Generation Renter: Why the Multifamily Pipeline is So Promising

- Pent-up household formations and Generation Z’s positive opinions of renting will support rental housing demand in the years ahead.

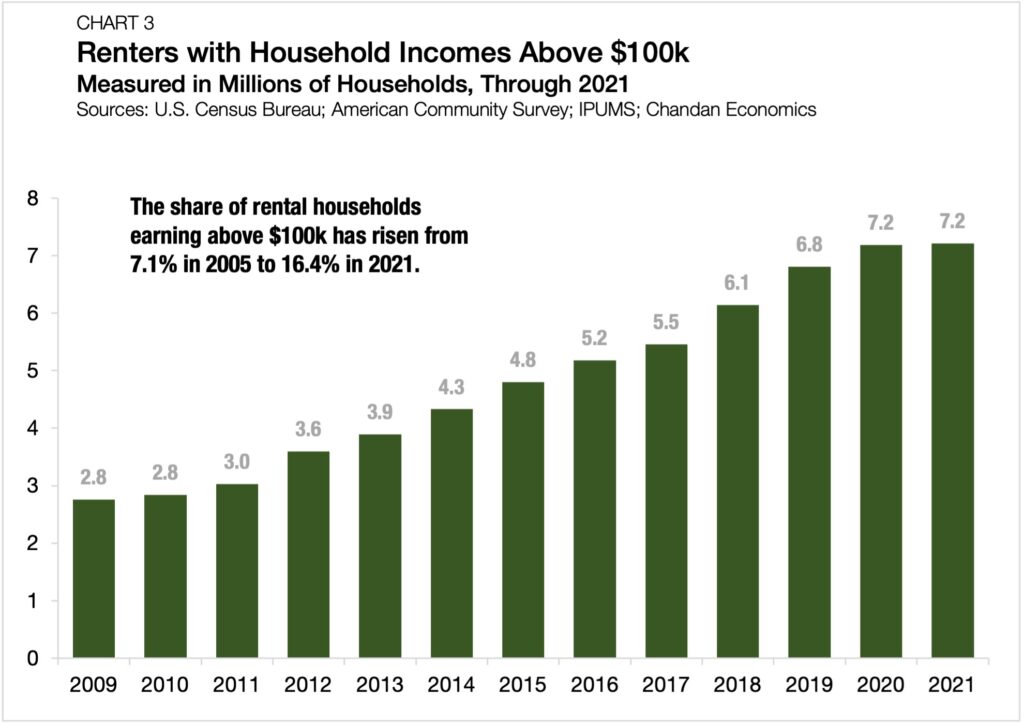

- Lifestyle renters, 7.2 million of whom earn over $100,000 per year, continue to increase their share of the rental market.

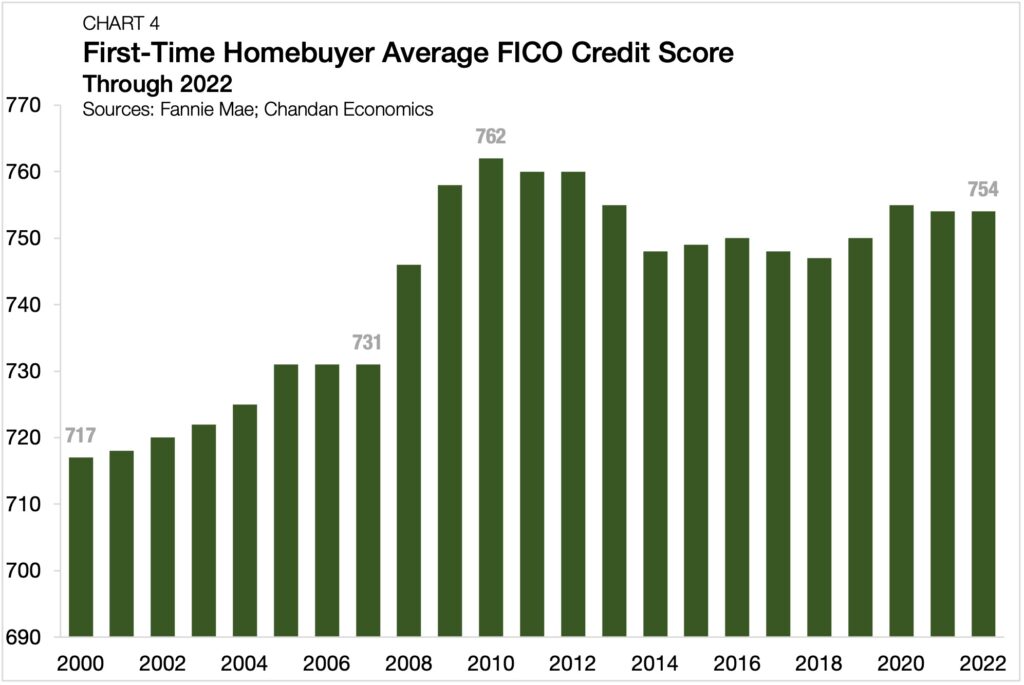

- Home price affordability and persistently tight underwriting standards for first-time homebuyers could cause more young adults to delay homeownership.

After the historic rental housing bull run of the 2010s and the early 2020s, the open question is: can it maintain this momentum over the next cycle? While the answer is highly debatable, trends in demographics, preferences, and market conditions show the presence of significant tailwinds that will continue to propel investment prospects forward. Chandan Economics, Arbor’s research partner, analyzed historical data from the U.S. Census Bureau to project how Generation Z could impact the future of the rental housing market.

Demographics

Demographic analysis can be used to identify the amount of people who could potentially be renters. Even as population growth has slowed, the next group of young people to become adults is larger than ever. According to the U.S. Census Bureau’s Current Population Survey, there are an estimated 17.2 million people in the country between the ages of 16 and 19 — more than at any point in history. This impending wave of young adults should strengthen already-high rental demand, since historically, homeownership rates have been lowest among young Americans.

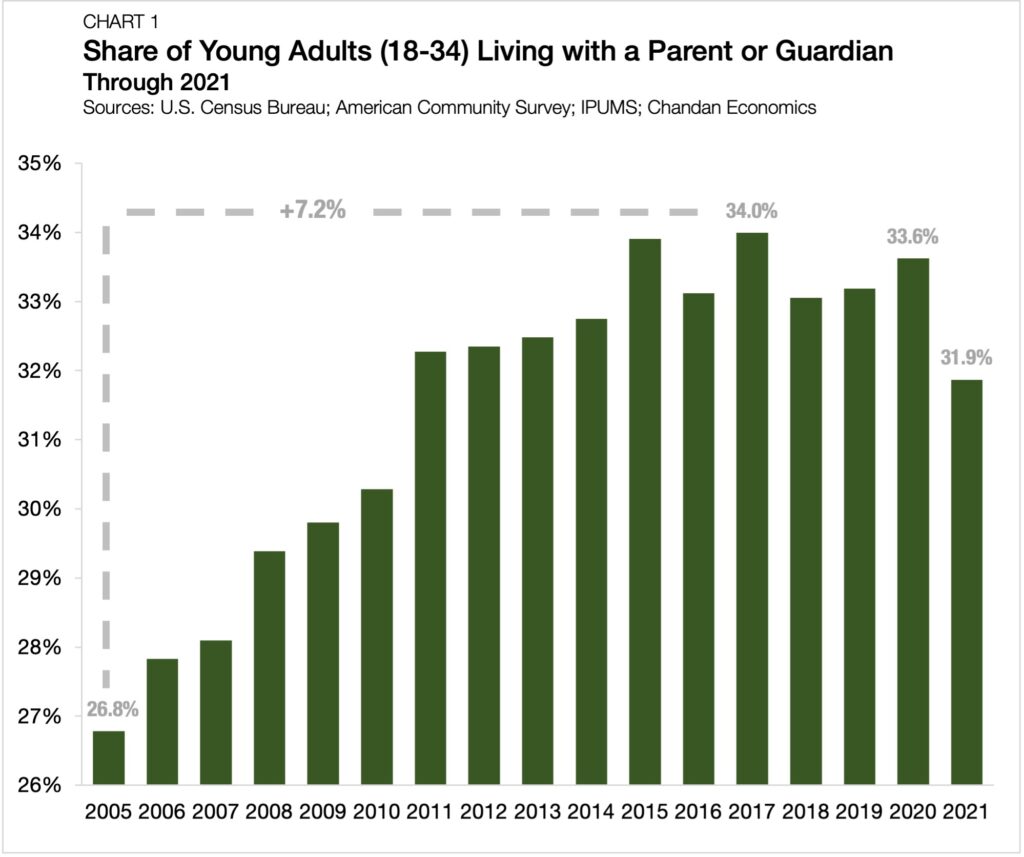

Driven by affordability, economic turbulence, and cultural factors, young adults today have become more likely to live with their parents. Between 2005 and 2017, the share of people 18-34 years old living with their parents rose from 26.8% to 34.0% (Chart 1). Chandan Economics estimates that this shift has led to an excess of 5.5 million young adults not living on their own.[1]

However, there is some evidence that this trend is starting to reverse. After moderating between 2018 and 2020, the share of young adults living with parents saw a major decline — shifting down in 2021 by 1.8 percentage points as an additional 1.7 million young adults moved out of their parent’s or guardian’s residence.

Further, there is reason to believe the reversal has more room to go. According to Pew Research Center, Americans view young adults living with their parents as a negative to society by more than a two-to-one ratio. If the share of young adults living with their parents continues to fall, it will unlock a significant volume of pent-up household formations, a major new source of rental demand.

Preferences

Housing attitudes and preferences will also contribute heavily to rental demand as Generation Z comes of age.

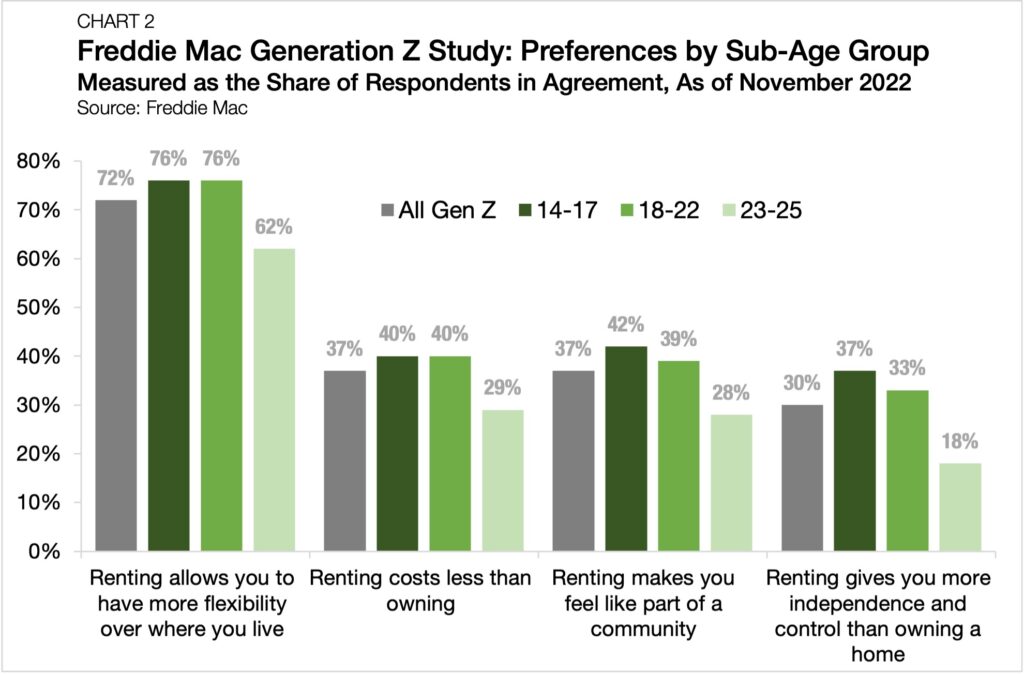

First, as this generation moves into adulthood, early indications suggest that they have positive attitudes toward renting. According to a 2022 Freddie Mac Gen Z Survey, Gen Z views the flexibility that renting affords as a primary advantage, much like their elders.

Notably, the generation’s youngest age groups, now 14-17 and 18-22 years old, appear more pro-renting than Gen Z’s oldest group, who are 23-25 (Chart 2). The younger cohorts are more likely to rate renting as more appealing, community-driven, and less costly.

Evidence suggests that renters across all age groups have adjusted their views of homeownership as an investment. According to the N.Y. Federal Reserve’s SCE Housing Survey, the share of renters rating ownership as a sound investment has decreased in recent years. While 58.2% of renters still view homeownership as either a somewhat or very good investment in 2023, the share fell by 9.7 percentage points from 2020’s high watermark of 67.9%. These trends in renters’ sentiments align with recent comments by Fannie Mae’s Chief Economist, Doug Duncan, who remarked that “confidence in the housing market appears to have plateaued at a relatively low level, suggesting that many consumers may be coming to terms with elevated mortgage rates and high home prices.”

Lastly, the proliferation of lifestyle renters — people that can afford to own a home but choose to rent — is another major factor impacting the rental housing market. According to an analysis of the U.S. Census Bureau’s American Community Survey, the number of renters earning more than $100,000 per year hit a new high in 2021 of 7.2 million households (Chart 3). Between 2012 and 2021, the number of households in the U.S. that rent and earn over $100,000 has more than doubled.

Market Conditions

Today’s market conditions tend to impact tomorrow’s pool of potential renters. While rising inflation has stretched the budgets of young adults, older generations are staying in their homes longer, restricting the available housing supply. As a result, the homebuying market is more competitive and costly for Gen Z to enter than it was for their parents.

At the same time, home lenders have become extremely selective when extending mortgages to first-time home buyers. According to a Chandan Economics analysis of Fannie Mae Mortgages, the average first-time homebuyer in 2022 had a FICO credit score of 754 — only 8 points below the peak level of tightness recorded in the aftermath of the 2008 housing crisis (Chart 4).

As housing affordability worsens, home prices are growing once again and lending rates remain generationally high. As a result, it is more difficult for young households to access homeownership today than for generations prior. A recent National Association of Realtors report notes that the average age of a first-time homebuyer has risen to 36 years old — a new record high.

Altogether, the inability of the owner-occupied housing market to provide enough accessible, quality housing options supports a swell of renter demand. As long as the rental housing market continues strategically adding inventory in product types, like single-family rentals (SFR), which appeal to would-be homeowners, the sector’s performance stands to gain from the coming wave of young renters.

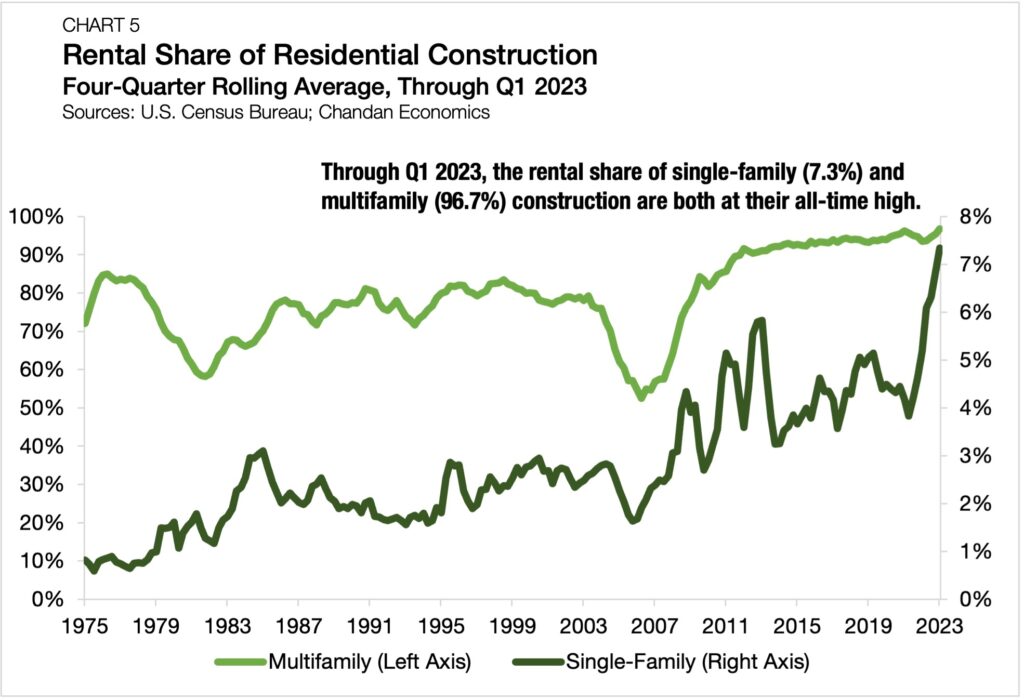

Within multifamily, rental housing built on its dominance in the first quarter of 2023, sitting at 97% of new development (Chart 5). However, where rental housing construction has taken its biggest steps forward in recent years is the single-family housing sector. Even as owner-occupied remains the dominant model for single-family properties, the rental share of construction has more than doubled in the past decade, rising from 3.2% in 2013 to 7.3% in 2023. As these new SFR units become available to rent, they may become the starter homes of choice for Gen Z.

From demographics to preferences to market conditions, rental housing demand has several supportive tailwinds that should make the number of rental units needed in the U.S. continue to grow for the foreseeable future, positively positioning multifamily investment beyond our current corrective environment.

[1] Calculation considers the difference between the actual number of 18-34-year-olds living with parents in 2017 (25,836,973) and what the total would have been if the 2005 share remained fixed (20,358,675).

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily posts in our research section.