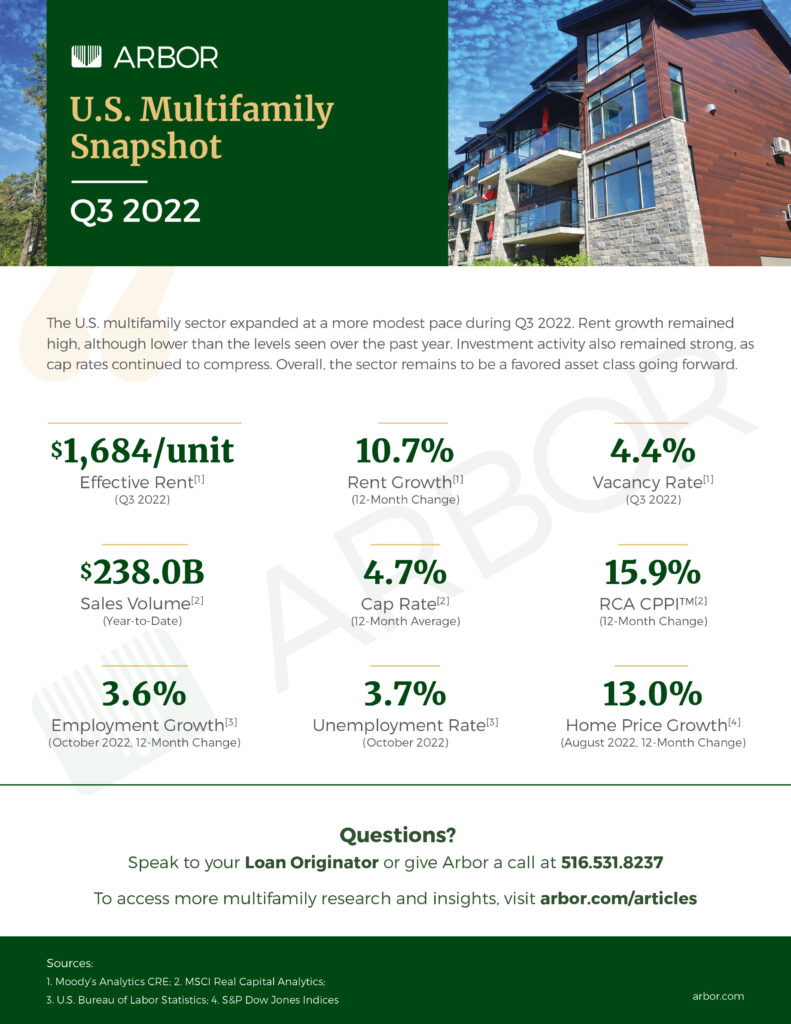

U.S. Multifamily Market Snapshot — Q3 2022

The U.S. multifamily market continued to expand during the third quarter of 2022, although at a more modest pace. Moody’s Analytics CRE reported that rent growth remained strong, climbing 10.7% year-over-year, yet down from the second quarter’s skyrocketing rate of 17.7%. The vacancy further improved to 4.4%, reaching a new five-year low.

MSCI Real Capital Analytics reported solid multifamily investment activity during the first nine months of the year, with nearly $240 billion in sales, on pace to reach $317 billion. Cap rates for third-quarter transactions remained at historic lows, averaging 4.6%, down slightly from 4.9% in 2021. Additionally, multifamily cap rates remained the lowest among major property types. The RCA CPPI apartment index posted a 15.9% annual pace of growth, down from 18.2% one year ago.

According to the U.S. Bureau of Labor Statistics, U.S. employers added 261,000 jobs in October, significantly above estimates. Total employment has surpassed pre-pandemic levels by 800,000 jobs, although it remains below the prepandemic pace. The unemployment rate increased to 3.7% in October, slightly higher than the pre-pandemic level.

The housing market continued to show signs of slowing amid affordability constraints and rising interest rates. The S&P CoreLogic Case-Shiller National Home Price Index fell 1.1% in August, the second straight monthly decline. Year-over-year, the index was up 13.0% in August, down from 15.6% in July.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q3 2022.

For more market insight, read our 2022 Top Opportunities in Large Multifamily Investment Report and view our other market research and multifamily posts in our research section.