Top Markets for New Multifamily Construction Permits

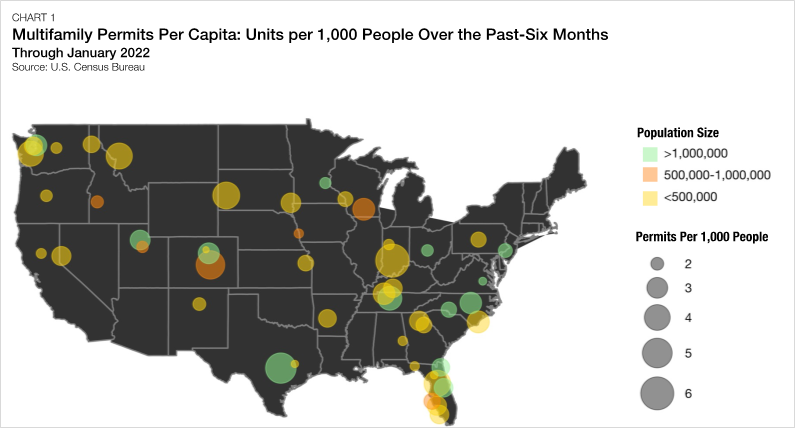

- In the past six months, U.S. metros authorized around 0.58 new multifamily units for construction per 1,000 residents, however several metros are authorizing permits at a significantly higher rate. Across small, medium, and large markets, multifamily permitting leaders are authorizing units at 8-10x the national rate.

- For large metros, economies with growing tech centers are seeing the highest volume of new multifamily permits per capita. Across the Sun Belt, Austin, Nashville, and Raleigh all rank highly. Further west, Denver, Seattle, and Salt Lake City are seeing similar levels of permitting activity.

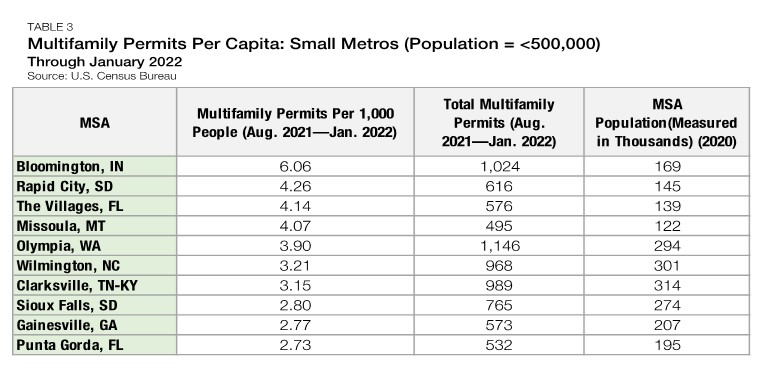

- For metros with less than 500,000 residents, the Plains states are emerging as a surprising hotbed for new multifamily activity. Bloomington, IN leads the country for the most multifamily permits per capita in the past six months. Rapid City, SD, Missoula, MT, and Sioux Falls, SD also perform favorably.

If there is one thing that housing advocates can agree on, it’s that there is not enough housing in the U.S. to keep pace with growing demand. This supply-demand mismatch, combined with the migration of households across state lines, is leading several growing metros to rapidly authorize new housing units to meet growing local needs.

The median U.S. metro area has authorized 0.58 new multifamily units for every 1,000 residents over the past six months1. In epicenters of new multifamily demand, permits per capita totals are much higher. The list of metros with noticeably higher permits per capita includes familiar growth markets such as Austin, TX, and Nashville, TN, but also under-the-radar markets like Bloomington, IN, and Rapid City, SD (Chart 1)2. In this analysis, we look at which metros are authorizing the most construction permits for multifamily housing units, adjusted for current population size.

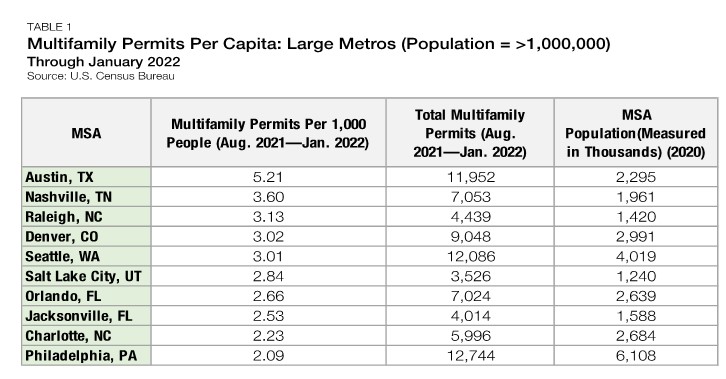

Large Metro Areas (Population: >1,000,000)

Headlining the group of large metros seeing the most multifamily permitting activity is Austin, TX. Over the past six months, Austin has authorized 11,952 units, or 5.21 multifamily permits per 1,000 people (MPP). Next are Nashville, TN, and Raleigh, NC, recording 3.60 and 3.13 MPP, respectively. The triumvirate of Austin, Raleigh, and Nashville all hold the distinction of being rapidly growing employment hubs for Professional, Scientific, and Technical Services. According to the U.S. Bureau of Labor Statistics, these STEM-heavy occupations have grown over the past year by:

- 13.9% in Austin, TX

- 9.6% in Nashville, TN

- 8.6% in Raleigh, NC3

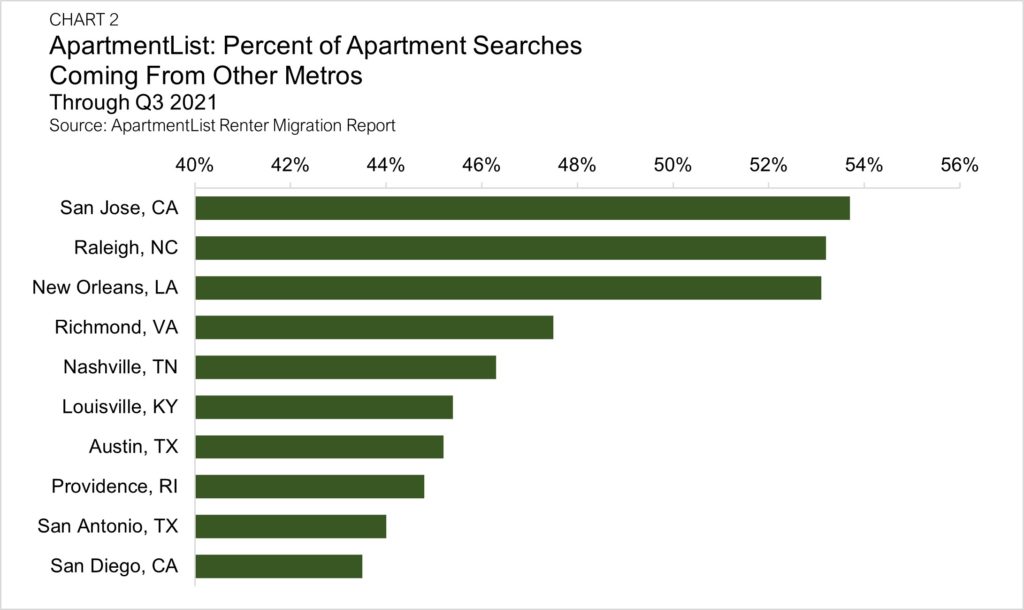

According to ApartmentList‘s latest Renter Migration Report, all three of these metros rank amongst the top areas in the country for attracting residents from other metros (Chart 2).

In the west, several large metro areas are seeing high levels of new multifamily permitting activity. Denver, CO has authorized 3.02 MPP over the past six months, as demand for multifamily units continues to sprout up in the Denver Tech Center— a semi-urban neighborhood catering to the growing local tech sector. Seattle and Salt Lake City followed closely, authorizing 3.01 and 2.84 MPP over the past six months. Salt Lake City is benefiting from the strong net migration totals experienced through the entire State of Utah. According to the Ken C. Gardner Policy Institute at the University of Utah, net migration into Utah rose to 34,858 in 2021— eclipsing 2020’s total by nearly 10,000 people. Meanwhile, Yardi Matrix notes that Amazon, Microsoft, and Meta have all made either new office development or leasing commitments in the Seattle area, reinforcing their footprints which should continue to support rental housing demand.

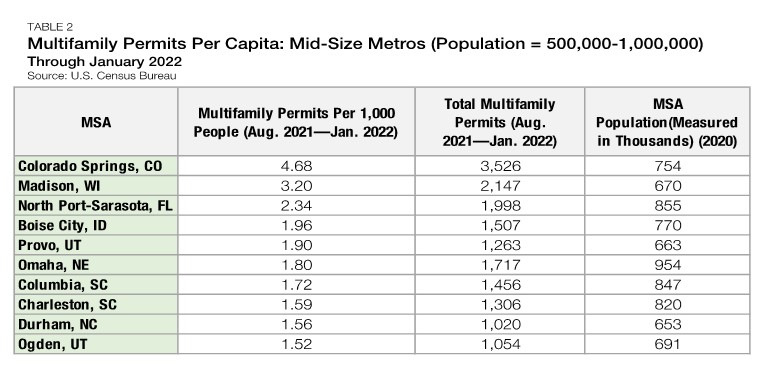

Medium Metro Areas (Population: 500,000-1,000,000)

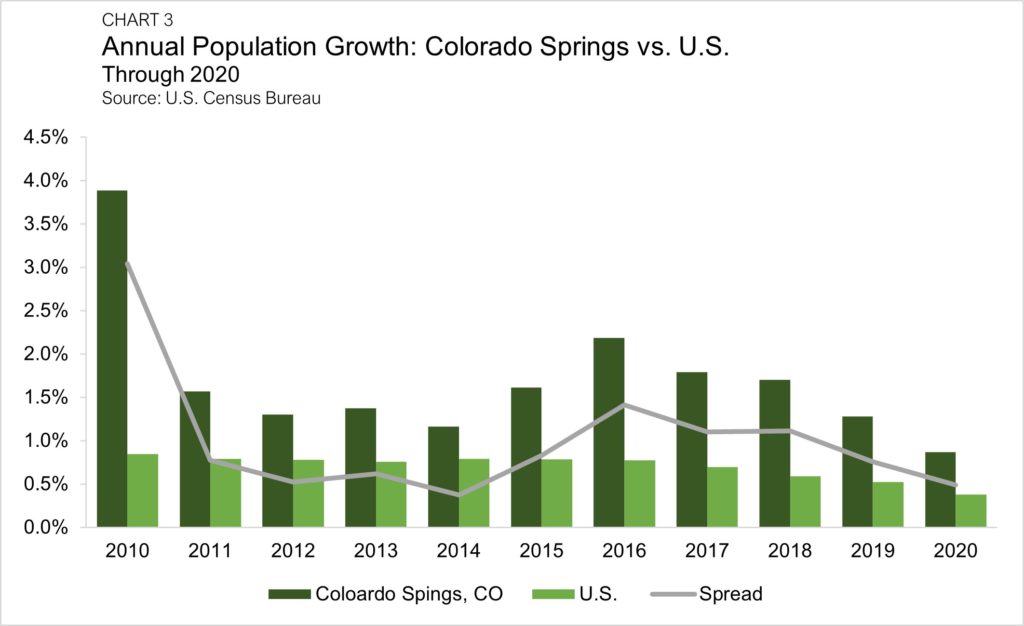

For medium metropolitan areas, Colorado Springs, CO, stands alone as the market, adding the most multifamily supply, authorizing 4.68 MPP in the past six months. The Colorado Springs labor market fully recovered by November 2021 and currently has 1.4% more employees working than it had at its pre-pandemic peak. These data compare favorably to the national average, where the number of employees remains down by 1.8% from the early-2020 peak. In line with many of the other high-activity markets, Colorado Springs is a metro attracting new residents and increasing its population above the national growth rate— a critical reason it is adding new supply at a feverish pace. Between 2010 and 2020, the Colorado Springs’s annual average population growth was more than twice the national average — helping its population swell by 15.9% during the last decade. Over the same period, the U.S. population grew by just 6.7% (Chart 3).

Among the other medium metros with robust levels of multifamily permitting, the top-10 list has a distinct western focus. Two Utah metros, Provo and Ogden, crack the top-10, recording 1.90 and 1.52 MPP over the past six months, respectively. Utah’s Provo, Ogden, and Salt Lake City all register as some of the most affordable cities to live in the country— a strong marketing pitch that is leading to state-wide housing demand growth and sustained economic success. For all three metros, the largest source of incoming out-of-state migration is from one of the most expensive markets in the country: Los Angeles. Boise City, ID, and Omaha, NE also rank high on the multifamily permitting list, with each metro posting 1.96 and 1.80 MPP since August 2021, respectively.

Small Metro Areas (Population: <500,000)

Moving into the smaller markets, it is the Plain states that are coming up as a hotbed for new multifamily permitting. Bloomington, IN leads not only small metros but also the entire country for the most multifamily permits relative to its current population size. In the six months ending January 2022, Bloomington recorded 6.06 units for every 1,000 metro residents— beating out Austin, TX (2nd in the U.S.) by almost an entire unit. An undersupply of quality apartment options available to students at Indiana University’s Bloomington campus should continue to support housing investment growth into the metro. Beyond Bloomington, several other central U.S. reaches into the top-10 for small metros, including:

- Rapid City, SD (4.26 MPP)

- Missoula, MT (4.14 MPP)

- Sioux Falls, SD (2.80 MPP)

Unsurprisingly, the Sun Belt does not lose its shine even for these smaller metros. The Villages, FL— a master-planned retirement community that also happened to be the fastest-growing MSA in the country over the decade ending 2020—has authorized 4.1 MPP in the past half-year. Other smaller metros in the region whose growth follows closely behind are:

- Wilmington, NC (3.21 MPP)

- Gainesville, GA (2.77 MPP)

- Punta Gorda, FL (2.73 MPP)

Look Ahead

This analysis of small, medium, and large metros highlights where the country has seen the most multifamily permitting activity in the past half-year, making these metros the likely landing spots for new multifamily supply in the coming months. While robust construction pipelines should be watched with caution as they could soften short-term net absorption and pricing, over the long-term, these supply additions are broadly supportive for cultivating sustained rental housing demand and urban agglomeration. Across metros of all sizes, the markets rising to the top of these rankings have significant demand-side growth factors— from burgeoning tech sectors to attractive balances of affordability and livability attracting residents from elsewhere. All else is equal, the markets covered here are poised to remain hotbeds for new multifamily construction and investment activity in the year ahead.

—–

Footnotes:

1. Measured through January 2022

2. Hawaii and Alaska removed from Chart 2 for visual purposes

3. Measured year-over-year through January 2022

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts on the Chatter blog.