How the Changing Labor Market Could Impact Multifamily

- The softening of the labor market has increased the likelihood that the Federal Reserve will begin loosening its monetary policy at its September meeting.

- Well-positioned multifamily investors are on target to reap the benefits of interest rate reductions.

- Although a cooler labor market presents risks, lower rates will encourage more transaction activity and fuel the growth of multifamily valuations.

Following strong post-pandemic gains, the U.S. labor market has cooled over the past few months, placing multifamily investors in a position to realize the benefits of less restrictive monetary policy.

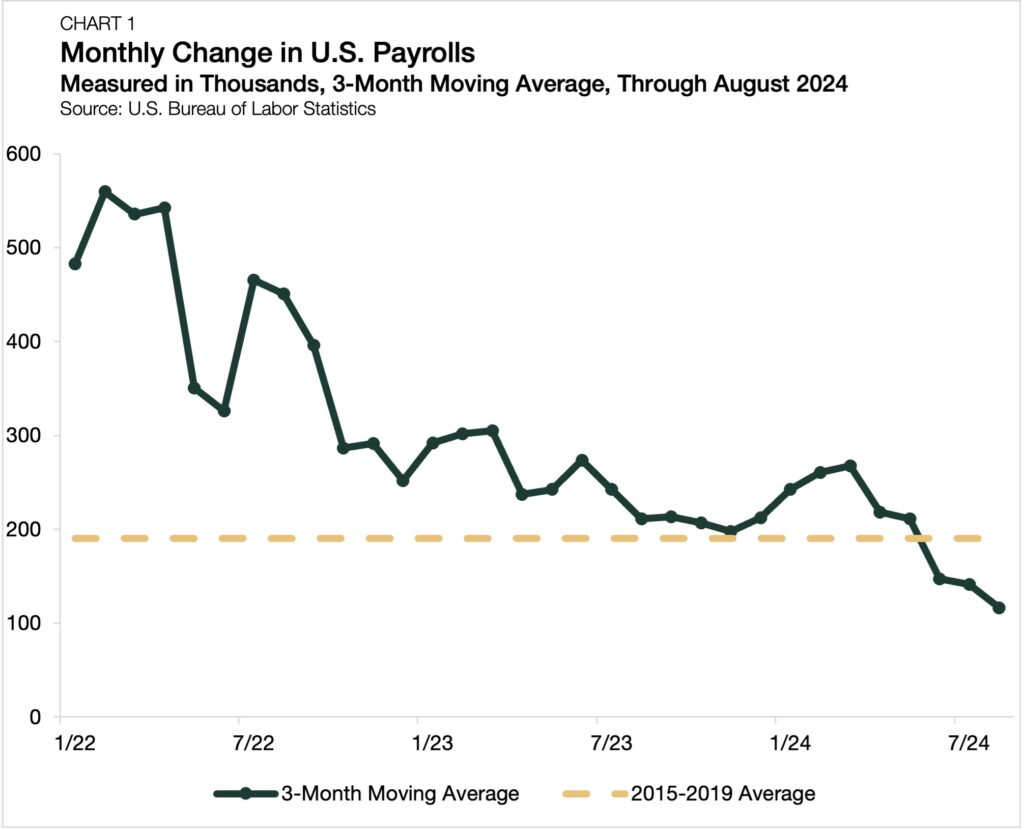

According to the U.S. Bureau of Labor Statistics, the nation’s unemployment rate rose 0.4 percentage points in August 2024 compared to a year earlier. However, this uptick was driven mainly by an increase in workers who entered the labor force. Nonfarm payrolls increased by 142,000 during the month, falling short of consensus expectations. As of August, the three-month average for job growth had decreased to 116,330 payroll additions per month, which was below recent historical averages (Chart 1).

Beyond the tepid recent job reports, other indicators also show the labor market has continued to soften. Average hourly earnings stand higher than pre-pandemic levels, although they have slipped over the past two years. The ratio of job openings to employed persons has fallen to 1.1, down from a peak of 2.0 in early 2022. The robust labor market has lost some of its luster, impacting the macroeconomy, the interest rate environment, and, by extension, multifamily real estate investing.

Multifamily Impact

Recent labor market readings present many signals that multifamily investors should have on their radar in the months ahead. A material worsening of economic conditions could reduce renters’ ability to make monthly rent payments. However, cooling inflation has lessened burdens on household finances, layoffs have remained steady, and the Federal Reserve Bank of Philadelphia’s Third Quarter Survey of Professional Forecasters suggests that leading economists do not foresee a severe deterioration of the unemployment rate ahead.

On the other side of the risk-opportunity spectrum, the state of the labor market has made it highly probable that the Federal Reserve will begin cutting interest rates at its September policy meeting — a welcome development for multifamily real estate investing. According to the CME Group’s FedWatch Tool, as of September 6, there is a 69% chance that the Fed will cut by 25 basis points (bps) and a 31% chance they will cut by a more substantial 50 bps. This fall, the markets are no longer debating if the Fed will cut rates; they are pondering by how much.

Over the past two years, high interest rates have created significant gaps between what multifamily buyers are willing to pay and what sellers are willing to accept for an asset. As noted by Freddie Mac in its 2024 Multifamily Midyear Outlook, an improvement in market interest rates could spur a modest increase in transaction volume through the end of the year. The report stressed the crucial role of interest rate stability in the price discovery process, concluding that “if the 10-year Treasury rate gains some stability, property prices and cap rates should stabilize, allowing buyers and sellers to agree on property values and increasing transaction volume.”

Moreover, the current elevated rate environment has contributed to the impaired feasibility of many new multifamily development projects. Feasibility is the most frequently cited reason for project delays, according to the National Multifamily Housing Council’s latest Quarterly Survey of Apartment Construction & Development Activity. Debt financing costs for acquisitions and ground-up development should begin normalizing, creating more investment activity in the multifamily space.

Outlook

The Federal Reserve has succeeded in its plan to let some air out of the labor market’s sails, which should temper inflationary pressures once rate cuts arrive. However, the question has become whether or not the labor market slowdown will continue. Just last month, Federal Reserve Chair Jerome Powell expressed his confidence: “With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to two percent inflation while maintaining a strong labor market.” Provided the labor market continues moderating, the multifamily sector is on target to reap the benefits of an interest rate inflection.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.