Full ‘STEAM’ Ahead: Skilled Workers Supporting Small Asset Apartment Growth

Growth trends for small asset renters in highly skilled occupations are encouraging. These findings align with projected job growth forecasts into the middle of the next decade.

The Big Picture – Occupations with High Future Demand

As noted in a pervious research brief, high-skill workers have higher wages and are more likely to concentrate in urban cores. This contributes to a demand advantage to larger buildings.

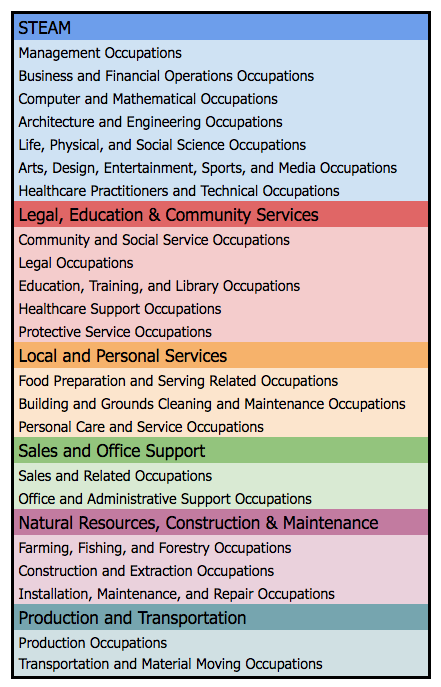

These highly skilled jobs include science (plus medicine), technology, engineering and mathematics, plus design, arts, finance and management. We are calling this group STEAM — as a play on STEM plus Arts — to include the creative industries. Before we break down the prevalence and growth of various industries within the small and large multifamily stock, let’s get an idea of near-term employment growth.

According to the Bureau of Labor Statistics, of the 9.8 million new jobs projected for the U.S. between 2014 and 2024, about a third are in the STEAM category. This is followed by Legal, Education and Community Services occupations. The box below details the likely job composition of each category.

Worker Growth in Small Buildings

These are encouraging signs for the small asset market, as renters employed in the above groupings are also growing faster compared to the overall small asset renter population.

As shown above, small building STEAM workers grew at an annual rate of 6.6% over 2014-15, while Legal, Education and Community occupations grew at 3.6%. Both grew faster than the rate of population growth of around 3%, but slower compared to the growth of workers in these categories living in large buildings.

Wage Levels by Occupation

The STEAM and Legal, Education and Community Services groupings also had higher overall average wages across all small asset worker occupations, but considerably lower compared to workers in these same categories living in large buildings.

For example, in 2015, STEAM workers in small buildings earned around $55,000 compared to $75,000 for those in large buildings, as shown below.

The lower comparative STEAM wages in small buildings, while noticeable, is not alarming. Property owners and developers should take some comfort in the fact that small building renters are — on average — 10 years younger compared to those living in larger buildings.

Proactive retention and further growth of these younger STEAM-ers could prove a valuable and stable source of demand over the medium-term.