The Evolving Characteristics of Multifamily Construction

- Small multifamily completions jumped by 36.4% in 2023, driven by a growing need for affordable and suburban multifamily housing units.

- Large multifamily construction increased by 12.0%.

- Studios and one-bedroom apartments account for more than half of all multifamily units, doubling their market share since 2005.

During the post-global financial crisis (GFC) cycle, a disproportionate share of new multifamily construction was of high-rise units in properties with amenities. However, the tides have turned. The rising cost of homeownership has brought the need for more affordable housing development in the U.S. to the top of many legislative agendas. In this deep dive, our research teams utilize data from the U.S. Census Bureau’s Annual Survey of Construction to show how and why the characteristics of new multifamily properties continue to evolve alongside shifting market needs.

Small Multifamily Construction Jumps

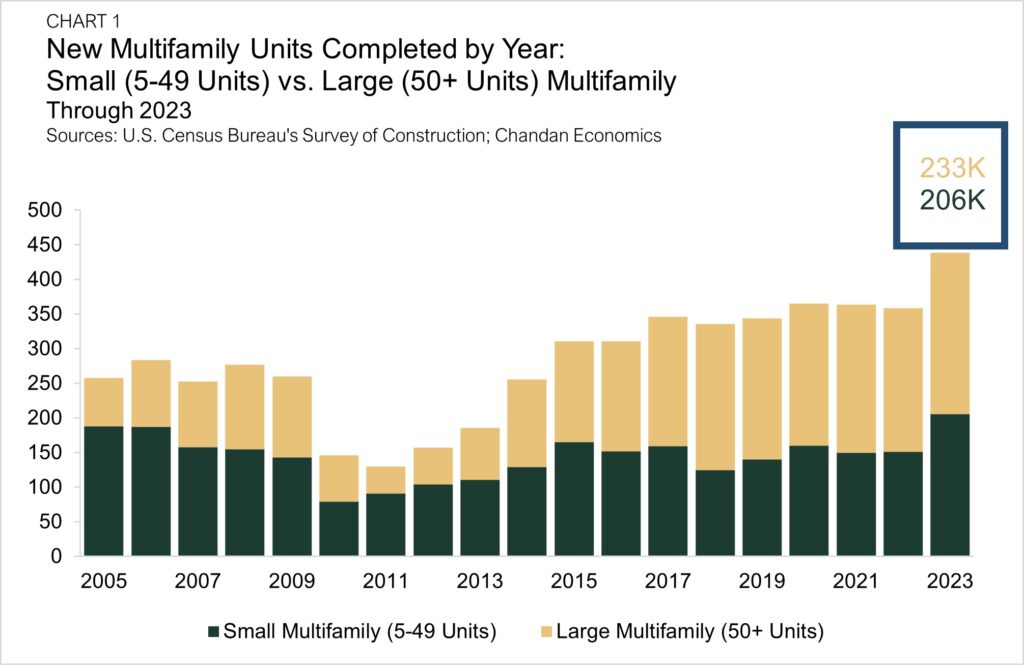

Before the GFC in 2007-2008, large multifamily development was not an overly well-represented part of the apartment sector. Large multifamily production totaled just 70,000 units in 2005, accounting for 27.1% of the sector’s total units produced (Chart 1). But, as Millennials flocked to downtowns across the country, the multifamily industry responded quickly.

Over the next 13 years, large multifamily production soared, peaking at 62.8% of multifamily completions in 2018. Even though large properties lost market share after 2018, the aggregate total completions of these units continued to rise, hitting an all-time high of 233,000 in 2023.

Small multifamily production, on the other hand, moderated through the post-GFC cycle. Completions improved in the four years leading up to 2015, clawing back to 165,000 units, although remaining well below the asset class’ historical peak of 256,000 units in 1999. However, with the rising need for affordable housing options nationally — in both urban and suburban geographies — small multifamily production is once again percolating.

In 2023, small multifamily completions jumped by 36.4%, marking the most significant single-year increase since 1995. Conversely, large multifamily completions climbed just one-third as high as small multifamily did last year. The 206,000 small multifamily units completed in the previous year were the highest total for the property type since 2004, when 211,000 units were finished.

Growing Demand for Shrinking Units

Beyond sub-property types, the Survey of Construction also showed the growing momentum of smaller units within multifamily construction.

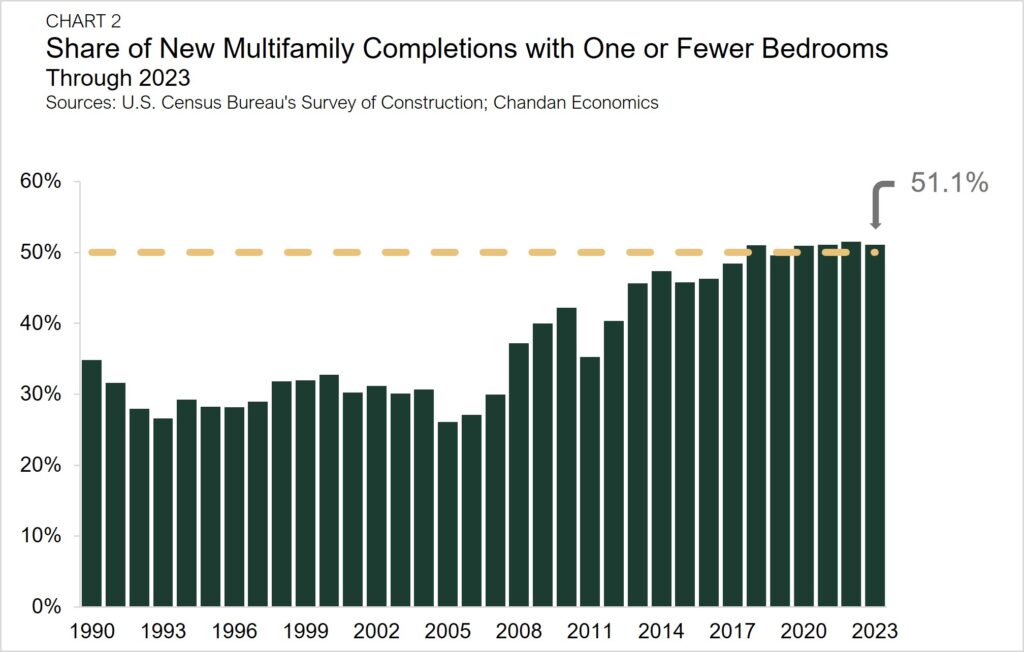

For the fourth consecutive year, studio and one-bedroom apartments accounted for more than half of completed multifamily units in 2023. The increase in production of studios and one-bedrooms represents a change from before the GFC. In 2005, these smaller layout multifamily units accounted for just 26.0% of all completed multifamily units. However, in less than 15 years the market share of these units nearly doubled, finishing 2023 at 51.1%.

The prioritization of affordability is one explanation for the increase in demand for small layout units, given the current rental affordability crisis in the U.S. The aggregate total and share of rental households that are rent-cost-burdened are sitting at all-time highs. As a result, renters are opting for smaller unit sizes to cut costs, one of three primary strategies used today to limit rent burdens.

The shift toward smaller layout sizes is also observable when looking at the square footage of completed units. A record 219,000 multifamily units under 1,000 square feet were completed in 2023, accounting for 48.7% of all units. Sub-1,000-square-foot completions have increased by double-digits in each of the past three years, including a 25.9% annual increase in 2023.

Outlook

Large and small multifamily trends continue to evolve as renters and builders respond to factors such as affordability, financial incentives, and functionality. Small multifamily construction continues to show signs of momentum, leading to a more balanced mix of new units across property sizes and geographies. Meanwhile, the trend of smaller-sized units accounting for an outsized share of construction established in the 2010s has endured and gathered steam into the early part of this decade.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.