Northern Virginia’s Multifamily Market Experiences a ‘Tech-Tonic’ Shift

- Already rich in top-tier universities, Northern Virginia is emerging as a mid-Atlantic tech and engineering hub.

- The concentrations of STEM workers in Alexandria and Arlington are more than double the national average.

- The household incomes of renters in Alexandria and Arlington have now eclipsed those of renters in the rest of the Washington, D.C. metropolitan area.

When people think of tech hubs, they often imagine a familiar mix of standards such as Silicon Valley, Boston, and New York, or recent-growth markets like Austin and Miami. However, Northern Virginia is quickly becoming a bona fide technology hub in its own right.

Alexandria and Arlington, rich in educational resources, are flourishing as public and private investment pours into the region. Potomac Yard, a neighborhood that straddles Alexandria and Arlington, is set to become the corridor’s next major development site. The owner of the NBA Washington Wizards and NHL Washington Capitals has preliminary plans to build a new arena and entertainment complex at the site in a $2.2 billion proposal that would also include a concert hall, a convention center, hotels, offices, apartments, and improvements to the Metro and major roads in the area. The National Landing Business Improvement District is also helping to attract increased science and tech investment into the area.

The livability and vibrance of the corridor are on the rise, and the area is approaching an inflection point that is already having ripple effects on its apartment market.

Growing Tech Hub

Nestled within the Washington, D.C. metropolitan area, Alexandria and Arlington are gaining more recognition for creating downstream success throughout their local economies.

The corridor’s high density of top-tier universities, including Georgetown, The George Washington University, The University of Virginia, Virginia Tech, and George Mason University, produces attractive talent pools for local employers. Additionally, Virginia’s tax code is more generous to corporations and individuals than that of the District of Columbia.

In 2018, Amazon announced that it had selected Arlington as the site for its new East Coast headquarters. In 2022, Boeing followed suit, relocating from Chicago. Additionally, the AI boom and its integration with government operations should provide another boost for this burgeoning tech hub.

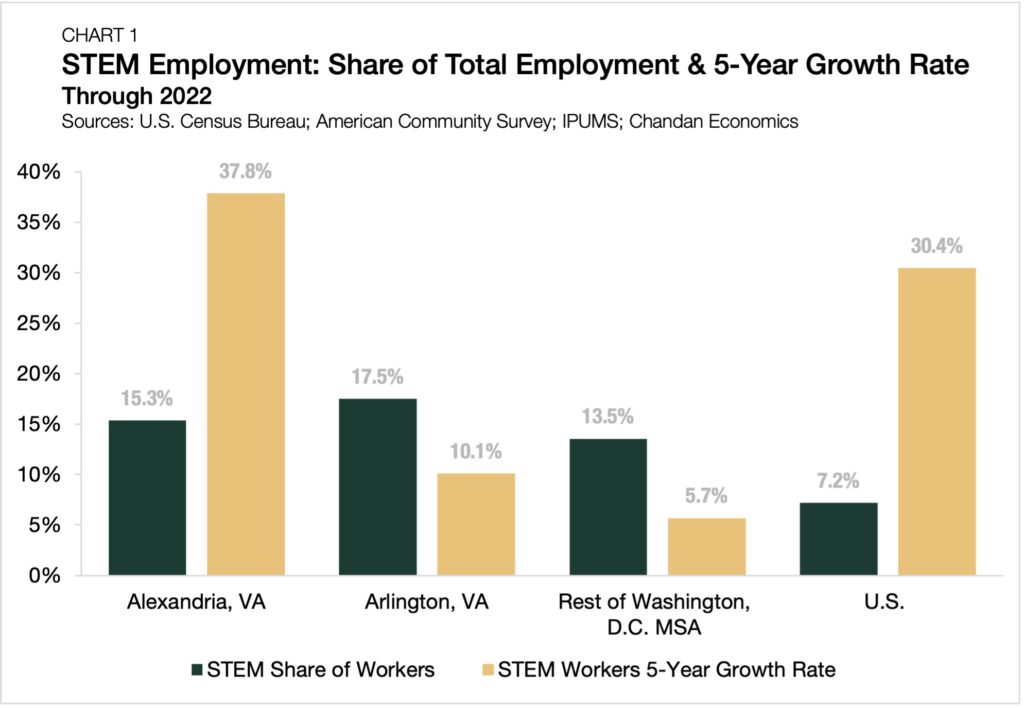

Looking at the U.S. Census Bureau’s American Community Survey, one sees that Northern Virginia has technology encoded in its urban DNA. Among workers living in Alexandria, 15.3% are employed in jobs classified as STEM (science, technology, engineering, and mathematics) occupations (Chart 1). In Arlington, the share of workers in STEM jobs rises even higher, to 17.5%. Both cities have higher concentrations of STEM workers than the rest of the Washington, D.C. metropolitan area (13.5%) and the U.S. (7.2%), respectively. Looking at the Census Bureau data another way, it shows that the concentration of STEM workers in both Alexandria and Arlington is more than twice that of the overall U.S. labor market.

Despite Arlington having a more extensive base of STEM residents (26,775 in Arlington vs. 15,064 in Alexandria), the gap has narrowed. Over the past half-decade, the number of STEM residents in Alexandria has exploded by 37.8%. Still, while the growth rate in Arlington over the same period is considerably lower (up 10.1%), it remains well above the growth of the overall Washington, D.C. metro area (up 5.7%).

Rentals Surge

The labor market success of Alexandria and Arlington is transforming the hubs into full-fledged live-work-play districts. National Landing Business Improvement District, which is made up of Pentagon City (Arlington), Crystal City (Arlington) and Potomac Yard (Alexandria), is home to more than 450 shops and restaurants and is the target of $8 billion worth of planned investment.

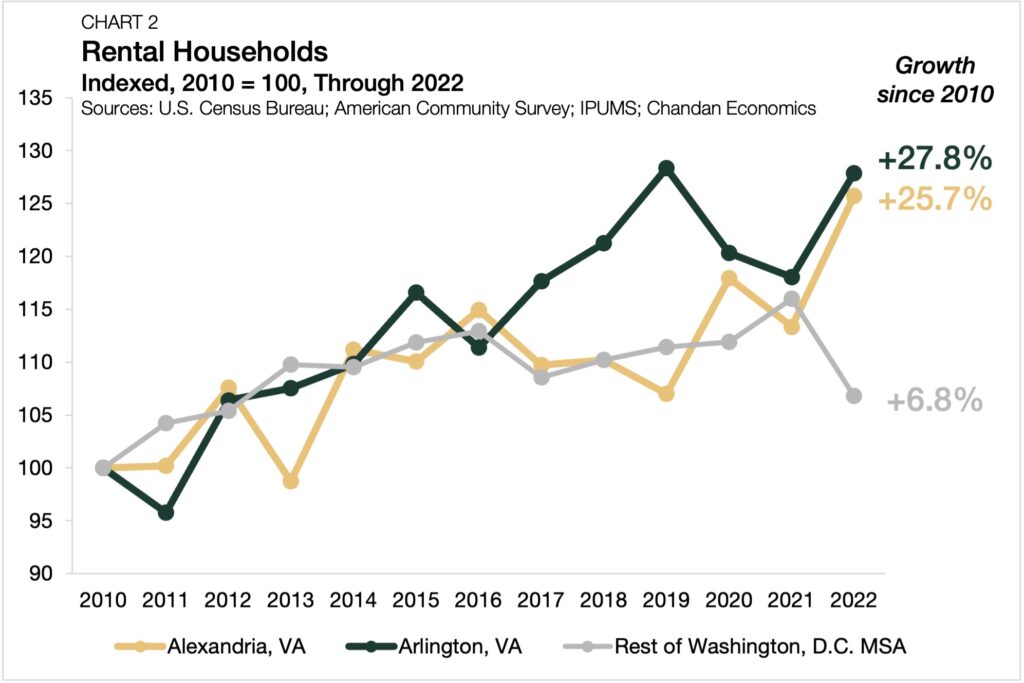

Since 2010, the number of renter households in Alexandria and Arlington has swelled by 27.8% and 25.7%, respectively (Chart 2). Throughout the rest of the D.C. area, rental households increased by 6.8% during this time. Given that the labor force is tech-centric, the average annual salaries for renter households are higher in Arlington ($126,499) and Alexandria ($99,383) than for the metro area overall ($92,175).

Thanks to the high-paying nature of the local labor markets, the Northern Virginia corridor attracts a niche of lifestyle renters. In 2022, apartment rents in Arlington and Alexandria averaged $2,207/unit and $1,952/unit, respectively — well above average rents throughout the rest of the metro area ($1,749), according to Census data.

Notably, several major development projects are underway to enhance the region’s selection of highly amenitized, class-A apartments. At the same time, the corridor has also embraced the need to provide quality housing options at affordable price points. In 2023, the delivery of Residences at North Hill marked a major win for affordable housing advocates and urban planners alike, as the project introduced 279 new affordable units to the neighborhood.

Outlook

The ascent of Arlington and Alexandria shows no signs of slowing down. The area’s STEM workforce is already at nearly twice the concentration of the U.S. overall and growing rapidly. Additionally, the corridor’s existing high density of top-tier universities, highly educated workforce, and generous tax code have made it an attractive destination for major corporate headquarters relocations. And, while still in the early stages, the economic impact of the planned development of a sports and entertainment district at the Potomac Yard site would be an additional boost to the area. On balance, the Northern Virginia technology corridor is engineering a roadmap of urban success.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.