Why Rising Apartment Vacancy Rates are Not Here to Stay

- Structural trends suggest the recent rise in apartment vacancy rates will be short-lived.

- Rental renewal rates have significantly increased since the global financial crisis, as most householders who live in apartments reported being satisfied with their living situations.

- Slowing multifamily permitting activity indicates that the pace of new apartment deliveries is on a path to normalization.

Although they remain near historical lows, apartment vacancy rates in the U.S. have begun to climb. However, this recent reversal may be a temporary trend, driven by renter satisfaction and a slowdown in the pace of new construction.

Vacancy on the Rise

As 2023 winds down, residential rental vacancy rates have started to move higher for the first time since the end of the global financial crisis. According to the U.S. Census Bureau, rental vacancy rates reached their highest point on record in 2009, peaking at 11.1% (Chart 1). Rental vacancy rates then proceeded to fall, albeit unevenly, through mid-2022, reaching a low point of 5.6% last year. However, this trend has reversed over the past year. In three of the past five quarters, rental vacancy rates have risen — jumping by 1.0 percentage point to 6.6% by the end of the third quarter of 2023.

The Cresting Construction Wave

The single most significant factor contributing to increasing rental vacancy rates is the recent jump in construction activity that has brought an abundance of much-needed new housing inventory to the market.

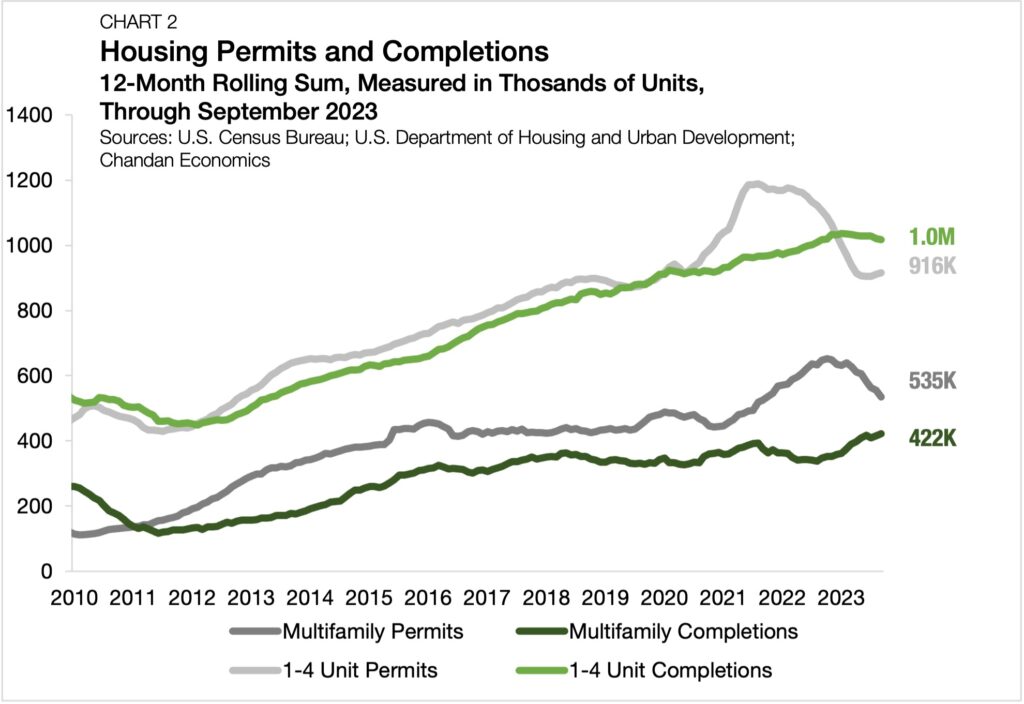

In 2021 and 2022, construction permits surged. Measured by a rolling 12-month sum, the single-family housing market (apartment homes with 1-4 units) reached a permitting peak in August 2021, when 1.2 million more units were authorized for construction compared to the previous one-year period (Chart 2). Within the multifamily sector, this permitting peak came later in October 2022, when the rolling annual sum reached 653,000 units.

While these totals indicate that rental housing construction is still booming, the data also suggests a return to a more stable flow of new apartment additions may be on the horizon. The rolling sum of permits for single-family and multifamily housing units are both in decline — signaling that the current deluge of new apartment supply will return to a more modest pace over the next year.

Renters are Moving Less Often

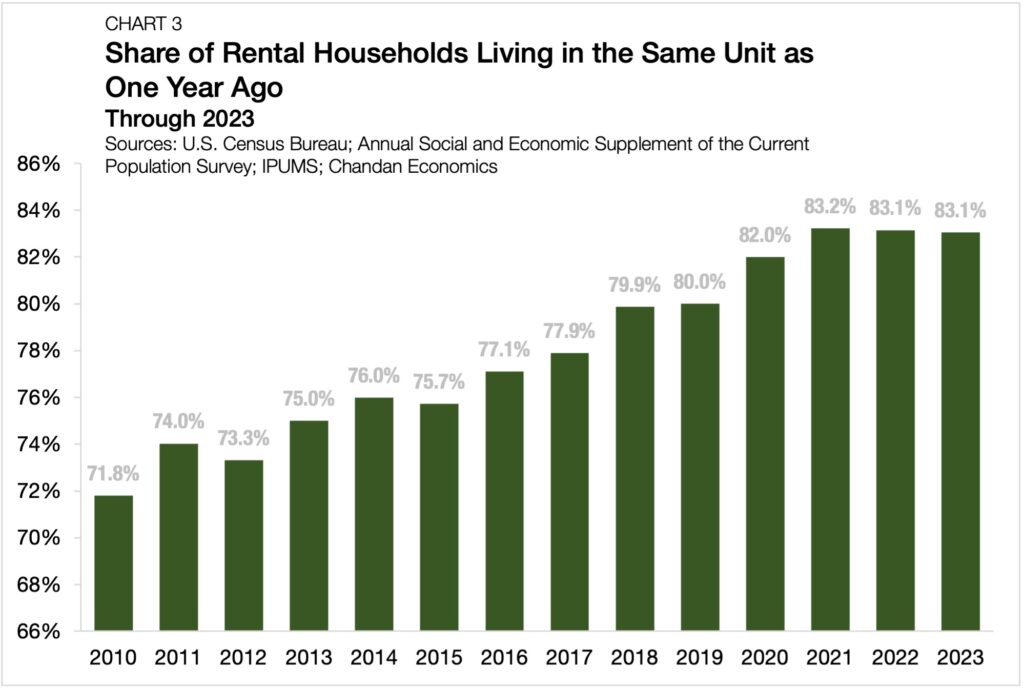

Shifting mobility patterns are another essential piece of the story about apartment vacancy rates. Since 2010, the share of renters renewing their leases has steadily risen, placing downward pressure on vacancy rates. In 2023, 83.1% reported living in the same apartment as they did one year before, according to an analysis of U.S. Census Bureau data (Chart 3).[1] Compared to 2010, the share of renters staying put for longer than a year has grown considerably, jumping by 11.3 percentage points.

Outlook

Even as the ramped-up pace of apartment construction pushes vacancy rates higher, current levels remain historically low. The increased costs of homeownership and renter satisfaction are likely to continue to keep the apartment occupancy rate high. Over the next few years, these structural tailwinds will likely take root while the cyclical construction headwinds are positioned to dissipate.

Unlike today’s apartment renters who are staying put more often, it looks like rising apartment vacancy rates are likely to be short-lived.

[1] Data are from the U.S. Census Bureau’s Annual Social and Economic Supplement of the Current Population Survey.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.