The Top Five Tightest Rental Markets in the U.S.

- Diverse by nature, the top five tightest rental markets in the U.S. share several commonalities, including relative affordability, labor market specialization, and an ability to attract retirees.

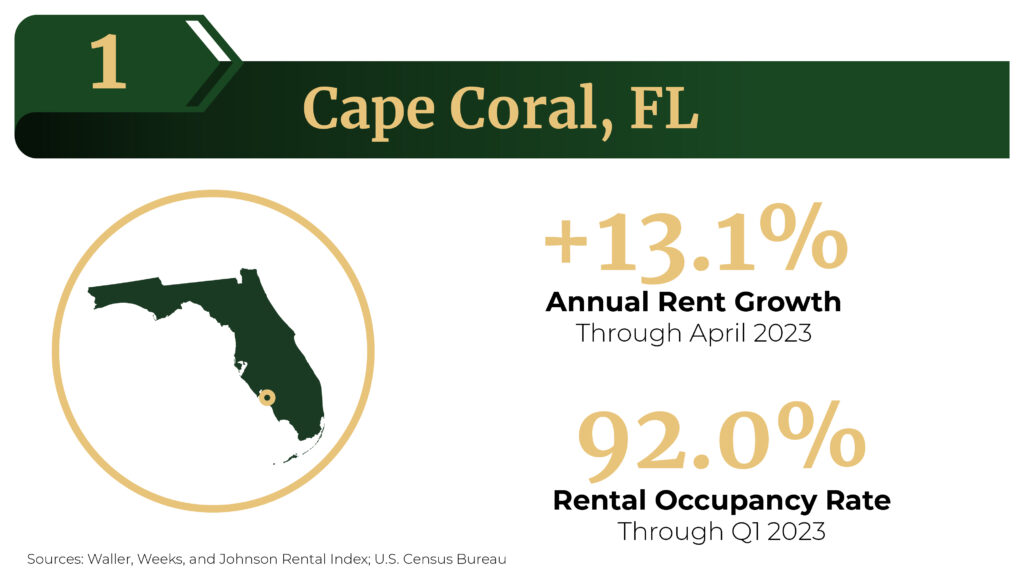

- Cape Coral, FL, where rents have risen 13.1% year-over-year, has the tightest rental market in the nation right now.

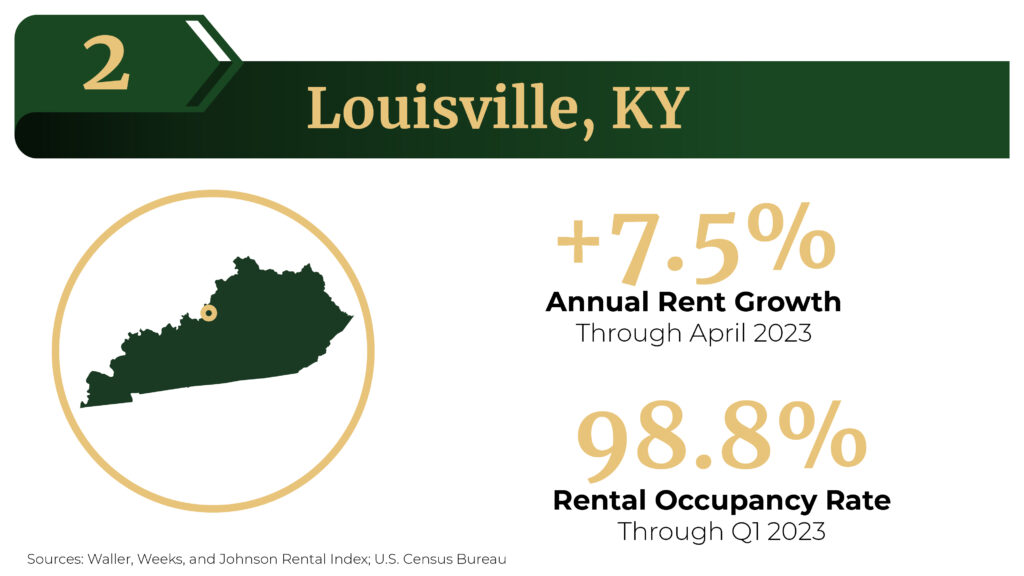

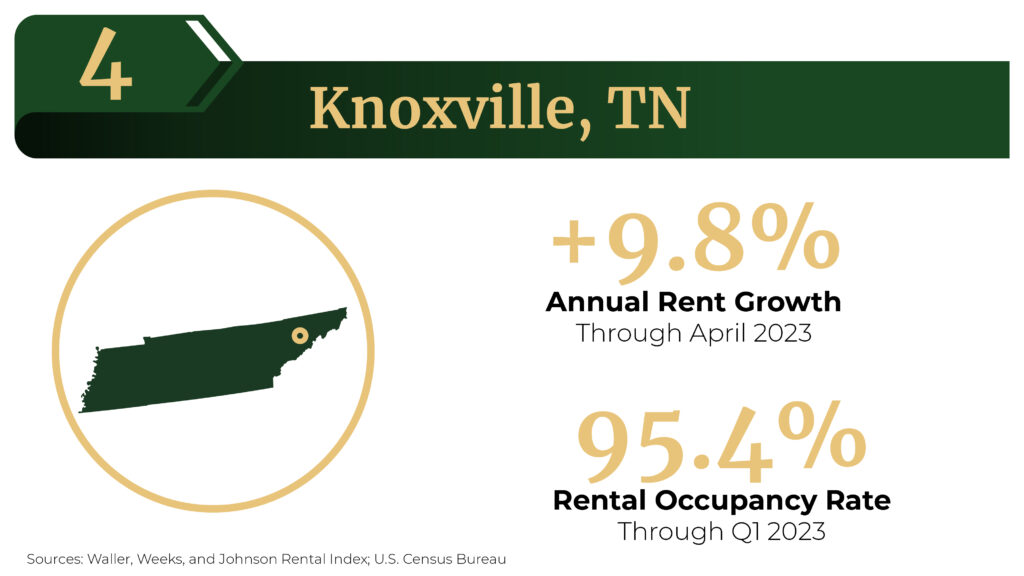

- Louisville, KY, and Knoxville, TN, rank in the top 5 due to attractive entry-level home and rent prices.

Most rental markets from New York City to San Francisco are tight right now, but are some feeling the pinch more than others? To answer this question, Chandan Economics created a matrix that analyzes rent growth and rental occupancy rates to find out which of the top 75 largest metro markets have the highest demand for rental housing.

Cape Coral, FL has the highest rent growth pressure in the country, with prices rising 13.1% year-over-year. Rapid increases in local population growth have contributed to acute price pressure. The population in the area grew by 4.0% in 2002 — roughly 10 times higher than the national average. Cape Coral has become increasingly popular among retirees. In 2021, more than 60% of people that moved to Cape Coral from another U.S. state were at least 55 years old.[1] Secondly, much like the I-95 corridor improved the interconnectivity of Florida’s east coast, the Sunshine State’s I-75 on the west coast is quietly doing the same.

Louisville, KY, has the highest rental occupancy rate in the country, averaging 98.8% through the first quarter of 2023, and its rent growth was well above average, reaching 7.5% through April 2023. Entering 2023, Realtor.com ranked Louisville as the number three housing market for growth. Renters and homebuyers are finding entry price points in Louisville more attractive than regional alternatives. According to the WWJ Rental Index, Louisville’s average rent price of $1,341 is 11.3% lower than rents in Memphis and 31.3% lower than in Nashville.

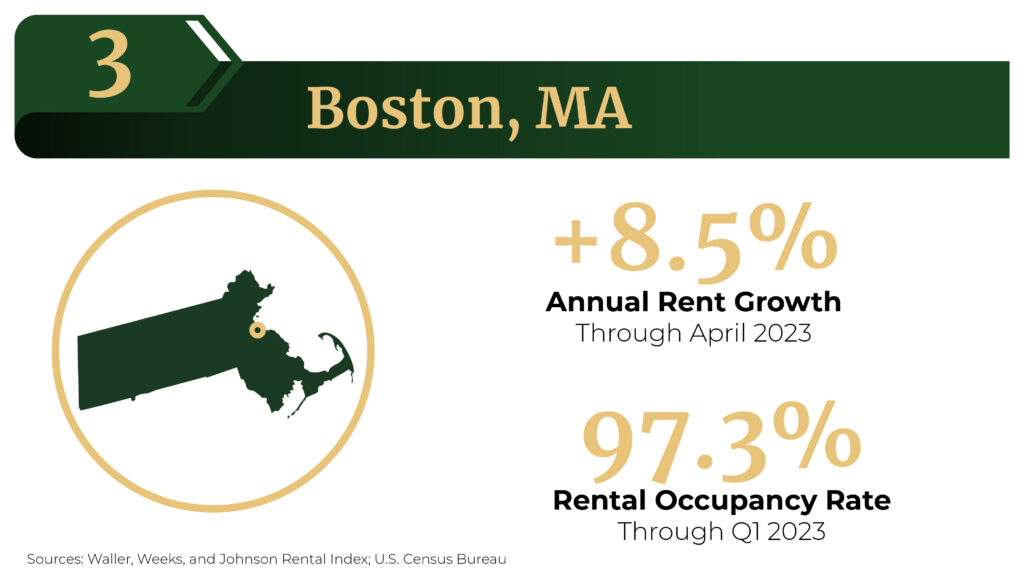

Boston, MA, is the only Gateway market to crack the top five, coming in third on our list of tightest rental markets. Occupancy rates in Boston currently sit at 97.3% — 2.8 percentage points higher than the median major metro. Already the third most expensive rental market, rents in Boston have climbed an additional 8.5% year-over-year through April. A recent report from RentCafe, which tracks online rental listings, noted that Boston saw some of the most robust rental activity of any northeast market in May. Limited availability of inventory coupled with high demand has led to an exceptionally tight rental market. Compounding Boston’s supply shortage, housing permits contracted in April 2023 to reach their lowest annualized rate since the pandemic shutdown.

Knoxville, TN, slotted into the fourth spot on our list, had the third-highest annual rent growth rate through April 2023, totaling 9.8%. Market Square, its revitalized downtown area, has created a walkable nexus of shops and restaurants, an attractive feature to newcomers migrating from dense coastal metros. Much like Louisville, Knoxville is comparatively more affordable than many regional and coastal alternatives, with average rents of $1,757. According to the 2023 State of Housing Report by the Knoxville Area Association of Realtors (KAAR), Knox County failed to add sufficient volumes of new supply from 2017-2021, leading to its current housing imbalance.

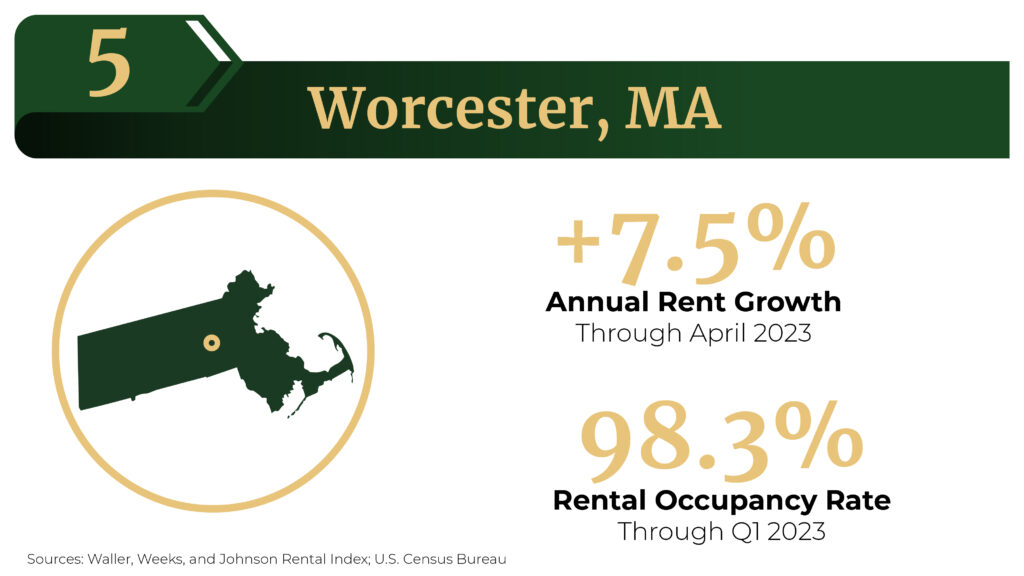

Rounding out the top five is Worcester, MA, where rental capacity is nearly maxed out, and rents have risen 7.5% over the past year. The second-largest city in Massachusetts has increasingly attracted residents from nearby Boston. According to ApartmentList, nearly half (46.1%) of incoming Worcester renters were originally Bostonians. Over the past decade, Worcester has added about 25,000 new residents while only expanding its housing inventory by 10,000 units — creating upward pricing pressure on existing inventory. Home to the University of Massachusetts Medical School, UMass Memorial Health Care, and biotech companies like AbbVie Bioresearch Center and Pfizer, Worcester is a central node in the Life Sciences corridor. Worcester is also undergoing an extensive downtown revitalization intended to boost livability.

While interest rate pressure has challenged commercial real estate investors recently, the exceptionally tight rental markets in many states could be a promising avenue for investment. Markets like Cape Coral and Louisville which are burdened with high rent growth and high occupancy rates are likely to benefit from more housing options.

Methodology

The Market Tightness Index developed for this analysis equally weighs two factors: annual rent growth and rental occupancy. For each variable, a market-level Z-score is calculated. A Z-score is a measure of how far away a particular data point is from the average in a set of data, and it shows how many standard deviations that data point is from the mean. The average of the two respective Z-scores then serves as the Market Tightness score in the rankings in this article.

Rent growth data, taken from the Waller, Weeks, and Johnson Rental Index, is current through April 2023. Occupancy data, which is from the U.S. Census Bureau, is current through the first quarter of 2023. Only the 75 largest Metropolitan Statistical Areas (MSAs) were included in this analysis.

[1] Based on a Chandan Economics analysis of the U.S. Census Bureau’s 2021 American Community Survey.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily posts in our research section.