San Antonio Multifamily Market Snapshot — Q3 2022

Arbor recently published its 2022 Top Opportunities in Large Multifamily Investment Report. Among the markets that stood out was San Antonio. Although it didn’t stand out in any one particular area, it performed well across the board, with high rental demand and a growing economy.

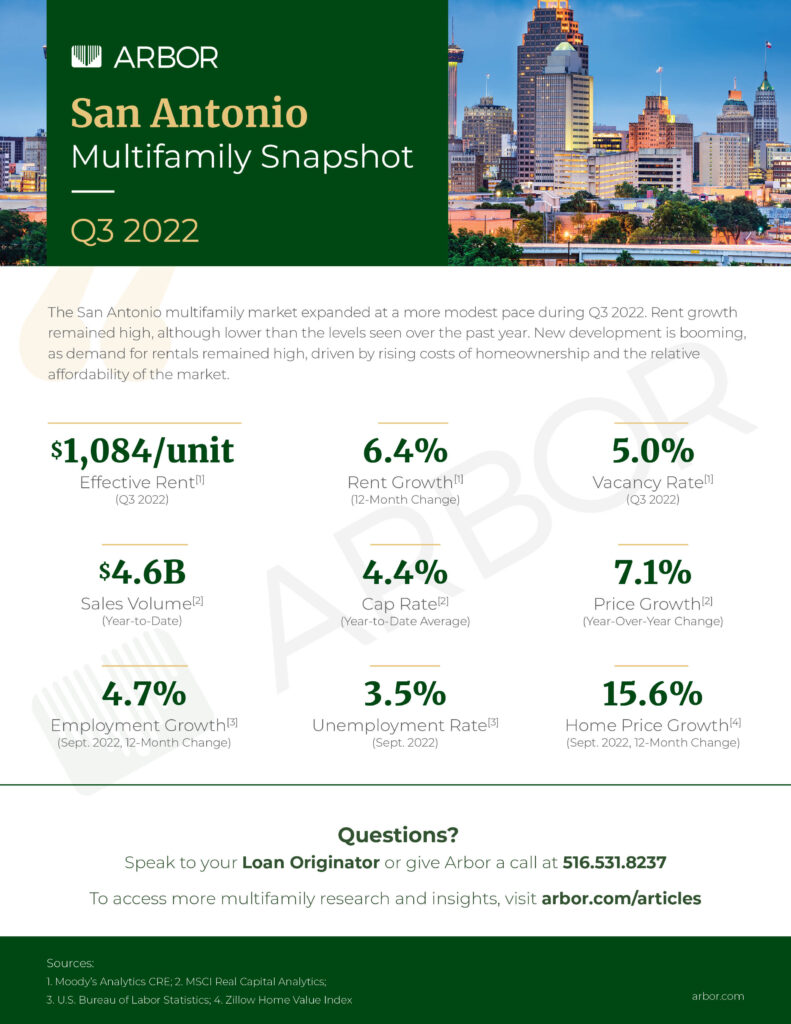

Multifamily rent growth remained strong in the San Antonio market during the third quarter of 2022, although began showing deceleration from the most recent record highs measured earlier in the year, according to Moody’s Analytics CRE. Barriers to homeownership continued to drive rental demand, as vacancy rates reached all-time lows.

“Apartment demand remains strong for San Antonio, likely buoyed by rising mortgage rates and a single-family housing market that has yet to cool significantly,” Lu Chen, a senior economist at Moody’s Analytics CRE told Arbor. “But affordability may become an issue if rent growth outpaces improvements in income.”

Investment sales were on pace to set a new annual all-time high of over $6.0 billion for 2022, according to data from MSCI Real Capital Analytics. A record $5.8 billion in multifamily sales were recorded during 2021, more than the totals from 2018 and 2019 combined. Cap rates remained near historical lows, averaging 4.3% during the quarter. The average sales price reached $187,000/unit, up 7.1% from one year ago, and a new record high for the market.

The U.S. Bureau of Labor Statistics reported that the unemployment rate in the San Antonio metropolitan area was 3.5% in September 2022, an improvement from 3.8% in August and down from 4.7% one year ago. Total employment surpassed the pre-pandemic level in March, five months earlier than it did nationally. The recovery of the local economy has been driven by strong performance in the financial services sector and elevated oil prices.

Here’s a look at the San Antonio multifamily finance and investment key benchmarks for Q3 2022.

For more market insight, read our 2022 Top Opportunities in Large Multifamily Investment Report and view our other market research and multifamily posts in our research section.