State and Local Governments Step Up to Address Affordable Housing

- As the affordability gap widens, states have moved to the forefront of policy efforts to improve affordability in their own communities.

- Florida’s recent affordable housing investment is the largest in the state’s history, while Colorado, Washington, and several other states are considering legislative solutions of their own.

- On the local level, HUD funding remains critical, but cities, both big and small, are flexing their ability to move the needle.

Even as home prices posted their first annual decline in over a decade in March, affordability remains an urgent economic and policy challenge. As discussed in the recently released Arbor Affordable Housing Trends Report Spring 2023, produced in partnership with Chandan Economics, no single state has an adequate amount of affordable and available homes for its lowest-income renters. With public support for improving housing affordability growing stronger, state and local governments have been prioritizing policy solutions to close the nationwide housing gap.

States Take Charge

Florida’s recent passing of the Live Local Act may be the most significant of recent state-level actions. Signed into law in March 2023, the act creates the largest affordable housing investment in the state’s history, including $711 million in public funding and tax incentives for private developers. By some estimates, the law could also finance the construction, rehab, or sale of at least 25,000 Florida homes.

In Colorado, the state legislature is considering an overhaul of land use laws. If passed, the bill would reduce the use of exclusionary zoning policies by local governments, which can be used to set limits on building heights, effectively prohibiting multifamily construction. The new law would allow the state to supersede local restrictions, making it easier to construct duplexes, townhomes, and accessory dwelling units.

Colorado’s affordable housing bill faces opposition from several municipalities whose residents are concerned it would remove the home-rule authority status quo surrounding development decisions. At the same time, proponents claim that zoning changes are vital to increasing the housing stock where it is needed most.

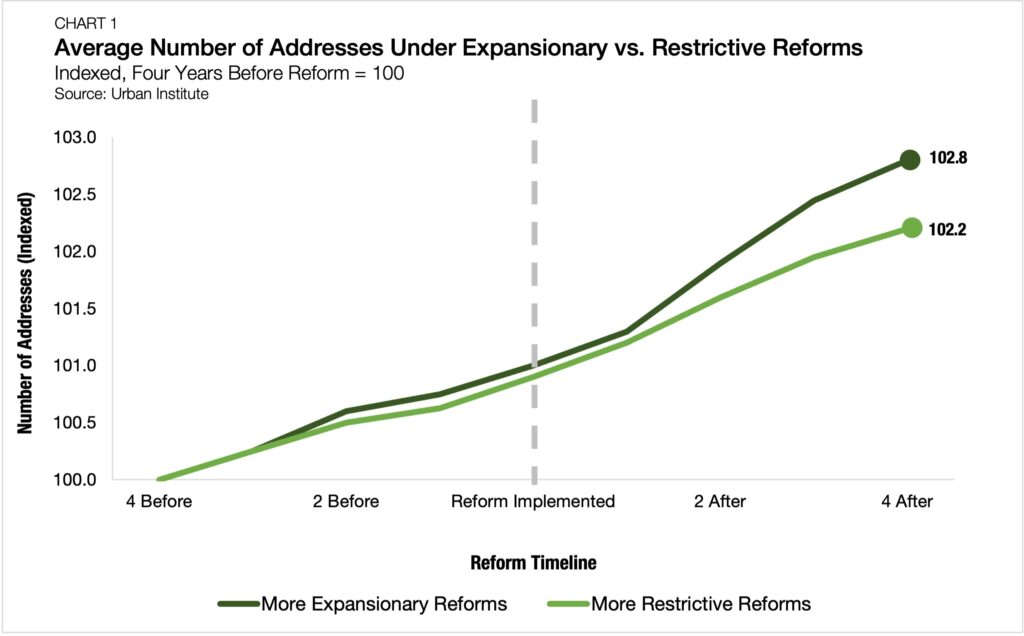

A recent study by Urban Institute found that reforms that loosen zoning restrictions result in a statistically significant 0.8% increase in housing supply within three to nine years after implementation. Additionally, when comparing cities that have passed expansionary housing reforms to ones that have passed more restrictive ones, both have been found to experience increases in the housing stock before implementation, but those areas with more expansionary reforms experienced more growth between years two and four (Chart 1).

Similar debates are taking place in Montana, North Carolina, California, and Washington. In Washington, the latest debate surrounds a proposal to raise taxes on real estate sales to fund affordable housing projects. The proposal has faced local industry pushback from those concerned that it will only increase the cost of housing, but the policy change has gained support from many low-income housing advocates. Washington has also made progress advancing up-zoning laws aimed at boosting supply while rent control efforts have been squashed there.

Keeping It Local

Zooming in to the local level, municipalities have also taken steps to tackle affordability issues despite the financial barriers they face. In late 2022, voters across four separate towns in the east end of Long Island, NY, approved a measure to create a new community housing fund that can be used to build new housing, provide rental opportunities, and supply direct assistance to first-time homebuyers. The law allows towns to access a new 0.5% real estate tax transfer at their discretion, and some municipalities have started rolling out development plans and projects.

In San Diego, local proponents and policymakers have revitalized efforts to maintain its roughly 70,000-unit lower-rent housing stock. Even smaller cities such as Portsmouth, OK, have found renewed urgency to tackle growing affordability challenges.

Still, most municipalities rely heavily on U.S. Department of Housing and Urban Development (HUD) funding for local initiatives. The HOME Investment Partnership Program (HOME), a HUD-administrated grant program for state and local governments, which is the primary vehicle for local funding, has been strengthened by incremental boosts in recent years.

The 2024 Federal Budget and Beyond

In the near term, the White House’s 2024 budget proposal represents the most reasonable opportunity to boost state and local funding through HOME. The proposed $300 million funding increase will likely face an uphill climb in Congress as budget negotiations grow more contentious amid the U.S. debt ceiling debate. Until additional Federal solutions come along, state and local lawmakers will have to take the lead in creating meaningful policy reform in order to close the affordable housing gap in their own communities.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.