains anxious to reopen, many of the jobs lost during the COVID-19 upheaval may never return due to a combination of factors, including technological changes. Although the economy could recover in the second half of the year, uncertainty remains. Talks for additional financial assistance are underway in Washington. If would be advisable for the next round of funding to target cities in the Northeast and California, areas hardest hit from the early shutdowns.