A Closer Look at the State of the Nation’s Housing

- Rent growth in professionally managed apartment buildings climbed 11.6% during 2021, the highest year-over-year increase on record.

- Low inventory of existing for-sale homes continues to strain the housing market.

- Multifamily construction is booming, as starts of new units has reached its highest level since the mid-1980s.

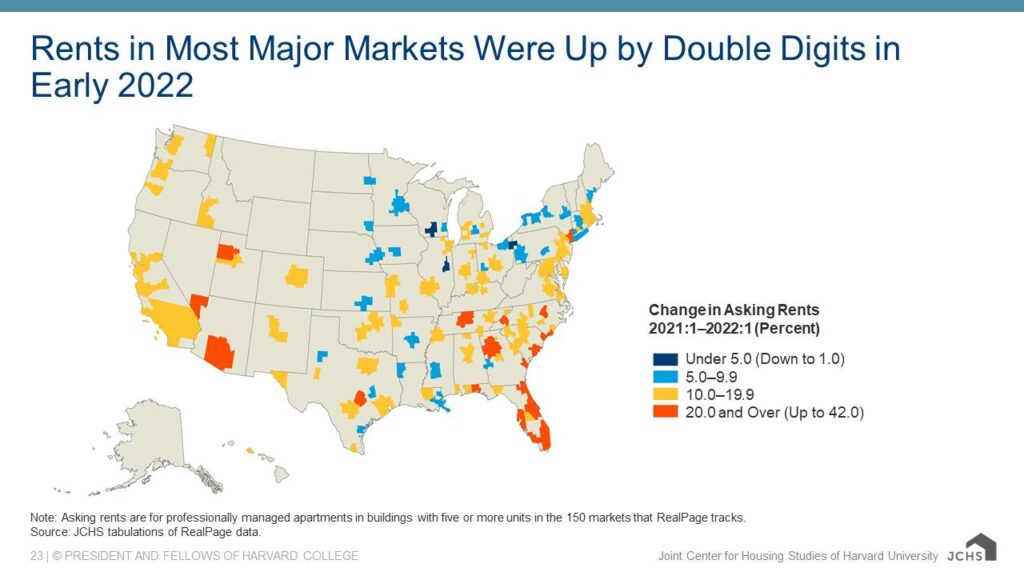

Following record gains last year, the housing market may have reached an inflection point. Rents are surging nationwide as a supply/demand imbalance leaves renters and would-be homebuyers with fewer housing options. In the first quarter of 2022, 116 of 150 markets tracked by RealPage posted year-over-year increases of at least 10%. However, The Joint Center for Housing Studies of Harvard University contends in The State of the Nation’s Housing 2022 that the current torrid pace of the market might be ready to ease up, with a record number of new units under construction.

The Rent Surge

Over the last year, rent prices nationwide have climbed to historic levels.

Rent growth in professionally managed apartment buildings climbed 11.6% during 2021, the highest year-over-year increase on record. This rapid rise in rents was more than three times the 3.2% average annual increase seen during the five years before the pandemic began.

During the same time, single-family rents rose at an even faster pace — up 12.4% percent year-over-year, according to CoreLogic. Rents rose most sharply in Sun Belt Metros, including Miami (up 39%) and Cape Coral (up 28%), Phoenix, and San Diego (up 17%).

Apartment Demand Outpaces Housing Supply

Low housing inventory continues to strain the housing market.

Existing for-sale homes hit a new low of 850,000 in January 2022. Although for-sale homes edged up to 1.0 million units by April, inventory still sat 10% below where it was just a year earlier.

The tight supply of for-sale homes and high prices has kept many in the rental market, driving up apartment demand even more. Rental demand in 2021 also outpaced expectations due to a confluence of temporary factors, including Federal cash supports, student loan payment deferrals, and the quick recovery of the job market.

Vacancy Rates Hit All-Time Lows

With demand surging, vacancy rates have dropped to near historic lows even in prime urban areas.

In the third quarter of 2021, the national vacancy rate for all professionally managed stock hit a record low of 4.8%, according to CoStar data. The Housing Vacancy Survey also found that the vacancy rate of all rental housing in the United States fell each quarter in 2021, ending the year with the lowest quarterly reading since 1984.

Multifamily Construction is Booming

While vacancy rates are historically low, more inventory is on the way.

Last year, starts of multifamily units reached its highest level since the mid-1980s. The 474,000 units started was 24% above the average annual increases found in 2015-2019.

This feverish pace of construction continued in the first quarter of 2022, which saw more multifamily starts than any first quarter since 1986.

The Outlook

Rental housing demand is likely to remain brisk for the time being as a large number of adults in their 20s, 30s, and 40s continue forming new households. Looking forward, The Joint Center for Housing Studies of Harvard University projects a tight housing supply will become less restrictive as a record number of new units become available, causing rent growth to stabilize from its recent torrid pace.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.