The Top (and Bottom) Markets for Remote Workers

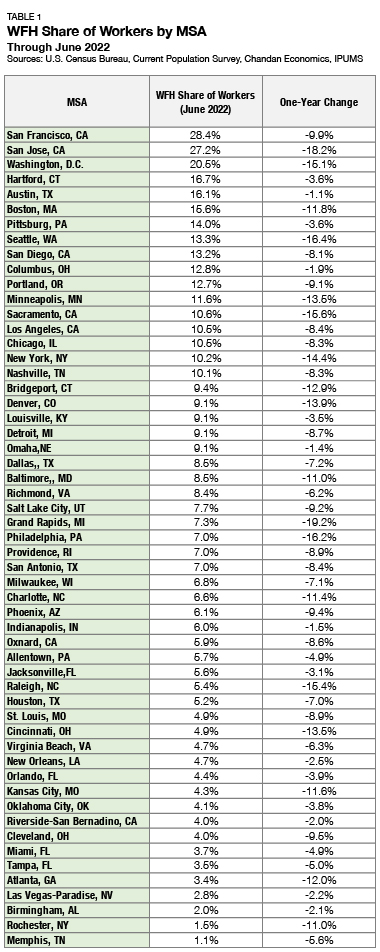

- The median metropolitan area in the U.S. had 5.1% of workers working remotely in June 2022 due to the pandemic.

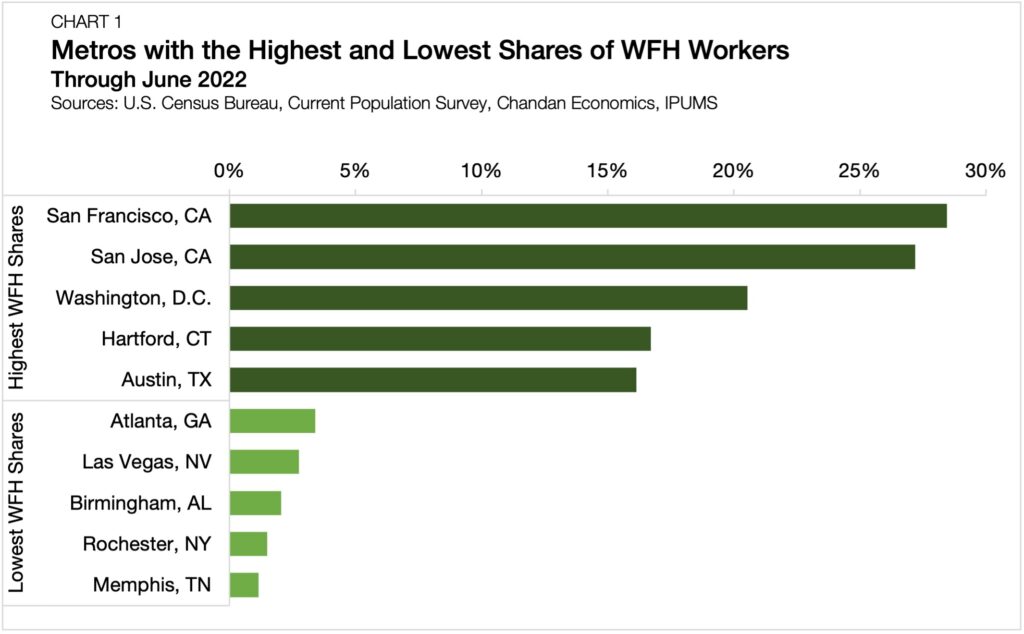

- San Francisco and San Jose have the highest shares of work-from-home workers in the U.S., followed by Washington, D.C., Hartford, and Austin.

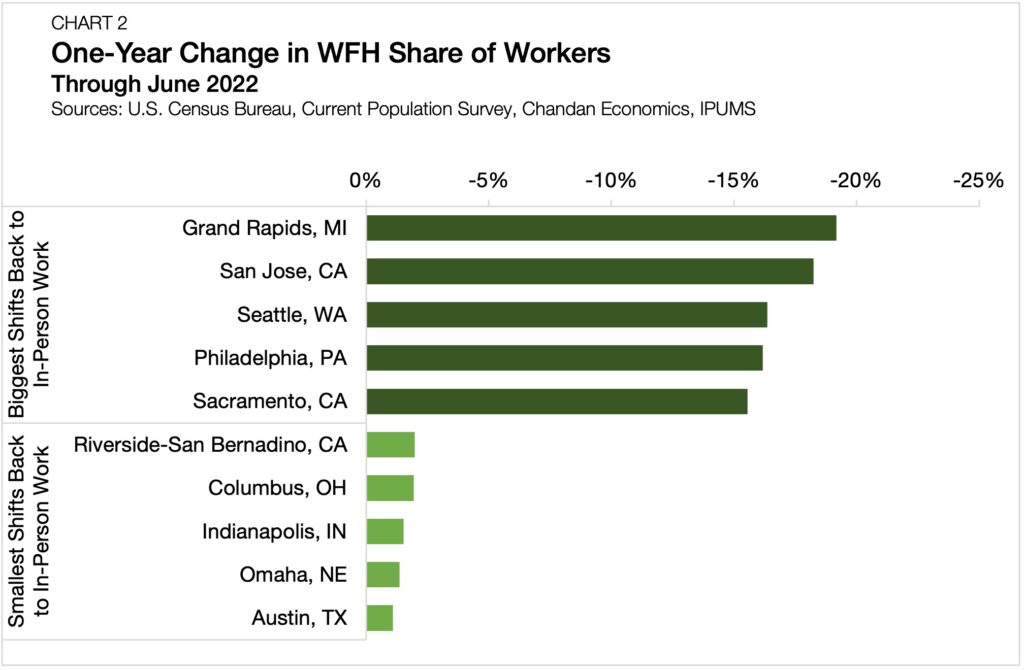

- Grand Rapids, San Jose, and Seattle saw the largest shifts back to office between June 2021 and June 2022.

The onset of the pandemic kicked off a widescale work-from-home (WFH) experiment that left the labor market structurally altered, creating significant downstream impacts on residential markets. In this brief, we will use data from the U.S. Census Bureau’s Current Population Survey to uncover which metropolitan areas have the highest share of workers that work from home (WFH) due to the pandemic.

ABOUT THE DATA: Data are based on the Current Population Survey question, “at any time in the last 4 weeks, did (you/name) telework or work at home for pay because of the coronavirus pandemic?” Persons who were working remote full-time before the pandemic were instructed to answer “no.” As a result, listed data may understate true work-from-home shares of the working population. Survey responses correspond to a person’s metropolitan area of residence.

WFH Starts to Reshape U.S. Cities

There are many factors that may influence a metropolitan area’s prevalence of remote workers. A high WFH share on its own is neither a market strength nor a weakness. Instead, it is a datapoint that should be viewed within the local context. For example, a high share of remote workers in a high-cost market may suggest that residential demand is at risk of heavy outward migration. Meanwhile, a high share in a low-cost market may suggest the market is attracting remote workers.

Across the U.S., the median metropolitan area had a 5.1% share of WFH workers in June 2022. For areas with workforces above 500,000 people, the median was 7.0%.

The highest share of remote workers was in the adjacent and tech-centric San Francisco (28.4%) and San Jose (27.2%) metro areas (Chart 1). According to ApartmentList’s Q1 2022 Renter Migration Report, both markets are seeing more renters head for the exits than are coming in. Additionally, Washington, D.C. (20.5%), Hartford (16.7%), and Austin (16.1%) have some of the highest WFH shares in the country.

On the other side of the spectrum, Birmingham (2.0%), Rochester (1.5%), and Memphis (1.1%) have some of the lowest shares of WFH workers.

Between June 2021 and June 2022, the biggest shift back to the physical office was in Grand Rapids, where the share dropped from 26.5% to 7.3% — a 19.2% decline. San Jose saw one of the largest shifts back to the office in the past 12 months, as 18.2% fewer workers are working remotely. Although despite the decline, this market still had one of the highest WFH shares in the country in June 2022.

On the other hand, Austin, which also has one of the highest WFH shares, saw the smallest amount of change. These data likely signal that Austin is now a ‘WFH importing’ market, where remote workers target them as an attractive spot to live long term. This new trend is yet another factor likely to be contributing to Austin’s soaring rent growth.

—–

Appendix

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.