Multifamily Households Reach a Record High

- Multifamily households grew 5.0%, to 21.3 million in 2022.

- 47.1% of rental households live in multifamily properties, making multifamily the predominant rental property type.

- Annual household growth of 8.6% in large multifamily properties was the fastest of all types of rental housing.

Driven by investor confidence in multifamily housing’s long-term fundamentals, the volume of debt outstanding in the sector has grown by nearly 150% since the end of the Great Recession. As this piece will detail, where investment dollars have flowed, housing demand has followed. Through an analysis of newly released U.S. Census Bureau American Community Survey data, our research teams pinpoint the growing size and scope of the largest rental housing property type.[1]

Multifamily Households Surge

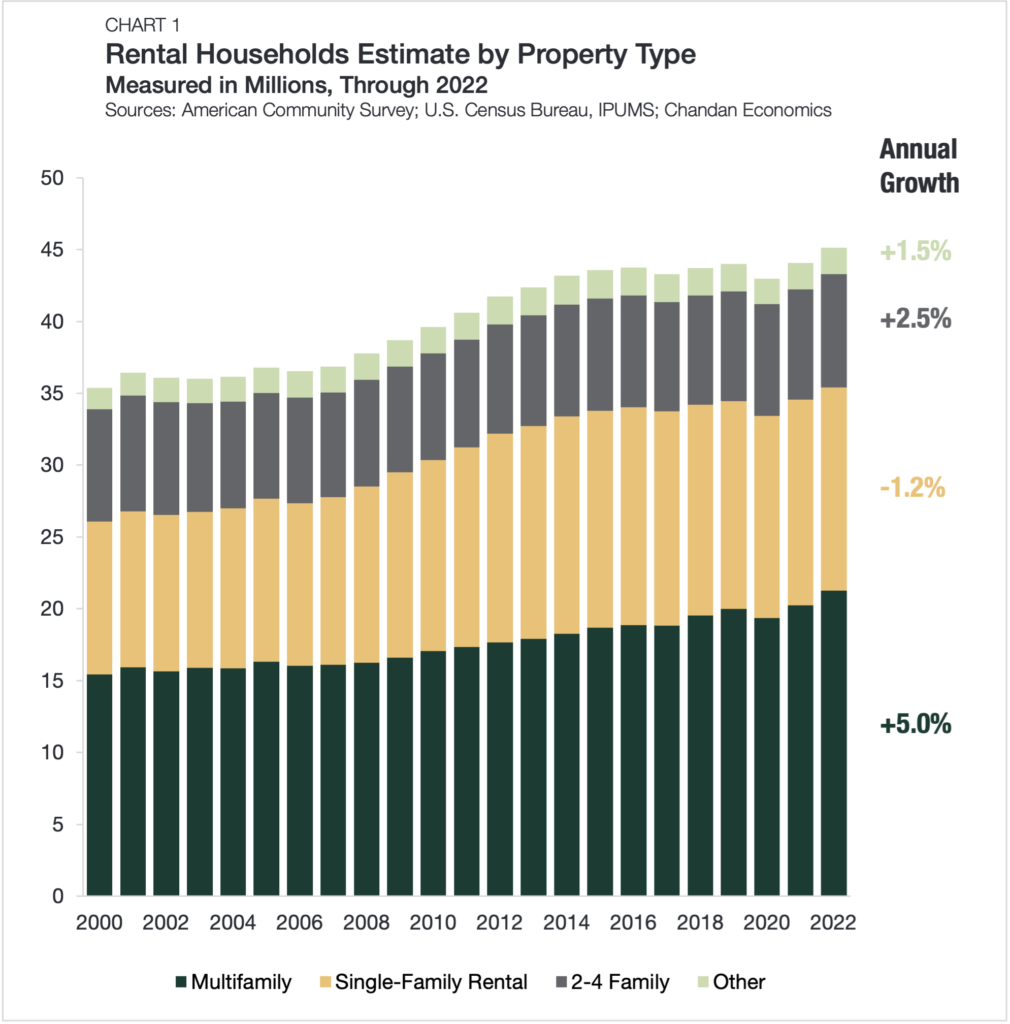

The number of multifamily households in the U.S. grew to 21.3 million in 2022 — a new all-time high, according to an analysis of Census Bureau data (Chart 1). Reflecting the impact of both increasing multifamily supply and high mortgage interest rates, the 5.0% increase in the pace of multifamily household growth in 2022 was the fastest on record since at least 2000.

Multifamily is the largest rental housing type, accounting for 47.1% of all rental households. Over the past ten years, multifamily households have swelled by 20.4%, and its rental sector market share has grown by 4.9 percentage points.

Small and Large Multifamily

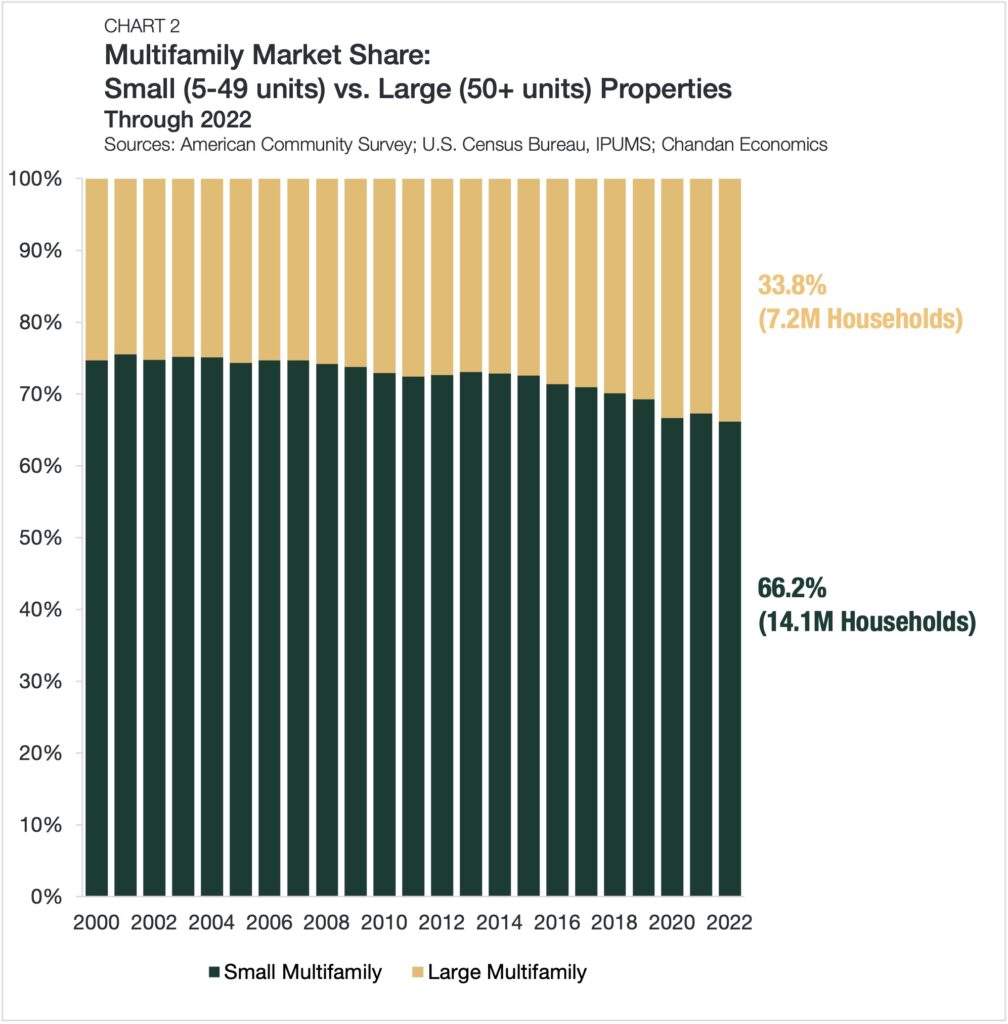

The multifamily sector includes two sub-property types: small multifamily (5-49 units) and large multifamily (50+ units). Small multifamily, which comprises the majority (66.2%) of all multifamily units, increased 3.6% in market size to reach 14.1 million households (Chart 2).

Although large multifamily is still the minority subset, the market share gap has closed. Large multifamily, which is now 33.8% of the sector, gained 7.2 million households in 2022, climbing 8.6% from the year before. In the past 10 years, the share of multifamily households in large properties has increased 6.4 percentage points.

Undoubtedly, the multifamily sector has seen impressive growth in recent years. Given the cost challenges of transitioning into homeownership and a strong pipeline of young renters, multifamily is likely to continue to expand in 2024.

[1] Unless otherwise stated, all referenced data are based on a Chandan Economics analysis of the U.S. Census Bureau’s American Community Survey.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.