Top Markets for Single-Family Rental Tenant Retention

- Markets where homeownership is more expensive often have higher single-family rental (SFR) tenant retention rates.

- The three largest U.S. cities (New York, Los Angeles, and Chicago) all have significantly higher SFR retention rates than the national average.

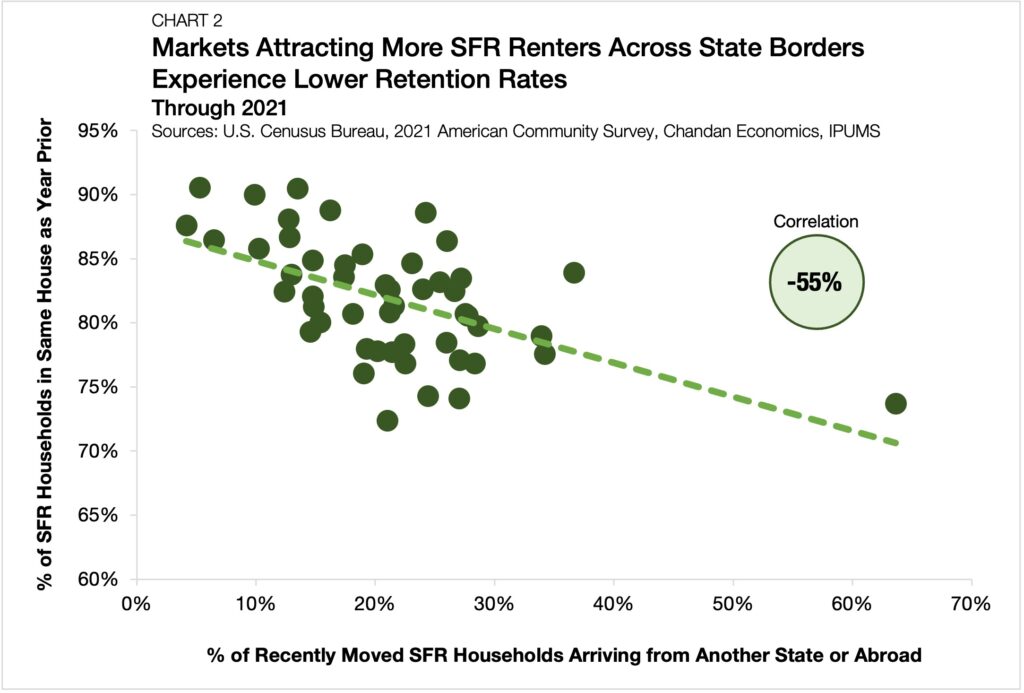

- Markets that attract new SFR householders across state lines tend to have lower retention rates.

Single-family rentals’ role in the U.S. housing ecosystem is malleable. In different markets, this product type serves different purposes — acting as a magnet for transient lifestyle households in some metros, while providing families with affordable access to quality public school districts in others. As a result, SFR retention rates vary dramatically across the country, depending not only on the cost of homeownership but on the purpose that single-family rentals serve in that market, creating a unique group of top markets.

High Retention Markets

California is one of the hottest spots for SFR retention right now, according to an analysis of U.S. Census Bureau data. Among the top 50 markets in the U.S., the Oxnard-Thousand Oaks-Ventura metropolitan area had the highest share of households (90.5%) that have lived in their current homes for at least one year through 2021 (Table 1).

The next top three Metropolitan Statistical Areas (MSAs) for SFR renter retention were also in California. These metros include Bakersfield (90.5%), Fresno (90.0%), and Los Angeles (88.8%). In fact, seven of the top 10 are all from the Golden State.

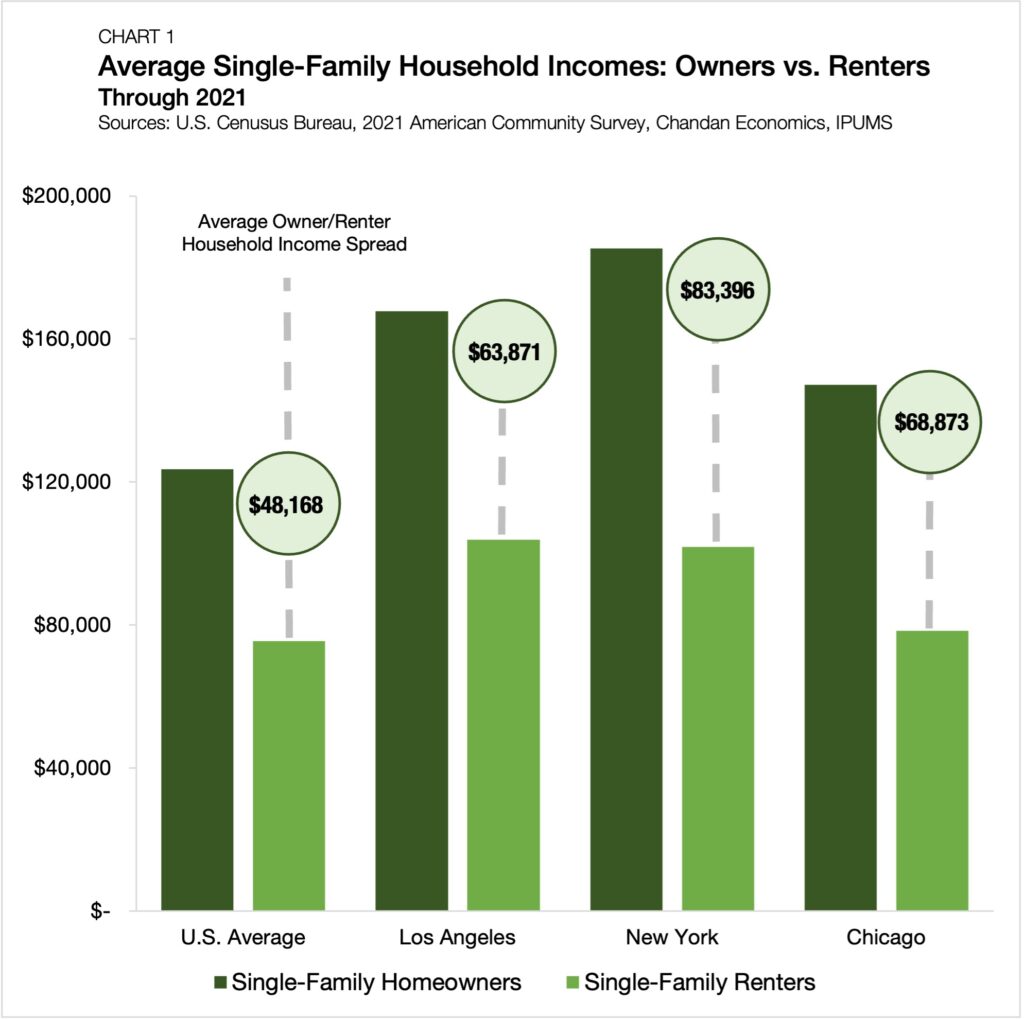

Notably, the country’s three largest cities, New York, Los Angeles, and Chicago, were all among the top 13 metros. A possible explanation for why SFR retention rates are higher in major metropolitan areas is that it has become more challenging to afford homeownership in these areas, creating a larger share of renters-by-necessity. Across the U.S., single-family homeowner households earn, on average, $48,168 more than SFR households (Chart 1). This income gap is even higher in New York ($83,396), Los Angeles ($63,871), and Chicago ($68,873).

Low Retention Markets

On the opposite side of the spectrum for retention are Oklahoma City (72.4%), Urban Honolulu (73.7%), and Denver (74.1%). Evidence suggests markets that cater more to lifestyle renters, especially those arriving from beyond state borders, tend to see higher rates of lease turnover (Chart 2). Urban Honolulu had the highest share of SFR households moving from another state or abroad (63.6%), while Denver ranked 11th (27.0%).

Retention Rates Differ Widely by Market

National trends in tenant retention show how SFRs fit in uniquely within the different metros where they are located. They attract both renters-by-necessity and lifestyle renters, leading to sizeable retention differences across markets. When a unit turns over less frequently, it means fewer periods of interrupted cash flows while also creating fewer opportunities to reset base rents (depending on in-place escalation agreements). As a result, SFR investors and operators must understand the natural tradeoff between safety and opportunity to maximize risk-adjusted returns.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.