Data for Assisted Living and Independent Living Investments

- Senior housing shows strong performance under different market conditions.

- In senior housing, occupancy depends on local market demographics, supply and demand, housing stock and other factors.

- In recent years rent growth continues with assisted living and independent living.

The National Investment Center for Senior Housing & Care (NIC) has the data on recent senior housing and healthcare trends. But where investors target their dollars will depend on their individual strategies and goals. Investors face multiple factors creating different kinds of opportunities for building profit-making portfolios. Citing the NIC Investment Guide, fifth edition, NIC senior principal Lana Peck noted in an Arbor Realty Trust interview, “The senior housing sector has performed well throughout the recession when properties outperformed other commercial real estate property types in terms of investment returns and rent growth.”

Lana Peck, senior principal, NIC

Lana Peck, senior principal, NICSenior Housing, Independent Living and Assisted Living Trends

NIC is a non-profit organization focused on enabling access and choice for America’s elders. Tracking senior housing and care across more than 15,000 properties in 140 U.S. metropolitan markets, it provides data, analytics and connections for investors and providers. This article refers to charts where NIC tracked and analyzed the largest 31 markets in its pool.

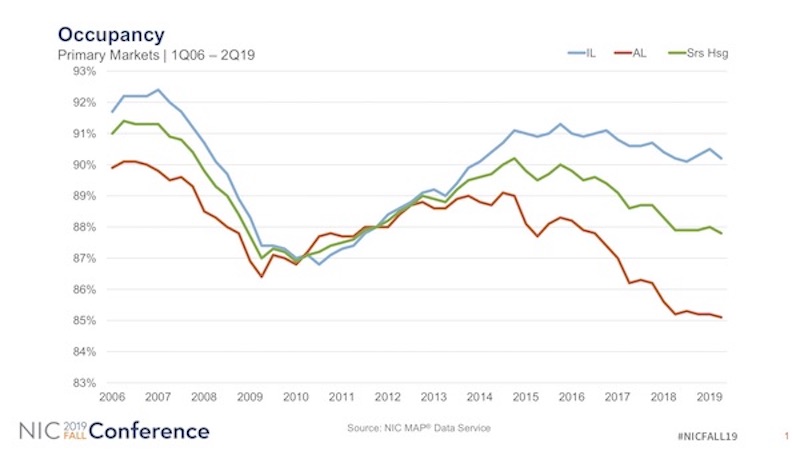

Dating back to 2006, in the graph below, the organization charted occupancy percentages for senior housing in green. This encompasses both independent living in blue and assisted living in red. There are different levels of services with independent living. But generally, it has a commercial kitchen and provides at least one meal a day, housekeeping and transportation. Assisted living provides a higher level of care. This includes medication reminders and personal assistance with other activities of daily living.

Dating back to Q1 2013, the trend shows a downward decline in occupancy at assisted living properties. It fell from slightly under 89% to about 85% by Q2 2019. However, in the same timeframe, the rate of occupancy for independent living remained relatively stable. It oscillated around 90% over the past six years.

“In 2018 we had record high inventory growth,” Peck said. She attributed the decline in assisted living occupancy to the number of units added to supply in recent years, where demand has not yet caught up.

Large Variations in Market Occupancy

“There is a huge disparity in occupancy rates in senior housing depending on supply and demand in each local market,” Peck said. NIC’s data points to a 15% disparity between the strongest and weakest markets in its primary 31 markets. Currently, for senior housing the highest occupancy rate is in San Jose, California at 95.7%. This compares to the market with the lowest occupancy rate of 81.1% in Houston, Texas.

NIC data shows Portland and San Francisco also have high occupancy rates without a lot of supply coming to the marketplace. At the other end, additional cities in Texas, plus Phoenix and Denver with lower occupancy are growth areas.

There are several reasons for variations in occupancy rates within and across individual markets. These include senior and adult child demographics, supply and demand balances and imbalances, competitive intensity, age of seniors housing stock, consumer sentiment regarding senior housing, climate and local economic conditions, in addition to other factors.

Investors see opportunities in both high and low occupancy markets, depending upon their different business strategies.

Inventory and Absorption Rates: Assisted Living Exceeds Independent Living

The U.S. News & World Report wrote the youngest baby boomers turned 50 in 2014. The oldest baby boomers turned 65 in 2011. In a 2015 article, NIC reported that the average age of transitioning into senior housing is between 82 to 84. Using these statistics, the oldest baby boomers will reach 82 in 2028. The youngest in this generation become 82 in 2046.

ASHA reported in the Seniors Housing Statistical Handbook, edition VI, that most residents live in their independent living or assisted living apartment between one to four years with a longer period for independent living than for assisted living. Since the Great Recession, the average age of moving into these types of senior housing has risen, said Peck.

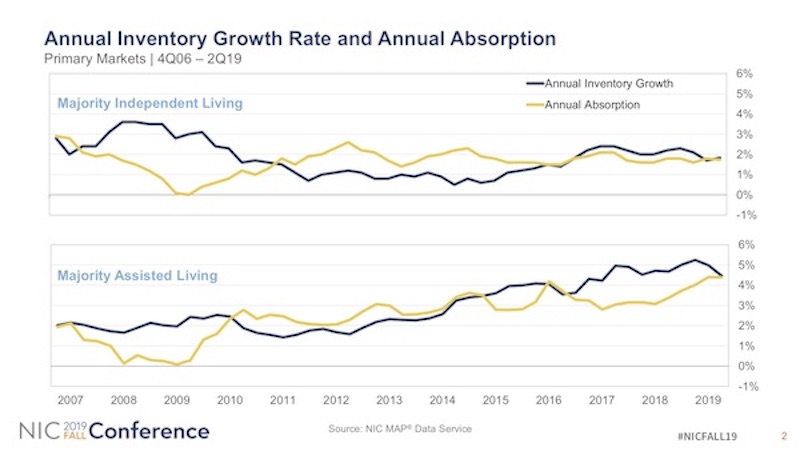

The absorption rate or filling of spaces in senior housing depends both on the numbers of people moving into the facilities and the available inventory. Both absorption and inventory indicate a progressive climb in percentages. NIC indicates by Q2 2019 the annual inventory growth and absorption rates for independent living were both at 1.8% and for assisted living the annual inventory growth and absorption rates both reached 4.5%. This reveals that by Q2 2019 assisted living absorption and inventory growth were more than twice the levels seen in independent living.

As of Q2 2019, 43,000 senior housing units were under construction in the primary markets that NIC tracks. That represented 6.9% of total inventory, Peck stated.

Rent Growth Continues

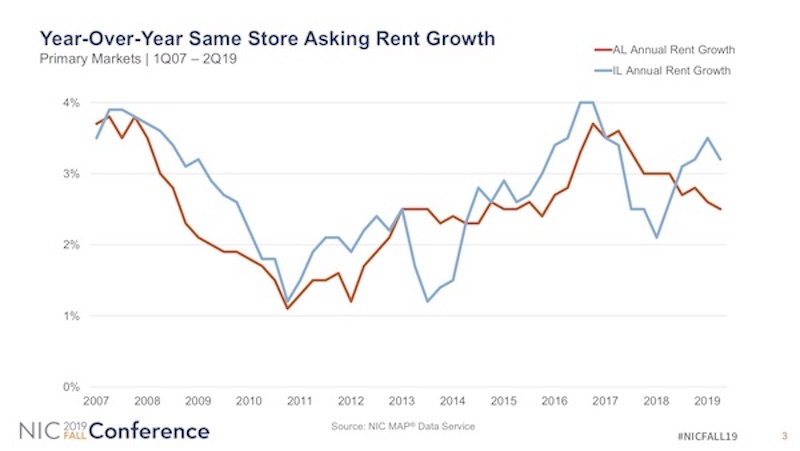

The NIC chart shows assisted living annual rent growth in red declining from a high point in 2016 of 3.7% but still at 2.5% for Q2 2019.

For independent living rent growth depicted in blue was at 4% in 2016. It dropped to slightly over 2% in 2018, rising to just over 3% by Q2 2019. While there have been some variations in independent living asking rent, assisted living rent growth has declined since reaching a high peak of 3.7% at the end of 2016. Supply and demand pressures and occupancy rates explain some of the recent discrepancy, according to Peck.

Nonetheless, for both assisted living and independent living since 2007, even with fluctuations in percentages, asking rent has consistently grown. The rent growth curves never hit 0% nor dipped into negative percentages.

Beyond the Numbers

Peck concluded her conversation with Arbor emphasizing that investing in senior housing real estate goes beyond bricks and mortar. “A strong case can be made for senior housing in that it prolongs lives with the socialization that seniors get from living in a community with meals, activities, programming and transportation. There is empirical evidence,” said Peck. “Research shows that seniors who live senior living communities are healthier and live longer than folks who may be more isolated in their single-family homes.”

She underscored that operations in senior housing and care properties are more involved than in other commercial real estate property types. Thus, it remains important for investors to choose operators with proven track records.