Build-to-Rent’s Robust Activity Settles into Stable Pattern

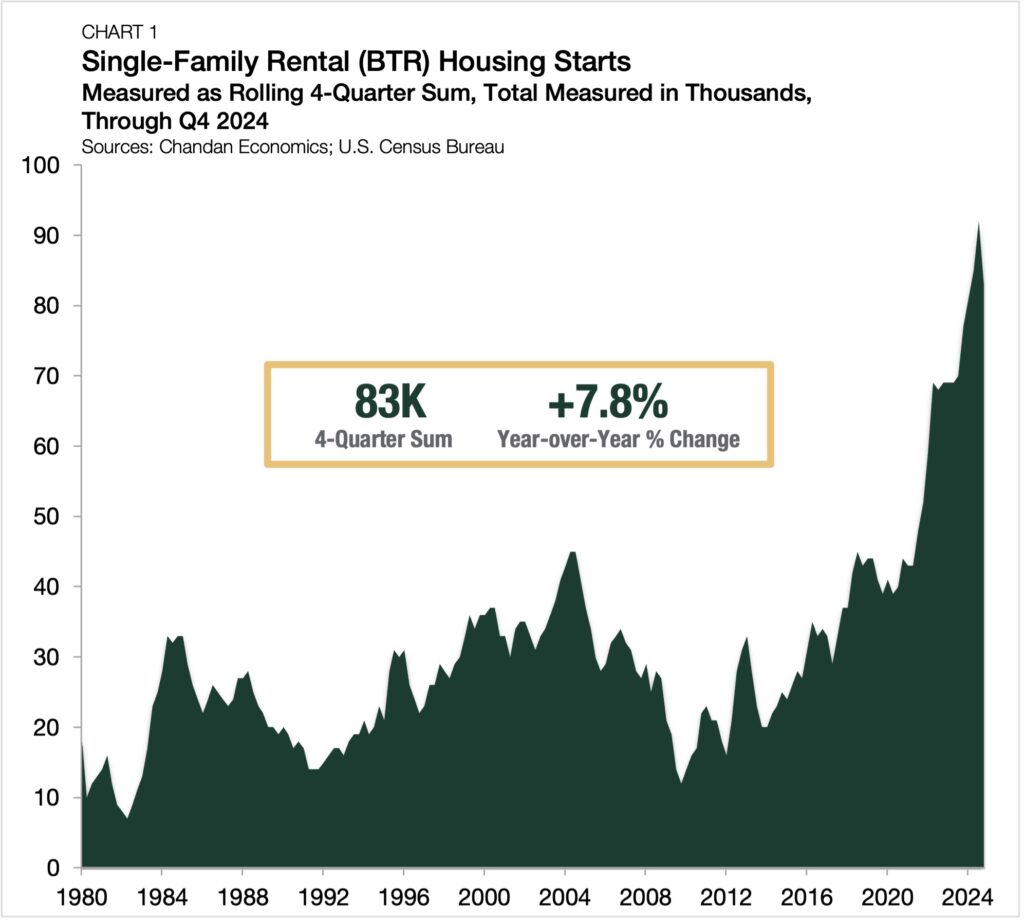

- SFR/BTR housing starts totaled 83,000 in 2024, retreating from its record-setting pace.

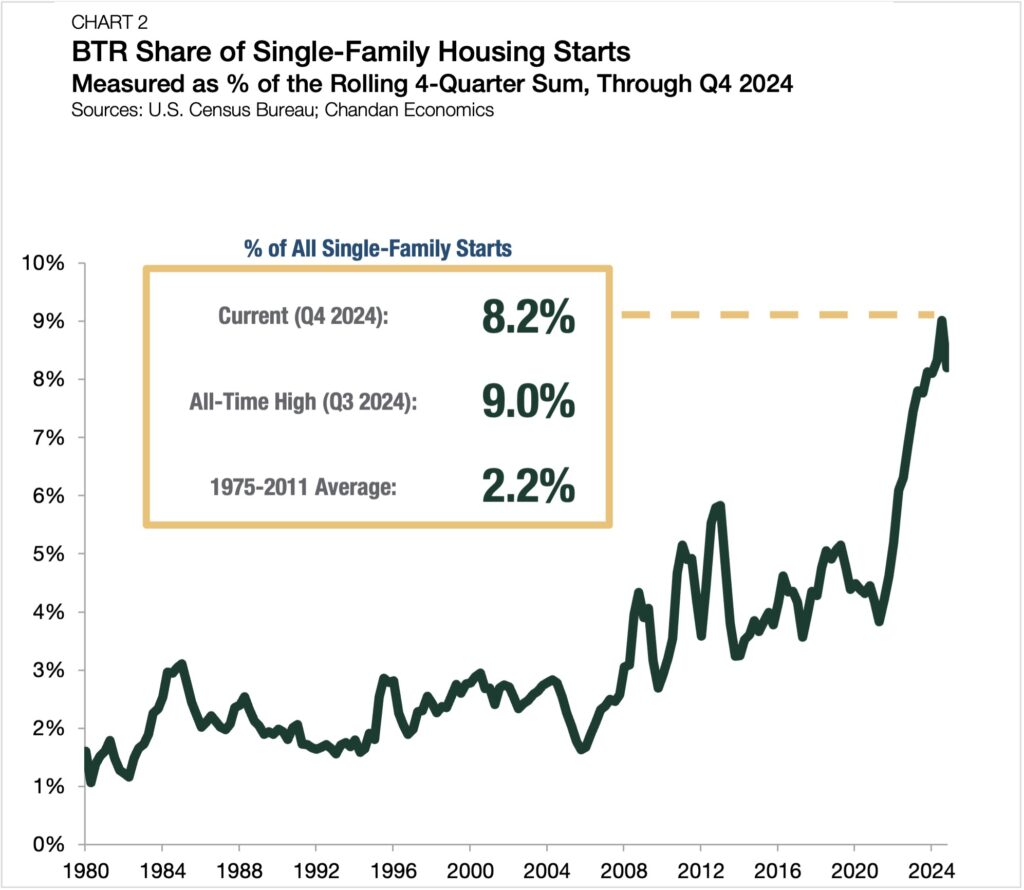

- BTR accounted for 8.2% of all single-family housing starts, maintaining a steady market share compared to last year.

- The SFR/BTR development ecosystem remains healthy, with structural tailwinds at its back.

Increasingly, single-family rental (SFR) operators have been relying on build-to-rent (BTR) development to satisfy their inventory needs. The popularity of BTR communities made economies of scale possible for the SFR sector in the recovery after the 2007 housing crisis and continues to fill a housing need nationwide. Now, newly released U.S. Census Bureau data shows that SFR development activity remained robust even as its momentum slowed, moving the sector into a more stable equilibrium.

SFR Construction Ends the Year Strong

As detailed in Arbor’s latest Single-Family Rental Investment Trends Report, 2024 was another strong year for SFR development. SFR/BTR construction starts totaled 83,000 units in the last four quarters of data (Chart 1). Measured as a rolling four-quarter sum, 2024’s final three-month period showed a sizeable pullback from the third quarter when BTR starts hit an all-time high of 92,000 units. However, measured year-over-year, 2024’s tally remains record-setting, rising by a healthy 7.8% over 2023.

Beyond unit totals, the BTR share of all single-family construction also reflected a modest contraction. In 2024, BTR accounted for 8.2% of all single-family construction starts (Chart 2). In the year ending in the third quarter of 2024, BTR’s market share stood higher at 9.0%. The fourth-quarter decline brings BTR’s market share back in line with where it was one year ago when it accounted for 8.1% of single-family development.

Despite a fourth-quarter retreat from a record high, the SFR/BTR development ecosystem remains healthy, with structural tailwinds at its back. Above all, the longevity of BTR construction will continue to be supported by underlying rental demand for single-family homes. With home prices at record highs and mortgage rates holding near 7%, the supply of for-sale homes remains exceptionally tight. As a result, SFRs continue to fill a critical market need, offering an affordable access point to suburban neighborhoods.

Outlook

While it was unclear when it would occur, a plateauing of SFR/BTR development was always inevitable. Although it is premature to declare the BTR construction boom over, all signs point to the sector settling into a stable pattern as it navigates declining occupancy rates and an influx of completions. The next few quarters will be telling, but many industry insiders believe 2025 will be a year of maturation and stabilization for the sector.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.