Coronavirus (COVID-19) Special Report

- Investor seeking safety amid growing uncertainty push Treasury yields to new depths.

- Pent-up labor demand should drive the economy and labor market to recover more rapidly in this scenario.

- Multifamily will see its turbulence, but the sector is better positioned to weather the storm than most.

Key Highlights

State of Uncertainty

The emergence of the coronavirus (COVID-19) has sent synchronized shock waves through global supply chains and equity markets alike. The universe of uncertainty is expanding rapidly, and forecasting a return to normalcy given what we know is challenging. While the depth and timeline of an economic downturn have a wide range of possible outcomes, we can begin to at least take account of what impacts the coronavirus has already had and speculate on how this crisis may continue to unfold, using history as a guide.

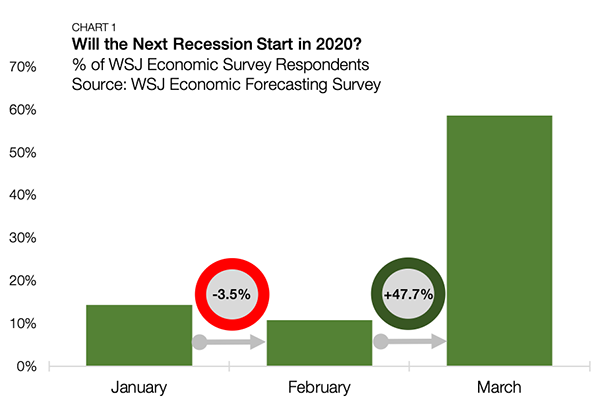

The rapid pace at which COVID-19 has routed equity markets is a symptom of just how much it was overlooked as a potential risk until its pandemic scale became inevitable. When the Wall Street Journal conducted its monthly survey of economists in January, 14.3% of respondents believed the U.S. would enter a recession in 2020. By the end of the month, there were close to 12,000 confirmed COVID-19 cases, and questions over containment were beginning to rise. Despite this, an even smaller cross-section of economists, 10.8%, believed a 2020 recession was imminent when asked in February. Fast forward to March, and economic expectations started to match the sobering circumstances at hand: 58.5% of economists believed a recession was approaching or upon us.

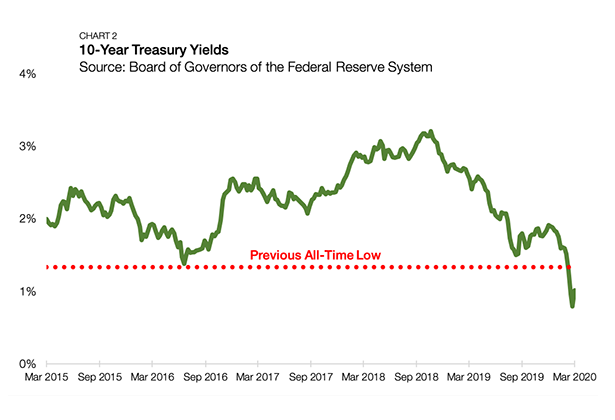

With uncertainty rising, investors have quickly piled into safe-haven assets, sending bond yields to new depths. Before COVID-19, U.S. 10-year Treasury yields had an all-time low of 1.33%, observed in June 2016. This crisis has pushed Treasurys well below 1% for an extended period, and there is open speculation on whether we could move into a negative interest rate environment.

Finding a Baseline

Policymakers breaking out their Great Recession playbook are likely looking in the wrong place for clues. The Financial Crisis unfolded over the course of two years, while COVID-19’s critical moments are occurring over the span of weeks. The immediacy of the pandemic’s economic effects are more similar to a natural disaster-type event than a recession caused by a misallocation of goods, services and capital.

To assess how an event like COVID-19 might affect the U.S. labor market and the broader economy, economists often look for “natural experiments.” A relatively recent domestic example that saw similar disruptions to both local supply and demand was Hurricane Katrina.

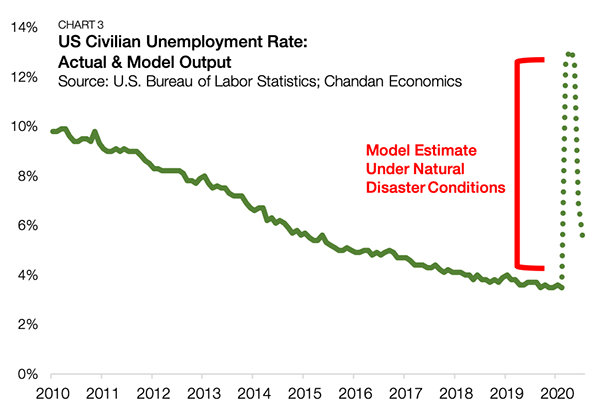

In Louisiana, initial unemployment claims measured monthly surged by nearly 1400% in the month of the storm, then slowly began to dissipate over the next few months. Looking just within New Orleans, the unemployment rate surged from 5.9% before the storm to a high of 15.5% in the months after. We simulated how the current U.S. unemployment rate would be impacted under a Katrina-like scenario.

In this model, the U.S. unemployment rate races up from its generational low point of 3.5% to a high of 13.1% in the coming months. To the extent that there is still considerable pent-up demand, as the effects of the shock begin to fade, the economy and labor market would improve much more rapidly in this natural disaster simulation than they would in a typical recession.

Simulated Effect of the Coronavirus on Cap Rates

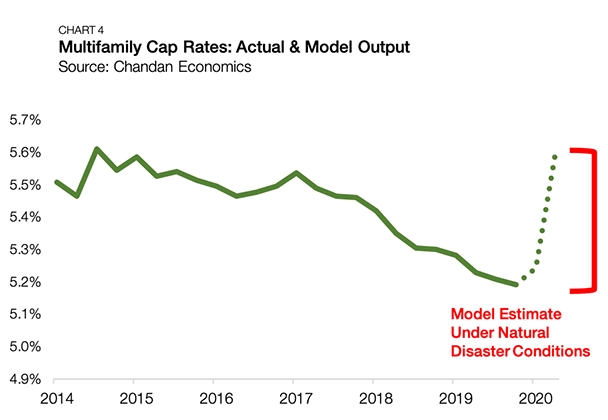

Much like every other asset class, concerns over risk pricing and liquidity are filtering into commercial real estate valuations. According to Chandan Economics’ model estimates, an employment shock like the one described above would widen cap rates over the next few months by about 40 basis points (bps). Multifamily cap rates averaged 5.2% to close out 2019, and with COVID-19 affecting domestic markets only in the latter end of the first quarter, most of the observable effects will likely only appear in second-quarter 2020. The simulated projection for multifamily cap rates between April and June of this year averages 5.6%.

A Cloudy Outlook

It is important to note that this forecast is fluid. Our ideas about what six months from now will look like are changing by the hour. Real estate is both physical and local, and the industry will take some time to return to normal, as will our day-to-day lives. As long as the crisis endures, we can expect softness in tenant performance, new leasing, and transaction activity. Of course, for the simple reason that people will continue to need somewhere to live, multifamily will likely see less volatility than the other real estate property types. Fundamentals were exceptionally strong before this disruption, which will aid the sector as it weathers the storm.

There are silver linings and reasons to believe that the worst-case economic scenarios will not come to pass. Amid the chaos in public debt markets, Freddie Mac was still able to price its latest small balance securitization: a reassuring sign of market functionality despite the country working from home. The FHFA has also reiterated its commitment to supporting multifamily, announcing this week that the agencies will offer property owners who demonstrate they have been significantly impacted by COVID-19 temporary mortgage forbearance under the condition that they don’t evict renters who are unable to pay rent due to the coronavirus impact. The agencies appear well set up to act as a counter-cyclical stabilizer where needed, and the recency of the last “once in a lifetime” global meltdown means that the industry’s senior decisionmakers are more battle-tested and ready to navigate the complexities and volatility ahead. Calmer waters will come once there is more clarity regarding the duration and severity of this outbreak. Until then, wash your hands.

View all of our coverage of the coronavirus outbreak and what it means for the commercial real estate industry by visiting our COVID-19 research page. Have questions on multifamily financing and investment in the current market? Contact us today to speak to an experienced originations specialist.