Hunting High-Yield SFR Markets: Where to Find Double-Digit Returns

Single-family rentals (SFR) are anything but a passive investment. Much more goes into net operating income (NOI) or, more accurately, detracts from it than just gross rents. Investors must also consider rehab, taxes, concessions, vacancies, and a myriad of other expenses. And like any other investment, higher returns are generally associated with higher investment risk.

Still, investors looking to enter the SFR space should start by looking at markets that have an appropriate combination of property value and rents to achieve their required returns and use their skills to mitigate those risks. With that in mind, where are rents still high and property values relatively low?

Top Markets for SFR Investment Returns

HouseCanary’s mid-year Canary Rental Index (CRI), a proprietary model that tracks and analyzes rental returns across the U.S. and major metro areas, showed an overall national rental yield of 8.41%, which was lower than the 2017 mid-year CRI national rental yield of 8.86%. We calculated the mid-year national median home value at $217,400, and the mid-year median national rental price at $1,695 per month.

Property values have been increasing faster than rents in most of the country, resulting in lower returns on most SFR investments. Despite this, there are still pockets of opportunity for rental investors where rental yield is in the double-digits across every zip code in a given metropolitan statistical area (MSA). The CRI helps us identify those opportunities where investors can build property concentrations and achieve economies of scale at a reasonable cap rate.

One area with several of those high-yield MSAs is Appalachia. We focused on six states that are generally considered part of “core Appalachia” — Georgia, Kentucky, North Carolina, Tennessee, Virginia, and West Virginia. Within those states, we only considered the counties that have been designated as part of Appalachia by the ARC.

Highest-Yield MSAs in Appalachia

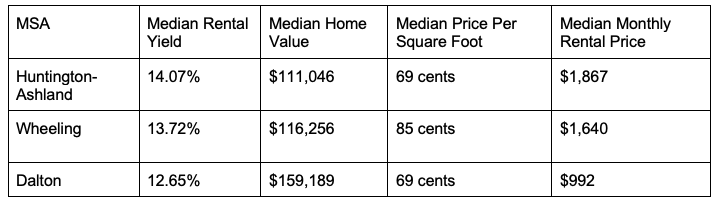

We found three MSAs that generate double-digit median rental yield in every zip code in the market: Huntington-Ashland, which includes parts of West Virginia, Kentucky, and Ohio; Wheeling, which includes parts of West Virginia and Ohio; and Dalton, GA.

1. Huntington-Ashland

In Huntington-Ashland, the mid-year median rental yield was 14.07%, approximately 5.5 percentage points higher than the national mid-year median rental yield. Median rental yield in Huntington-Ashland has been above 14% since February 2017. Median home value is $111,046, less than half of the national median home value, but its mid-year median monthly rental price was $1,867, which is $172 higher than the national median rental price.

The highest-yield zip code in the MSA was 25703 in Huntington, which is located on the West Virginia side of the Ohio River; it delivered a 20.7% rental yield at mid-year.

Huntington-Ashland has a higher unemployment rate (5.3%) than the national unemployment rate (3.9%). Its median salary, $56,786, is slightly higher than the national median salary of $55,322, according to the U.S. Census Bureau in 2016.

2. Wheeling

Wheeling boasted a mid-year median rental yield of 13.72%, which is lower than the historical rental yield in Wheeling; the MSA has typically delivered median rental yield in the 14% range since 2013. The median home value in Wheeling is $116,256, and the median monthly rental price is $1,640, slightly below the national median. However, with home values in Wheeling well-below the national median home value, the market still presents an opportunity for rental investors.

Wheeling’s highest-yielding zip code was 26033, which spans from Sand Hill down to Rockport and encompasses Cameron, WV. The 26033 zip code reported a 22.5% mid-year median rental yield.

The unemployment rate in Wheeling was 6.1%, more than two full percentage points higher than the national rate; Wheeling’s median household income is $57,455.

3. Dalton

Dalton, GA, reported a mid-year median rental yield of 12.6%. Since 2013, rental yield in Dalton has been slowly declining. In 2013, Dalton regularly reported rental returns in the 14% range. The median mid-year home value in the MSA is $159,189, and although the median mid-year monthly rental price was only $992, rental investors still have plenty of opportunities to capture a return on their home-purchase investment.

The Dalton MSA contains only seven zip codes, and all of them reported mid-year median rental yield at least 3 percentage points above the national 8.41% median. The highest-yielding zip code in Dalton is 30755, which straddles Interstate 75 and spans from Tunnel Hill to the south, up to Catoosa Springs to the north.

The unemployment rate in Dalton was also higher than the national 3.9% benchmark, at 5.5% unemployment. Median income in Dalton beats the national median by slightly more than $300, at $55,635.

The Canary Rental Index also delved into MSAs in Appalachia where the mid-year median rental return was close to the national 8.41% metric, in addition to Appalachian MSAs where the mid-year median rental return was below the national median. To read more about how the rest of Appalachia measured up to mid-year national averages, visit: https://resources.housecanary.com/rental-yield-investment-index.

About HouseCanary

HouseCanary created the Canary Rental Index (CRI) to track and analyze rental returns across the country and in the major metropolitan statistical areas (MSAs), regularly summarizing new data to show rental investors where they might find high rewards for their efforts. HouseCanary’s proprietary models generate highly accurate median home prices and median rent prices, giving investors a benchmark for existing investments and a way to seek expansion opportunities.