The Single-Family Rental Sector Returns to Growth Mode

- SFR is the second-largest rental housing type in the U.S., accounting for 14.2 million households.

- The number of SFR households grew for the second time in three years.

- Attached single-family homes account for a growing share of SFR households, driven by the success of purpose-built rental communities.

Although the single-family rental (SFR) sector’s profile expanded after the 2007-2010 subprime mortgage crisis, the number of its households slid between 2016 and 2020 as many rentals transitioned into owner-occupied homes. Following a period of pandemic-related uncertainty, SFR has returned to growth mode, increasing its number of households for the second time in three years.

SFR Households Rising Again

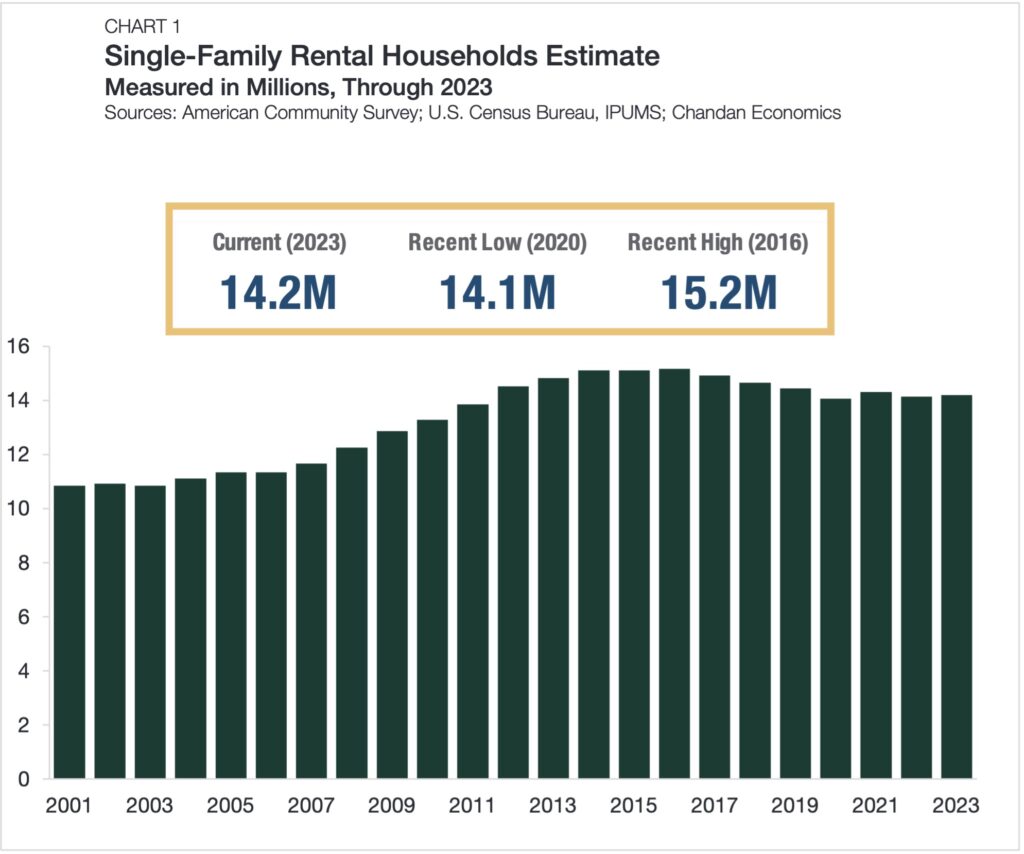

The number of SFR households continues to increase, establishing a pattern of strong demand that has taken hold since the onset of the pandemic, according to new data from the U.S. Census Bureau’s American Community Survey. As of 2023, there were 14.2 million SFR households, an increase of 0.4% from the previous year (Chart 1). SFR remains the second-largest rental housing type, representing 31.2% of all households.

Despite the recent increase, the total tally of single-family rental households still has considerable room to grow before overtaking its previous peak. SFR households hit a record-high of 15.2 million households in 2016 amid the sector’s rapid post-housing crisis expansion.

As the housing market became healthier and borrowing rates stayed low, many rental homes shifted back to homeownership, resulting in a cumulative decline of 1.1 million SFR households between 2016 and 2020.

However, since 2020, housing market dynamics have proven to be far less accommodating to first-time homebuyers amid high mortgage interest rates and record-high asset prices. As a result, demand for SFRs has trended higher, with the total rising in two of three years.

Attached vs. Detached

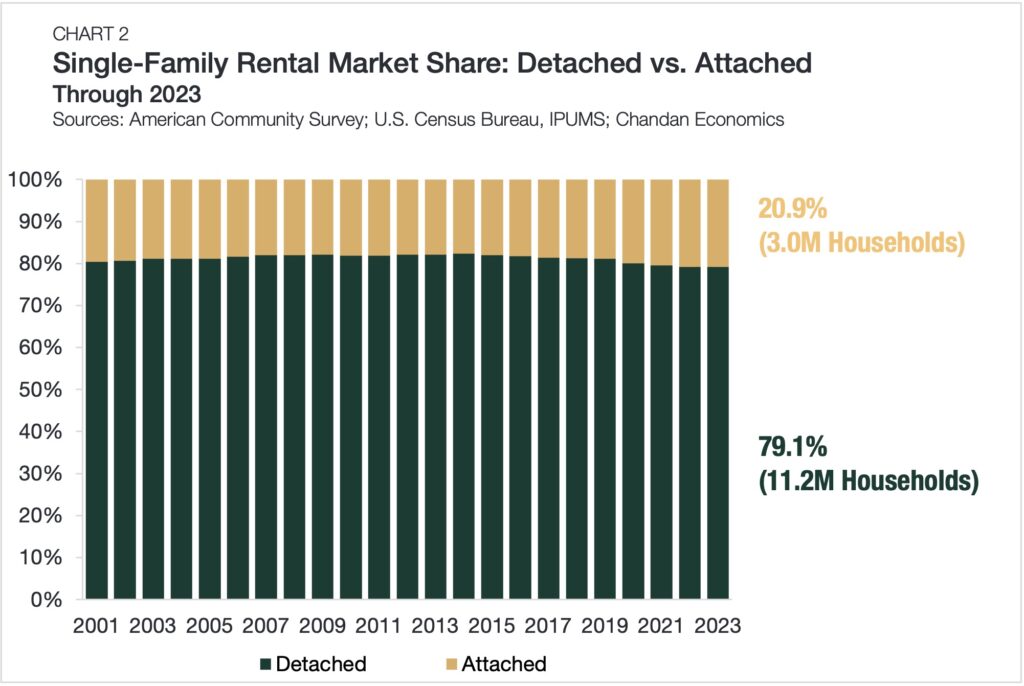

The SFR sector consists of two housing sub-types: attached single-family homes that are physically connected to others and detached single-family homes that are distinctly separated.

Detached homes make up the bulk of the sector’s units, accounting for 11.2 million households or 79.1% of all single-family rentals (Chart 2). Despite their large foothold in the SFR sector, the number of households in detached units has moderated recently, holding between 11.2 million and 11.4 million households over the past four years.

While the 0.4% annual increase in the number of SFR households living in detached homes may be relatively small, it is not insignificant. Between 2015 and 2020, its market share declined annually five times. Since then, the market share of detached SFRs has increased in two of the past three years.

At the same time, attached SFRs continue to see growth. Although these types of conjoined properties account for only 20.9% of the SFR sector, totaling just under 3.0 million households, they have posted annual increases in 15 of the past 17 years, including in the past four consecutive years. The ascendent success of SFR/BTR rental communities, which often utilize attached property build types, has been one of the driving forces of the long-term uptick.

The Bottom Line

Single-family rentals, now part of an institutionally supported asset class, add balance to the U.S. housing market. Small mom-and-pop operators remain the largest class of landlords within the sector, and the ebb and flow of the sector’s growth continues to reflect the trends seen in the broader housing market. Going forward, purpose-built BTR communities will step into an expanding footprint within SFR, fueling its growth for years to come.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.