Larger Buildings and Smaller Units: How New Multifamily Completions Continue to Evolve

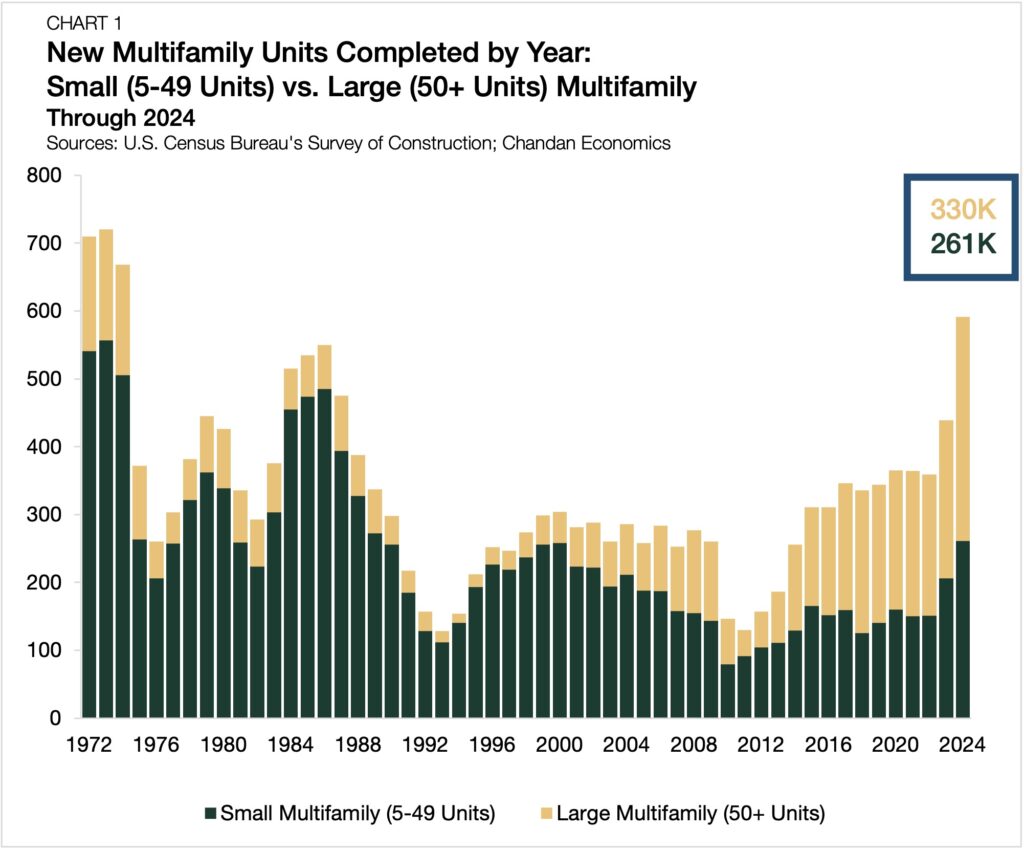

- Small and large multifamily completions jumped by 26.7% and 41.6%, respectively.

- Large multifamily completions reached an all-time high of 330 thousand units.

- New multifamily units have shrunk in size compared to two decades ago as studios and one-bedrooms account for more than 50% of completions.

Driven by high construction costs, land constraints, and rental affordability, developers are increasingly prioritizing smaller units in higher-density multifamily properties. Utilizing data from the U.S. Census Bureau’s annual Survey of Construction, the research teams at Chandan Economics and Arbor Realty Trust have analyzed how the characteristics of new multifamily properties continue to evolve.

Both Small and Large Multifamily Completions Jump

The push towards higher-density construction is an enduring legacy of the last real estate cycle. Before 2016, construction of 50-plus-unit properties (large multifamily) never constituted a majority of multifamily completions (Chart 1). However, they have accounted for more than half of completed units every year since, with the share of large multifamily properties hitting 55.8% in 2024.

Twenty years ago, large multifamily properties accounted for less than 1-in-4 of multifamily completions, underscoring just how much the sector has evolved in the past three decades. In total, 330,000 large multifamily units finished construction in 2024 (+41.6%), marking an all-time high for the sub-sector. The long-term runup in construction of large multifamily properties is the result of several converging trends, including job growth concentration in urban centers and greater efficiencies in the development process, allowing for higher returns.

For its part, small multifamily (5-49 units) has also experienced a recent renaissance thanks to a growing investment case for workforce housing and rising demand for multifamily in suburban locations. Small multifamily completions rose to 261,000 in 2024 (+26.7%), hitting a 34-year high.

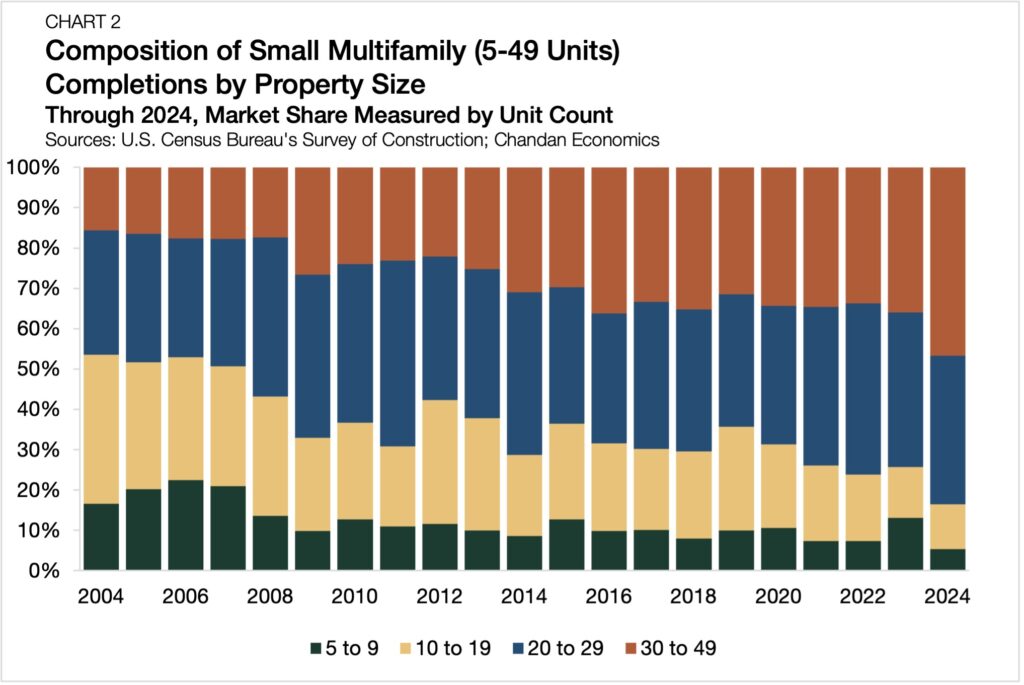

Even within small multifamily, the push towards higher density remains observable. Twenty years ago, properties with 20-49 units accounted for slightly less than half (46.4%) of the sub-sector’s completions (Chart 2). Last year, these 20-49-unit buildings take up the majority of small multifamily development at 83.5% of completions.

Growing Market Share for Shrinking Floorplans

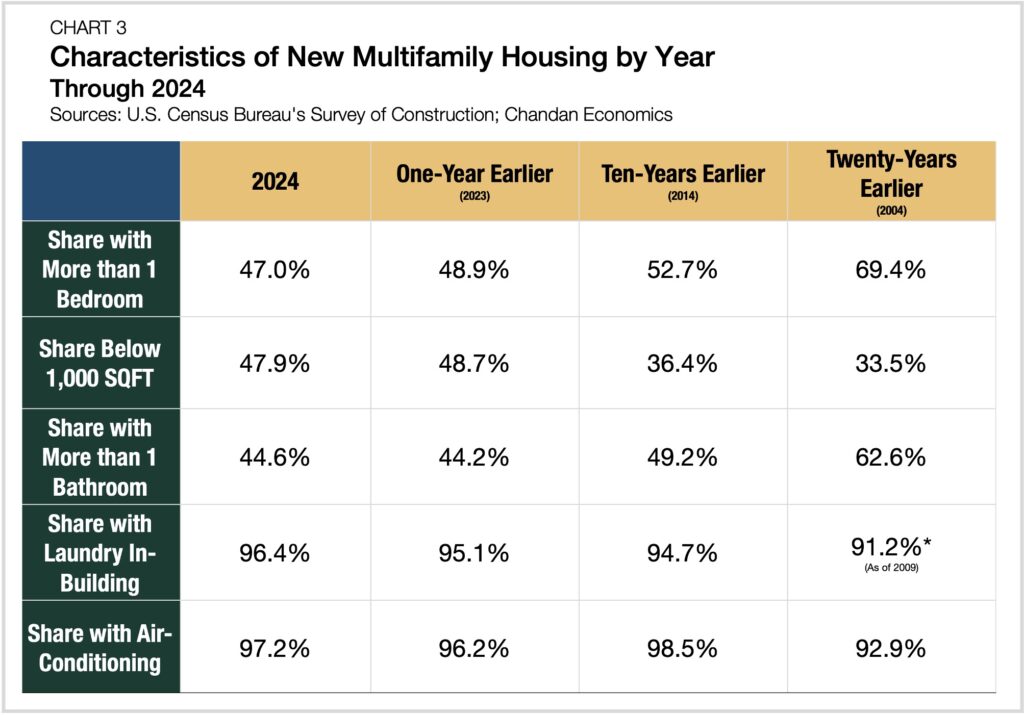

Examining evolving construction trends within the units themselves, multifamily development is increasingly favoring smaller unit sizes (Chart 3). This shift is largely driven by rising construction costs, land constraints in urban markets, and the need to keep monthly rents within reach for renters facing affordability pressures. Smaller units help developers optimize revenue per square foot while appealing to cost-sensitive, lifestyle-oriented renters.

Studios and one-bedroom apartments accounted for 53.0% of completed multifamily units in 2024, the fifth consecutive year of eclipsing 50%. Twenty years ago, studios and one-bedrooms only made up 3-in-10 multifamily completions. Similarly, the share of units with only one bathroom has risen to 55.4% of completions.

Arriving alongside fewer bedrooms per unit is a reduction in the average square footage. Units with less than 1,000 square feet accounted for about a third of completions in 2004. Through 2024, they comprise nearly half (47.9%) of all multifamily completions.

While multifamily units are on average getting smaller, quality-of-life features, such as laundry and air-conditioning, have gone from common to standard inclusions over the past twenty years. Through 2024, nearly all multifamily completions in had air conditioning (97.2%) preinstalled for tenants and had laundry (96.4%) available in either the unit or the building’s shared common areas.

The Bottom Line

There is a constant evolution in the types of multifamily units and properties constructed each year. Both renters and builders respond to factors such as affordability, financial incentives, and functionality. Recent trends have shown that multifamily developers are focusing on lifestyle and workforce renters, resulting in smaller units in larger developments.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.