Higher-Income Young Adults Drive Up Multifamily Demand

- Young adults form a majority share of workers living in apartments across all occupational categories.

- Millennial and Gen Z technology workers have a greater impact on multifamily demand in terms of higher occupational shares and income levels.

- The income gap between older and younger renters is the smallest in small multifamily.

Millennials and Gen Z Increase Market Shares

Millennials and the emerging Gen Z cohort are collectively the most educated generation in history, according to a Pew Research Center 2019 report, “Millennial Life: How Young Adulthood Compares with Prior Generations.” While this group is saddled with rising student debts, young adults are more immediately accessing high-earning jobs than prior generations.

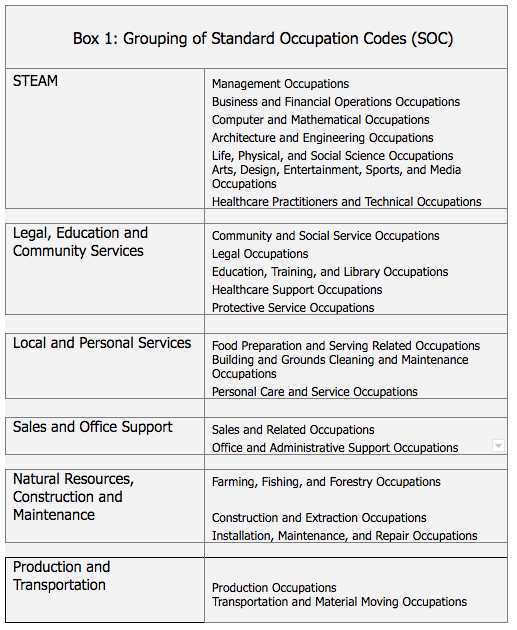

Technology and design STEAM (think STEM plus the Arts) workers not only have the highest incomes across all occupational categories, they are also increasing their overall share across rental asset classes at a faster clip. These trends are partly fueled by the impact of young adults on the rental landscape. (See Box 1 for occupations grouped by standard occupation categories.)

According to recent American Community Survey data, young workers constituted 41% of the overall U.S. workforce, and 37% within STEAM occupations. Narrowing in at the distribution of workers in multifamily properties, these young workers made up a significantly larger share.

Across small and large multifamily properties, Millennials and Gen Z made up as much 60% of workers across all occupations and 66% of workers employed in STEAM jobs. These numbers dropped off to about 50% in single-family rentals (SFRs).

Young Tech Worker Incomes Competitive with Older Colleagues

Not only do young adults form a higher share of STEAM workers living in apartments, they also earn nearly as much as their more seasoned colleagues. From the survey data, Millennial and Gen Z technology workers earned as much as $75,000 in large properties and $56,000 in small apartment buildings. This amounted to nearly one and a half times the average for their cohort across all occupations.

Within small multifamily, the income of young workers was only 11% short of the overall average within STEAM and 9% across all occupations.

With both large multifamily and SFRs, wage differences across age groups is more pronounced. For property operators, the strong spending power of young workers bodes well for future property-level cash flows and tenant credit quality. Millennials are starting to move to the suburbs in greater numbers as they form families. While multifamily attention is increasingly turning to the nascent emergence of Gen Z, the debt burden of the Millennial cohort may continue to act as an impediment to homeownership, increasing aggregate demand for rentals.

Visit Arbor’s Chatter blog to read our latest reports and news on multifamily housing. Contact Arbor today to inquire about our various financing products to assist with your business goals.

Note: All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection, and include a margin of error. Small multifamily, based on the ACS data, is defined as structures with 5 to 49 units.