Annual SFR CMBS Issuance On Pace to Triple in 2024

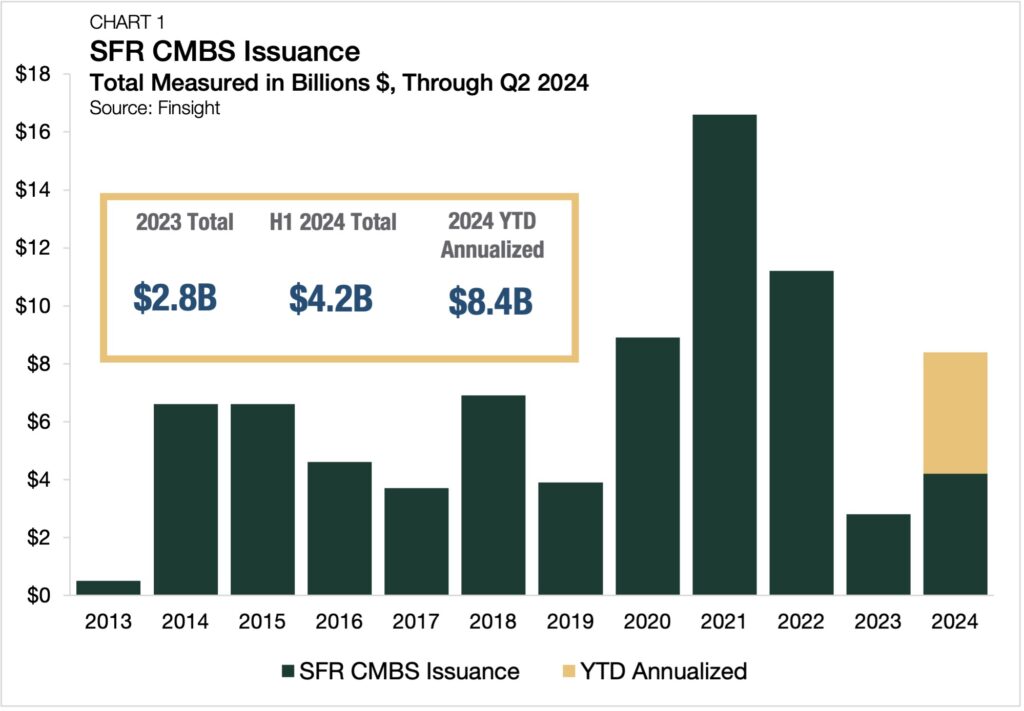

- A total of $4.2 billion of new SFR CMBS has been issued in the first half of 2024.

- SFR CMBS issuance is on pace to triple 2023’s total and exceed pre-pandemic averages.

- An early fall timeline for a federal monetary policy pivot has emerged, creating another tailwind for the SFR CMBS market.

Single-family rental (SFR) CMBS issuance saw a sizeable pickup through the first half of 2024, with $4.2 billion in new issuance, placing it on pace to at least triple last year’s annual total.

Between 2014 and 2019, annual SFR CMBS issuance ranged between $3.7 billion and $6.9 billion, according to data from Finsight. Activity then surged during the pandemic and its immediate aftermath, as demand for SFRs increased and interest rates sat at record lows. However, in 2023, as the Federal Reserve reached the presumptive peak of its monetary tightening cycle, total SFR CMBS issuance sank to just $2.8 billion — its lowest point since 2013 (Chart 1).

The pickup in SFR issuance in 2024 tracks the trend observed throughout the broader CMBS market.

According to Trepp, total CMBS issuance, measured across all sectors, is on pace for a three-fold increase in 2024. Trepp notes that the growing acceptance of interest rate and valuation realities has unclogged the CMBS market this year.

CMBS issuance within the SFR sector remains below the heightened levels of activity seen in 2021 and 2022. This year’s pace of activity, if sustained, would fall roughly in line with 2020’s level and be more than double 2019’s total, showing an encouraging sign of normalization.

Throughout SFR’s recent formation into an institutionally supported asset class, structured financing through CMBS markets has been a key driver of its growth. The first SFR CMBS deal occurred just over a decade ago, in 2013. Since then, $76.5 billion worth of SFR issuance has flowed through the CMBS system.

Outlook

Structured SFR credit markets have already been showing signs of a rebound even before the Federal Reserve begins to loosen its monetary policy, indicating the sector’s structural strengths outweigh its cyclical headwinds. With investors anxiously anticipating interest rate relief, SFR CMBS issuance is in a prime position to improve upon its accelerated activity in the months ahead.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.