Aging Baby Boomers Reshape the Housing Market

- Senior households have risen by more than 50% since 2007, dwarfing the growth of non-senior households.

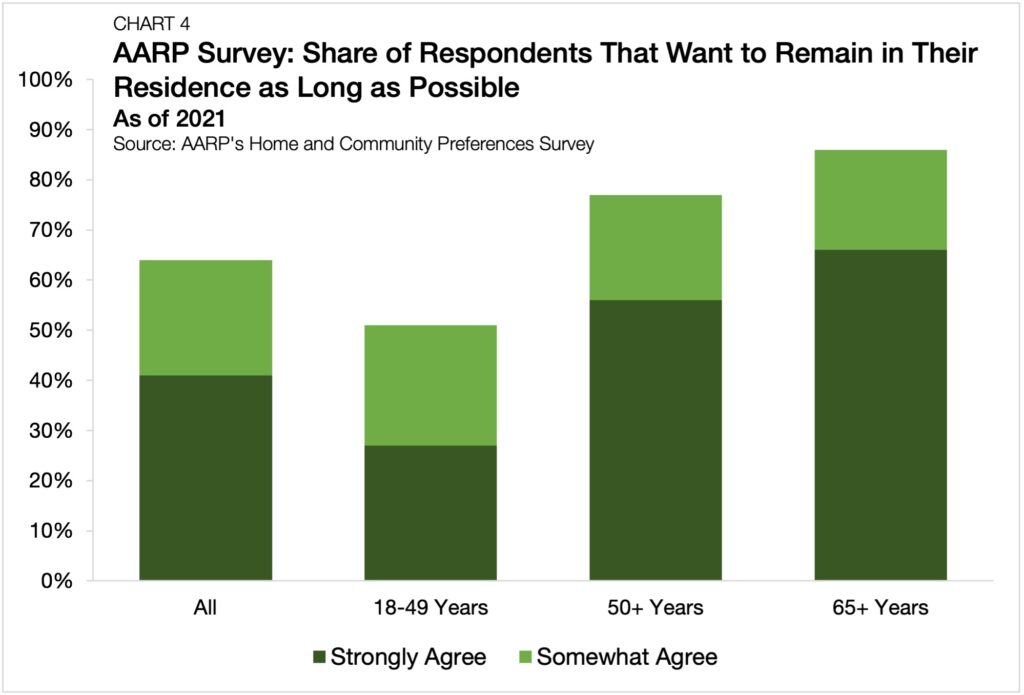

- 86% of seniors have reported wanting to remain in their homes as long as possible.

- The trend of aging in place has increased aggregate demand for housing units, limiting homeownership options for younger generations and shifting demand to alternatives like single-family rental (SFR) communities.

The Great Senior Surge

While the 2008 financial crisis prompted a cyclical shift in U.S. housing — impacting everything from home prices to who can qualify for a mortgage — an equally impactful demographic change was just taking shape. The first Baby Boomers, a generation that ranked first in population until 2019, were entering their 60s.

In 2007, 76.6 million people in the U.S. were between the ages of 45 and 64 — 38.1% more than a decade earlier, according to an analysis of U.S. Census Bureau data. The unprecedented wave of Baby Boomers that began to retire the next year would disrupt the balance of the housing market. Fueled by advances in medicine and modern conveniences, this generation experienced a greater ability to age in place than those before.

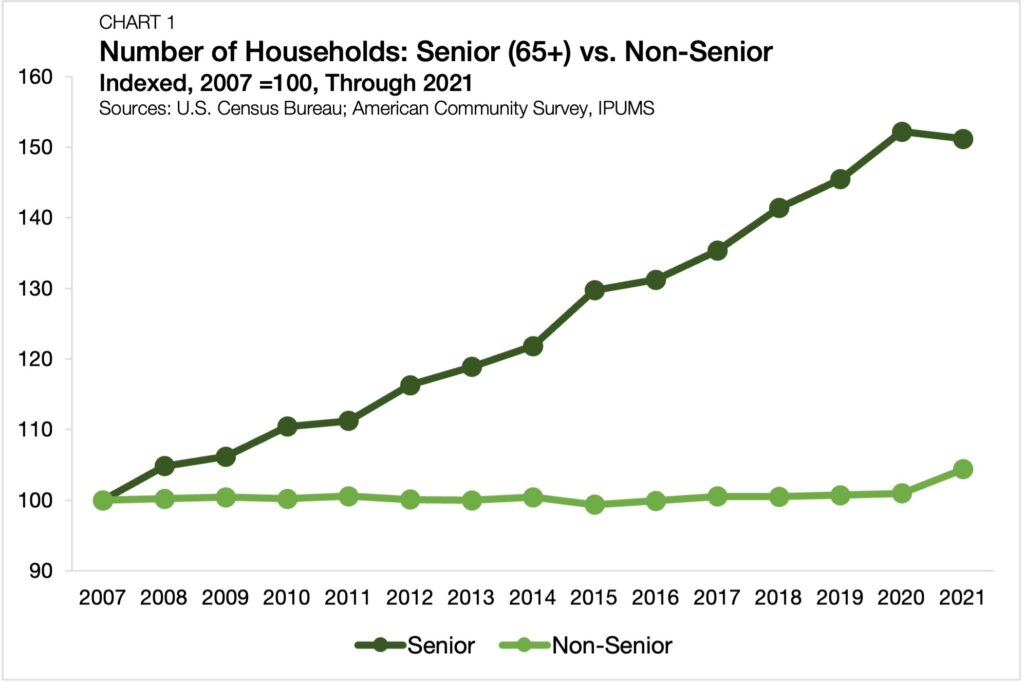

Between 2007 and 2021, the number of senior (65+ years old) households grew by 51.2%, increasing from 22.7 million to 34.3 million (Chart 1). Meanwhile, the number of non-senior households rose by a tepid 4.4%.

This age-related housing trend holds up across the owner-renter divide. In 2021, there were 58.4% and 15.9% more senior and non-senior renter households than in 2007, respectively. Among homeowners, the share of senior households jumped by 49.3%, while the number of non-senior households contracted by 2.0%.

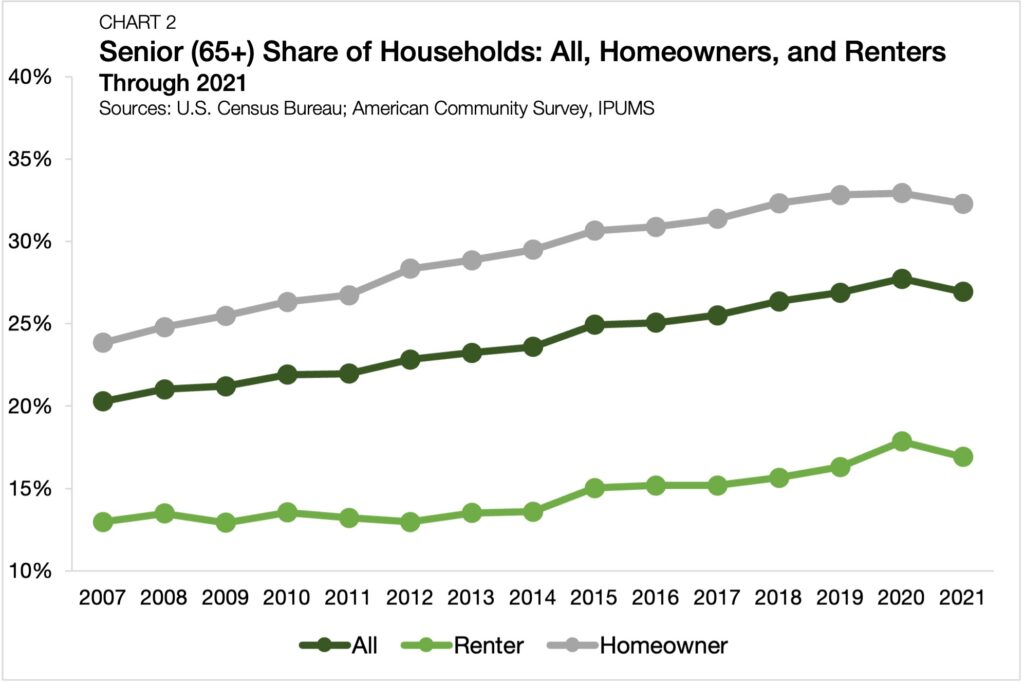

As more Baby Boomers have reached retirement age, seniors now account for a larger share of American households. Through 2021, seniors made up more than a quarter (26.9%) of all households — spiking 6.6 percentage points since 2007 (Chart 2).

Modernization Makes Aging in Place Possible

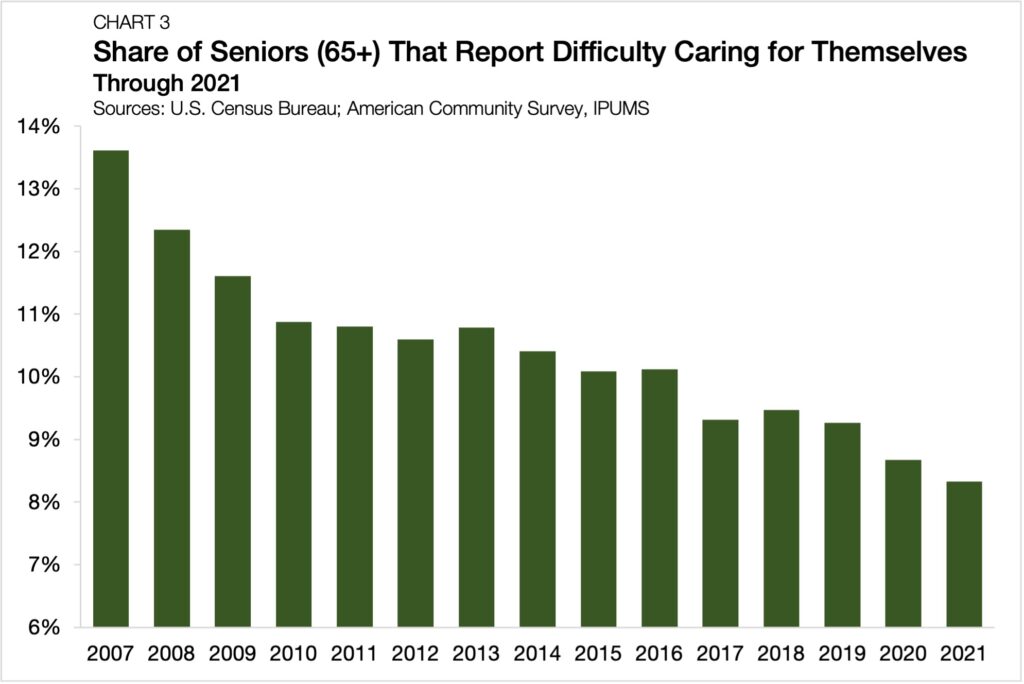

While the size of the Baby Boomer generation is a major reason for the shift in housing demand, it is not the only one. Aging in place has become more achievable. The advent of modern, smart home technologies has made it easier for today’s seniors to remain in their homes than at any time before it.

According to Modernize Home Services, 75% of homeowners have considered aging-in-place home renovations, such as walk-in tubs, medical alerts, shower seating, and non-slip flooring, this year for themselves or someone they love. In addition, the proliferation of e-retailers and online grocers has eased some of the burdens of senior independent living.

As a result, the share of seniors that report difficulty caring for themselves has steadily fallen in recent years. In 2007, 13.6% of seniors reported that they could not rely on themselves for self-care. By 2021, this share had fallen all the way down to 8.3% — a relative decline of nearly 39.0% (Chart 3).

The Growing Market Impact

Seniors becoming a significant source of housing demand has already had major market-shaping ramifications, and this may only be the beginning.

First, aging in place and the surge of senior households have meant a higher aggregate demand for housing. In 11 of the last 13 years, the growth in the number of U.S. households has exceeded the growth in the number of housing units.[1] Even after accounting for declines in recent months, home prices remain up by 120% since the 2008 financial crisis.

While existing homes are now more valuable, it has become more difficult for younger generations to buy homes. Seniors remaining in their homes for extended years means units are returning to the market less frequently, crowding out would-be first-time homebuyers. Today, only 1-in-20 single-family homeowners are less than 30 years old.

Younger generations remaining in the rental market for longer, on average, has paved the way for the emergence of new residential product types. Single-family rentals (SFR) and garden-style multifamily properties have grown in popularity in recent years as they allow access to suburban neighborhoods and quality public schools to families that cannot find an affordable ownership entry point.

Looking down the road, seniors’ demand for housing is poised to continue growing. A recent study by AARP found that 86% of people over 65 express either a somewhat or a strong desire to remain in their current residence for as long as they can (Chart 4). This increase in homeownership demand by retirees is not expected to cool down anytime soon, with there being 10.1% more Americans between the ages of 45 and 64 than just 15 years ago.

Senior Shift Reshapes Housing Market

With more total households competing for a limited supply of units, the increased number of seniors aging in place will be felt across generations. Until Generation Z reaches its twilight years, the number of retirees in upcoming decades will only continue to grow. At the same time, the smart home technologies that enhance safety and accessibility for seniors living alone will only continue to improve. Altogether, the rise of the senior householder has already reshaped the U.S. housing market, and all signs point to its growing importance in the years ahead.

[1] According to a Chandan Economics analysis of the U.S. Census Bureau’s Survey of Housing Vacancies and Homeownership

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.