2021 Outlook: Single-Family Rentals Have More Runway Ahead

- New technologies have streamlined operations and simplified the landlord-customer relationship for single-family rentals.

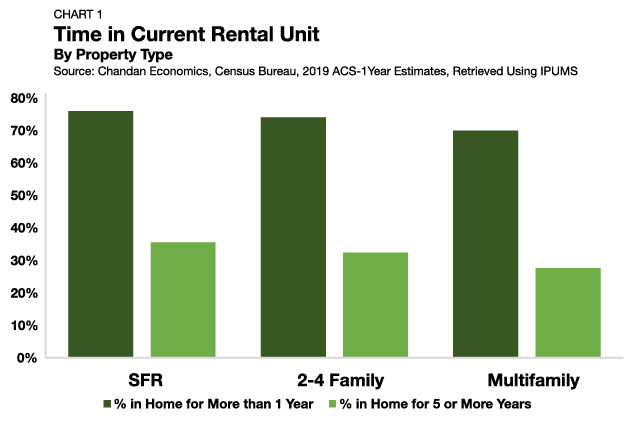

- SFR tenants tend to stay in their homes longer than in any other type of rental housing, making the asset class an attractive investment opportunity.

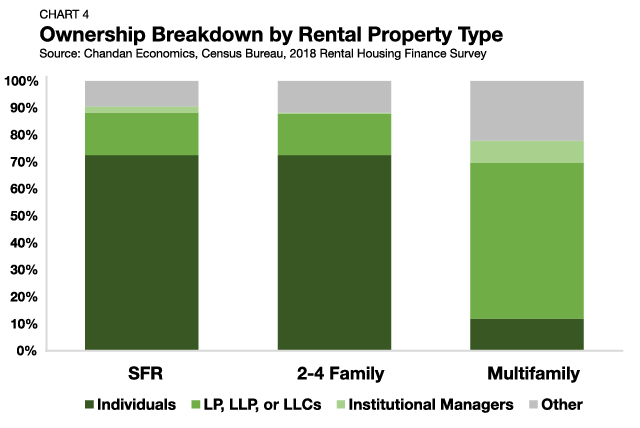

- While the market is maturing, SFR communities are still largely owned by smaller investors.

Key Findings

These days, it is rare to pick up any real estate publication and not see a single-family rental (SFR) headline near the top of the page. Industry attention and institutional participation are seemingly growing by the minute. Naturally, where there are advocates, there are also devil’s advocates, and they have raised the question as to whether the SFR space is already getting crowded. It may be true that the sector is no longer in its infancy, but if that’s the case, it has only matured into its adolescence.

Our 2021 single-family rental outlook sees the market in the middle of a rapid transformation, and it likely has several years of evolution before approaching anything resembling an equilibrium. Thanks to the sector’s still-low prevalence of professional management, efficiency-delivering tech adoption and supportive demographic drivers, there is little doubt that SFR has the solid fundamentals to sustain its momentum.

From Crisis to Creation

As the story goes, the professionally managed SFR sector as we know it today is a byproduct of the Great Recession and the inexorably linked Housing Crisis. Institutional capital opportunistically picked up undervalued single-family homes, adopted a rental strategy and waited for prices to recover for a profitable exit. However, over those initial few years, rental housing management was still in the nascent stages of determining the best ways to operate SFR communities.

Since then, the adoption of new technologies has streamlined operations and simplified the landlord-customer relationship. The implementation of self-showing technology, digital lockboxes and online rental screening tools have all allowed for a quicker, more seamless leasing process. Time is money in this industry, and the efficient matching of potential renters with their ideal units meaningfully cuts down on implicit vacancy costs.

Once a home is leased, renters now have access to mobile apps that streamline the process for maintenance requests, allowing landlords to monitor the property and get ahead of potential issues. A 2017 study of apartment tenants by Buildium found that 53% of renters prefer to be contacted via email with important updates from their landlord, while 47% of renters want the ability to file and track maintenance requests electronically.

This shift in renter preferences has likely leapt even further during the pandemic as the ability to conduct business remotely became paramount. Lastly, the integration of smart home technologies, especially in HVAC systems, reduces excess energy usage and allows for both greener pockets and environments. Collectively, these new developments have freed up time and resources for managers and tenants alike, all while improving product quality and the user experience.

The sheer volume of new innovative technologies introduced into SFR over the past decade is immense. Taking all of the small incremental cost savings together has proven to be a gamechanger for the industry — it is a main reason why institutional investors have reconsidered the ‘get out’ portion of their initial ‘get in, get out’ purchase strategy.

Demographic Sweet Spot

Inarguably, the single-family rental tenant profile is one of the sector’s most attractive aspects. On average, SFR tenants stay in their homes longer than in any other type of rental housing. According to our research partner, Chandan Economics, 76.0% of SFR tenants remain in their units for more than one year, with the share falling to 74.0% in two- to four-family homes and 69.9% in multifamily properties (Chart 1).[1]

Moreover, SFR leads the pack in the percentage of tenants who stay for five years or more. A sizable 35.6% of SFR households are five-year-plus residents, with the total edging down to 32.4% and 27.6% for two- to four-family and multifamily, respectively. These data are in line with what we all already know to be true: once there are kids in the home, moving becomes a more arduous process. For reference, single-family rental properties are 37% more likely to have children in the household than all other rental types.[2]

Between renters’ penchant for remaining in their homes for longer and the fierce competition to get into available units, it should come as no surprise that vacancy rates in SFR properties have historically sat 2.6% lower than all other asset types.[3] For landlords, these lower vacancy rates translate to less time without cashflow generation.

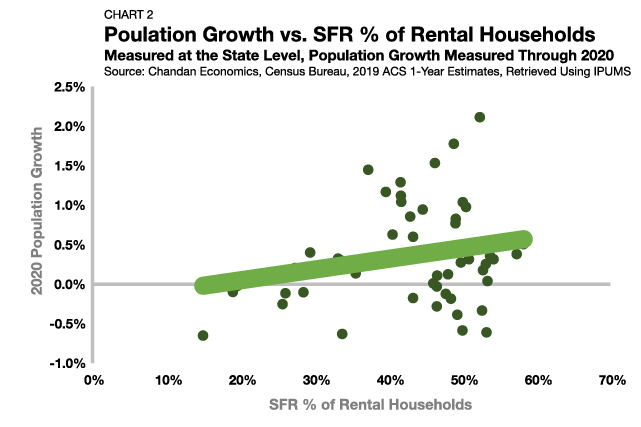

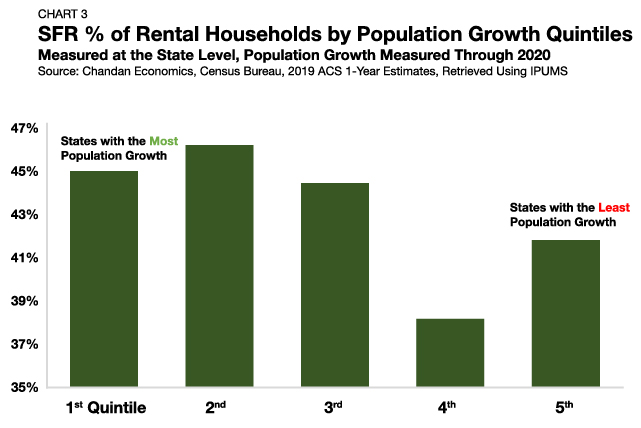

Certainly, these trends speak to SFR’s in-place value proposition, but how are forward-looking trends likely to shape future demand? The pandemic has accelerated domestic migration, and the SFR market is positioned to be a primary beneficiary. Chandan Economics notes that, generally, states that have enjoyed higher levels of population growth over the past year tended to have higher shares of SFR as a percent of total rentals (Chart 2). Within the 10 states posting the highest population growth in 2020, SFR made up an average of 45.0% of all rental households (Chart 3). The share rises to 46.2% for the next 10 by population growth but falls thereafter.

2021 Single-Family Rental Outlook: A Whole Lot of Runway

Despite attracting both investor and media attention, the SFR market is still largely owned by smaller investors. According to a Chandan Economics analysis of the Census Bureau’s 2018 Rental Housing Finance Survey, the share of SFR owned and operated by institutional managers was just 2.3% in that year, while multifamily’s share was 8.3% (Chart 4).[4] The splits are even more disproportionate when it comes to the share of units owned and operated by individual investors. The ‘mom and pop’ contingent accounted for 72.5% of SFR units and just 11.9% of multifamily units. The trifecta of LLP, LP and LLC investors, a group that makes up a dynamic middle ground between large and small investors, accounts for 57.7% of multifamily control and just 15.7% within SFR.

While these data seem to reflect two separate rental housing universes, as the SFR sector continues to scale up, attract institutional investment and bring on professional managers that offer innovative technologies, institutional SFR is looking more like institutional multifamily day by day. It is only natural that their ownership structures will settle into a similar equilibrium as well. Though, with a sector that is already more than 17 million units strong and drawing in significant amounts of institutional capital, there is a lot of runway ahead before SFR settles into its new normal, whatever that may be.

[1] Chandan Economics analysis of Census Bureau’s 2019 ACS 1-Year Estimates, Retrieved Using IPUMS

[2] Ibid.

[3] Chandan Economics analysis of Census Bureau’s Housing Vacancies and Homeownership

[4] Chandan Economics analysis of Census Bureau’s 2018 Rental Housing Finance Survey

For more insights on the SFR market, read our Q1 2021 report and see more of our SFR research.