Where are Single-Family Rental (SFR) Rents Rising the Fastest?

- Single-family rental (SFR) rent prices increased fastest in Tampa, FL, a major business center on Florida’s Gulf Coast.

- All 20 major SFR markets analyzed registered positive rent growth into mid-2023.

- Compared to last year, SFR rent growth has decelerated nationally.

While the single-family rental (SFR) sector’s national rent growth averages have retreated from record highs, structural tailwinds are keeping price growth positive — both nationally and in major SFR markets. In this research brief, Chandan Economics and Arbor Realty Trust analyze DBRS Morningstar data, which covers the top 20 MSAs by SFR activity, to discover the metropolitan areas where SFR rent growth is the hottest right now.

Top Rent Growth Performers

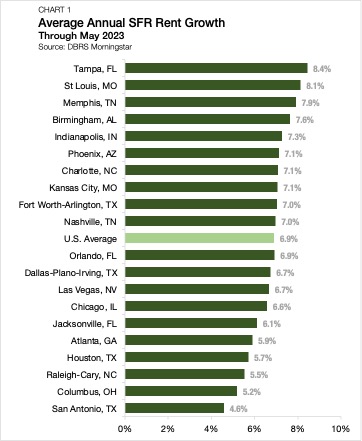

Tampa, FL, a city of 400,000 people with three major professional sports teams that have a string of recent championships, boasts the highest percentage increase in SFR rent among markets tracked by DBRS Morningstar. Through May 2023, average rent prices in Tampa were up 8.4% year-over-year (Chart 1).[1] The Tampa suburbs have become a hotbed of SFR activity in a state where population trends attract investors and developers alike.

St. Louis, MO (+8.1%) and Memphis, TN (+7.9%) follow Tampa closely behind in average annual SFR rent growth. While St. Louis often flies under the radar, the “Gateway to the West” has quietly developed a strong SFR market. The strength of SFR rent growth in St. Louis mirrors the local housing market, where prices are up 6.2% year-over-year — 1.7 percentage points better than the national growth rate. Meanwhile, according to Google Trends data, Memphis consistently pops up as one of the top searched markets for homes for rent in the country, underscoring SFR’s demand in the metro.

Trailing the Pack

Of the 20 SFR markets tracked by DBRS Morningstar, San Antonio, TX had the slowest average annual rent growth, at 4.6%. Columbus and Raleigh rounded out the bottom three. Still, even at the bottom end of the spectrum, these markets are all within 2.3 percentage points of the national average SFR growth rate (6.9%).

Notably, while 17-of-20 tracked metros saw rent growth slow compared to 2022, rent growth was still positive for all 20 markets. As detailed in Arbor’s Single-Family Rental Investment Trends Report Q3 2023, lease renewal rent growth continues outpacing historical norms, and new lease rent growth has shown signs of recovery.

The Takeaway

Undeniably, SFR rent growth has decelerated in 2023. At this time last year, 10 markets had SFR rents growing faster than 8.5% annually — a threshold that no market is above today. At the same time, silver linings are plentiful. Even as market momentum slows, all 20 of these metropolitan markets have continued to see positive rent growth.

[1] All rent growth data are from the DBRS Morningstar Single-Family Rental Sector Industry Study, measured through May 2023. Rent growth figures capture both new leases and lease renewals.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily posts in our research section.