Top SFR Annual Rent Growth Markets

- Over the last year, rents in single-family rental (SFR) units have risen the fastest in the Midwest and Northeast, with Madison, WI, outpacing all other markets in the study.

- Consistently strong rent growth and affordable cost of living are two characteristics most frequently found in the top-performing markets.

- Although SFR’s annual rent growth rate has been cooling in the Southeast, the region remains one of the sector’s hotspots where rents have climbed since March 2022.

Even as rents retreated elsewhere, single-family rentals (SFR) have continued to outperform all other housing sub-types, exceeding the all-property type national average in 17 consecutive months through February 2024, according to Zillow’s Observed Rent Index (ZORI). Annual SFR rent growth has seen substantial gains in many metropolitan areas since national rent growth peaked in March 2022. In this deep dive, the Chandan Economics and Arbor Realty Trust research teams pinpoint the metropolitan areas where SFR rents are rising the fastest.

Top 100 Metropolitan Areas

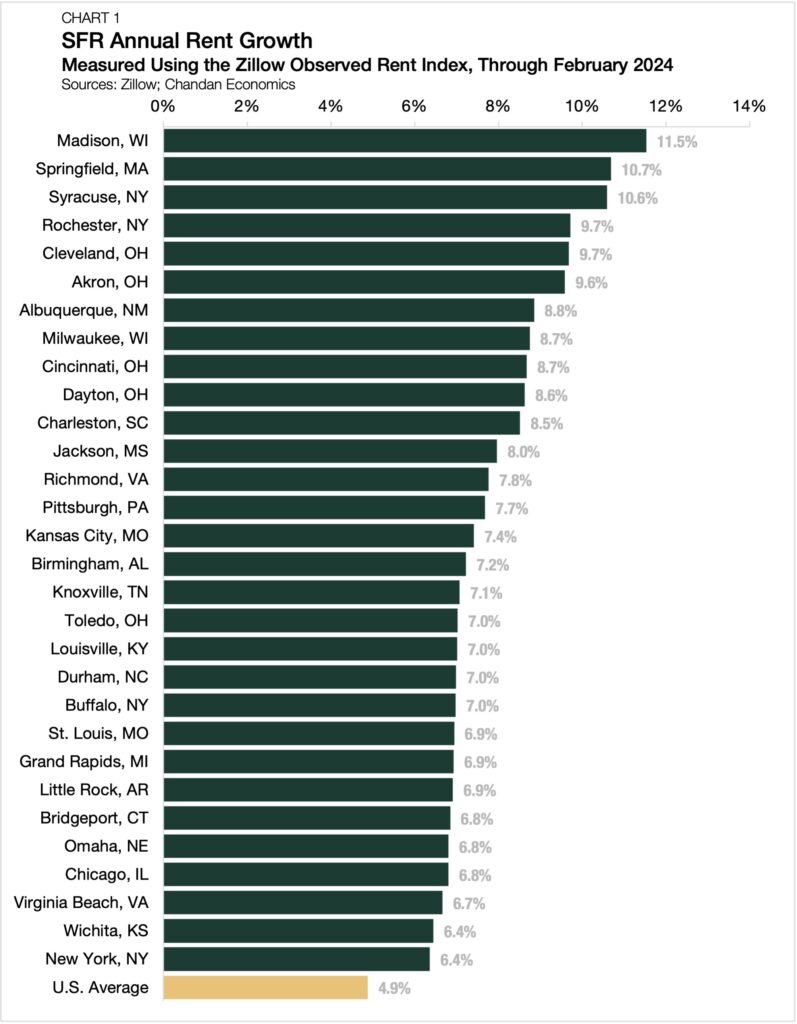

Among the top 100 U.S. metropolitan areas, Madison, WI, was the hottest spot for SFR rent growth over the past year. In the 12-month period ending in February 2024, single-family rents in Madison jumped by 11.5%, leading all other markets (Chart 1). In February alone, SFR rents rose 1.6% in Milwaukee’s capital city, placing it first out of 100 markets in annual SFR rent growth.

Madison’s SFR rent growth acceleration is a classic symptom of a supply-demand imbalance. Since 2020, nearly 14,000 people have moved to Dane County, where Madison is located, according to the Wisconsin State Journal. While its population has ballooned, Madison’s housing supply has not expanded enough to sufficiently meet demand. Property listings have been remaining on the market for 12.3 fewer days than the national average, according to Realtor.com.

Northeast and Midwest Hold 9 Top Spots

The Northeast and Midwest outperformed all other regions, accounting for nine of the top ten markets. Consistently strong rent growth in these regions contributed to strong performances by many of their metropolitan areas.

Springfield, MA, outpaced Syracuse, NY, by one-tenth of a percentage point to claim second place. Rochester, NY, and Cleveland, OH, were tied for fourth place with 9.7% on Zillow’s index.

Ohio claimed four of the top ten spots with Cleveland, Akron, Cincinnati, and Dayton all ranked in the top ten.

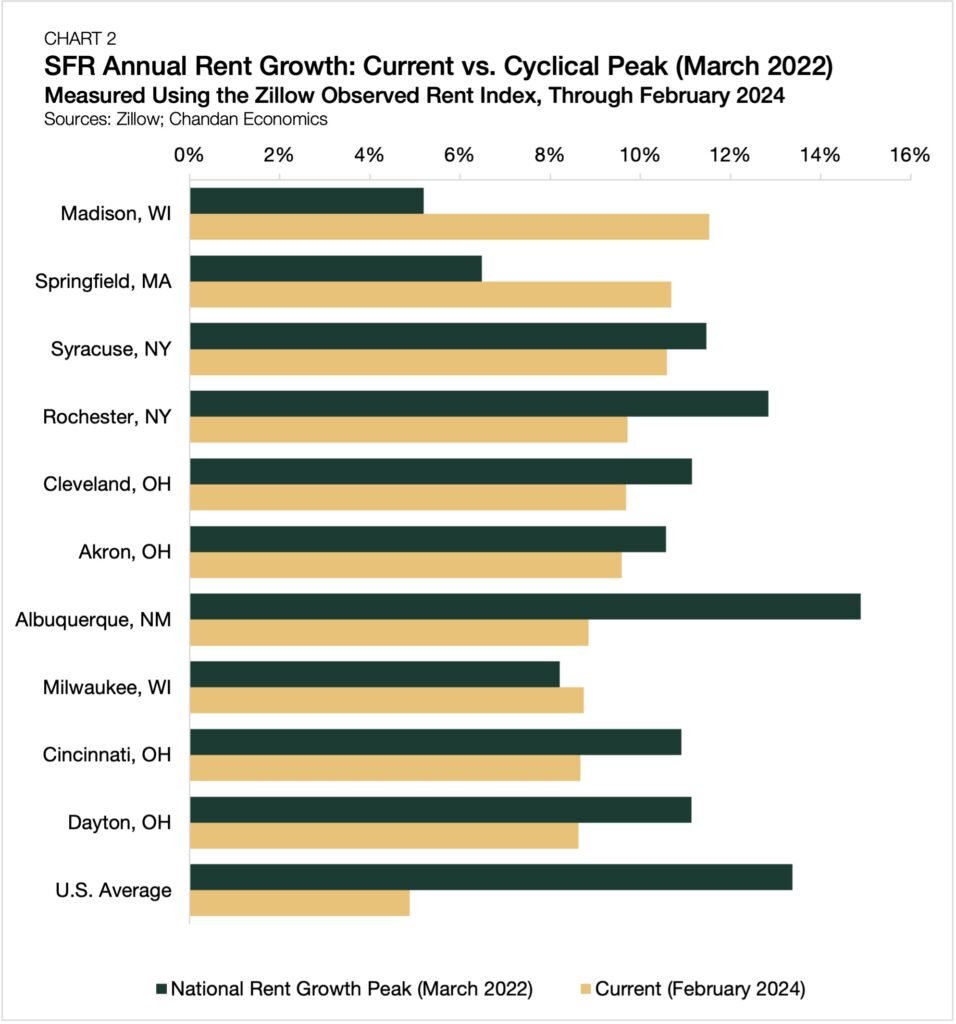

Many of the leading metropolitan areas for SFR rent growth have seen a reversal in fortunes over the last several years. When national SFR rent growth hit its cyclical peak of 13.4% in March 2022, nine of the ten current leading markets saw below-average rent growth. Since then, national rent growth has seen an 8.5 percentage point decline, landing at 4.9%. All the current top ten markets have seen significantly less SFR rent growth deceleration than the national average over the last two years (Chart 2).

Post-Pandemic SFR Rent Growth

Many of the markets where SFR rent growth rates are now the slowest are the same places that saw the most intense acceleration in 2021 and 2022. Of the seven slowest-growing markets, five are in either Texas or Florida. While rent growth has retreated recently in these two states, SFR demand has been robust.

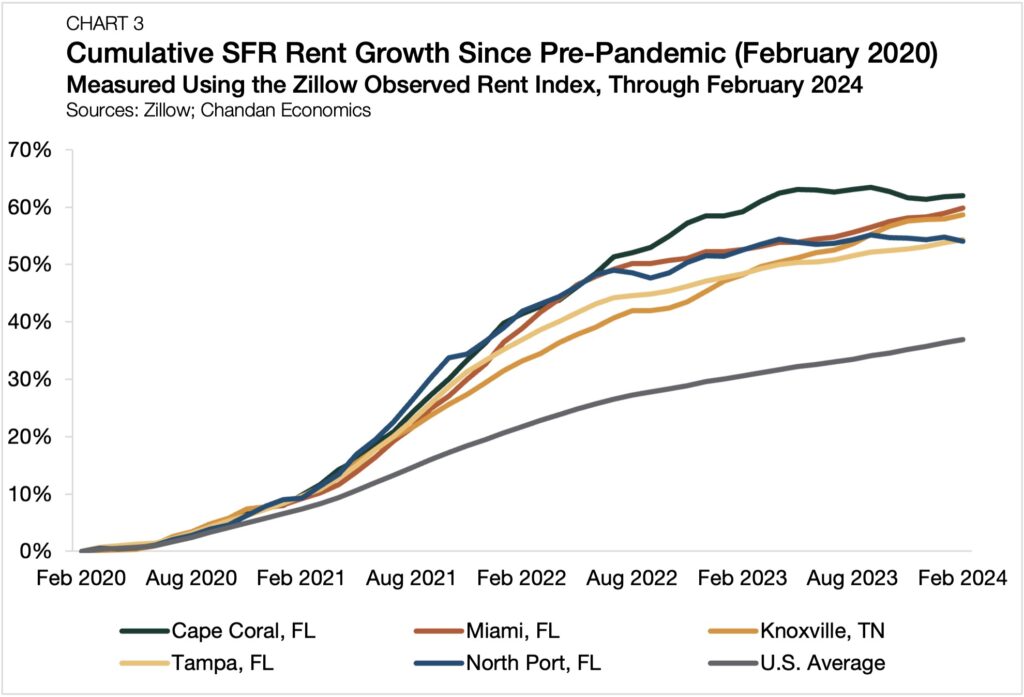

Since the onset of the pandemic, SFR rents are up an average of 36.9% across the country, and every one of the 100 largest U.S. metros has seen at least a double-digit percentage price gain. The range of increases between markets has varied considerably, with more than 50 percentage points of growth between the top and bottom-performing markets.

Despite cooling down recently, the Southeast remains the hotspot with the most intense rise in pricing pressures since before the start of the pandemic. Cape Coral, FL, leads all U.S. metropolitan areas with the highest SFR rent growth since February 2020, with prices rising 62.0% (Chart 3). Cape Coral is still one of the tightest rental markets in the country, driven by rising numbers of relocating retirees. SFR rent growth has also been notably strong in other Southeast metros, including Miami, FL, Knoxville, TN, Tampa, FL, and North Port, FL, all of which saw cumulative SFR rent growth of better than 50% since February 2020.

The Outlook

Even as the pace of national rent growth has slowed, SFR rent growth continues to accelerate. Through February 2024, 86 of 100 markets saw month-over-month gains. With high mortgage rates and limited housing supply, SFR sits in a strong position, bolstered by growing demand and a robust pipeline of new units under construction.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.