Diversity in Baby Boomers’ Senior Housing

- Greater inventory will be needed for baby boomers' senior housing.

- Seniors with growing healthcare issues will impact real estate trends.

- Expect greater options in senior housing in the future.

The “Silver Wave” or “Silver Tsunami” refers to the inevitable aging of baby boomers. The National Investment Center for Seniors Housing & Care (NIC) recently published a whitepaper that reflects the impacts of this generation. The data shows a significantly greater need for baby boomers’ senior housing. NIC concluded that even if the usage rate of senior housing were to decline, sheer demographics would support future inventory growth. However, don’t expect a proliferation of your grandparents’ old folks’ homes. “Baby boomers do things differently,” NIC Chief Economist Beth Mace told Arbor Realty Trust. “Their impacts will change senior housing.”

Beth Mace, Chief Economist, NIC

Beth Mace, Chief Economist, NICInventory Growth Needed

In the NIC study, senior housing refers to both independent living and assisted living. The data for the overall market points to expanding opportunities. NIC reported that in the fourth quarter of 2019, the senior housing occupancy rate slightly rose to 88.0%, up from 87.7% in the third quarter for the 31 NIC MAP® Primary Markets. The assisted living inventory growth slowed in 2019, and the occupancy rate increased 30 basis points to 85.7%. This was the highest occupancy level since the fourth quarter of 2017. NIC also reported approximately $1.8 billion in senior housing property sales nationally for the fourth quarter of 2019. The total reached $13.1 billion for the entire year, according to preliminary estimates.

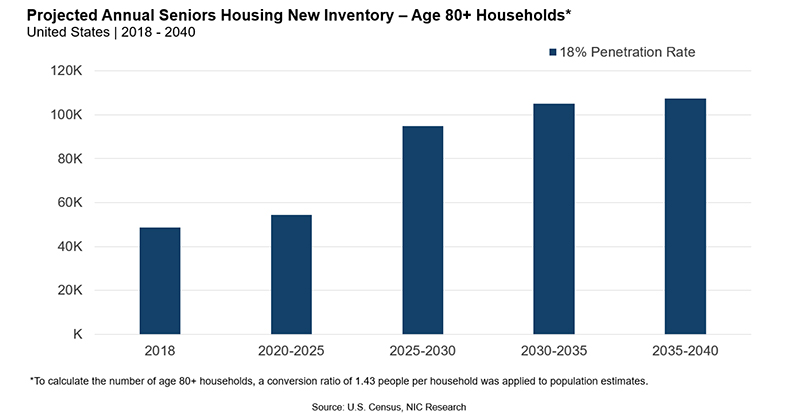

In the NIC study that estimated national demand, the researchers calculated usage rate. NIC compared the total senior housing inventory to the number of households headed by people 80 years and older. Currently, with a national estimate of senior housing inventory of 1.6 million units and 8.9 million 80+ age households, the 1.6 to 8.9 ratio equates an 18% penetration rate.

Maintaining this 18% penetration rate for the 80+ age household group, NIC predicts the country will need approximately 881,000 additional units of senior housing between 2019 and 2030. This demand will only accelerate with time due to the baby boomers’ senior housing needs, according to Mace. Born between 1946 and 1964, the oldest baby boomer today is 74. The NIC charts show projections for seniors 80 years and older: From 2020 to 2025, approximately 54,000 additional senior housing units will be needed. From 2025 to 2030, this demand will rise to 95,000 units before reaching 105,000 units between 2030 and 2040.

Independent living operators generally provide a commercial kitchen, at least one meal a day, housekeeping and transportation. With assisted living, residents receive a higher level of care, including help with daily living activities. According to NIC’s fourth quarter of 2019 data, occupancy declined in independent living and rose in assisted living. Mace explained this occurred as a function of supply and demand. Using the 31 NIC MAP® Primary Markets, the study found assisted living inventory growth dropped from the 10-year record high in 2018 of almost 15,000 new units down to slightly over 9,000 new units in 2019. Inventory for independent living grew from approximately 7,000 new units in 2018 to nearly 7,775 new units in 2019.

Baby Boomers Will Need Senior Care Assistance

People are moving to senior housing at older ages and with higher levels of medical needs than in the past, Mace stated. An AARP survey updated in July 2019 found 76% of adults over the age of 50 would prefer to age in their current residences. However, Mace noted baby boomers might not necessarily have the ability to stay at home as their aging progresses.

NIC conducted a national study of seniors who are in the middle of the economic spectrum. It concluded by the year 2029, of the middle-income seniors who will total 14 million people, 66% will have mobility needs. NIC forecasted approximately two-thirds of this group will have a chronic condition such as diabetes, CRPD (chronic restrictive pulmonary disease), COPD (chronic obstructive pulmonary disease) or obesity. In the COPD category, with progressive lung diseases such as chronic bronchitis and emphysema, breathing becomes more difficult.

Mace added only 54% of this group is likely to be married. Thus, that reduces the number of spouses at home serving as primary caretakers. Plus, the ratio of adult children to seniors is dramatically shrinking. “In 2019, there were seven adult children defined as someone who is 45 to 64 to every one person who is over 80. By 2030 this ratio of 7:1 drops to 4:1. By 2050, that statistic goes down to 3:1,” said Mace.

Baby boomers may want to remain at home. However, the NIC study states the declining numbers of caretakers will likely lead to higher penetration rates in senior housing.

Reinventing the “Old Folks Homes”

Mace described baby boomers as a large, diverse group. Many were part of the counter-culture of the 1960s, active in civil rights protests and the women’s movement. “They’ve been a generation typically more exploratory than any prior generation,” she opined.

She predicted greater options in baby boomers’ senior housing. The trends indicate a continued differentiation of what’s on the market today.

“There will be more intergenerational houses,” said Mace. “I think you’re going to see more of ‘The Golden Girls’ type housing where you move in with a group of your friends. I think the variety is going to be pretty robust because this is a group of individuals who don’t tend to do things the same as each other.”

The NIC economist pointed to affinity senior housing groups, which are rooted in shared interests. Senior housing associated with universities or towns, where people were born or choose to live, is also growing in popularity. Mace commented that within a widening spectrum, “you’ll see senior housing as it morphs into its future.”

Check out Arbor’s blog to learn more about baby boomers’ senior housing and healthcare. You can also read about Arbor’s loan programs for different senior housing and healthcare financing options.