U.S. Multifamily Market Snapshot — November 2024

The U.S. multifamily market held steady in a more normalized cycle through the first three quarters of 2024, following its skyrocketing recovery from the pandemic-related contraction. Rental demand remained strong, driven by the continued nationwide housing shortage and strong wage growth, while the high levels of new construction seen over the last two years appears to have peaked. Investment activity also showed signs of increased deal flow as debt and equity financing conditions became more favorable.

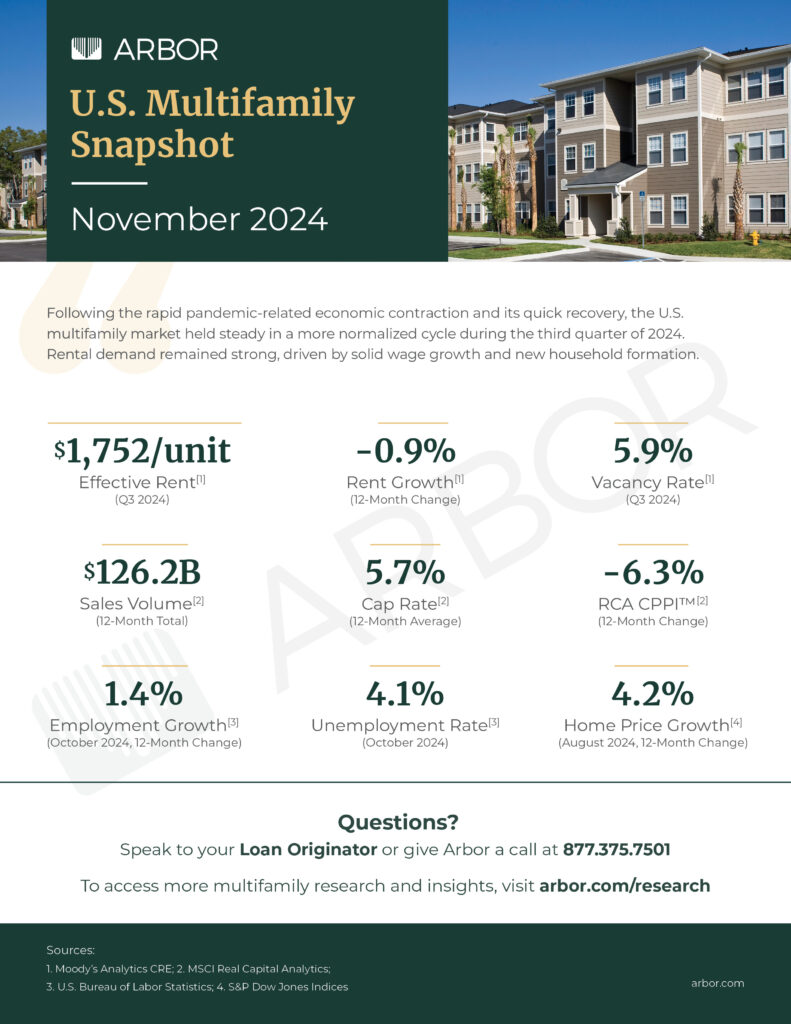

Moody’s Analytics CRE reported that effective rents were down less than 1% year-over-year nationally, partly slowed by the high levels of new supply delivered to the market during this cycle. Rents remained more than 20% higher than during 2019. The vacancy rate finished the quarter at 5.9%, up from 5.3% one year ago and only slightly higher than the historic lows measured before the pandemic.

Multifamily sales volume picked up during the third quarter, a sign that the Federal Reserve’s recent cuts to short-term interest rates have increased investment activity. According to MSCI Real Capital Analytics, $98.6 billion in sales were recorded through the first nine months of the year, 6.6% higher than during the same period last year. The 12-month average cap rate was 5.7%, lower than historical averages, and has remained nearly unchanged this year.

The latest Quarterly Survey of Apartment Market Conditions from the National Multifamily Housing Council (NMHC) continued to show signs of improvement during the third quarter of 2024, as survey respondents reported more favorable conditions for debt financing for the third straight quarter.

Additionally, the NMHC’s Quarterly Survey of Apartment Construction & Development Activity showed that construction delays had been experienced by 52% of reporting participants, down significantly from 70% in the second quarter. The third quarter marked the fifth consecutive quarter of a decline in reported delays.

Although the labor market has cooled over the past few months, well-positioned multifamily investors are already beginning to realize the benefits of a dislocated market. With less restrictive monetary policy from the Federal Reserve, quality multifamily investment opportunities have emerged from coast to coast. For the rest of 2024 and into 2025, the multifamily sector is expected to benefit from strong demographic tailwinds, a slowing pipeline of new deliveries, and more favorable financing conditions.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q3 2024.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our multifamily articles and research reports.