Housing Market Dynamics Cause More Renters to Consider Delaying Homeownership

- A growing share of renters expect to stay in the rental market for the foreseeable future, with just 42.0% expecting to buy a home in the next three years.

- Rising interest rates and high home prices have made it more expensive for renters to transition into ownership.

- Two thirds of Millennial renters (66%) do not have any money saved for a potential down payment.

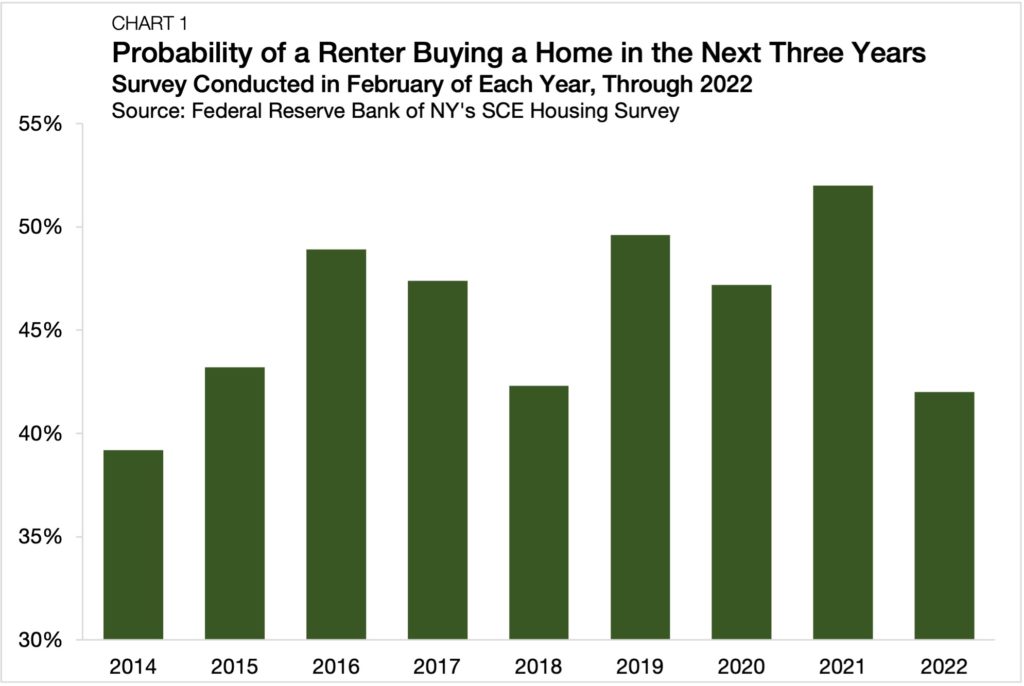

As home prices continue to rise at double-digit annual rates and the costs associated with obtaining mortgage financing begin to climb, a growing share of renters see themselves staying in the rental market for the foreseeable future. Newly released data from the NY Federal Reserve’s SCE Housing Survey indicates that the average probability of a renter buying a home in the next three years is 42.0%— its lowest level since 2014 (Chart 1). Moreover, the 2022 result marks a 10.0 percentage point drop-off from last year’s survey, which is the largest one-year decline on record. Among the key factors that are contributing to a more renter-centric outlook, there are three that carry the most weight:

1. Rising costs of homeownership

2. Tighter mortgage underwriting standards

3. Shifting attitudes toward lifestyle renting

Rising Costs of Homeownership

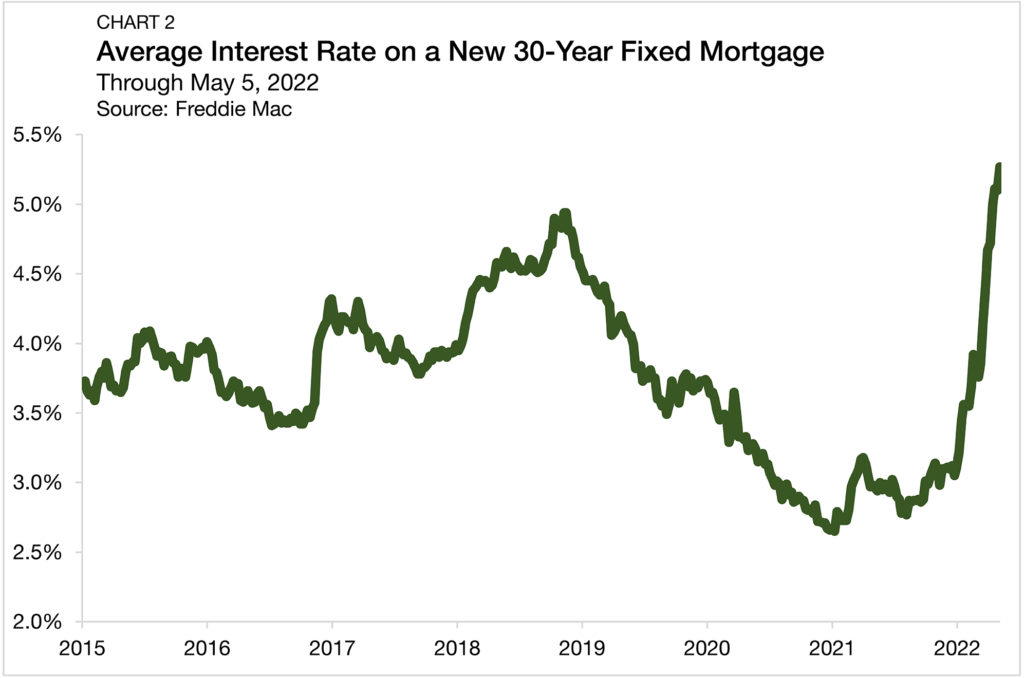

The most limiting factor keeping renters with a preference to own in the rental housing market is the costs associated with financing a potential purchase. Rising inflation has prompted an aggressive response from the Federal Reserve, which, in turn, has led to rising interest rates across the economy. According to Freddie Mac, through May 5, the average interest rate on a 30-year mortgage reached 5.3%, roughly doubling where it was to begin 2021 (Chart 2).

Beyond interest rates, down payments have become more expensive on an absolute dollar basis, as home prices soared – raising another barrier to entry for would-be buyers. The median home sales price was up an annual 15.9% through the first quarter of 2022, far exceeding growth in average hourly earnings, which are up by 4.6% from a year ago through April. According to a recent survey by ApartmentList, 66% of Millennial renters do not have any dedicated down payment savings. Further, 18% have some money saved but less than $10,000. Only 16% of these Millennial renters have more than $10,000 saved for a potential down payment.

Tightening Underwriting Standards

Even if a potential homeowner has the necessary funds for a down payment available to them and they can cover higher interest rates, obtaining a mortgage is still dependent on a lender extending the loan. Recently, conventional mortgage lenders have had less of an appetite for assuming risk, making qualifying for a mortgage more difficult. According to the Mortgage Bankers Association, underwriting standards for home mortgages are about 30% tighter today than they were in early 2020. According to renters in the NY Fed’s SCE Housing Survey, the tighter underwriting standards have not gone unnoticed. When asked about the ease of obtaining a mortgage in 2021, 50.4% of renters reported it would be very or somewhat difficult. When asked again in 2022, the share reporting it would be difficult to obtain a mortgage rose by 12.8 percentage points to 63.2%.

Shifting Preferences

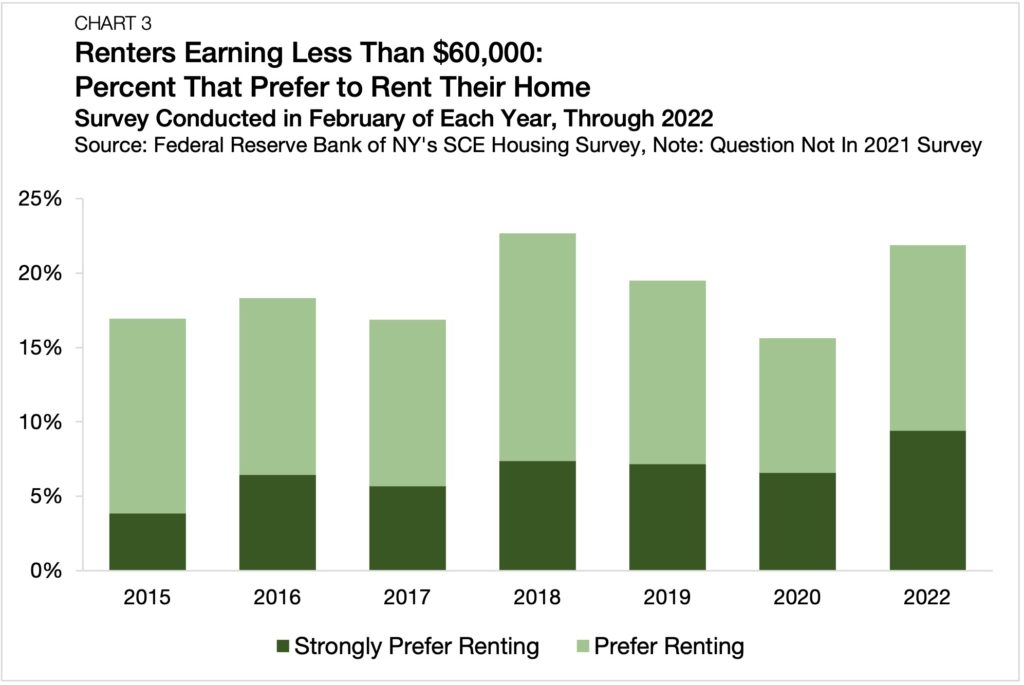

Lastly, the attitudes and preferences towards rental housing continue to evolve. While homeownership offers the benefit of equity accumulation, rentership has lifestyle advantages such as greater flexibility. According to ApartmentList, while most Millennial households would still like to own a home one day, a growing share sees themselves renting in perpetuity. When renters were polled about their preferences between owning and renting in the NY Fed’s SCE Housing Survey, a few key demographic groups appeared to have increasingly favorable views towards renting their homes. For renters with an income less than $60,000 per year, 21.8% of respondents preferred renting in 2022— up from 15.6% in 2020 (Chart 3). Further, 9.4% of renters earning less than $60,000 have a strong preference for renting, the highest response on record.

The share of renters preferring renting also shifted up for renters holding less than a bachelor’s degree and those over the age of 50. For renters holding less than a bachelor’s degree, the share that prefers renting grew from 13.1% in 2020 to 20.6% in 2022. For renters over the age of 50, these shares rose from 21.9% in 2020 to 29.5% in 2022.

Look Ahead

As the Fed continues its monetary policy tightening cycle and tries to tame inflation without triggering a slowdown, a growing share of renters anticipates staying in the rental market for the foreseeable future. All else equal, rising costs and declining affordability of homeownership, tighter mortgage underwriting standards, and shifting preferences should all apply upward pressure to homerentership demand over the medium term.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts on the Chatter blog.