Comparing 2020 Multifamily Prices to Prior Election Seasons

- While returns near elections are lower on average, there is no observable causal relationship.

- When controlling for recessions, the impact of an election falls to near zero.

- Multifamily asset price growth has slowed with COVID-19 but performance has held up compared to the Great Recession.

As a follow up to our recent Chatter blog piece, highlighting lower returns and increased volatility for public equities near U.S. presidential elections, this article narrows in on multifamily asset prices. Reviewing Real Capital Analytics data from 2001 through the present, we find that multifamily prices tend to grow less quickly near general elections.

However, with the limited number of general elections over the sample period and the deep recession of 2008, slumping asset prices near election day may prove to be more happenstance rather than resulting from an independent causal relationship. In this limited study, when controlling for the effects of a recession, the impact of an election on multifamily prices falls to near zero.

Multifamily Prices During Election Windows

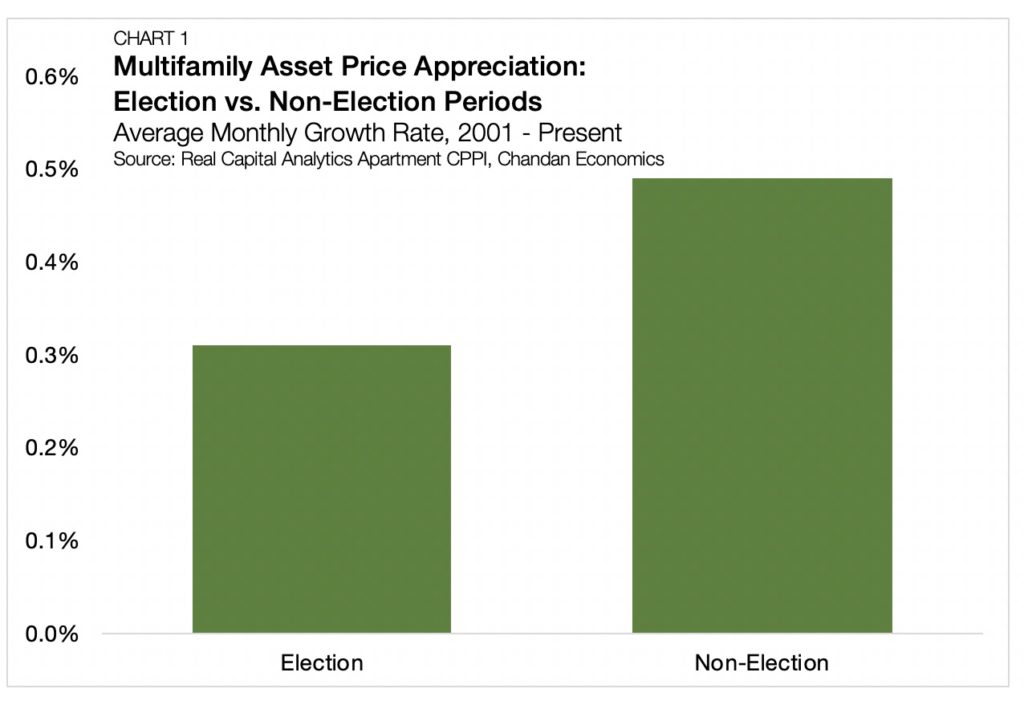

According to the Real Capital Analytics national apartment Commercial Property Price Index (RCA CPPI), returns on multifamily properties average 0.31% month-over-month during our election window (Chart 1).

To isolate the impact of a U.S presidential election, which occurs on the second Tuesday of November every four years, we assign a window of observation around the calendar month before, including and following each qualifying date. This enables us to capture the most intense moments of national political attention.

Across all other months, price increases averaged a slightly sharper rate of 0.49%. On an annualized basis, these returns total 3.72% and 5.88%, respectively. While these differences appear material on the surface, it is critical to consider how much returns vary from month-to-month.

Outside of our election window, two-thirds of monthly observations fall between -.025% and 1.25%. The average monthly return near elections sits squarely within this band of returns that are considered normal.

Multifamily Prices, Elections and Recessions

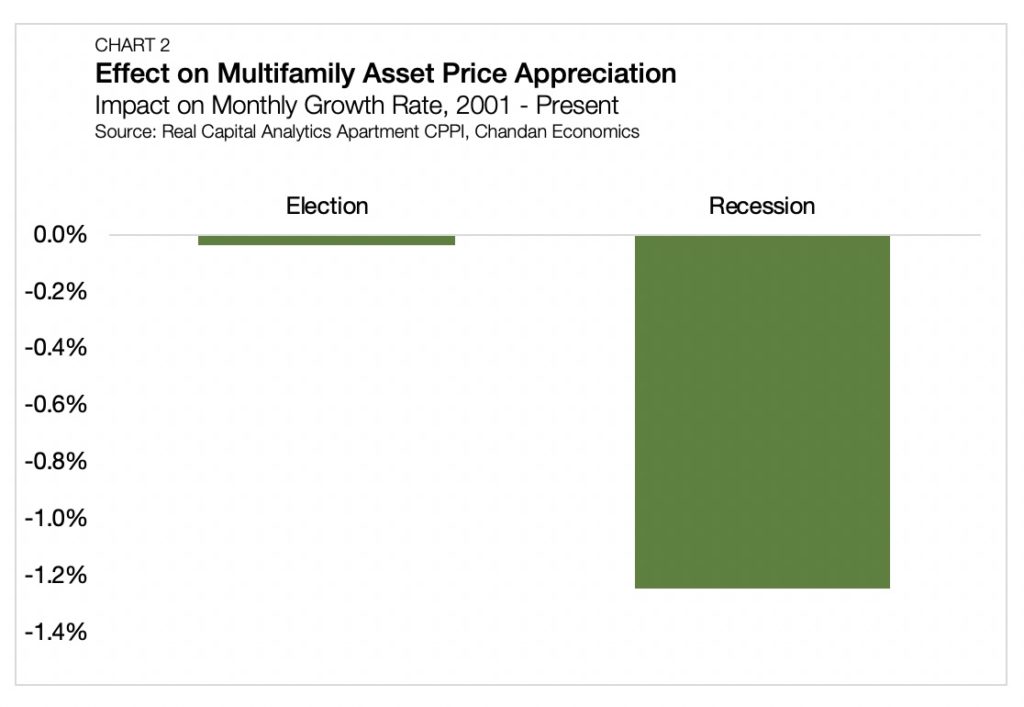

In further evaluating the data, we constructed a two-factor model that accounts for both the effects of an election and a recession. When controlling for a recession, elections are measured as reducing the monthly rate of return by -.04%. In other words, the effect is negligible. Conversely, the presence of a recession causes monthly returns to fall by -1.25% (Chart 2).

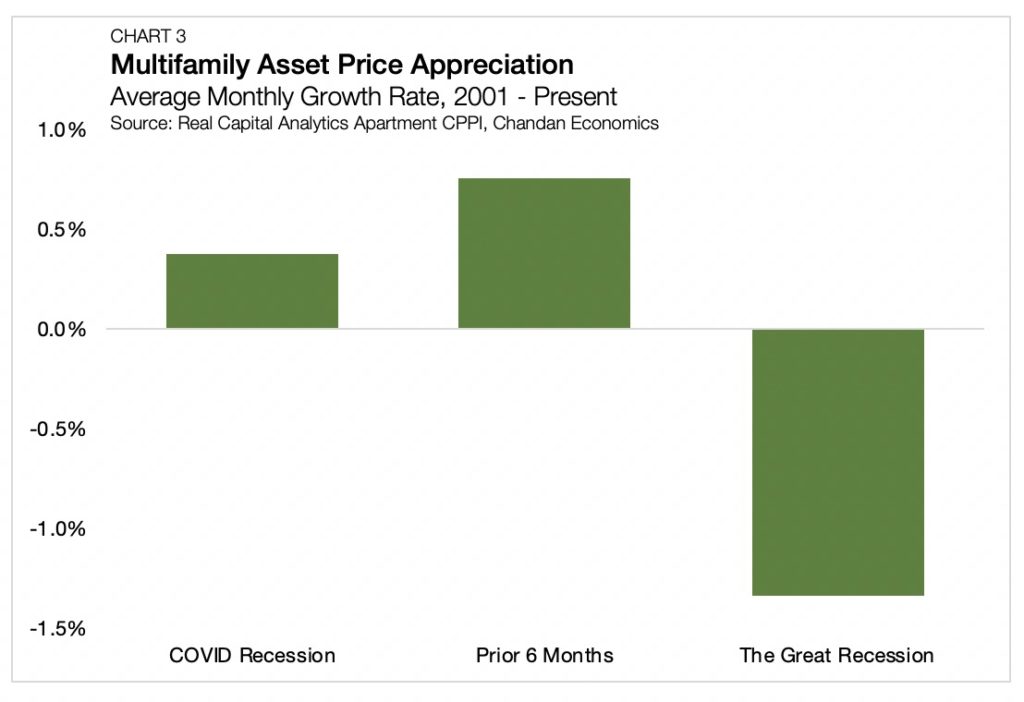

In 2020, we are grappling with not just the policy uncertainty that accompanies elections, but also a pandemic and its coinciding recession, creating immense household hardships. While multifamily asset prices have seen their growth rate slow, the performance has stood up well above the precedence set in 2008.

Between February and July of this year, in the midst of a global pandemic, multifamily prices have grown by an average of 0.37% per month. While this is less than half the growth rate observed in the six months prior when returns averaged 0.75%, they remain firmly above the -1.34% averaged over the Great Recession (Chart 3).

Forecasting Multifamily with the Volatility of 2020

Volatility remains a factor in the year-to-date analysis. Social tensions are near a fever pitch, and extreme stock market swings have become commonplace. Yet despite all of this, multifamily asset pricing has maintained its penchant for stability.

There are concerns still facing the sector. The economic toll of the shutdowns and subsequent recession are exerting strains on household balance sheets. By extension, this affects multifamily rent collections. In addition, the pandemic has impaired the appeal of the density and cultural amenities of cities. This likely will continue to lure many urban households to more spacious, exurban locations.

Nonetheless, multifamily assets have generally held up exceedingly well. While 2020 has routinely surprised forecasters, pegging multifamily as an asset class that will weather the upcoming election and continued recession is amongst the more conservative predictions across the CRE board.

Stay informed on the latest multifamily news and analysis by reading our Chatter blog. Contact Arbor to learn how our products could further your business goals.