Build-to-Rent Construction Continues Its Record-Breaking Ascent

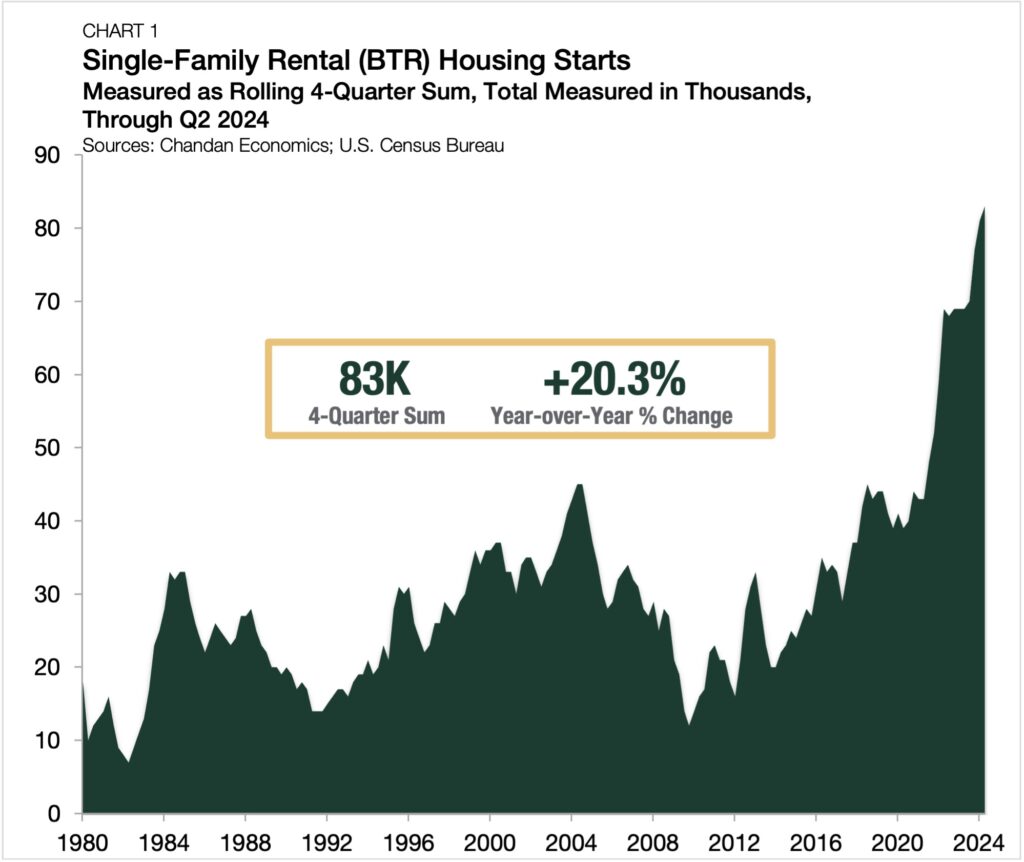

- SFR/BTR housing starts hit another all-time high, totaling 83,000 units over the year ending in the second quarter of 2024.

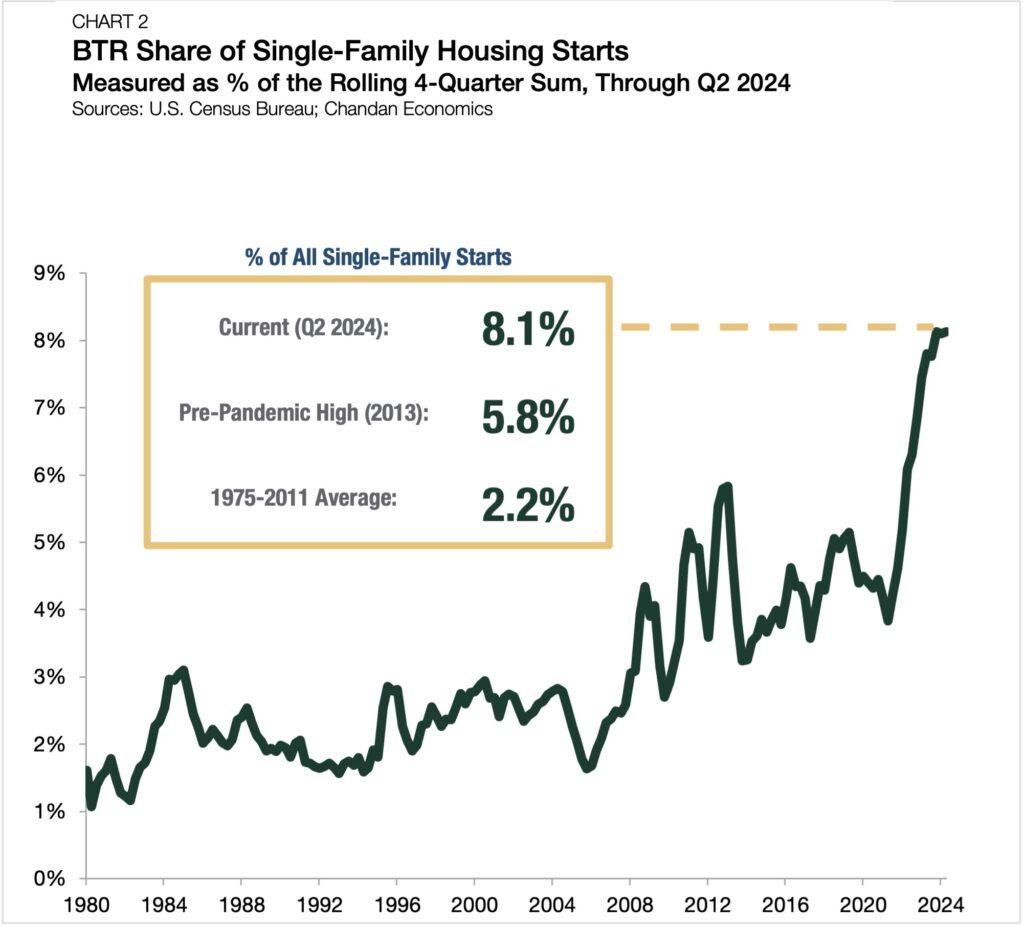

- BTR accounted for 8.1% of all single-family housing starts, another record high.

- Institutional investors have begun to favor purpose-built development over acquisitions.

Increasingly, single-family rental (SFR) operators have been relying on build-to-rent (BTR) development to bridge the housing gap, accelerating the momentum of SFR construction through 2024’s halfway point. Both total SFR/BTR housing starts and BTR’s share of all single-family housing starts reached new record highs in the second quarter, setting the stage for another banner year.

SFR/BTR Construction Surges

As detailed in Arbor’s Single-Family Rental Investment Trends Report, acquisitions only narrowly outpaced dispositions among SFR REITs in recent quarters. Instead, institutional investors have focused attention on ground-up, purpose-built development. SFR/BTR construction starts eclipsed 83,000 units in total over the past four quarters, representing an all-time high and an annual increase of 20.3% over the same period one year ago (Chart 1).

BTR’s share of all single-family construction also reached an all-time high of 8.1% through the second quarter of 2024, representing a significant change in residential development (Chart 2). Before investment accelerated into SFR after the 2008 housing crisis, the BTR share of single-family construction never eclipsed 3.1%. Today, it rests 5.0 percentage points higher.

The decreasing affordability of homeownership in the U.S. continues to be a significant driver behind the expansion of SFR/BTR. According to data from the Federal Reserve Bank of Atlanta, buying a home is about 38% less affordable today than in 2020 as mortgage rates remain elevated and U.S. home prices continue to move upwards. SFR/BTR’s strong demand profile, which is bolstered by lifestyle renters and downsizing Baby Boomers, continues to provide a solid backbone for growth.

Outlook

As the level of SFR/BTR investment grows and the affordability of homeownership weakens, the number of housing starts should continue to ramp up, and the BTR share of single-family development should continue to widen, amplifying its performance over the short and long term.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.